Weekly Market Roundup

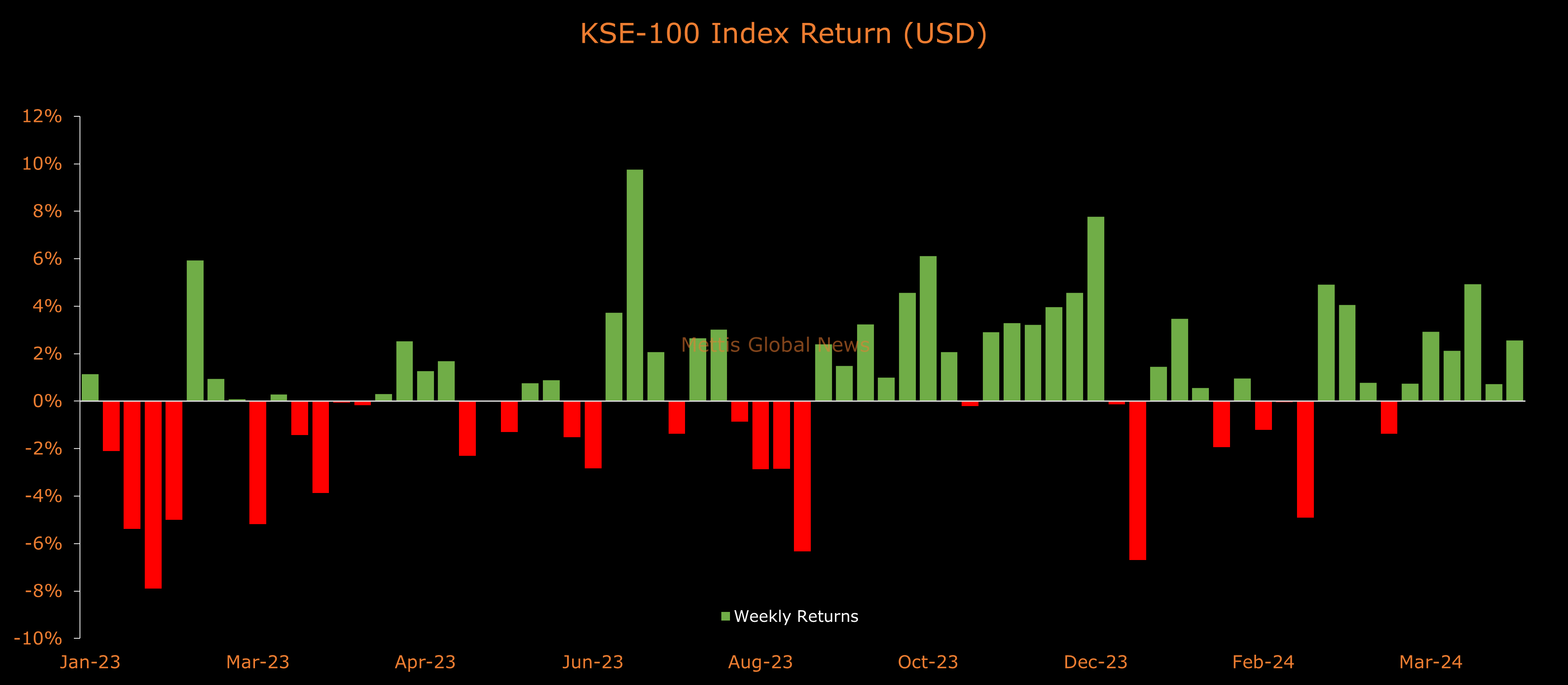

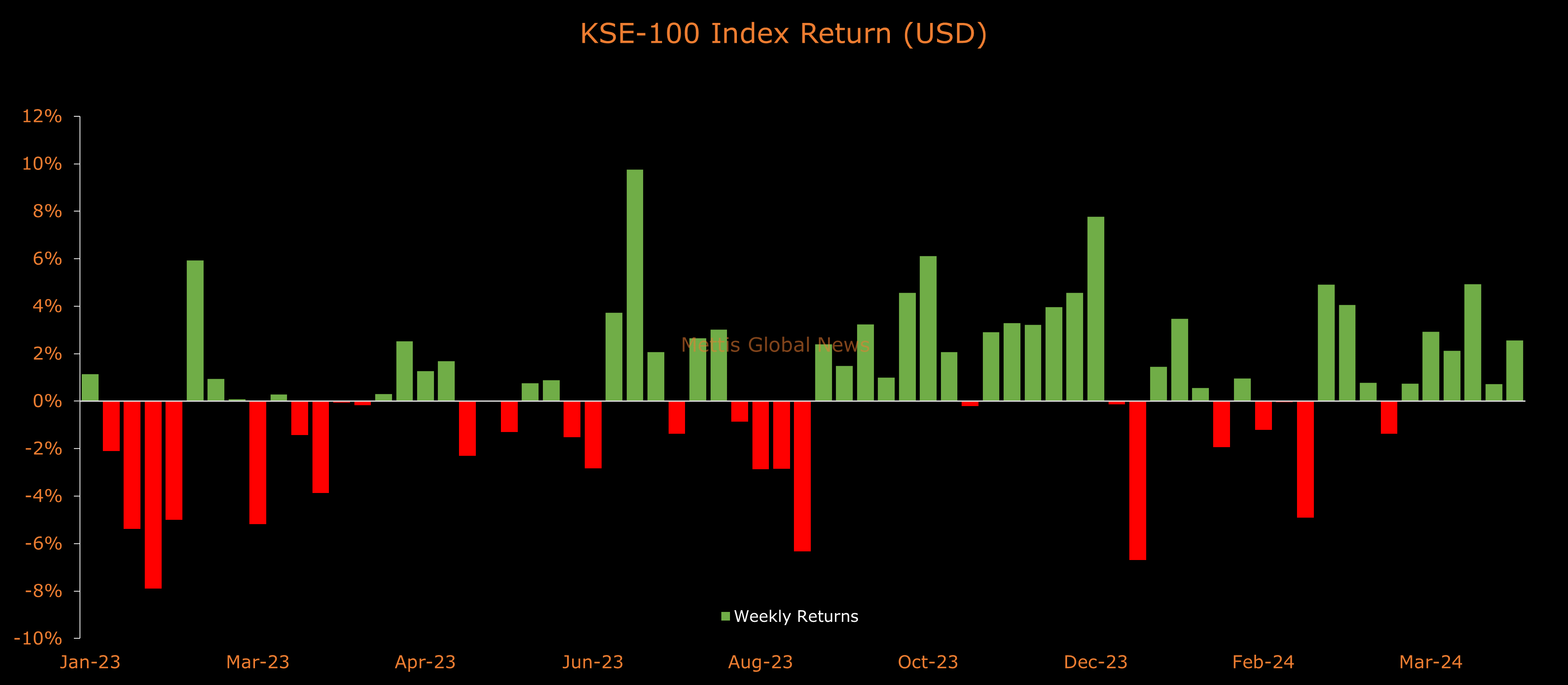

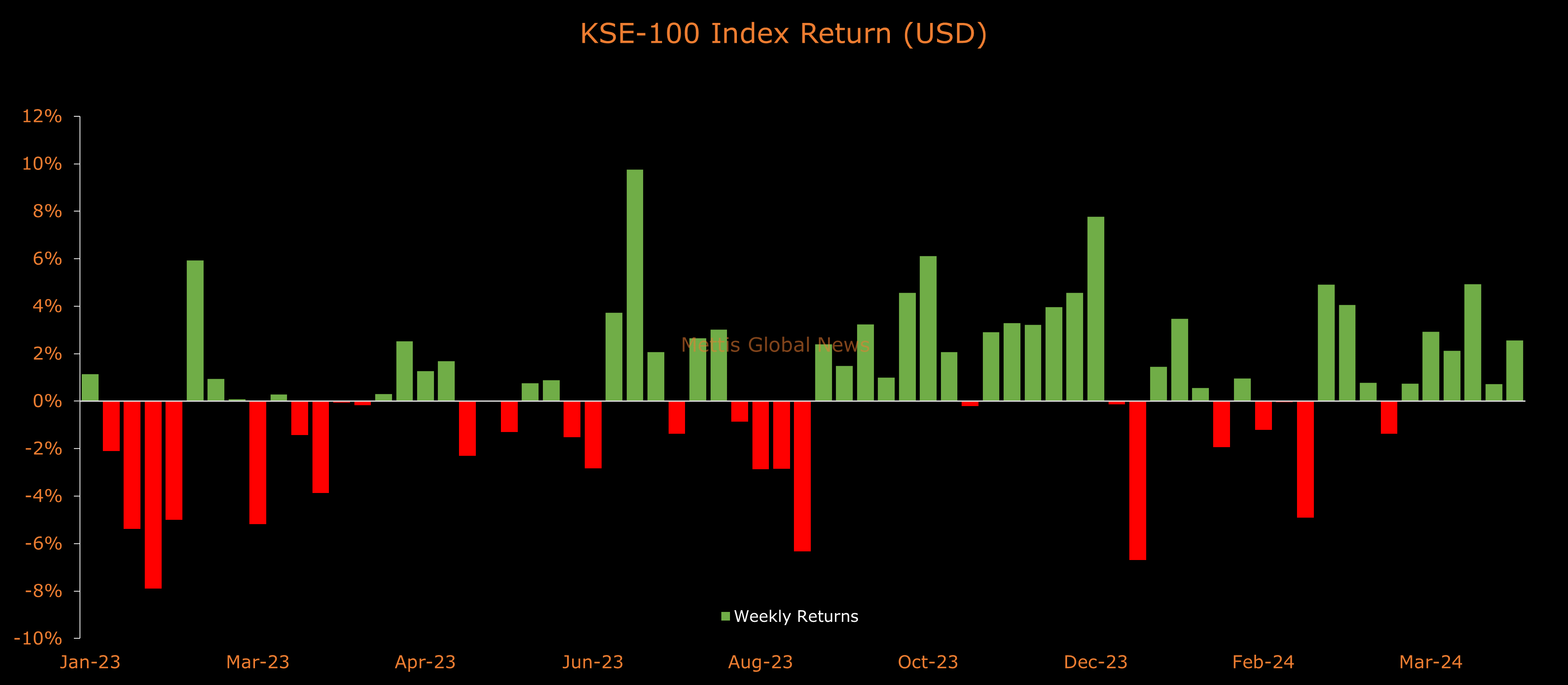

The benchmark KSE-100 index closed sixth consecutive week in green, gaining 1,833 points or 2.58% to another record high of 72,743….

The benchmark KSE-100 index closed sixth consecutive week in green, gaining 1,833 points or 2.58% to another record high of 72,743….

The International Air Transport Association (IATA) has called on Pakistan to immediately release airline revenues, worth $399 million, that are being held in…

UBL Currency Exchange has signed a Mergers and acquisitions (M&A) transaction to acquire assets of Wallstreet Exchange…

The Securities and Exchange Commission of Pakistan (SECP) has introduced a new digital platform, SECP-XS, to promptly resolve user queries and concerns…

The benchmark KSE-100 index surged another 771.35 points or 1.07% to close Friday’s trading session at a record high of 72,742.75…

Prime Minister Muhammad Shehbaz Sharif will attend the World Economic Forum (WEF) special meeting on Global Collaboration, Growth and Energy being held…

Amreli Steels Ltd. (PSX: ASTL) reported its profit and loss statement for the first quarter of 2024, wherein it incurred a loss of Rs665.8 million…

In order to help Pakistan reduce its energy import bills and provide affordable energy solutions, Shanghai Electric Group has made an investment in Thar…

Lalpir Power Limited (PSX: LPL) reported its earnings for the first quarter of 2024, wherein the profit after tax rose to Rs1.45 billion [EPS: Rs3.81]…

Gharibwal Cement Limited (PSX: GWLC) reported a profit of Rs557.72 million [EPS: Rs1.39] during the quarter ended March 31, 2024, around 1.4% YoY…

The Monetary Policy Committee (MPC) of State Bank of Pakistan (SBP) will meet on Monday, April 29, 2024, to decide about the Monetary…

The Pakistani rupee (PKR) lost around 8 paisa against the US Dollar this week and settled at PKR 278.39 per USD, compared to the previous week’s closing…

Pakistan National Shipping Corporation Limited (PSX: PNSC) experienced a fall of 72.9% YoY in its profits in the first quarter of 2024, earning a profit after t

The Bank of Punjab (PSX: BOP) announced its results for the quarter ended March 31, 2024, wherein the bank’s profit after tax rose 43.43% YoY to…

Cnergyico PK Limited (PSX: CNERGY) turned around in the first three months of 2024, earning a profit after tax of Rs1.19 billion [EPS: Rs0.22] compared…

The benchmark KSE-100 index closed sixth consecutive week in green, gaining 1,833 points or 2.58% to another record high of 72,743….

The International Air Transport Association (IATA) has called on Pakistan to immediately release airline revenues, worth $399 million, that are being held in…

UBL Currency Exchange has signed a Mergers and acquisitions (M&A) transaction to acquire assets of Wallstreet Exchange…

The Securities and Exchange Commission of Pakistan (SECP) has introduced a new digital platform, SECP-XS, to promptly resolve user queries and concerns…

The benchmark KSE-100 index surged another 771.35 points or 1.07% to close Friday’s trading session at a record high of 72,742.75…

Prime Minister Muhammad Shehbaz Sharif will attend the World Economic Forum (WEF) special meeting on Global Collaboration, Growth and Energy being held…

Amreli Steels Ltd. (PSX: ASTL) reported its profit and loss statement for the first quarter of 2024, wherein it incurred a loss of Rs665.8 million…

In order to help Pakistan reduce its energy import bills and provide affordable energy solutions, Shanghai Electric Group has made an investment in Thar…

Lalpir Power Limited (PSX: LPL) reported its earnings for the first quarter of 2024, wherein the profit after tax rose to Rs1.45 billion [EPS: Rs3.81]…

Gharibwal Cement Limited (PSX: GWLC) reported a profit of Rs557.72 million [EPS: Rs1.39] during the quarter ended March 31, 2024, around 1.4% YoY…

The Monetary Policy Committee (MPC) of State Bank of Pakistan (SBP) will meet on Monday, April 29, 2024, to decide about the Monetary…

The Pakistani rupee (PKR) lost around 8 paisa against the US Dollar this week and settled at PKR 278.39 per USD, compared to the previous week’s closing…

Pakistan National Shipping Corporation Limited (PSX: PNSC) experienced a fall of 72.9% YoY in its profits in the first quarter of 2024, earning a profit after t

The Bank of Punjab (PSX: BOP) announced its results for the quarter ended March 31, 2024, wherein the bank’s profit after tax rose 43.43% YoY to…

Cnergyico PK Limited (PSX: CNERGY) turned around in the first three months of 2024, earning a profit after tax of Rs1.19 billion [EPS: Rs0.22] compared…

| PairID | Symbol | Bid | Ask | High | Low | Update |

|---|---|---|---|---|---|---|

| 1 | PKR | 278.60000 | 278.80000 | 278.80000 | 278.60000 | 01:02 PM |

| 2 | EUR | 1.06990 | 1.07020 | 1.07020 | 1.06990 | 02:41 AM |

| 3 | GBP | 1.24870 | 1.24890 | 1.24890 | 1.24870 | 02:41 AM |

| 4 | CHF | 0.91464 | 0.91512 | 0.91512 | 0.91464 | 02:50 AM |

| 5 | JPY | 158.09000 | 158.10000 | 158.10000 | 158.09000 | 02:41 AM |

| 6 | CAD | 1.36780 | 1.36830 | 1.36830 | 1.36780 | 02:41 AM |

| 7 | AUD | 0.65320 | 0.65360 | 0.65360 | 0.65320 | 02:41 AM |

| 8 | INR | 83.40270 | 83.40320 | 83.40320 | 83.40270 | 08:00 PM |

| 9 | SAR | 3.75050 | 3.75070 | 3.75070 | 3.75050 | 11:51 AM |

| 10 | AED | 3.67240 | 3.67340 | 3.67340 | 3.67240 | 01:59 AM |

| 11 | HKD | 7.82830 | 7.82840 | 7.82840 | 7.82830 | 02:41 AM |

| 12 | CNH | 7.26210 | 7.26410 | 7.26410 | 7.26210 | 08:00 PM |

| 13 | CNY | 7.24640 | 7.24650 | 7.24650 | 7.24640 | 09:11 PM |

| 14 | THB | 36.99000 | 37.04000 | 37.04000 | 36.99000 | 08:00 PM |

| 15 | MYR | 4.76500 | 4.77000 | 4.77000 | 4.76500 | 08:00 PM |

| 16 | IDR | 16,232.20000 | 16,250.40000 | 16,250.40000 | 16,232.20000 | 08:00 PM |

| 17 | SGD | 1.36210 | 1.36310 | 1.36310 | 1.36210 | 02:41 AM |

| 18 | NZD | 0.59360 | 0.59420 | 0.59420 | 0.59360 | 02:39 AM |

| 19 | MXN | 17.14510 | 17.17510 | 17.17510 | 17.14510 | 02:41 AM |

| 20 | TRY | 32.50600 | 32.51000 | 32.51000 | 32.50600 | 08:00 PM |

| 21 | SEK | 10.76040 | 11.01820 | 11.01815 | 10.76041 | 02:41 AM |

| 22 | ZAR | 18.55910 | 18.96020 | 18.96019 | 18.55911 | 02:41 AM |

| 23 | NOK | 11.03580 | 11.04180 | 11.04180 | 11.03580 | 02:41 AM |

| 24 | DKK | 6.97030 | 6.97130 | 6.97130 | 6.97030 | 02:39 AM |

| 25 | ARS | 875.82900 | 875.97800 | 875.97823 | 875.82872 | 02:50 AM |

| 26 | BDT | 108.34000 | 111.70400 | 111.70397 | 108.33995 | 08:00 PM |

| 27 | BHD | 0.37698 | 0.37713 | 0.37713 | 0.37698 | 06:54 PM |

| 28 | BRL | 5.11480 | 5.11780 | 5.11780 | 5.11480 | 08:00 PM |

| 29 | KRW | 1,376.43000 | 1,379.75000 | 1,379.75000 | 1,376.43000 | 08:00 PM |

| 30 | KWD | 0.30808 | 0.30818 | 0.30818 | 0.30808 | 01:03 AM |

| 31 | LKR | 293.46400 | 300.00500 | 300.00467 | 293.46353 | 08:00 PM |

| 32 | OMR | 0.38476 | 0.38526 | 0.38526 | 0.38476 | 01:58 AM |

| 33 | QAR | 3.64600 | 3.64800 | 3.64800 | 3.64600 | 01:59 AM |

| 34 | RUB | 92.27000 | 92.29000 | 92.29000 | 92.27000 | 08:00 PM |

| 35 | AFN | 71.37320 | 73.24210 | 73.24207 | 71.37317 | 08:00 PM |

| 36 | AZN | 1.70000 | 1.70000 | 1.70000 | 1.70000 | 06:54 AM |

| 37 | TMT | 3.35000 | 3.65000 | 3.65000 | 3.35000 | 08:00 PM |

| 38 | MVR | 15.26000 | 15.66000 | 15.66000 | 15.26000 | 08:00 PM |

| 39 | UZS | 12,638.40000 | 12,703.80000 | 12,703.82657 | 12,638.41518 | 08:00 PM |

| 40 | PHP | 57.51700 | 57.76000 | 57.76000 | 57.51700 | 08:00 PM |

| 42 | NGN | 1,305.72000 | 1,306.72000 | 1,306.72000 | 1,305.72000 | 08:00 PM |

| 43 | KES | 131.42100 | 134.22400 | 134.22417 | 131.42083 | 08:00 PM |

| 44 | AMD | 388.08000 | 388.08000 | 388.08000 | 388.08000 | 08:00 PM |

| 45 | TWD | 32.58800 | 32.61800 | 32.61800 | 32.58800 | 08:00 PM |

| 46 | XAU | 2,337.48000 | 2,338.39000 | 2,338.39000 | 2,337.48000 | 01:32 AM |

| 47 | XAG | 27.15820 | 27.20580 | 27.20580 | 27.15820 | 01:32 AM |

| 48 | XPT | 915.55000 | 917.95000 | 917.95000 | 915.55000 | 01:59 AM |

| 49 | XPD | 954.21200 | 962.02800 | 962.02800 | 954.21200 | 02:00 AM |

| 2,120 | VES | 36.33200 | 36.42320 | 36.42315 | 36.33204 | 08:00 PM |

| 2,212 | UGX | 3,781.71000 | 3,865.81000 | 3,865.81320 | 3,781.71284 | 08:00 PM |

| 2,213 | TZS | 2,549.64000 | 2,643.09000 | 2,643.08742 | 2,549.64257 | 08:00 PM |

Data is delayed by 20 minutes

| Name | High | Current | Low | Change | % Change | Volume | Value | Direction | DateTime |

|---|---|---|---|---|---|---|---|---|---|

| KSE100 | 72,862.41 | 72,742.748 | 71,764.18 | 771.347 | 1.072 | 302,352,233.0 | 14,307,377,262.460 | 0 | 26/04/2024 05:12 PM |

| ALLSHR | 47,721.89 | 47,489.465 | 47,040.09 | 314.510 | 0.667 | 540,778,150.0 | 22,562,380,076.020 | 0 | 26/04/2024 05:12 PM |

| KSE30 | 24,069.72 | 24,033.869 | 23,676.59 | 284.824 | 1.199 | 79,764,833.0 | 9,454,683,795.040 | 0 | 26/04/2024 05:12 PM |

| KMI30 | 122,624.63 | 122,414.850 | 120,539.93 | 1,511.894 | 1.251 | 130,473,781.0 | 8,715,975,575.960 | 0 | 26/04/2024 05:12 PM |

| KMIALLSHR | 34,120.82 | 34,003.274 | 33,623.23 | 303.834 | 0.902 | 336,036,323.0 | 17,261,793,362.150 | 0 | 26/04/2024 05:12 PM |

| BKTi | 18,098.00 | 18,061.700 | 17,783.46 | 189.341 | 1.059 | 12,829,416.0 | 1,502,941,695.300 | 0 | 26/04/2024 05:12 PM |

| OGTi | 17,165.47 | 17,018.023 | 16,915.39 | -13.038 | -0.077 | 13,158,963.0 | 1,843,356,910.500 | 0 | 26/04/2024 05:12 PM |

Data is delayed by 20 minutes

| Name | Symbol | ExchangeCode | Last | High | Low | Change | UpdateDate | CreateDate |

|---|---|---|---|---|---|---|---|---|

| BITCOIN FUTURES | BTC | 64,530.0 | 65,395.0 | 63,775.0 | -740.00 | |||

| BRENT CRUDE | EB | 89.3 | 89.8 | 88.8 | 0.32 | |||

| RICHARDS BAY COAL MONTHLY | EF | 105.5 | 0.0 | 0.0 | -1.25 | |||

| ROTTERDAM COAL MONTHLY | ET | 117.5 | 117.5 | 117.5 | -1.05 | |||

| USD RBD PALM OLEIN | POL | 832.5 | 832.5 | 832.5 | 0.00 | |||

| CRUDE OIL – WTI | QCL | 83.7 | 84.5 | 83.4 | 0.09 | |||

| SUGAR #11 WORLD | SB | 19.1 | 19.6 | 19.0 | -0.04 |

To see more commodities please register for our portal

© 2024 Mettis Link News All rights reserved