Putting Taylor’s Rule to test for Projecting Policy Rate

Monetary Policy is around the corner, and results of surveys meant for gauging market sentiments concerning the direction …

Monetary Policy is around the corner, and results of surveys meant for gauging market sentiments concerning the direction …

Seeing is believing, has long been instrumental in shaping our spiritual and social life. And, now it has invaded our investing life too. For instance, our belief that a stock price will ascend to its

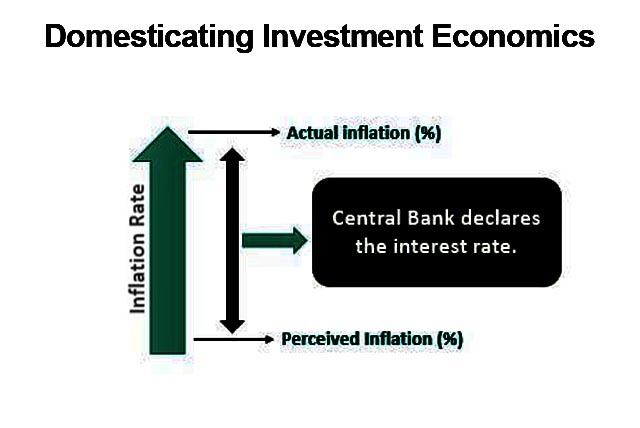

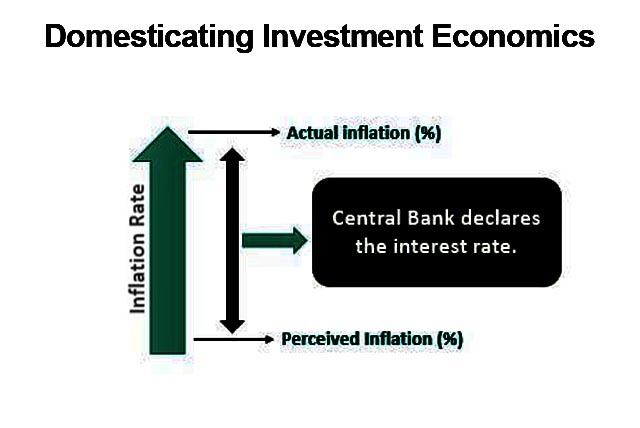

Managing investment by disregarding probable changes in interest rates can hardly be an acceptable norm for equity and fixed-income investors alike. Cognizance of investors’ appetite to have a dependable estimate paved the way for opinionated

It is like the tenth commandment for day traders and for those whose investment in stocks rests on technical analysis…

A sudden departure of Indices from the predicted trajectory is not an unusual incident in the stock market. We have seen this in the past and will continue to experience …

Where a rising Stock Market is a good omen for Institutional and high-net-worth Individuals, it is a premonition of new challenges for small stock investors

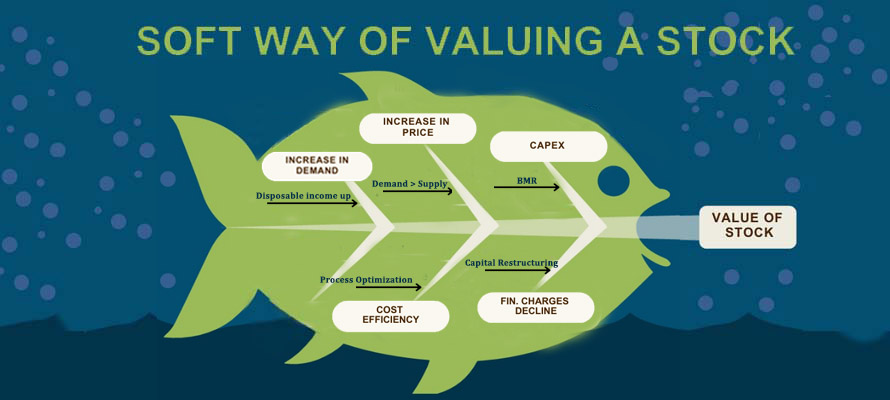

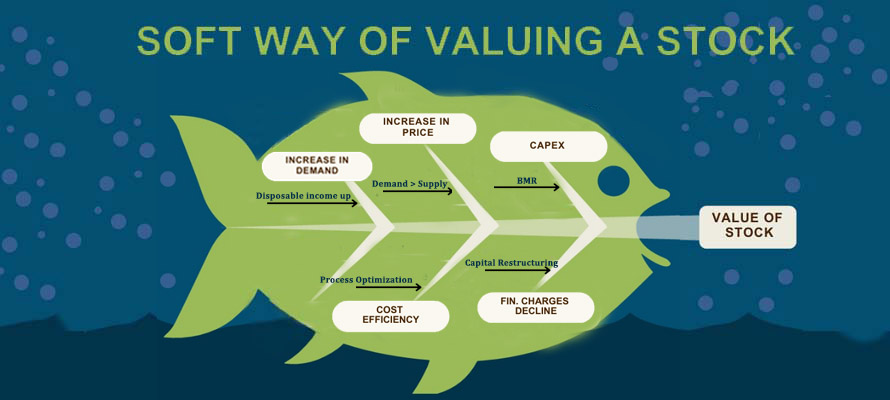

Valuing a Stock is the first step towards wise investing. But few have the acumen and skills to do it. And that is too because of their educational background and professional training…

The article examined the applicability of Life Cycle Investing from the socio-economic vantage of our society…

The article questions the rationale behind institutional investors’ belated selling of shares in an extended bearish market…

The Article revalidates the concept that “Even Rising Interest Rate Could be Good for Equity Investment!”…

In this era of hyperinflation investment managers of Life Funds are under immense pressure to generate alpha returns to support policyholder obligations…

Investments in Bonds are made for steady income streams over the life of bonds, yet the desire for extraordinary profit continues to haunt investors….

An Investment Strategy meant to bring fortune. The Article is about making windfall gains by investing in Stocks through tails investing….

The coincidence of lower stock prices with higher interest rates is one of the prime postulates in the theory of investing….

Mutual Funds have no exception to myths like other investing. Some are widespread and reason for selective perception among investors of equity mutual funds….

Monetary Policy is around the corner, and results of surveys meant for gauging market sentiments concerning the direction …

Seeing is believing, has long been instrumental in shaping our spiritual and social life. And, now it has invaded our investing life too. For instance, our belief that a stock price will ascend to its

Managing investment by disregarding probable changes in interest rates can hardly be an acceptable norm for equity and fixed-income investors alike. Cognizance of investors’ appetite to have a dependable estimate paved the way for opinionated

It is like the tenth commandment for day traders and for those whose investment in stocks rests on technical analysis…

A sudden departure of Indices from the predicted trajectory is not an unusual incident in the stock market. We have seen this in the past and will continue to experience …

Where a rising Stock Market is a good omen for Institutional and high-net-worth Individuals, it is a premonition of new challenges for small stock investors

Valuing a Stock is the first step towards wise investing. But few have the acumen and skills to do it. And that is too because of their educational background and professional training…

The article examined the applicability of Life Cycle Investing from the socio-economic vantage of our society…

The article questions the rationale behind institutional investors’ belated selling of shares in an extended bearish market…

The Article revalidates the concept that “Even Rising Interest Rate Could be Good for Equity Investment!”…

In this era of hyperinflation investment managers of Life Funds are under immense pressure to generate alpha returns to support policyholder obligations…

Investments in Bonds are made for steady income streams over the life of bonds, yet the desire for extraordinary profit continues to haunt investors….

An Investment Strategy meant to bring fortune. The Article is about making windfall gains by investing in Stocks through tails investing….

The coincidence of lower stock prices with higher interest rates is one of the prime postulates in the theory of investing….

Mutual Funds have no exception to myths like other investing. Some are widespread and reason for selective perception among investors of equity mutual funds….

© 2024 Mettis Link News All rights reserved