April 26, 2024 (MLN): The benchmark KSE-100 index closed sixth consecutive week in green, gaining 1,833 points or 2.58% to another record high of 72,743.

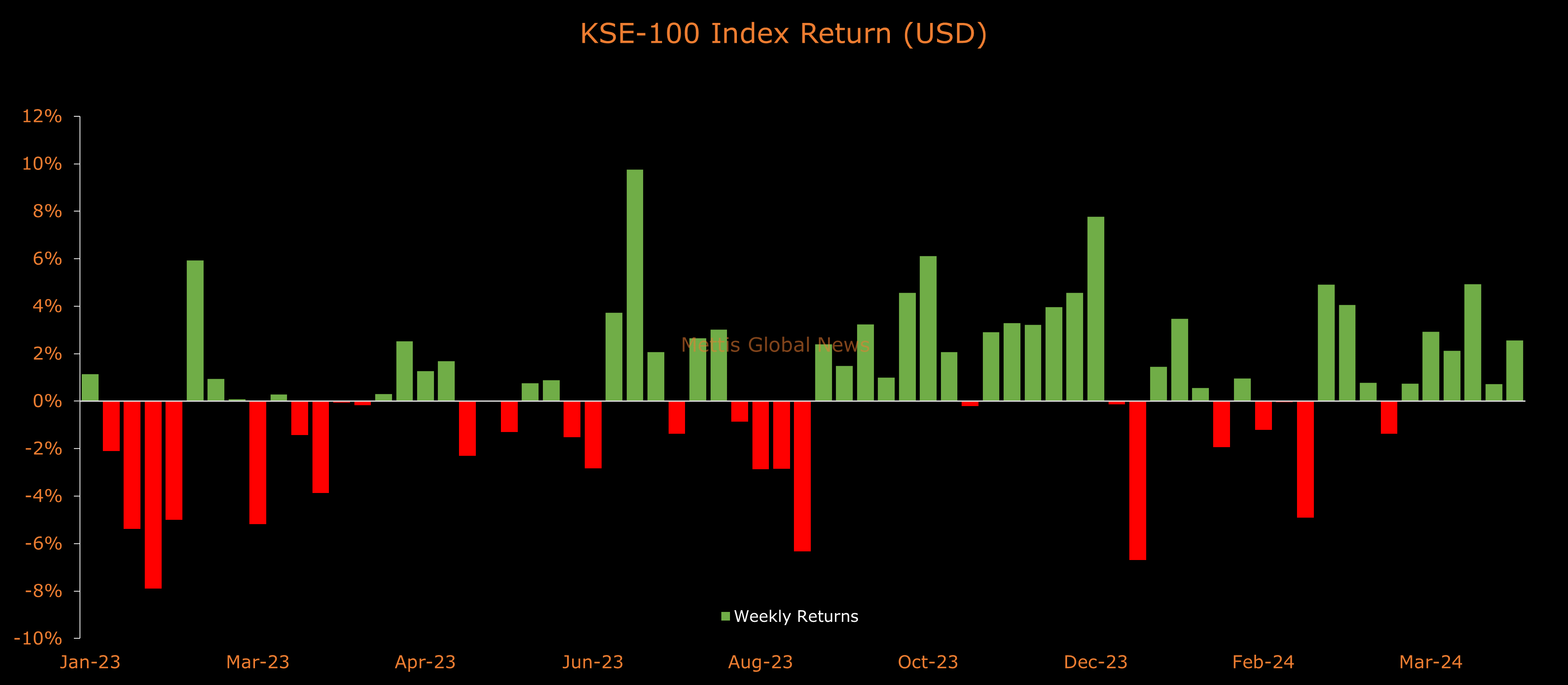

Meanwhile, the Pakistani Rupee recorded a marginal decline of 0.03% WoW. In USD terms, the KSE-100 index gained 2.55% WoW.

Throughout the week, KSE-100 traded in a range of 1,980 points, between a high of 72,862 (+1953) and a low of 70,882 (-27) points.

KSE-100's average traded volume was recorded at 359 million shares worth Rs16.95 billion, marking an increase of 56.10% WoW in the number of shares and 31.69% WoW in traded value.

Moreover, the overall PSX average traded volume was recorded at 649m shares worth Rs26.04bn, marking an increase of 31.93% WoW in the number of shares while an increase of 22.15% WoW in traded value.

On the economic front, the country posted the highest monthly current account surplus of $619 million in 9 years, largely due to a significant increase in workers' remittances.

Moreover, it recorded $258m FDI in March 2024, and $182m inflows under Roshan Digital Accounts during the month.

Meanwhile, strong corporate results also played its due role in boosting investors' sentiment this week.

For the upcoming week, investors are closely monitoring the upcoming Monetary Policy Committee (MPC) meeting of the State Bank of Pakistan (SBP) scheduled on Monday, with renewed bets for a rate cut.

Top Index Movers

From the sector-specific lens, Fertilizer was the best performing sector, as it added 587 points to the index.

This was followed by Cement (380pts), Commercial Banks (348pts), Oil & Gas Exploration Companies (201pts), and Power Generation & Distribution (164pts) points.

Contrary to that, negative contributions came from Tobacco (54pts), Miscellaneous (48pts), Oil & Gas Marketing Companies, (39pts), Refinery (29pts), and Inv. Banks / Inv. Cos. / Securities Cos. (28pts).

Scrip-wise, EFERT, UBL, LUCK, MARI, and HUBC were the best-performing stocks during the week as they added 332, 214, 207, 164, and 156 points to the index respectively.

Whereas, PAKT, PSEL, POL, NBP, and MEBL collectively took away 203 points from the index.

FIPI/LIPI

Foreign investors continued to remain net buyers during the week, acquiring $3.01m worth of equities.

Flow-wise, Mutual Funds were the dominant buyers, with a net investment of $6.02m.

They allocated the majority of their capital, $3.09m, to Cement.

On the other hand, the leading sellers were Insurance Companies, with a significant net sale of $13.13m, the highest since mid-2021.

Their most substantial sales activity was in Commercial Banks, amounting to $11.57m, while they acquired $0.64m of equities in the Oil and Gas Exploration Companies.

To note, the local stock market has been on a bullish streak amid hopes of improved economic conditions following the expected inflows from IMF and friendly countries, relatively stable currency, and the anticipation of monetary easing cycle.

The KSE-100 has gained 31,290 points or 75.48% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 10,292 points, equivalent to 16.48%.

Copyright Mettis Link News

Posted on: 2024-04-26T21:01:27+05:00