Why Shouldn’t We Apply Life Cycle Investing in Dot?

By Abu Ahmed | October 04, 2023 at 04:43 PM GMT+05:00

October 04, 2023 (MLN): When the legendary poet William Shakespeare composed the poem “The Seven Stages of Life” he had hardly imagined that the theme of the poem “Life Cycle” would permeate from the social boundaries to the business domain to the extent that it would ubiquitously be accepted as a business strategy for product development to marketing and from business to personal investing.

Life Cycle Investing is an investing approach that offers a comprehensive framework for managing personal investment to meet changing financial needs throughout life by taking into stock social needs and economic constraints right from the start of professional life to the end of it.

|

Age (in Years) |

20 to 30 |

31 to 50 |

50 to 60 |

60 + |

|---|---|---|---|---|

|

Life Cycle Investing Phase |

Early to Mid-Career |

Mid-Career |

Post Mid-Career |

Retirement |

|

Investment Mix |

|

|

|

|

|

Cash |

10% |

10% |

10% |

10% |

|

Stock |

60% |

55% |

40% |

25% |

|

Bond |

30% |

35% |

50% |

65% |

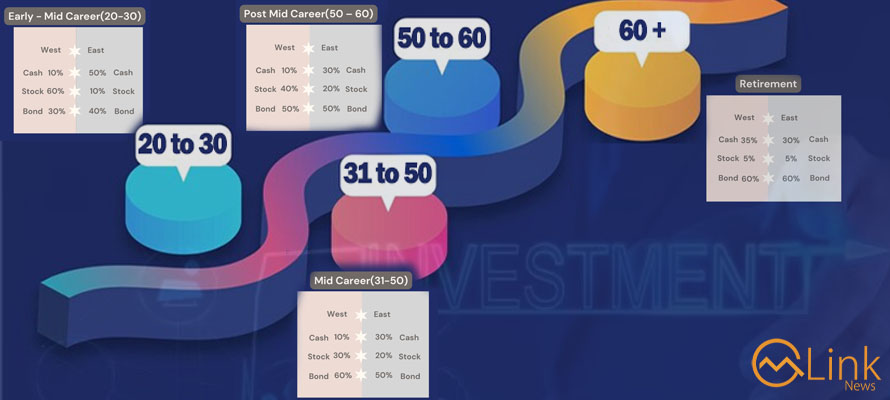

The above image and the table offer a glimpse of what Life Cycle Investing is and how to practice to ensure financial comfort at all stages of life by fragmenting social needs age-wise and translating those into financial goals, investment horizon, and risk tolerance, and by proposing an optimal investment mix for each stage of life.

The above investment mix appears conclusively correct when seen from the vantage of Western Society, as the concept is deeply ingrained in the West's social, psychological, educational, experiential, and economic backgrounds.

But what about when it comes to practising in our society? Should it be adapted verbatim? The two differ socially and economically despite some similarities. Ours is a family-oriented, socially obliged, conservative, and economically less privileged than the West. The following table offers an age-wise segmented view of the social needs and economic priorities of individuals living in two societies.

|

Age |

20 – 30 Years |

31 – 50 Years |

50 – 60 Years |

Retirement |

||||

|---|---|---|---|---|---|---|---|---|

|

Life Cycle Phase |

Early - Mid Career |

Mid-Career |

Post Mid-Career |

Retirement |

||||

|

|

West |

East |

West |

East |

West |

East |

West |

East |

|

Social Factors |

Single/Independent No family support Focus on Career Longer Working |

Single Support Family Focus on Career Long Working |

Family–Kids Financing Kids’ Education |

Family-kids Parents Supporting Family Financing Kids’ Education |

No family Kids moved No family support |

Kids Edu. Exp./ Merge |

Medical Coverage Old home

|

Poor/ Expensive Medical Coverage

|

|

Economic Factors |

Education Loan Long earnings stream More job opportunity Little saving |

Long Earnings Stream Less Job Opp. Little/No Saving |

Paid much of the debt Expenses Income Exceeds Expenses Reasonable Saving |

Income not Exceeding much Exp Higher Disposable Income

|

Peak Income Inflow of Inv. Inc. Low Disposable Income |

Peak Income Little Inflow of Inv. Income |

Social Security Suffice Pension Suff. Inc. From Inv.

|

Less Social Security No Pension Inc. from Inv. |

|

Inv. Horizon |

Long 40+ years for Inv |

Long 40+ years for Inv |

Long 30+ Years for Inv. |

Long 30+ Years for Inv. |

Medium 20+ Years for Inv. |

Medium 20+ Years |

Short |

Short |

|

Inv. Goals |

Retire Educational Loan Buy a Car |

To support Family Saving emergency |

Save for Home / Retirement Asset Growth |

Inv. For Emergencies Fulfill family obligations |

Secure Retirement Financially Preserve Capital |

Secure Retirement Financially Preserve Capital |

Liquid Assets & Outlive Saving |

Liquid Assets & Outlive Saving |

|

Return Objective |

Higher Return |

Return Preserve Cap |

Higher Return |

Moderate Return |

Return Preserve Cap |

Return Preserve Cap |

Stable Return |

Stable Return |

|

Risk Profile |

Aggressive |

Conservative |

Moderate |

Low |

Low |

Low |

Very Low |

Very Low |

|

Investing Phase |

Wealth Accumulation |

Wealth Accumulation |

Wealth Accumulation |

Wealth Accumulation |

Consolidation |

Consolidation |

Spending |

Spending |

Similarities between socioeconomic profiles of individuals who fall within a specific age bracket convincingly validate that the concept is equally applicable in our environment. However, the variations within eloquently ask for a conservative approach when adapting an investment mix with a dot.

Concerns for preserving capital, while investing to fulfill recurring financial obligations and to ensure a financially secure retirement, is more than justifiable in a society with fewer economic resources and opportunities.

Therefore, the table below offers a modified version investment mix from the Eastern perspective for each stage of Life Cycle Investing.

|

Age |

20 – 30 Years |

31 – 50 Years |

50 – 60 Years |

Retirement |

||||

|---|---|---|---|---|---|---|---|---|

|

Life Cycle Phase |

Early - Mid Career |

Mid-Career |

Post Mid-Career |

Retirement |

||||

|

Inv. Mix |

West |

East |

West |

East |

West |

East |

West |

East |

|

Cash |

10% |

50% |

10% |

30% |

10% |

30% |

35% |

30% |

|

Stock |

60% |

10% |

30% |

20% |

40% |

20% |

5% |

5% |

|

Bond |

30% |

40% |

60% |

50% |

50% |

50% |

60% |

65% |

So, liberate yourself from the fear of age syndrome and set in for an investing journey destined for a financially independent and secure post-retirement life as promised by the Life Cycle Investing Strategy.

This reminds me of a Chinese proverb:

“The Best Time to Plant a Tree Was 30 Years Ago, and the Second-Best Time to Plant a Tree is Now.”

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 125,627.31 258.99M |

1.00% 1248.25 |

| ALLSHR | 78,584.71 1,142.41M |

1.16% 904.89 |

| KSE30 | 38,153.79 69.25M |

0.63% 238.06 |

| KMI30 | 184,886.50 91.38M |

0.01% 13.72 |

| KMIALLSHR | 53,763.81 554.57M |

0.54% 290.61 |

| BKTi | 31,921.68 33.15M |

1.78% 557.94 |

| OGTi | 27,773.98 9.65M |

-0.40% -112.21 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 107,930.00 | 109,565.00 107,195.00 |

445.00 0.41% |

| BRENT CRUDE | 66.62 | 67.20 65.92 |

-0.18 -0.27% |

| RICHARDS BAY COAL MONTHLY | 97.00 | 97.00 97.00 |

1.05 1.09% |

| ROTTERDAM COAL MONTHLY | 107.65 | 107.65 105.85 |

1.25 1.17% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 64.97 | 65.82 64.50 |

-0.55 -0.84% |

| SUGAR #11 WORLD | 16.19 | 16.74 16.14 |

-0.52 -3.11% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpg)