Domesticating investment economics for forecasting of policy rate

By Abu Ahmed | March 13, 2024 at 02:36 PM GMT+05:00

March 13, 2023 (MLN): The article offers food for thought for adapting a Taylor Rule to estimate the target policy rate for the next Monetary Policy.

Managing investment by disregarding probable changes in interest rates can hardly be an acceptable norm for equity and fixed-income investors alike. Cognizance of investors’ appetite to have a dependable estimate paved the way for opinionated surveys before the announcement of Monetary Policy by the Central Banks.

Despite its utilitarian importance to fund managers, no survey provides any clues of exercising economic expediency by participants while expressing their opinion on the upcoming Policy rate. This necessitated the need to have an alternative framework that complements the findings of the survey.

A review of economic literature reveals the existence of many econometric models, both stochastics and on-stochastics, for projecting Policy rates. Amongst them is the Taylor Rule, proposed by Mr. John Taylor, the Standford Economist, in his 1993 paper “Discretion Versus Policy Rules in Practice”. The model stands prominent amongst peers due to its simplicity and reliance on radially available economic inputs.

The Taylor’s Rule:

The Taylor Rule offers a framework to estimate the policy rate the Central Bank is expected to announce in its next monetary policy by linking inflation and economic growth.

Target Rate = Neutral Rate + 0.5 x (GDPe – GDPt) + 0.5 x (Ie – It)

Whereas:

Neutral Rate = Real Policy Rate + Expected Inflation Rate (Current Short-term Interest rate)

GDPe = Expected GDP growth rate

GDPt = Long-term GDP growth rate

Ie = Expected increase in inflation

It = Target Inflation Rate (As set by the Central Bank)

Empirical Evidences in favor of Taylor Rule:

An empirical study, based on data concerning the Federal Reserve’s monetary policy from 1987 to 1992, showed that the policy rates announced by the Fed during that period closely tracked estimations derived from Taylor Rule. The pic-1 below is the reflexive of the fact that Taylor’s rule predicted Fed rates quite even before 1987 and thereafter 1992.

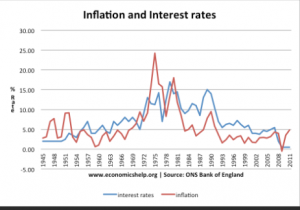

His findings were further corroborated by studies of Taylor and Davradakis (2006) and of Castroa and Muscatelli (2008) and Kulikauskas (2014). Castroa and Muscatelli (2008) and Robles and Maza (2018) also contended in their studies that Taylor’s Rule perfectly followed the Monetary Policy of Bank of England and European Central Bank in the past. It has been observed that the Taylor Rule fairly guides monetary policy during the economic period marked by steady growth and moderate inflation.

The Big “?”

Is the Taylor Rule relevant to Pakistan’s economy? A definite answer demands testing of the Rule on a comprehensive data set representing varied economic conditions over an extended period. Constraints to the availability of reliable data derived to test the Rule on a soft paradigm alternatively.

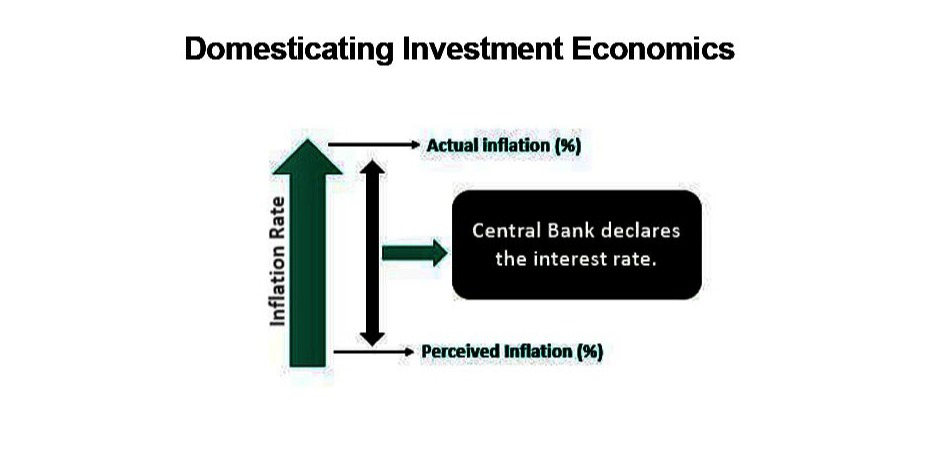

John Taylor’s Rule presumed that the upcoming Policy rate falls halfway between perceived and actual inflation (Pic-2). According to him, the Central Bank chooses a target inflation rate at the beginning of the fiscal year and then tries to achieve it. Any adjustments to it are the result of divergence between the actual and target inflation rate and the difference between real GDP growth and expected, which is made to maintain economic stability.

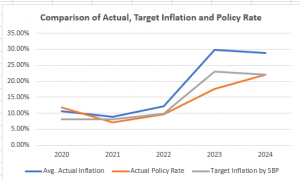

A test run on a small but on the most recent data, covering the period from 2020 to 2024, to observe how perfectly fit Taylor’s presumption of falling Policy rate between the two in our economy. The result was strikingly different than what was obvious in the US economy. The Policy rates happened to be below both the actual and perceived inflation (target inflation as set by SBP) for the study horizon Pic-3.

economy. The result was strikingly different than what was obvious in the US economy. The Policy rates happened to be below both the actual and perceived inflation (target inflation as set by SBP) for the study horizon Pic-3.

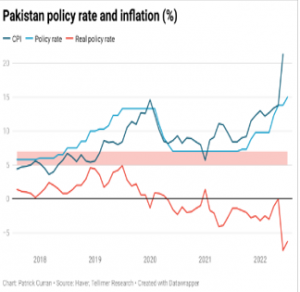

Further digging into the past revealed it to be a transitory phenomenon as the policy rates appeared to crisscross the inflation over the years with no major divergence unless the economy went through economic stress (Pic 4). A similar trend has also been observed in England (Pic 5).

To Infer:

Though the absence of relevant data made it difficult to test the relevance of Taylor’s Rule in totality within Pakistan’s economic context, yet based on available information it can fairly be concluded that policy rates usually stay closer to inflation.

The Conclusion:

As long as the economic environment lacks provisions for conformity of Taylor’s Rule to our economy, the soft approach will remain a preferable option over an opinionated survey for projecting Policy rates.

The Bottom Line:

Like most of the econometric models, Taylor’s Rule is too not devoid of constraints and criticisms. There have been periods when actual policy rates departed significantly from estimations derived from Taylor’s Rule. Mr. John Taylor himself pointed to those more than once in his paper such as:

“It is difficult to see how …. algebraic policy rules could be sufficiently encompassing” and “there will be episodes where monetary policy will need to be adjusted to deal with special factors.”

However, once an estimate is in hand, it can further be calibrated by employing guidelines described in the given matrix by Mr. John Taylor.

| Exceeds Target Inflation (As set by the Central Bank) |

Below Target Inflation (As set by the Central Bank) |

|

|---|---|---|

| Actual Inflation | Central Bank to raise Policy Rate | Central Bank to lower Policy Rate |

OR

| Exceeds Potential GDP (As anticipated by experts) |

Below Potential GDP (As anticipated by experts) |

|

|---|---|---|

| Actual GDP Growth | Central Bank to raise Policy Rate | Central Bank to lower Policy Rate |

Let us domesticate Investment Economics for smart Investment.

Copyright Mettis Link News

Posted on: 2024-03-13T10:48:45+05:00

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 125,627.31 258.99M |

1.00% 1248.25 |

| ALLSHR | 78,584.71 1,142.41M |

1.16% 904.89 |

| KSE30 | 38,153.79 69.25M |

0.63% 238.06 |

| KMI30 | 184,886.50 91.38M |

0.01% 13.72 |

| KMIALLSHR | 53,763.81 554.57M |

0.54% 290.61 |

| BKTi | 31,921.68 33.15M |

1.78% 557.94 |

| OGTi | 27,773.98 9.65M |

-0.40% -112.21 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,215.00 | 109,565.00 107,195.00 |

730.00 0.68% |

| BRENT CRUDE | 66.68 | 67.20 65.92 |

-0.12 -0.18% |

| RICHARDS BAY COAL MONTHLY | 97.00 | 97.00 97.00 |

1.05 1.09% |

| ROTTERDAM COAL MONTHLY | 107.65 | 107.65 105.85 |

1.25 1.17% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.03 | 65.82 64.50 |

-0.49 -0.75% |

| SUGAR #11 WORLD | 16.19 | 16.74 16.14 |

-0.52 -3.11% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|