Putting Taylor’s Rule to test for Projecting Policy Rate

Abu Ahmed | April 25, 2024 at 05:44 PM GMT+05:00

April 25, 2024 (MLN): Monetary Policy is around the corner, and results of surveys meant for gauging market sentiments concerning the direction and increase/decrease in interest rate are out.

It reminds me of one of my articles, published in March 2024 at MettisGlobal, under the caption Domesticating Investment Economics for Forecasting Policy Rate, wherein adoption of a structured approach, Taylor’s Rule, to predict the Policy rate was advocated. And, I found the moment opportune to put the rule to test its effectiveness in predicting Policy rates within our economic context.

Recall the Taylor Rule, which offers a framework for predicting policy rates by summarizing the collective understanding of policymakers on inflation and growth within the economy.

Target Policy Rate = Neutral Rate +0.5 x (GDPe – GDPt) + 0.5 x (Ie – It)

Whereas:

Neutral Rate = Real Policy Rate + Expected Inflation Rate (Current Short-term Interest rate)

GDPe = Expected GDP growth rate

GDPt = Long-term GDP growth rate

Ie = Expected increase in inflation

It = Target Inflation Rate (As set by the Central Bank)

Presumptions employed for the purpose are as under:

Estimation of Policy Rate:

| Key Economic Inputs | Conservative Presumptions | Aggressive Presumptions |

|---|---|---|

| Pakistan Short-Term Interest Rate, 3-month KIBOR average | 22.50% | 22.50% |

| Expected GDP for 2023-2024 (World Bank)-(IMF) | 1.70% | 2.00% |

| Target GDP for 2023-2024 (SBP) | 2.00% | 3.00% |

| Expected Inflation during 2024 (by World Bank) | 29.50% | 29.50% |

| Target Inflation for 2024 (by SBP) | 23.00% | 25.00% |

| Projected Policy Rate( Taylor’s Rule) | 25.6% | 24.70% |

Based on conservative and aggressive presumptions, the policy rate is to be around 24.70% to 25.6%.

is to be around 24.70% to 25.6%.

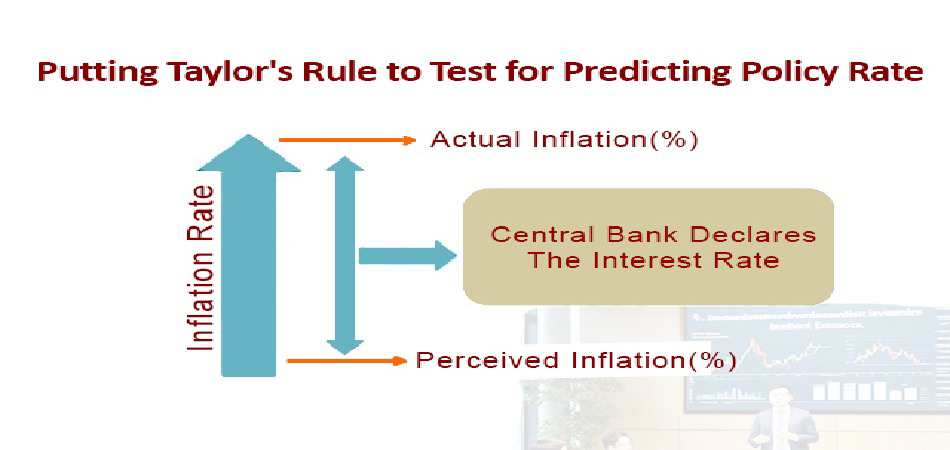

However, when the estimations are further calibrated under the extended concept of Taylor’s Rule, which states that the Central Bank usually declares the policy rate between Actual and Perceived inflation and is adjusted against generally prevailing and revised inflation expectations coupled with the view expressed by SBP in its “Inflation Monitor Report, January 2024” the Target Policy Rate comes in between 21% to 22%.

| Key Economic Inputs | Conservative Presumptions | Aggressive Presumptions |

|---|---|---|

| Pakistan Short-Term Interest Rate, 3-month KIBOR average |

22.50% |

22.50% |

| Expected GDP for 2023-2024 (World Bank)-(IMF) |

1.70% |

2.00% |

| Target GDP for 2023-2024 (SBP) | 2.00% | 3.00% |

| Expected Inflation during 2024 (widely prevailed) | 18.00% | 18.00% |

| Target Inflation for 2024 (by SBP)* | 20.00% | 22.00% |

| Projected Policy Rate (Taylor’s Rule) | 21.35% | 20.00% |

*SBP Annual Report 2022-2023

Therefore, a 1% cut in the Policy rate is what maximally be expected with a reasonable probability of no change in the Policy rate in the next Monetary Policy, due on 29th April 2029. Any aggressive cuts in interest rates at this juncture of time when the economy is in the process of stabilizing itself may inflect it of risks entailed with loose monetary policy.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction