Stocks are designed to be sold rather than bought

By Abu Ahmed | January 10, 2024 at 12:55 PM GMT+05:00

January 30, 2024 (MLN): It is like the tenth commandment for day traders and for those whose investment in stocks rests on technical analysis. The article ascertains rationality within the approach and its utility in respect of return on investment.

It sounds like a denial of the principle of Portfolio Investing! And equally contentious as well. Yet the most spoken phrase in the capital market by equity investors and traders around the globe. So, the phrase “Stocks Are Designed to Be Sold Rather Than Bought” was not bizarre to me when I read it in “Trading Rules” written by William F. Eng.

Despite I decided to explore the thematic depth of the phrase. A little pondering on the topic and a little analytics of stock trading data proved sufficient to infer that the phrase holds substance for stock investors, invariably for institutional and individual investors.

The saying seems more relevant to small stock investors who invest in shares to earn profit by capitalizing delta that comes along with the price volatility. To them, a realized return is more important than an expected one in the future, as the former ensures their existence as investors with resiliency in the capital market.

It does not mean that holding stocks forever and not selling them just for profit, are cornerstones of fundamental investing, no longer hold a place in the investing matrix. Many believe and practice it, especially institutional investors, such as Insurance Companies, Mutual Funds, and high net-worth investors, and are direct beneficiaries as practitioners.

Nonetheless, they too trade off the concept of forever holding with the selling of stock recently purchased for capital gains when left with no option but to meet the unmet investment objectives or to oblige corporate financial obligations of an imminent nature.

Whatever the reason for selling stocks, the truth is that the benefits of investing in stocks come only when stocks are sold at a profit. Otherwise, unrealized gains are ephemeral, which can be sensed, and felt but have no financial utility unless realized.

Letting a definite return forgo for a higher expected return in the future is like targeting two birds in bushes rather than one in hand. Though deferring return realization is not out of context by an investing paradigm, but is practical when it is not hurting long-term return objectives.

This is possible only when sitting on abundant financial resources for the smooth pursuit of long-term return objectives at the cost of sacrificing definite returns in the short term. A financial luxury, hardly available to individual investors in the presence of never-ending satiate for liquidity for managing investing risks & returns.

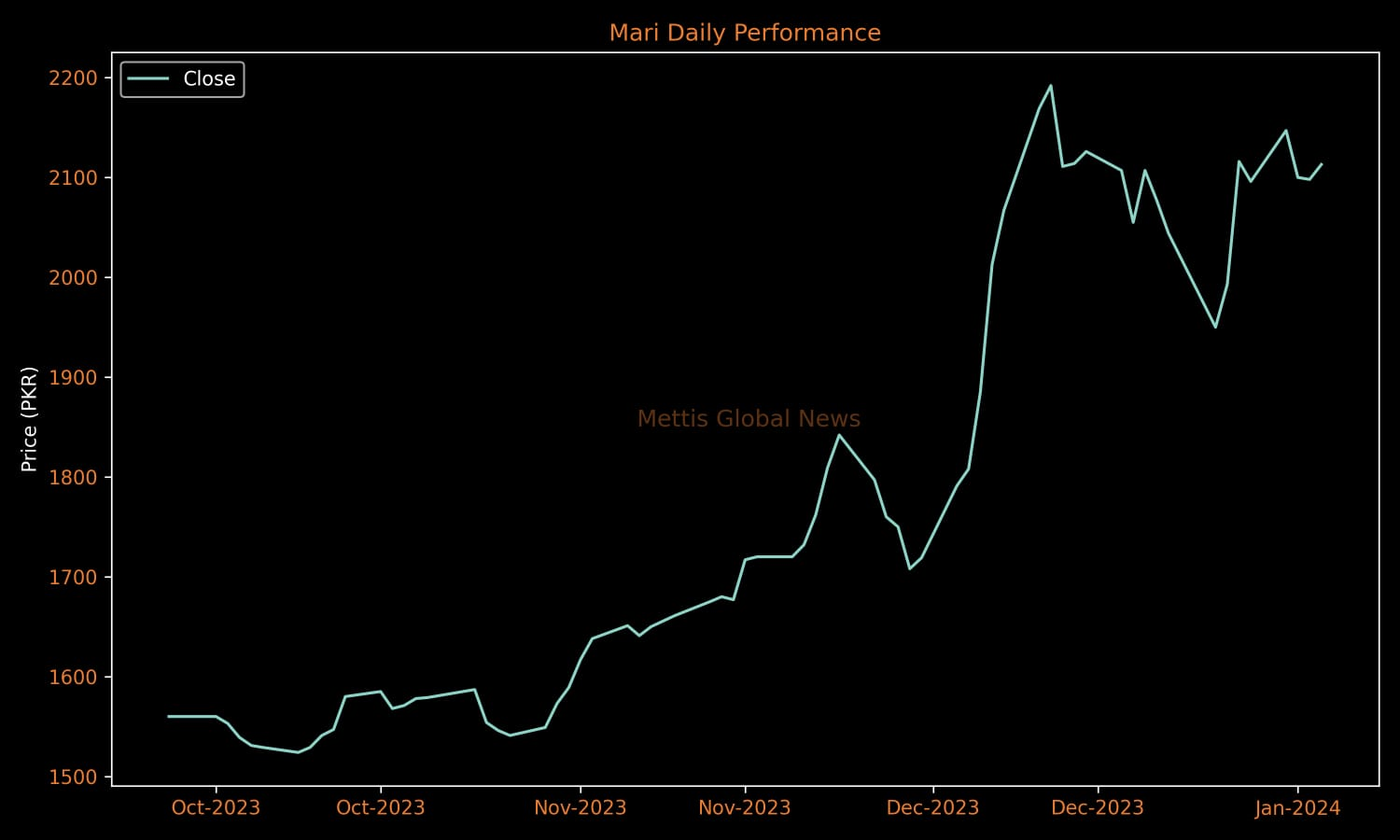

Moreover, the cyclic movement of stock price further weakens the argument of “forever holding”. A bird’s eye view of the share price chart of many stocks suffices to tell that the price oscillates between two extremes before attaining its target.

And there comes the occasion of making a profit bit by bit rather than waiting for profit to gather masses till the stock price reaches its target.

Given the limited fund size and frequent need for profit, accumulating profits as they come by along the way could preferably be a better strategy for individual investors. Remember;

“Little drops of water make a mighty ocean.”

Copyright Mettis Link News

Posted on: 2024-01-30T12:09:20+05:00

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI