A Soft Way of Valuing a Stock

Abu Ahmed | February 11, 2023 at 02:12 PM GMT+05:00

November 02, 2023 (MLN): Valuing a Stock is the first step towards wise investing. But few have the acumen and skills to do it. And that is too because of their educational background and professional training. The article offers an alternative approach to valuing stock with a soft approach.

“You take care of the earnings of a company; the investment will take care of itself”, the saying keeps evoking nostalgia even after retirement from service. I came across the phrase the first time during an investment meeting.

The phrase was orated by none other than the Chair of the meeting, Mr. Sami-ul-Haque, the then-Chairman of State Life. Rest of my career, I saw it reverting back like a pendulum whenever a company’s earnings resumed an upward trajectory to reckon its truthfulness.

The saying is certainly not unusual for investing professionals. The analysts and fund managers, both believed in it ritually with the difference that the former searches such stocks by estimating future earnings, while the latter takes the bait on analysts’ findings in the hope of climbing the podium to its highest standing.

Then, whom this article is for? It is for ordinary stock investors who desire to be on equal footing with investing professionals in identifying and selecting such stocks for investment but lack the knowledge and skills to compete.

For ordinary stock investors, applying a hard approach, such as financial modeling, for estimating future earnings is simply an outbound thing.

The best they could do is to employ a soft approach for the same. In a soft approach, a predictive model based on qualitative information such as operating performance, environments, and management policy of a company, is used for the projection of earnings.

Under the approach, the intention is not to hit the bull eyes but to be as close as possible to it.

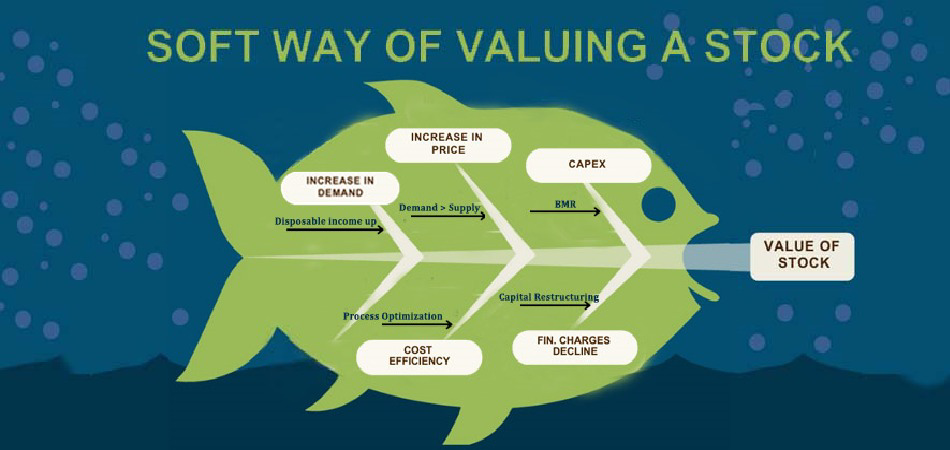

A Japanese technique, the Fishbone Diagram, could be helpful in this respect. The diagram consists of the head & tail of a fish with primary and auxiliary bones in between orchestrating the whole structure.

The head represents the outcome. Primary bones show the main factors responsible for the outcome whereas auxiliary bones bear the supporting pieces of evidence linked to a primary factor. The end result is a diagram similar to Fishbone.

The technique is extensively used in the fields of healthcare, brainstorming, and mind-mapping to identify causes and resolve the issues confronting a society or a company in the areas of quality and product management.

In valuing a stock, the effect could be substituted with growth in earnings and the causes could be management’s initiatives to support earnings growth. A predetermined template may be used for the purpose.

A sales infographic, showing the sales trend of the last few years’ sales, could be ab initio in the process.

Up-trending sales will warrant identifying of leading cause(s) that drove the sales up. Sales could be an effect, the head of fish, and an increase in demand and price may be enlisted as primary causes for growth in sales revenue.

The next step is to examine the spillover effect of sales on profitability.

An increase in profitability in tandem with an increase in sales will serve as a reason to initiate the next move, to gather pieces of evidence in support of sustainable growth in profit such as Capex already took or is to take, cost efficiency measures, restructuring of capital to reduce financial charges, and the competitive edge the company has.

The growing network of Fishbone will lead to an idea of the quality of earnings and its sustainable growth. The richer the structure is, the more crystally the diagram will foretell earnings.

Try it for fun. Sharpen your intuition to acclaim and be a financial wizard.

Intuition is what humanity relied on in the past for survival and prosperity and will continually rely on for marching to a new horizon.

What about scribing a financial destiny for yourself without becoming a mathematician?

Copyright Mettis Link News

Posted on: 2023-11-02T12:20:16+05:00

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 136,502.54 259.91M |

1.64% 2202.77 |

| ALLSHR | 85,079.90 838.35M |

1.26% 1061.74 |

| KSE30 | 41,552.62 97.27M |

1.81% 738.33 |

| KMI30 | 193,330.76 84.69M |

0.39% 741.60 |

| KMIALLSHR | 56,315.31 366.02M |

0.43% 243.06 |

| BKTi | 38,498.08 37.91M |

4.13% 1526.33 |

| OGTi | 28,138.38 5.66M |

-0.36% -101.89 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 120,040.00 | 123,615.00 118,675.00 |

1510.00 1.27% |

| BRENT CRUDE | 69.26 | 71.53 69.08 |

-1.10 -1.56% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.25 0.26% |

| ROTTERDAM COAL MONTHLY | 106.50 | 106.60 106.50 |

-2.20 -2.02% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 67.03 | 69.65 66.84 |

-1.42 -2.07% |

| SUGAR #11 WORLD | 16.31 | 16.67 16.27 |

-0.26 -1.57% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|