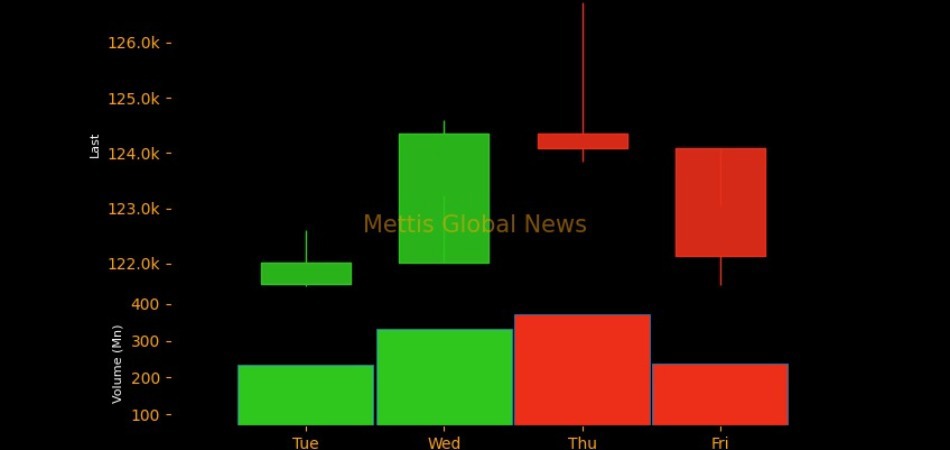

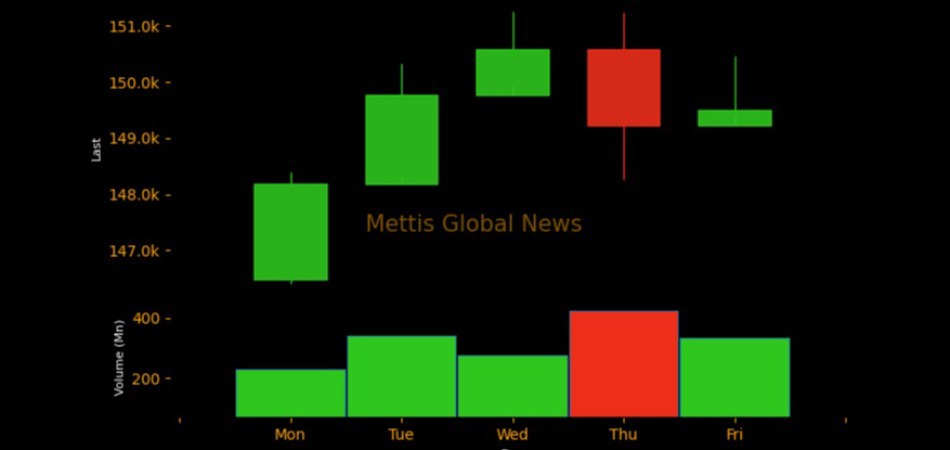

Consecutively, the bench mark KSE 100 index gained 502.56 points or 0.41%, closing the session at 122,143.56 compared to the previous week’s close of 121,641 .

Intraday swings were significant, with the index reaching a high of 126,718.28 (+4,574.72 points) and a low of 121,589.90 (-553.66 points).

Market cap

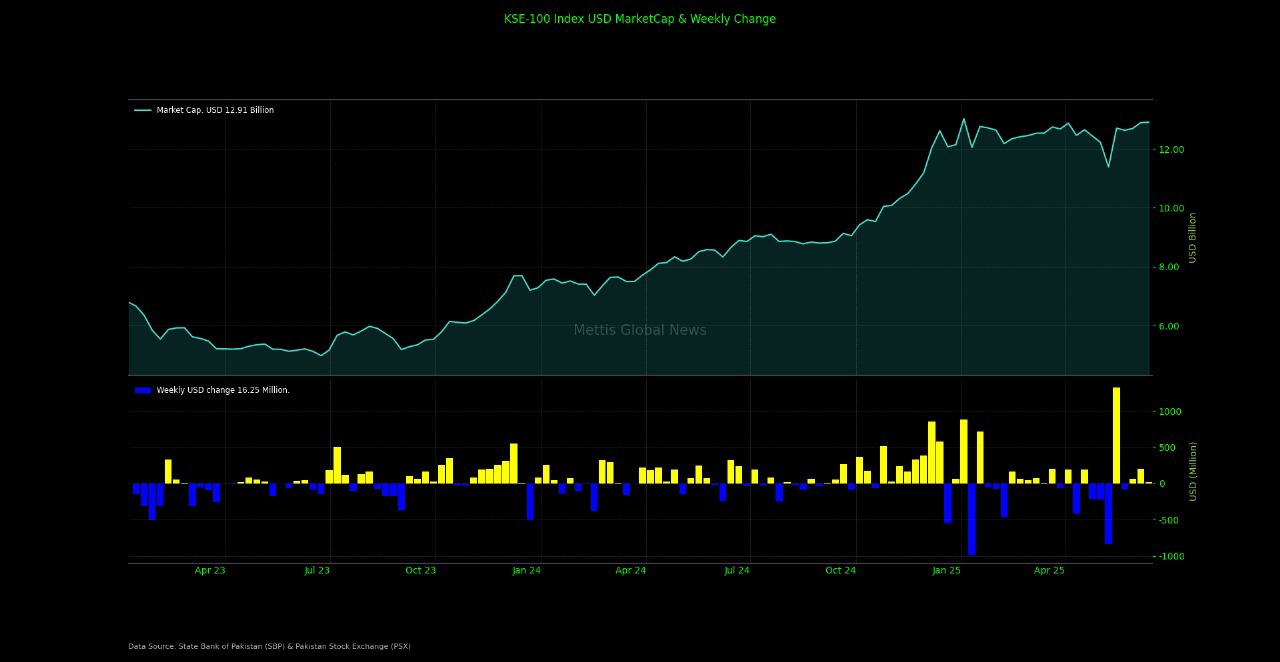

The KSE-100 market capitalization stood at Rs3.65 trillion, up 0.4% from the previous week’s Rs3.63tr. In USD terms, the market cap was recorded at $12.9 billion, compared to $12.89bn in the prior week.

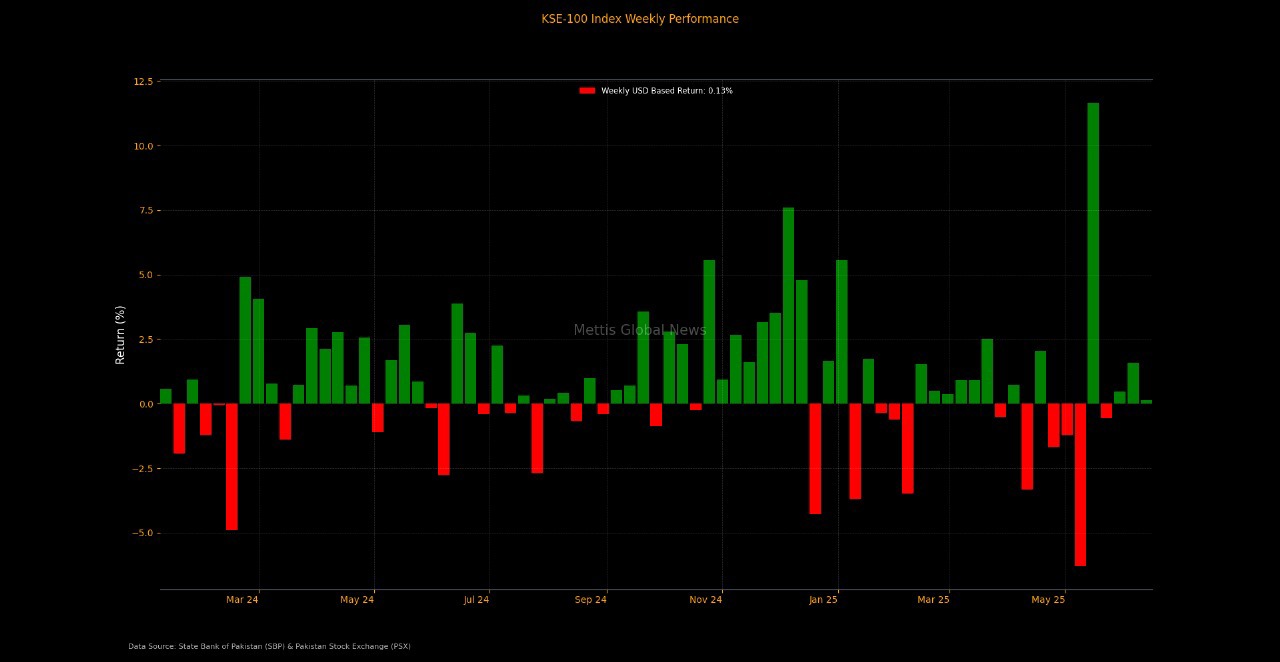

This week, the index return in USD terms was 0.13%, compared to 1.57% the previous week, with the market also marking its all-time high during the week.

On the economic front, Federal Minister Muhammad Aurangzeb presented the FY26 budget, projecting 4.2% GDP growth, 7.5% average inflation, a 3.9% budget deficit, and a primary surplus of 2.4%, with FBR revenue estimated at Rs14,131 billion.

State Bank of Pakistan’s (SBP) foreign exchange reserves rose by $166.8m to $11.68bn, while total reserves climbed to $16.88 billion during the week ended June 6, 2025.

Furthermore, car sales in Pakistan surged by 35.2% year-on-year and 39.7% month-on-month in May 2025, reaching 14,802 units, according to data from PAMA.

Pakistan's short-term inflation fell by 0.11% week-on-week and 1.41% year-on-year.

The positive economic cues helped stabilize investor sentiment, pushing the KSE-100 index’s fiscal year-to-date returns to 55.7%, while CYTD return stood at 6.09%.

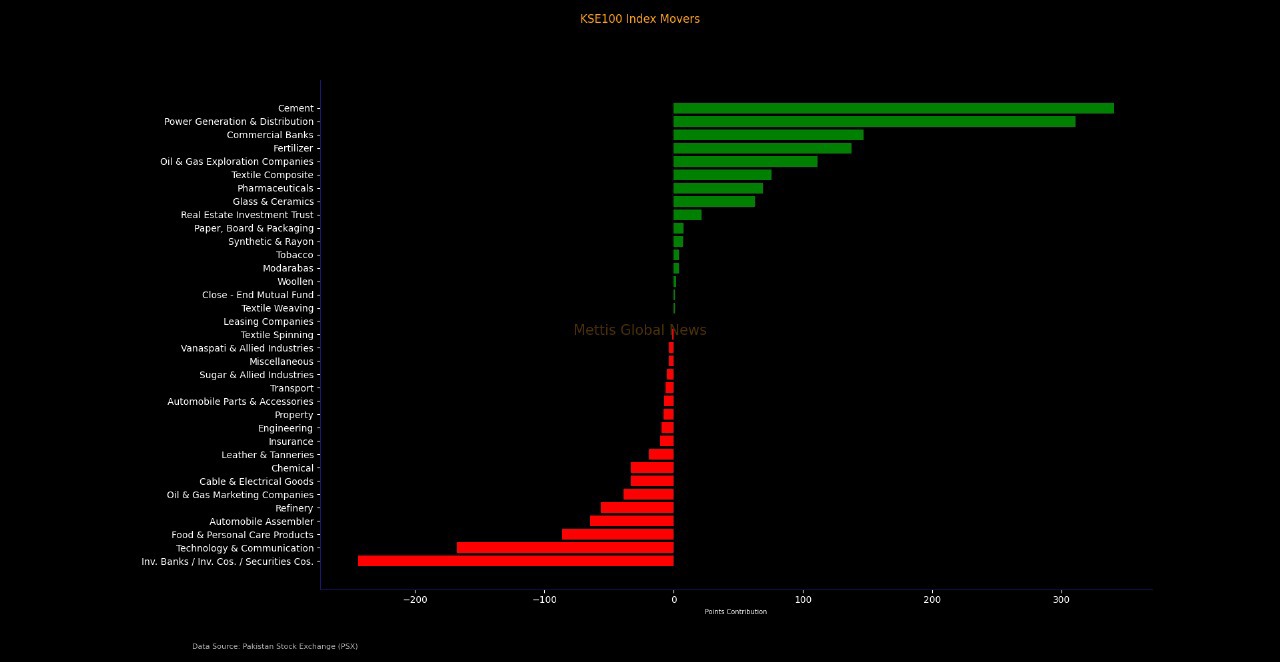

Top Index Movers

During the week, Cement, Commercial Bank and Power Generation & Distribution contributed 340.85, 310.89, and 146.95 points to the index.

On the flip side, Inv. Banks / Inv. Cos. / Securities Cos., Technology & Communication and Food & Personal Care Products dented the index by -244.2, -167.83 and -86.43 points, respectively.

Among individual stocks, PKGP added 427.28 points to the index while FCC, MLCF, and MARI contributed to the index by 161.6, 85.28, and 66.4, respectively.

Conversely, ENGROH, EFERT, and SYS eroded -242.9, -68.92, and -67.6 points, respectively.

FIPI/LIPI

This week, foreign investors remained net sellers, offloading equities worth $7.43m.

Foreign Corporates led the selling spree worth $9.25m while Overseas Pakistanis bought equities worth $2.03m.

On the other hand, local investors were net buyers this week, purchasing equities worth $7.43m.

Banks / DFI and Individuals bought securities worth $8.02m and $3.35m, respectively, while Insurance Companies sold securities worth $4.45m.

Copyright Mettis Link News