PSX in November: Fortune in Focus

Nilam Bano | December 01, 2025 at 01:11 PM GMT+05:00

December 01, 2025 (MLN): November 2025 proved to be a month where the KSE-100 Index truly flexed its muscles, closing at 166,677.7 points, up 5,046 points MoM, or +3.1%, as investors embraced optimism amid favourable policy cues and sector-specific catalysts.

On a YoY basis, the index jumped a whopping 63.5% from November 2024, indicating that the Pakistan equity market is not just walking but galloping ahead, despite global uncertainties and domestic macroeconomic pressures.

_20251201075419759_241dcc.jpeg)

The market’s heft was mirrored in its capitalization, which rose to Rs4.89 trillion, a 2.5% MoM increase from Rs4.7721 trillion in October, and a 57.3% YoY rise from Rs3.111 trillion in November 2024.

In USD terms, market cap reached $17.44 billion, rising 2.67% MoM from $16.99 billion in October and 55.9% YoY from $11.19 billion in November 2024.

These increases were supported by strong performances across key sectors, particularly fertilizer, oil and gas exploration, and power generation, combined with steady domestic investor participation.

_20251201075455907_5217a9.jpeg)

In USD terms, the KSE-100 delivered a 3.26% monthly return, rebounding from -2.19% in October 2025, though it remains below the 13.85% USD return YoY observed in November 2024.

The positive USD return in November reflects the combination of market gains outpacing currency depreciation, demonstrating resilience for foreign investors.

_20251201075427812_9af588.jpeg)

Economic Backdrop

Inflation remained a thorn in investors’ sides, with CPI climbing to 6.2% YoY in October, up from 5.6% in September, driven by seasonal food price rises and energy tariffs.

Trade continued to rattle nerves as the deficit widened to $3.2 billion in October, pushing the cumulative 4MFY26 deficit to $12.6 billion, up nearly 39% YoY.

Yet, there were bright spots. Remittances from overseas Pakistanis rose 12% YoY to $3.42 billion, buoyed by a 7% MoM increase, while Roshan Digital Account inflows hit $11.31 billion, showing that the diaspora remains a steadfast anchor for the economy.

The current account deficit widened to $733 million in 4MFY26, while REER increased to 103.95, indicating some stability in trade-adjusted exchange rates, offering a measure of reassurance for investors.

The country has recorded a value of $178.93m foreign

direct investment in October, compared to $145.92m in the Same Period

Last Year (SPLY).

Automobile

financing in Pakistan has increased to Rs315.4bn in October 2025,

witnessing a rise of 3.49% MoM compared to Rs304.77bn recorded in September

2025.

In the banking sector, the return

on bank deposits has decreased by 18 basis points to 5.10% in October

2025 compared to the deposit rate of 5.28% last month, according to the latest

official data.

Moreover, scheduled

banks’ total deposits eased marginally by 0.2% to Rs35.15tr in

October, down from Rs35.21tr recorded at the end of September.

Foreign investors' repatriation

of profit and dividends rose 38.97% YoY in 4MFY26 to $1.14 billion

compared to $818.36 million worth of repatriation in the same period last year.

The economic backdrop further strengthened market

sentiment. OGRA’s decision to cut prescribed gas prices by 3% for

SNGPL and 8% for SSGC signaled easing cost pressures for industries and

households, while improving financial discipline within the energy chain.

The government’s abolition of the 0.25% Export Development Surcharge was another policy

win for exporters aiming to reduce cost burdens and enhance global

competitiveness.

Local mobile phone production remained robust, with

25.11 million devices assembled during Jan–Oct 2025, significantly outpacing

commercial imports of just 1.7 million units, a reflection of sustained

momentum in import substitution.

Meanwhile, CCP’s latest assessment highlighted that the Reko Diq copper-gold project could inject up to

$74 billion into Pakistan’s economy over 37 years, strengthening expectations

of long-term sectoral transformation.

SBP’s foreign exchange data showed purchases of $257 million from the interbank market in

August, up from $189 million in July.

Money supply rose 1.3% month-on-month to Rs44.9

trillion in October, compared to Rs44.84 trillion in September, while

increasing 12.5% from October last year’s Rs39.93 trillion.

Inflation for November is projected between 5% and 6%,

consistent with stable price trends but reflecting continued pressure from food

and agriculture.

In monetary adjustments, SBP reduced the Special Cash Reserve Account remuneration rate by 14

bps to 2.86% for December.

Pakistan's tax-to-GDP

ratio has remained stubbornly low at around 10% over the past five years,

and a new IMF’s Governance and Corruption Report reveals the problem goes far

deeper than collection efficiency.

The report exposed a tax system plagued by excessive

complexity, corruption vulnerabilities, and ad hoc policy-making that

undermines revenue mobilization efforts.

The Fund (IMF) urged that Pakistan could achieve economic growth of 5% to 6.5% over the next five years if it swiftly implements a 15-point reform agenda to tackle governance weaknesses and curb corruption.

IMF Executive Board has

scheduled a meeting for December

8 to review Pakistan’s progress under its ongoing loan programs, a key step

toward releasing approximately $1.2 billion in financing, according to

Bloomberg News.

The board will conduct the second review under the 37-month

Extended Fund Facility (EFF) and the first review under the Resilience and

Sustainability Facility (RSF).

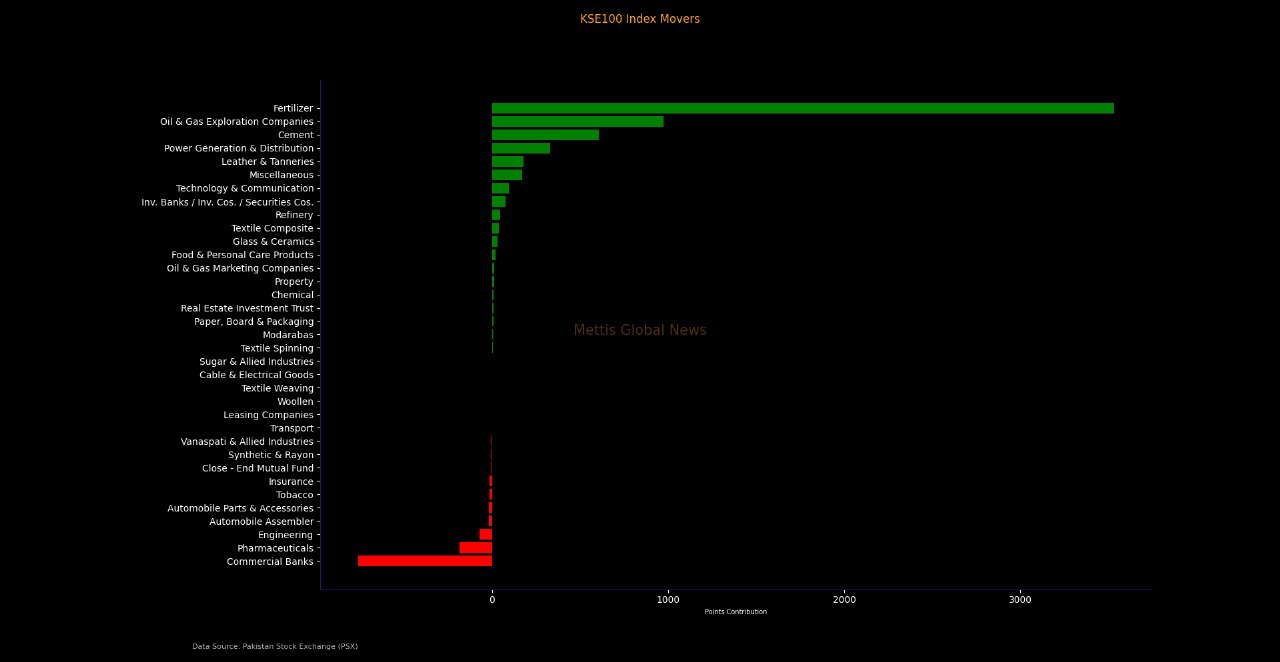

Index Movers

The November rally had its heroes and laggards. Fertilizer companies roared ahead, contributing 3,533 points, with FFC alone adding 3,105 points after its inclusion in the KSE-Meezan 30 Index and government approval to switch from RLNG to Mari gas.

Oil & Gas Exploration companies added 972 points, with PPL (+568 points) and OGDC (+265 points) leading the charge.

Power Generation & Distribution contributed 330 points, while Cement (+607 points) and Refinery (+45 points) sectors also powered the index higher.

Technology & Communication added 94 points, Investment Banks & Securities Cos. 75 points, Textile Composite 38 points, Glass & Ceramics 30 points, Food & Personal Care 18 points, and Oil & Gas Marketing Companies 12 points.

On the flip side, Commercial Banks lost 762 points, Pharmaceuticals 185 points, Engineering 71 points, and other sectors like Automobile Assemblers, Tobacco, and Insurance saw moderate pressure, reflecting selective profit-taking.

Scrip Highlights

Individual companies mirrored sector performance. FFC (+3,105 points), PPL (+568), PIOC (+490), and HUBC (+284) led the pack, followed by OGDC, EFERT, PSEL, SRVI, and FATIMA. Moderate contributions came from POL, HBL, DHPL, SYS, and KTML.

On the downside, UBL (-174), BAHL (-289), NBP (-116), SNGP (-76), and BAFL (-97) were the biggest decliners, reflecting profit booking and sectoral rotations.

_20251201075509795_7e24f7.jpeg)

Investor Flows

Foreign investors (FIPI) were net sellers in November, offloading $41.34 million, dominated by foreign corporates and individuals, while Overseas Pakistanis sold a smaller amount.

Local investors (LIPI) stepped in to offset the foreign selling with net inflows of $41.34 million, led by banks, individual investors, insurance companies, and mutual funds.

This dynamic shows that while foreign investors remain cautious, domestic capital is holding the fort that keeps the market on an upward trajectory.

_20251201075607076_82b368.jpeg)

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 168,893.09 355.32M | 2.59% 4266.79 |

| ALLSHR | 100,888.78 687.85M | 1.91% 1889.56 |

| KSE30 | 51,723.30 154.72M | 2.74% 1380.77 |

| KMI30 | 236,793.15 125.14M | 3.40% 7778.72 |

| KMIALLSHR | 64,642.45 317.23M | 2.51% 1584.54 |

| BKTi | 49,503.80 58.63M | 0.97% 475.26 |

| OGTi | 32,753.55 16.04M | 2.00% 643.61 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Monetary Aggregates (M3) - Monthly Profile

Monetary Aggregates (M3) - Monthly Profile