Bank deposits decrease to Rs35tr in Oct

MG News | November 18, 2025 at 11:15 AM GMT+05:00

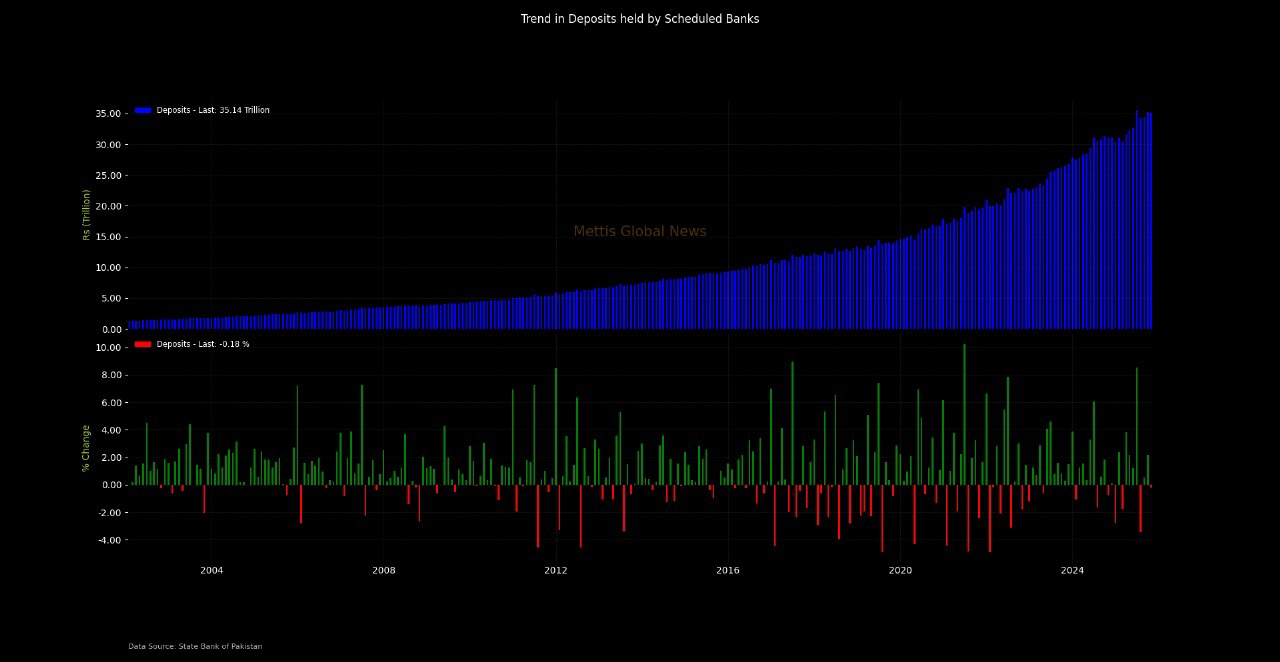

November 18, 2025 (MLN): Scheduled banks’ total deposits eased marginally by 0.2% to Rs35.15 trillion in October, down from Rs35.21 trillion recorded at the end of September.

However, on a year-on-year basis, deposits grew robustly by 13%, up from Rs31.12 trillion in October 2024, according to the latest data from the central bank.

Total advances declined by 1.3% month-on-month to Rs13.28 trillion, down from Rs13.46 trillion in September.

Compared to October last year, advances were down 3.6%, from Rs13.78 trillion. Consequently, the Advances to Deposit Ratio (ADR) fell to 37.8%, reflecting a drop of 44 basis points from the previous month and a significant 650 basis points decrease from a year earlier._20251118060837059_1dc381.jpeg)

Meanwhile, banks’ investments continued their upward trajectory, rising 2.0% month-on-month to Rs36.55 trillion.

Year-on-year, investments surged 26.3% from Rs36.55 trillion in October 2024.

The Investment to Deposit Ratio (IDR) climbed to 104.0%, up 226 basis points from September and 1,098 basis points compared to last year._20251118060843937_3f48a0.jpeg)

The decline in advances alongside rising deposits and investments indicates a cautious lending environment, as banks prioritize liquidity amid uncertain economic conditions.

Analysis of scheduled banks' balance sheet data from January 2019 to October 2025 reveals a fundamental transformation in the banking sector's role as an intermediary.

The period is characterized by robust deposit growth of 169%, tepid credit expansion of 76%, and explosive investment growth of 586%.

Most significantly, the Advance-to-Deposit Ratio (ADR) has collapsed from 60% to 39.2%, while the Investment-to-Deposit Ratio (IDR) has surged from 40% to 101.9%, indicating a structural pivot away from private sector lending toward government securities.

Pakistan's banking sector has undergone a dramatic structural transformation between January 2019 and October 2025, fundamentally altering its role in financial intermediation.

While deposits expanded impressively from Rs13.06 trillion to Rs35.15 trillion, representing 169% growth, the sector's deployment of these resources reveals a troubling divergence from traditional banking functions.

The most striking feature of this period is the collapse in lending activity relative to deposit mobilization. Advances grew a mere 76% to Rs13.79 trillion, significantly underperforming deposit growth and reflecting deep risk aversion within the banking system.

This translated into the Advance-to-Deposit Ratio plummeting from a healthy 60% in early 2019 to just 39.2% by October 2025, representing a 21 percentage point decline that signals severe underutilization of deposits for productive credit creation.

Conversely, bank investments exploded by 586% to Rs35.82 trillion, growing at a compound annual rate of 33.6% compared to credit's modest 8.9%.

This dramatic reallocation pushed the Investment-to-Deposit Ratio from 40% to an unprecedented 101.9%, meaning banks now invest more than their entire deposit base in government securities.

This threshold breach, first observed in August 2024, represents a historic anomaly indicating that banks are predominantly leveraging their balance sheets into sovereign paper.

The COVID-19 pandemic marked a clear inflection point, after which credit growth stagnated while investment allocation accelerated sharply.

This suggests elevated government financing needs coincided with banks finding more attractive risk-adjusted returns in sovereign securities than in private sector lending.

The recent October 2025 deposit contraction of 0.2% adds urgency to these concerns, potentially signaling emerging deposit pressures after years of consistent growth.

This structural shift carries profound implications for economic development, as the banking sector has effectively transformed from a credit intermediary into a conduit for government financing, potentially crowding out productive private investment and constraining long-term growth prospects.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 168,893.09 355.32M | 2.59% 4266.79 |

| ALLSHR | 100,888.78 687.85M | 1.91% 1889.56 |

| KSE30 | 51,723.30 154.72M | 2.74% 1380.77 |

| KMI30 | 236,793.15 125.14M | 3.40% 7778.72 |

| KMIALLSHR | 64,642.45 317.23M | 2.51% 1584.54 |

| BKTi | 49,503.80 58.63M | 0.97% 475.26 |

| OGTi | 32,753.55 16.04M | 2.00% 643.61 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20251224092146390_42f21c.webp?width=280&height=140&format=Webp)

_20260114103724909_a51a75_20260226171819731_df4419.webp?width=280&height=140&format=Webp)

.png?width=280&height=140&format=Webp)

Monetary Aggregates (M3) - Monthly Profile

Monetary Aggregates (M3) - Monthly Profile