Pakistan’s REER rises to 103.95 in October 2025

MG News | November 17, 2025 at 10:29 AM GMT+05:00

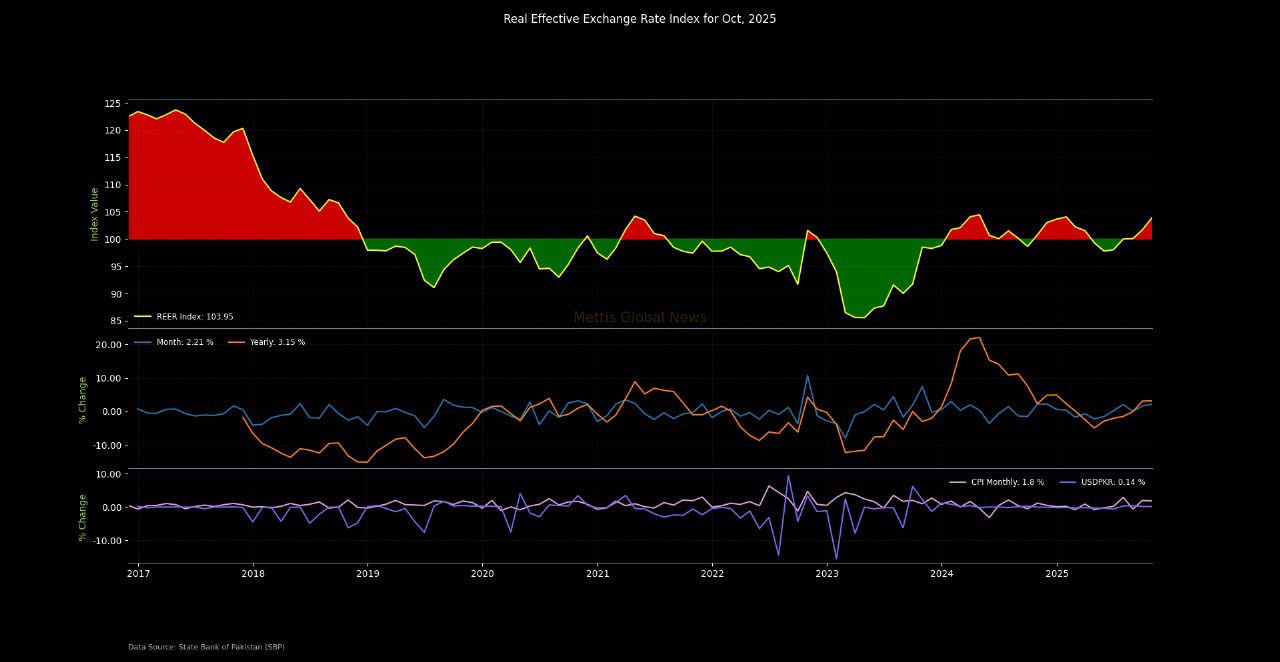

November 17, 2025 (MLN): Pakistan’s real effective exchange rate (REER) increased to 103.95 in October 2025, up from 101.70 in September 2025, reflecting a 2.2% MoM gain and a 3.2% rise YoY from 100.78 in October 2024.

The increase in REER indicates a relative strengthening of the Pakistani rupee when adjusted for inflation against its trading partners.

Meanwhile, the nominal effective exchange rate (NEER) recorded a slight decline to 37.996 in October 2025, compared with 37.766 in September 2025, marking a 0.6%MoM rise, but a 0.7% decline YoY from 38.271 in October 2024.

The Pakistani rupee closed at PKR 280.92 per USD on October 31, 2025, appreciating 0.15% month-on-month compared to PKR 281.35 in September 2025, but depreciating 1.13% year-on-year compared to PKR 277.85 in October 2024.

REER is an index of the price of a basket of goods in one country relative to the price of the same basket in that country's major trading partners.

An increase in REER implies that exports become more expensive and imports become cheaper; therefore, this increase indicates a decline in trade competitiveness.

The price of each trading partner's basket is weighted by its share in imports, exports, or total foreign trade.

A REER index of 100 should not be misinterpreted as denoting the equilibrium value of the currency. 100 merely represents the value of the currency at a chosen point in time (in this case the average value of the currency in 2010).

Therefore, the movement of the REER away from 100 simply reflects changes relative to its average value in 2010 and is unrelated to its equilibrium value.

While NEER is an index of the bilateral nominal exchange rates of one country relative to its major trading partners or a selected basket of currencies.

The bilateral nominal exchange rate index with each trading partner is weighted by that country’s share in imports, exports, or total foreign trade.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 168,893.09 355.32M | 2.59% 4266.79 |

| ALLSHR | 100,888.78 687.85M | 1.91% 1889.56 |

| KSE30 | 51,723.30 154.72M | 2.74% 1380.77 |

| KMI30 | 236,793.15 125.14M | 3.40% 7778.72 |

| KMIALLSHR | 64,642.45 317.23M | 2.51% 1584.54 |

| BKTi | 49,503.80 58.63M | 0.97% 475.26 |

| OGTi | 32,753.55 16.04M | 2.00% 643.61 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20251224092146390_42f21c.webp?width=280&height=140&format=Webp)

_20260114103724909_a51a75_20260226171819731_df4419.webp?width=280&height=140&format=Webp)

.png?width=280&height=140&format=Webp)

Monetary Aggregates (M3) - Monthly Profile

Monetary Aggregates (M3) - Monthly Profile