Weekly Market Roundup

MG News | September 21, 2025 at 11:19 PM GMT+05:00

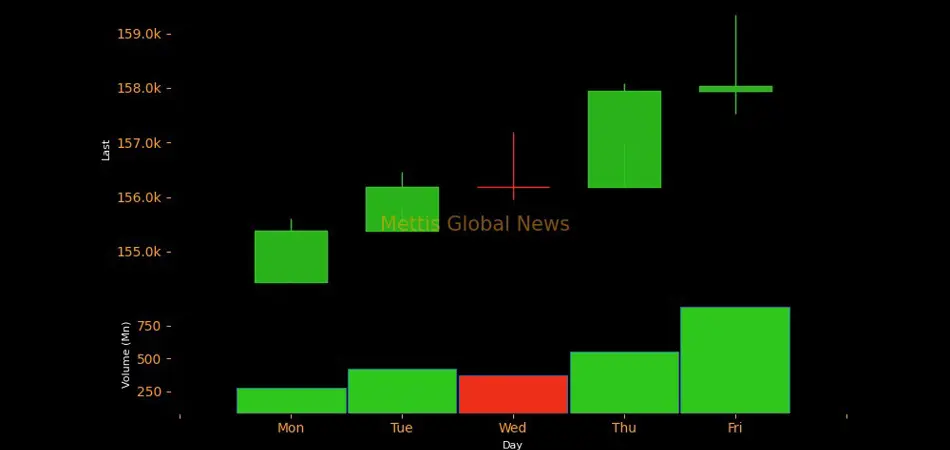

September 21, 2025 (MLN): The good luck charm for

Pakistan equities has not ended, it seems; it just started as the KSE-100 Index closed

the week at a whopping 158,037 points, a gain of 3,598 points, or a respectable

2.33% week-over-week.

The news of the Saudi-Pakistan defense pact, have given

investors a much-needed confidence boost. It is like the market is now cruising

on newfound optimism.

Market cap

The KSE-100 market capitalization stood at Rs4.67 trillion,

up 2.13% from the previous week’s Rs4.58tr.

This week, the index return in USD terms was 2.36%, compared

to 0.14% the previous week.

On the economic front, the State Bank of Pakistan (SBP)

decided to hold steady, keeping the policy rate at 11%, keeping a close eye on

the recent floods and their potential impact on the economy.

The current account deficit is getting smaller, which is

always a good sign. It came in at a manageable $245 million in August, a

significant improvement from the $379m in July.

The industrial sector is showing some serious muscle. Large

Scale Manufacturing Industries (LSMI) saw a solid 8.99% increase YoY in July,

and a 2.6% jump MoM. This is great news, as it shows that Pakistan's factories

are humming along and churning out goods.

During the week, SBP raised Rs201.9 billion in the T-Bill

auction, blowing past its target of Rs175bn. This shows that investors are keen

on lending to the government.

The local currency appreciated slightly by 0.03%

and closed at 281.46 against the US Dollar.

Top Index Movers

During the week, Cement, Commercial Banks, and Technology

& Communication contributed 553.05, 517.03, and 507.81 points,

respectively, to the index.

Among individual stocks, HUBC, BOP, and LUCK gained 442.39, 394.15,

and 264.34points, respectively.

FIPI/LIPI

This week, Foreign Investors remained net sellers, selling

equities worth $20.84m.

Foreign Corporates led the selling spree worth $15.65m.

On the other hand, local Investors were net buyers this

week, purchasing equities worth $20.84m.

Mutual Funds bought maximum securities worth $17.71m while

Insurance Companies and Individuals bought $6.29m, and $4.07m respectively.

On the other hand, Banks and Other organizations sold

securities worth $8.15m and $3.67m, respectively.

Copyright Mettis

Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 184,129.58 798.69M | -1.97% -3702.50 |

| ALLSHR | 110,763.73 1,266.28M | -1.85% -2087.96 |

| KSE30 | 56,278.51 173.32M | -2.19% -1261.46 |

| KMI30 | 259,907.89 102.57M | -2.03% -5380.16 |

| KMIALLSHR | 71,198.64 822.49M | -1.72% -1247.03 |

| BKTi | 53,693.69 102.25M | -2.59% -1425.61 |

| OGTi | 37,589.24 28.20M | -2.72% -1052.27 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 70,580.00 | 71,690.00 60,005.00 | 6785.00 10.64% |

| BRENT CRUDE | 68.10 | 68.83 66.56 | 0.55 0.81% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 96.00 96.00 | 1.50 1.59% |

| ROTTERDAM COAL MONTHLY | 102.75 | 103.25 101.30 | 2.25 2.24% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 63.50 | 64.58 62.20 | 0.21 0.33% |

| SUGAR #11 WORLD | 14.14 | 14.30 14.07 | -0.13 -0.91% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20260206191044099_c99cfd.jpeg?width=280&height=140&format=Webp)

MTB Auction

MTB Auction