Weekly Market Roundup

_20260206191044099_c99cfd.jpeg?width=950&height=450&format=Webp)

MG News | February 07, 2026 at 12:15 AM GMT+05:00

February 7, 2026 (MLN): The Pakistan Stock Exchange (PSX) ended the outgoing week on a muted note, as the benchmark KSE-100 Index slipped marginally by 44.91 points, or 0.02% WoW, closing at 184,129.58 on February 6, 2026, compared to 184,174.49 at the end of the previous week.

The market remained cautious throughout the week, as concerns over a potential super tax on high-earning corporates weighed on trading.

Developments in a US India trade deal were closely

monitored, while a surge in government bill yields further limited risk

appetite, keeping activity subdued and selective across sectors.

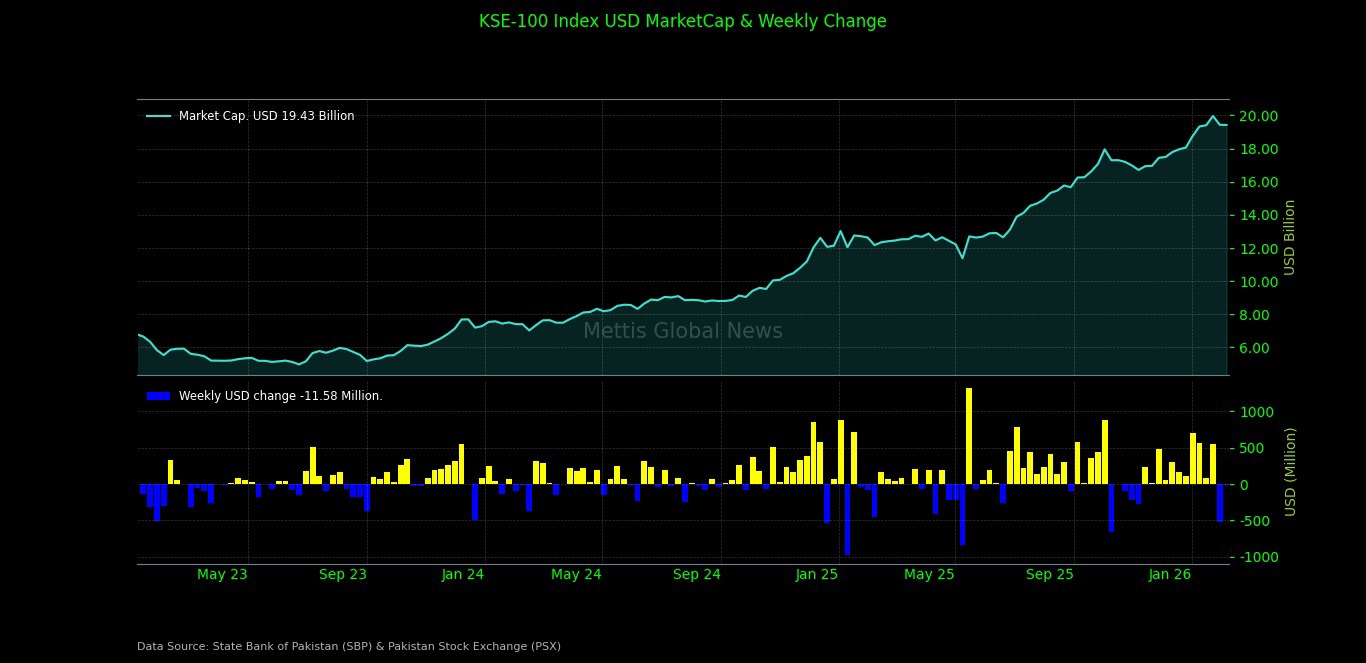

Market Capitalization

In terms of market capitalization, total market cap in rupee

terms edged down to Rs5.43 trillion, from Rs5.44 trillion last week.

This represents a decline of Rs4.42bn, or 0.08% WoW,

indicating a broadly flat market outcome with limited net value erosion.

In dollar terms, market capitalization declined

slightly to $19.43bn, compared to $19.44bn in the previous week, showing

a marginal loss of $11.6m, or 0.06% WoW.

Consequently, USD returns remained nearly flat,

standing at -0.003% for the week, compared to -2.61% in the prior

week, highlighting stability in foreign-adjusted equity performance._20260206191026840_ea4552.jpeg)

On the macroeconomic front, SBP raised Rs823bn

in its February 4 MTB auction as cut-off yields rose across all tenors, while

the 12-month paper saw the highest participation.

The central bank, however, rejected all bids for the 10-year

PIB Floating Rate bond despite Rs353bn in offers.

Pakistan’s

trade deficit shrank sharply by 28.5% MoM to $2.73bn in January 2026 as

exports crossed a record $3bn for the first time and imports fell.

However, despite the strong monthly showing, the cumulative

FY26 deficit widened 28.2% YoY, highlighting persistent external pressures.

Pakistan’s CPI inflation edged up to 5.8% YoY

in January 2026, from 5.6% in December, with monthly prices rising 0.4% amid

higher rural inflation.

While headline and core pressures showed a mild uptick,

wholesale inflation remained subdued at just 0.2% YoY.

Pakistan faces a net foreign currency outflow

of $31.1bn due to maturing external obligations, with over $22bn falling

due within one year, signaling near-term pressure on the external account.

This comes despite official reserve assets standing at

$26.3bn as of end-December 2025, supported by foreign currency holdings and

gold reserves.

The Pakistani rupee remained broadly stable, posting

a slight appreciation during the week.

The PKR strengthened marginally to Rs279.71 per USD,

compared to Rs279.77 a week earlier, limiting currency-driven volatility

in equity valuations.

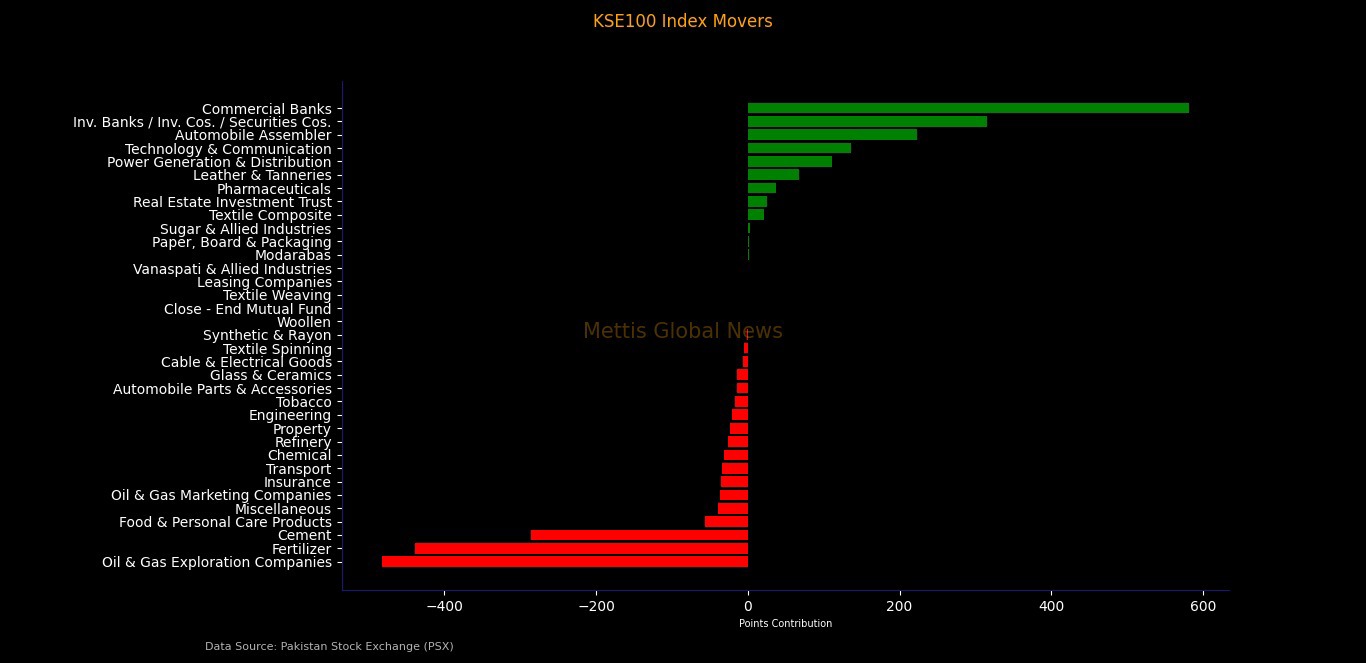

Index Movers

Sector-wise performance remained mixed, with gains in

banking and select cyclical sectors offset by weakness in fertilizer, cement,

and energy stocks.

On the downside, Oil & Gas Exploration Companies

emerged as the biggest drag on the KSE-100 Index, shaving off 483 points,

followed by Fertilizer, which subtracted 439 points, and Cement, erasing 286

points from the index.

Further pressure came from Food & Personal Care

Products (-56 points), Miscellaneous (-39 points), Oil & Gas Marketing

Companies (-37 points), Insurance (-35 points), and Transport (-35 points).

Additional losses were recorded in Chemicals (-31

points), Refinery (-27 points), Property (-24 points), Engineering (-21

points), Tobacco (-16 points), Automobile Parts & Accessories (-14 points),

Glass & Ceramics (-14 points), and Cable & Electrical Goods (-7

points), keeping overall index movement subdued.

On the positive side, Commercial Banks provided the strongest support, adding 582 points to the index.

This was followed by Investment Banks / Investment Companies / Securities

Companies, which added 316 points, Automobile Assemblers (+222 points), Technology

& Communication (+136 points), and Power Generation & Distribution,

which contributed 111 points.

Gains were also recorded in Leather & Tanneries (+68

points), Pharmaceuticals (+37 points), REITs (+25 points), and Textile

Composite (+21 points), partially offsetting losses in other sectors.

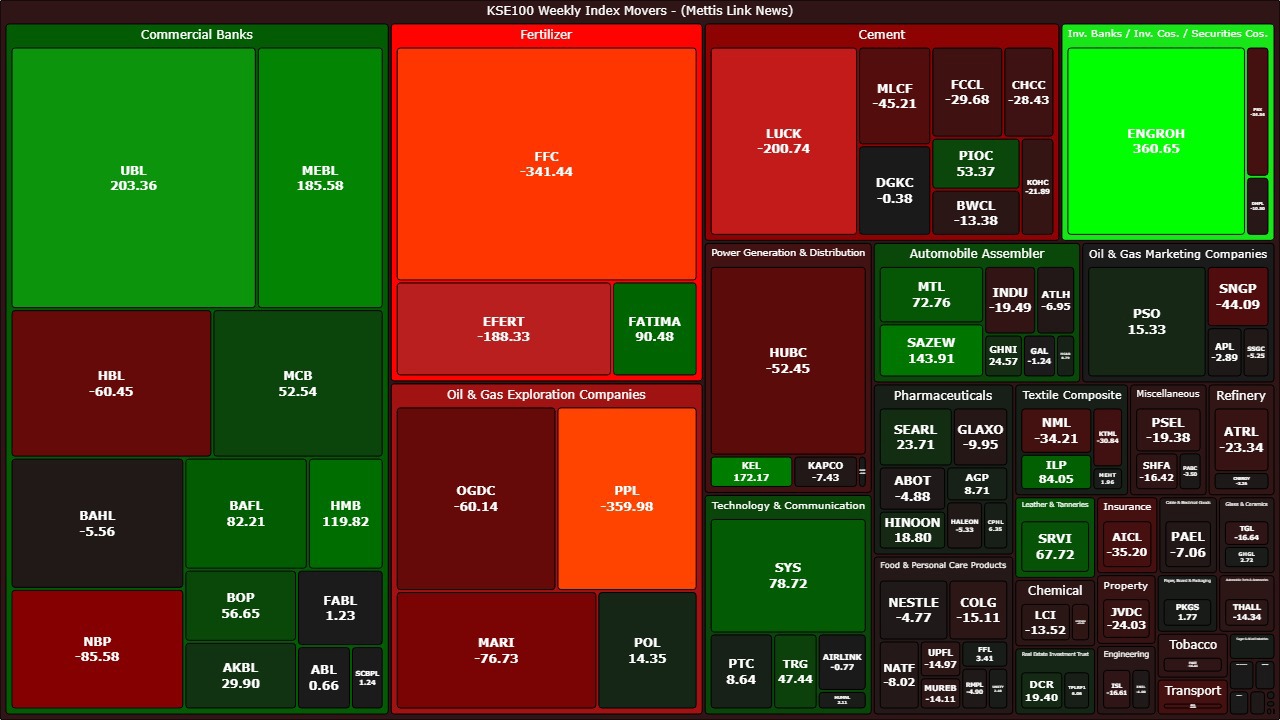

Scrip-wise, ENGRO Holdings (ENGROH) emerged as the

single largest positive contributor, adding 361 points to the KSE-100

Index.

Other major gainers included United Bank Limited (UBL),

which added 203 points, Meezan Bank (MEBL) (+186 points), K-Electric

(KEL) (+172 points), and SAZEW, which contributed 144 points.

Additional upside support came from Habib Metropolitan

Bank (HMB) (+120 points), FATIMA Fertilizer (+90 points), Interloop

(ILP) (+84 points), Bank Alfalah (BAFL) (+82 points), Systems

Limited (SYS) (+79 points), Millat Tractors (MTL) (+73 points).

Service Industries (SRVI) (+68 points), MCB Bank

(+53 points), and TRG Pakistan (+47 points), driven mainly by buying

interest in banking, autos, and technology stocks.

On the downside, Pakistan Petroleum Limited (PPL)

emerged as the biggest laggard, shaving off 360 points from the index.

It was followed by Fauji Fertilizer Company (FFC),

which dragged the index by 341 points, Lucky Cement (LUCK) (-201

points), and Engro Fertilizers (EFERT), which subtracted 188 points.

Other notable negative contributors included National

Bank of Pakistan (NBP) (-86 points), Mari Petroleum (MARI) (-77

points), Habib Bank Limited (HBL) (-60 points), Oil & Gas

Development Company (OGDC) (-60 points).

Hub Power Company (HUBC) (-52 points), Maple Leaf

Cement (MLCF) (-45 points), Sui Northern Gas Pipelines (SNGP) (-44

points), and several cement, fertilizer, and energy stocks, highlighting

continued pressure in index heavyweights.

FIPI / LIPI Flow

From an investor flow perspective, foreign investors

turned net sellers, with FIPI outflows of $11.44m during the week.

Selling was primarily led by foreign corporates,

which recorded net outflows of $12.09m, while foreign individuals

remained largely neutral.

This was partially offset by modest buying from overseas

Pakistanis, who posted net inflows of $0.67m.

In contrast, local investors emerged as net buyers,

with LIPI inflows of $11.44m, fully offsetting foreign selling.

Buying was driven mainly by mutual funds ($16.39m), companies

($7.89m), and broker proprietary trading ($8.30m), while selling

pressure was seen from banks/DFIs, insurance companies, and individual

investors._20260206191019776_b56f88.jpeg)

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 155,777.21 362.16M | -0.86% -1354.88 |

| ALLSHR | 92,994.52 618.17M | -0.61% -572.34 |

| KSE30 | 47,890.76 137.48M | -0.85% -412.22 |

| KMI30 | 220,015.06 115.60M | -0.35% -783.45 |

| KMIALLSHR | 59,910.72 260.41M | -0.13% -77.81 |

| BKTi | 45,388.60 42.55M | -1.74% -804.48 |

| OGTi | 30,631.34 29.10M | 1.45% 438.24 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 72,695.00 | 73,600.00 72,390.00 | -750.00 -1.02% |

| BRENT CRUDE | 83.83 | 83.95 82.13 | 2.43 2.99% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -17.10 -14.68% |

| ROTTERDAM COAL MONTHLY | 121.50 | 124.00 121.25 | -6.50 -5.08% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 77.18 | 77.42 75.56 | 2.52 3.38% |

| SUGAR #11 WORLD | 13.71 | 14.07 13.70 | -0.22 -1.58% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpg_20260127052750720_42cc2c.jpeg?width=280&height=140&format=Webp)

MTB Auction

MTB Auction