January inflation rises by 5.8%

MG News | February 02, 2026 at 04:35 PM GMT+05:00

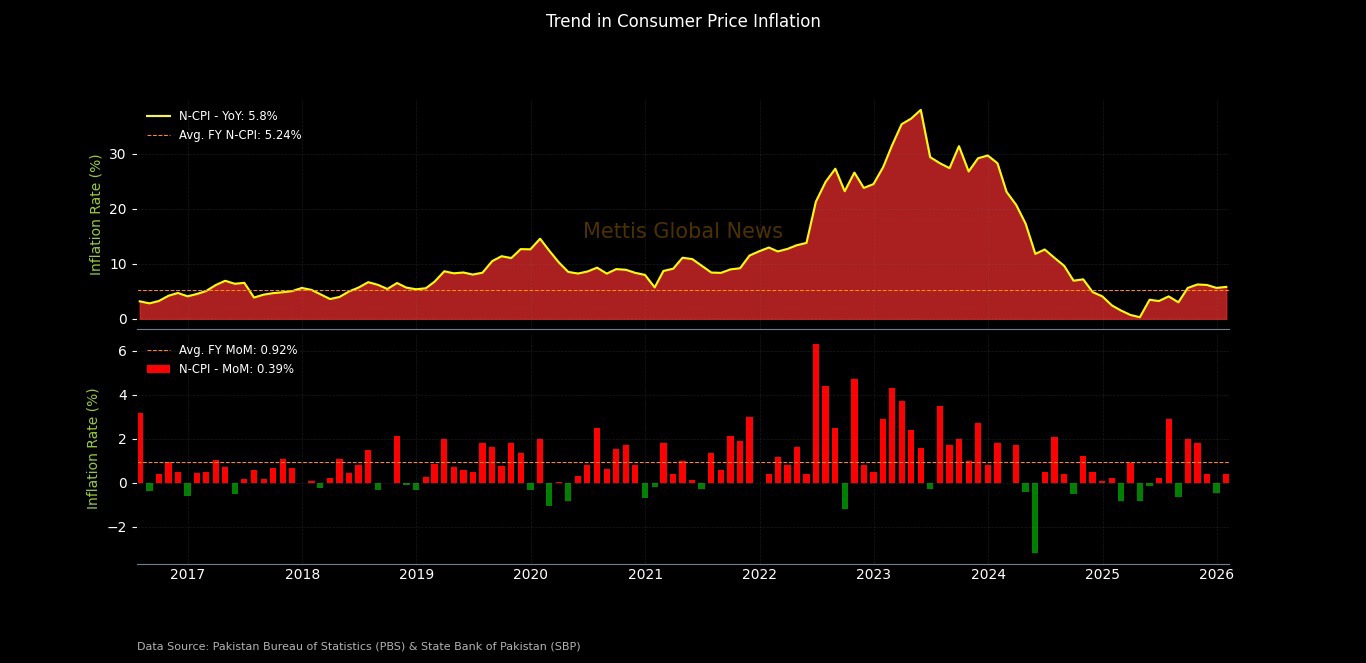

February 2, 2026 (MLN): Pakistan's headline Consumer Price Index (CPI) inflation increased to 5.8% year-on-year (YoY) in January 2026, up from 5.6% in December 2025, the Pakistan Bureau of Statistics (PBS) reported today.

This compares to 2.4% recorded in January 2025.

On a month-on-month (MoM) basis, inflation increased by 0.4% in January 2026, reversing the 0.4% decrease recorded in the previous month .

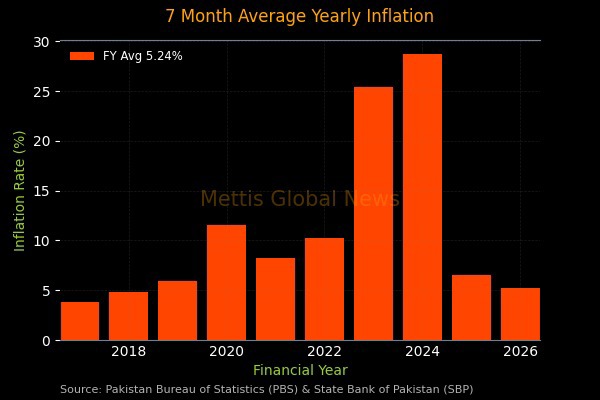

Cumulatively, on a 7MFY26 basis, the average CPI stands at 5.24% compared to 6.6% in the same period last year.

In urban areas, CPI inflation remained stable at 5.8% YoY, unchanged from December but higher than 2.7% in January 2025. On a monthly basis, urban inflation increased by 0.2%, compared to a 0.4% decrease in the previous month and a 0.2% increase in January 2025.

Meanwhile, rural CPI inflation rose to 5.8% YoY in January, compared to 5.4% in December and 1.9% in January 2025. On a MoM basis, rural prices increased by 0.6%, reversing the 0.6% decrease recorded in the previous month and contrasting with a 0.2% rise in January 2025.

The Sensitive Price Index (SPI), which tracks weekly changes in essential items, registered a 3.3% YoY increase in January 2026, up from 2.5% a month earlier and 0.7% recorded in January 2025. On a MoM basis, it fell 0.8%, matching the 0.8% decline in December and contrasting with the 1.4% decrease seen in January 2025.

Separately, Wholesale Price Index (WPI) inflation moderated to 0.2% YoY, compared to 0.6% in the previous month and 0.6% in January 2025. On a monthly basis, wholesale prices decreased by 0.2%, following a 0.9% decline in December and contrasting with a 0.2% increase in January 2025.

Core inflation indicators showed mixed trends. Non-food non-energy (NFNE) inflation in urban areas rose to 7.2% YoY from 6.9% in December, though lower than 7.8% in January 2025.

In rural areas, NFNE inflation remained elevated at 8.3% YoY, slightly up from 8.1% in December but significantly lower than 10.4% in January 2025.

The 20% weighted trimmed mean measure showed urban core inflation at 4.9% YoY, down from 5.5% in December and lower than 5.4% in January 2025.

Rural trimmed mean inflation stood at 5.4% YoY, easing from 6.0% in December and matching the 5.4% in January 2025.

The data indicates that headline inflationary pressures have ticked up in January after moderating in December, with the pace of annual price growth remaining significantly above last year's levels. However, wholesale prices continue to show subdued inflationary pressures across both urban and rural areas.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 168,062.17 222.44M | -0.49% -830.92 |

| ALLSHR | 100,418.83 533.18M | -0.47% -469.95 |

| KSE30 | 51,322.39 95.56M | -0.78% -400.92 |

| KMI30 | 235,325.12 71.27M | -0.62% -1468.03 |

| KMIALLSHR | 64,292.17 192.91M | -0.54% -350.28 |

| BKTi | 49,115.42 49.83M | -0.78% -388.38 |

| OGTi | 32,316.78 8.08M | -1.33% -436.77 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Monetary Aggregates (M3) - Monthly Profile

Monetary Aggregates (M3) - Monthly Profile