December 14, 2023 (MLN): The benchmark KSE-100 index opened Thursday’s session on a negative note, extending its downslide to retest yesterday’s lows of around 64,400, however, buyers stepped in and successfully defended this level once again.

The index remained rangebound for the rest of the session and closed at 65,450.19, up by 170 points or 0.26% DoD.

To note, this comes after the index suffered its steepest daily drawdown yesterday in almost 3.5 months.

In today's session, the index traded in a range of 1,184.86 points showing an intraday high of 65,622.56 (+342.40) and a low of 64,437.70 (-842.46) points.

The total volume of the KSE-100 index was 407.56 million shares.

Of the 100 index companies 38 closed up, 41 closed down, 1 was unchanged, while 20 remained untraded.

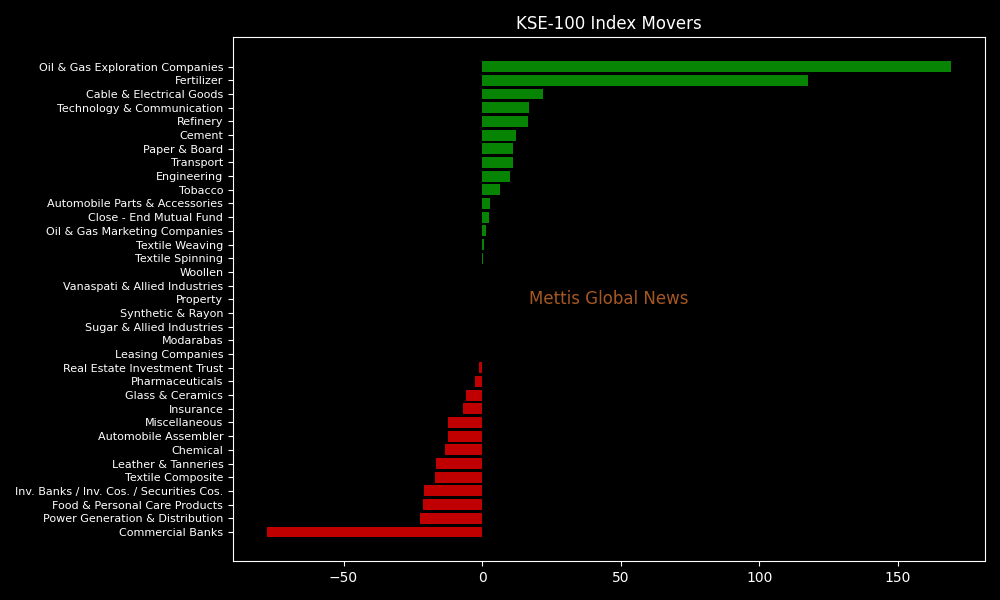

KSE-100 index was supported by Oil & Gas Exploration Companies with 169.1, Fertilizer with 117.72, Cable & Electrical Goods with 22.07, Technology & Communication with 16.85, and Refinery with 16.42 points.

On the contrary, the index was let down by Commercial Banks with 77.58, Power Generation & Distribution with 22.4, Food & Personal Care Products with 21.49, Inv. Banks / Inv. Cos. / Securities Cos. with 20.99, and Textile Composite with 17.05 points.

Companies adding points to the index were PPL with 114.05, FFC with 53.27, OGDC with 48.72, BOP with 28.49, and MCB with 26.92 points.

Meanwhile, companies that dragged the index lower were MEBL with 53.51, UBL with 32.53, HUBC with 26.26, NBP with 24.4 and DAWH with 20.85 points.

In the broader market, the All-Share index closed at 43,492.51 with a net gain of 212.86 points.

Total market volume was 981.195 million shares compared to 1,358.412 from the previous session while traded value was recorded at Rs23.74 billion showing a decrease of Rs13.91bn.

There were 265,312 trades reported in 388 companies with 197 closing up, 174 closing down and 17 remaining unchanged.

KOSM was the volume leader today, with its scrip price gaining a staggering 16.38% DoD.

While PTC's scrip gained 8.33% following the agreement to buy 100% of Telenor Pakistan (Private) Limited (TPL)'s shares, at a value of Rs108 billion.

| Company | Volume |

|---|---|

| KOSM | 160,178,500 |

| BOP | 89,773,616 |

| HASCOL | 79,313,000 |

| WTL | 49,254,234 |

| KEL | 48,049,791 |

| FFL | 40,578,684 |

| PIBTL | 33,496,000 |

| PAEL | 30,251,388 |

| PRL | 24,058,219 |

| TELE | 21,376,690 |

In a related development, yesterday's Market Treasury Bills (MTBs) auction saw heightened participation, with large participants willing to park their money in 12-month papers, implying a downward trend or stability in interest rates.

The auction garnered participation worth Rs4.629 trillion following Tuesday's Monetary Policy Committee decision to maintain the policy rate at 22% for the fourth consecutive meeting.

To note, the KSE-100 has gained 23,997 points or 57.89% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 25,030 points, equivalent to 61.92%.

Copyright Mettis Link News

Posted on: 2023-12-14T16:20:25+05:00