SBP maintains policy rate at 22% for fourth time

MG News | December 12, 2023 at 04:53 PM GMT+05:00

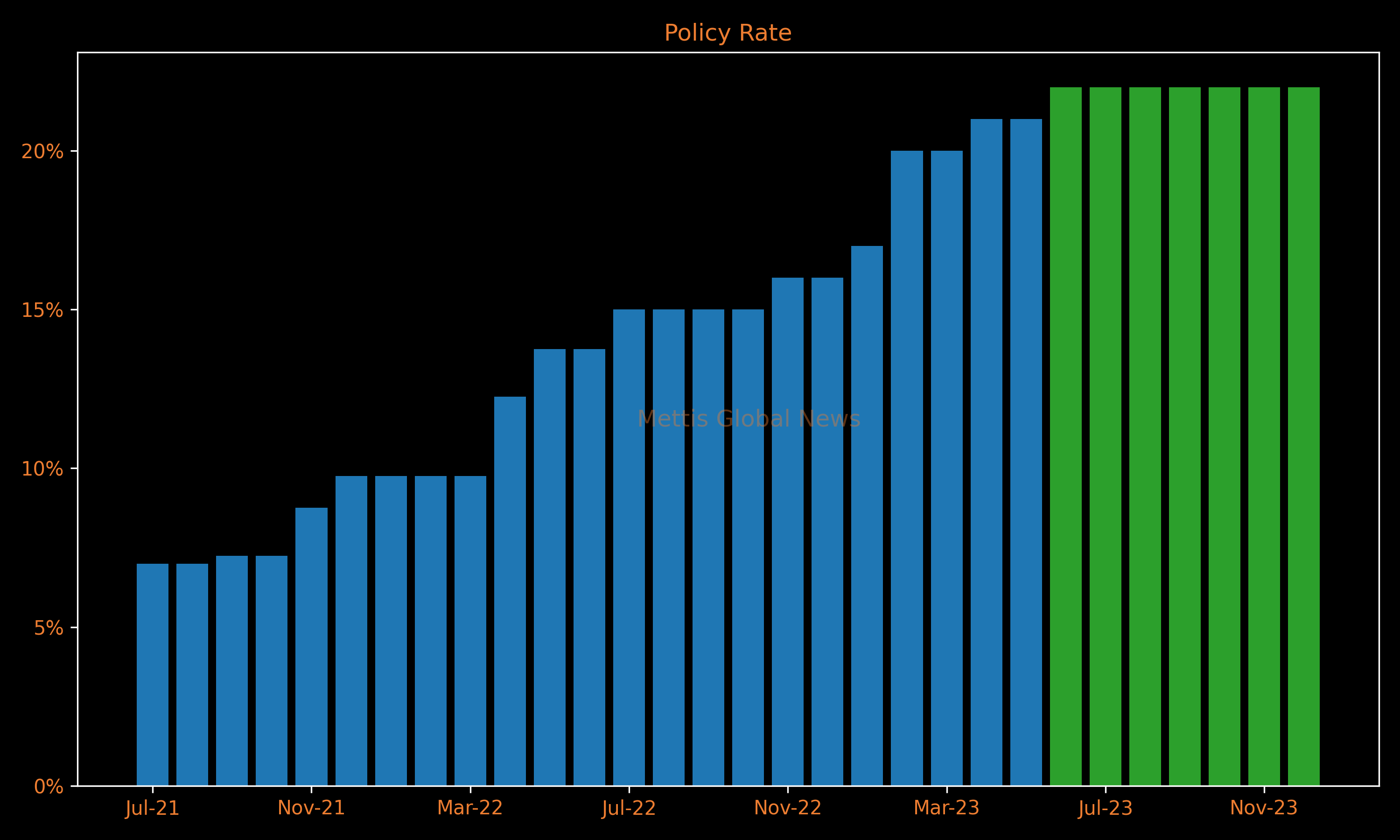

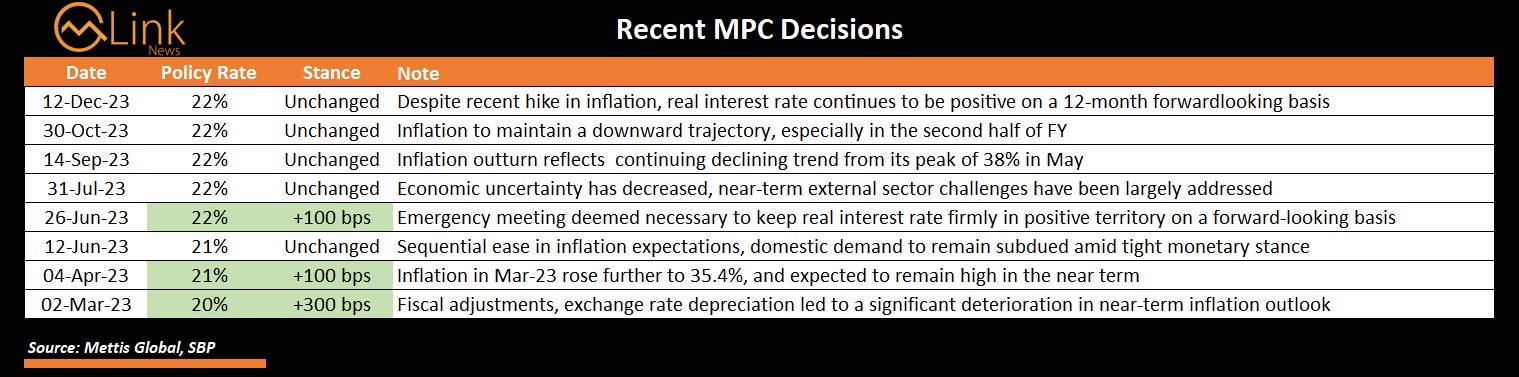

December 12, 2023 (MLN): The Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) in its meeting held today, has decided to keep the policy rate unchanged at 22% for the fourth consecutive meeting.

The decision came in line with the market expectations wherein the majority of market participants were in consensus on the rate pause.

As per the Monetary Policy Statement issued by the central bank, the decision does take into account the impact of the recent hike in gas prices on inflation in November, which was relatively higher than the MPC’s earlier expectation.

The Committee viewed that this may have implications for the inflation outlook, albeit in the presence of some offsetting developments, particularly the recent decrease in international oil prices and improved availability of agriculture produce.

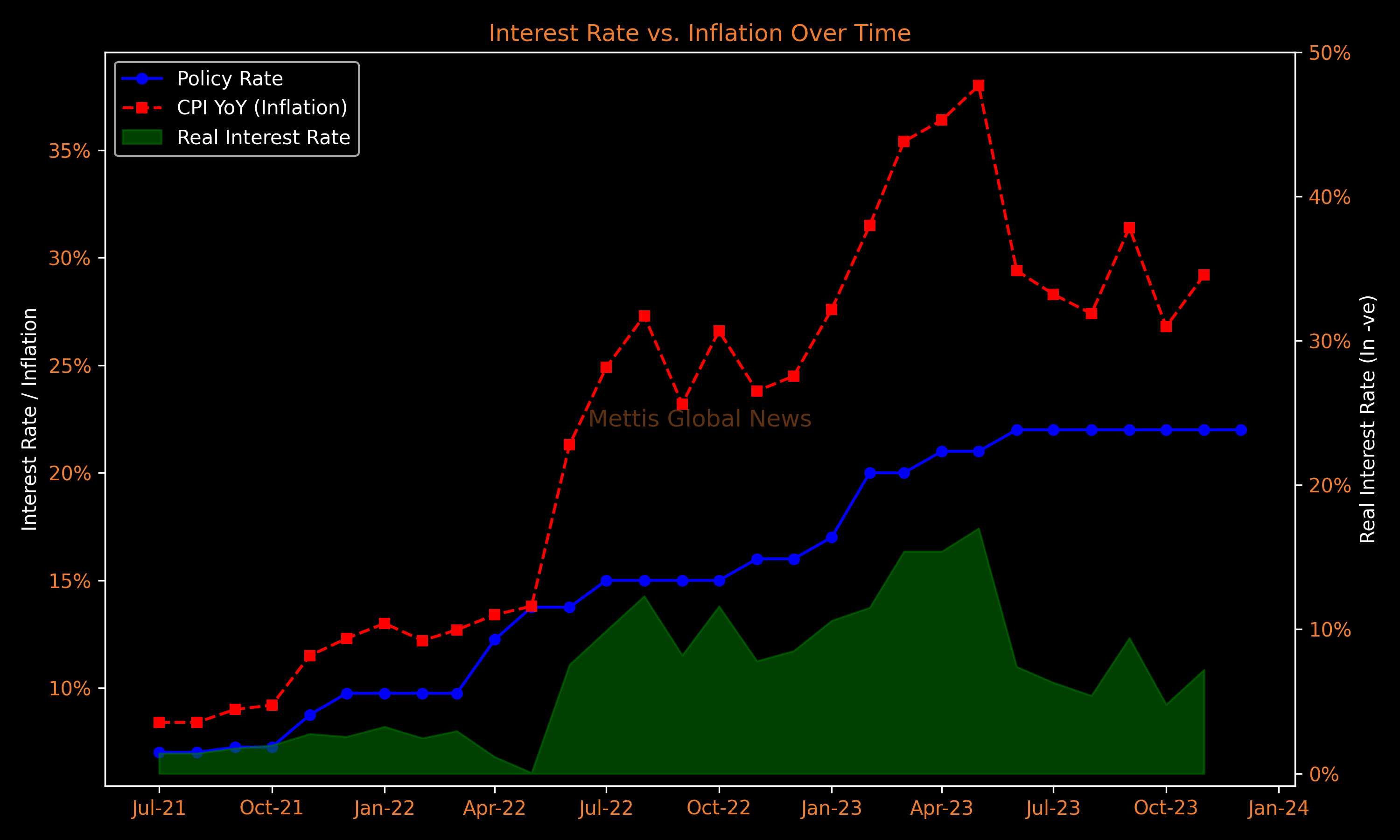

Further, the Committee assessed that the real interest rate continues to be positive on a 12-month forward looking basis and inflation is expected to remain on a downward path.

The MPC noted several key developments since its October meeting. First, the successful completion of the staff-level agreement of the first review under the IMF SBA program would unlock financial inflows and improve the SBP’s FX reserves.

Second, the quarterly GDP growth outcome for Q1-FY24 remained in line with the MPC’s expectation of a moderate economic recovery.

Third, recent consumer and business confidence surveys show improvement in sentiments. Finally, core inflation is still at an elevated level and is coming down only gradually.

Taking stock of these developments, the Committee assessed that the current monetary policy stance is appropriate to achieve the inflation target of 5-7% by end-FY25.

The Committee reiterated that this assessment is also contingent upon continued targeted fiscal consolidation and timely realization of planned external inflows.

Real Sector

The MPC viewed that the recovery in real GDP during FY24 is expected to remain moderate. According to the first estimates, real GDP grew by 2.15 YoY in Q1-FY24, compared to 1% in the same quarter last year.

As per earlier expectations, recovery in the agriculture sector was the major driver of this growth.

The manufacturing sector also recorded a moderate recovery, with growth in large-scale manufacturing becoming positive after contracting in the preceding four quarters. Unlike the commodity producing sector, growth in the services sector remained subdued.

External Sector

The MPC observed a significant improvement in the current account balance, as the deficit narrowed by 65.9% YoY to $1.1 billion during Jul-Oct FY24.

While imports declined, exports inched up on the back of food items, especially rice.

Further, workers’ remittances also improved in October and November 2023 as compared to corresponding months last year, incentivized by SBP and government initiatives to transfer funds through formal channels, and normalization of the kerb premium.

However, tepid official inflows since July and ongoing debt repayments have led to a gradual decline in the SBP’s FX reserves.

In this regard, the Committee expected that the successful completion of the first review of the ongoing IMF program is likely to improve financial inflows as well as the FX reserves position.

Fiscal Sector

The Committee noted that the improvement in fiscal indicators continued, as both tax and non-tax revenues have shown strong growth.

During Jul-Nov FY24, FBR tax collection grew by 29.6%, while non-tax revenues also increased amidst substantial growth in petroleum development levy and transfer of sizable SBP profit.

Further, overall expenditures in Q1-FY24 were contained at last year’s levels.

The MPC emphasized the importance of continuing the ongoing fiscal consolidation, preferably through broadening the tax base and restraints on non-essential expenditures, for achieving macroeconomic stability

Money and Credit

The broad money (M2) growth decelerated to 13.7% YoY as of November 24, 2023 from 14.2% as of end-June.

This deceleration is attributed to net retirements in private sector credit and more than seasonal decline in commodity operations financing.

Reserve money followed a similar trajectory, slowing down from June, primarily due to a significant deceleration in currency in circulation.

The Net Foreign Assets of the SBP and the overall banking system have expanded since June due to considerable FX inflows in July.

This, along with the contraction in Net Domestic Assets since June, has improved the compositional mix of broad money and reserve money.

Inflation Outlook

The MPC noted that the higher-than-expected increase in gas prices contributed 3.2 percentage points to the 29.2% YoY inflation in November 2023.

Further, core inflation remained sticky at 21.5% during the month, only slightly lower from its peak of 22.7% in May 2023.

Inflation expectations of both consumers and businesses, though improving in recent months, remain at an elevated level.

Nevertheless, barring further sizable increase in administered prices, the MPC continues to expect that headline inflation will decline significantly in the second half of FY24 due to contained aggregate demand, easing supply constraints, moderation in international commodity prices, and favorable base effect.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 135,939.87 307.74M |

-0.41% -562.67 |

| ALLSHR | 84,600.38 877.08M |

-0.56% -479.52 |

| KSE30 | 41,373.68 101.15M |

-0.43% -178.94 |

| KMI30 | 191,069.98 82.45M |

-1.17% -2260.79 |

| KMIALLSHR | 55,738.07 422.01M |

-1.03% -577.24 |

| BKTi | 38,489.75 45.79M |

-0.02% -8.33 |

| OGTi | 27,788.15 6.87M |

-1.24% -350.24 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 116,700.00 | 120,695.00 116,090.00 |

-3535.00 -2.94% |

| BRENT CRUDE | 68.81 | 69.41 68.60 |

-0.40 -0.58% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 96.50 96.50 |

0.50 0.52% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.25 |

-2.05 -1.92% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.68 | 67.13 66.22 |

-0.30 -0.45% |

| SUGAR #11 WORLD | 16.56 | 16.61 16.25 |

0.26 1.60% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|