December 13, 2023 (MLN): The key benchmark index of the Pakistan Stock Exchange (PSX) suffered its steepest daily drawdown in almost 3.5 months on Wednesday, a much-needed correction following a historical bullish run since September that lifted the index to record highs.

The KSE-100 index crossed 67,000 mark within the first few minutes of trading today, but then faced continuous selling pressure throughout the rest of the session.

By 01:50pm, the index was hovering around 66,300 until an intense selling spree sent it crashing to 64,427.39 points, a loss of nearly 2,000 points.

Despite a partial rebound towards the end, the session concluded with the index settling at 65,280.16 points, showing a loss of 1,146.62 points or 1.73% DoD.

The market turnover remained high, with 677.143 million shares worth Rs28.35 billion changing hands.

This long overdue correction can be attributed to over-leveraged positions in the market, coupled with profit-taking by investors after a prolonged rally.

Moreover, some market participants were also hoping for a slight rate cut, however, the Monetary Policy Committee (MPC) opted to maintain it at 22% yesterday.

The index traded in a wide range of 2,666.58 points showing an intraday high of 67,093.96 (+667.18) and a low of 64,427.39 (-1,999.40) points.

Of the 100 index companies 18 closed up, 72 closed down, 1 was unchanged, while 9 remained untraded.

KSE-100 index was let down by Commercial Banks with 268.84, Fertilizer with 232.53, Technology & Communication with 110.59, Oil & Gas Exploration Companies with 92.62, and Food & Personal Care Products with 78.77 points.

On the flip-side, the index was supported by Cable & Electrical Goods with 11.16, Transport with 7.07, and Close – End Mutual Fund with 0.4 points.

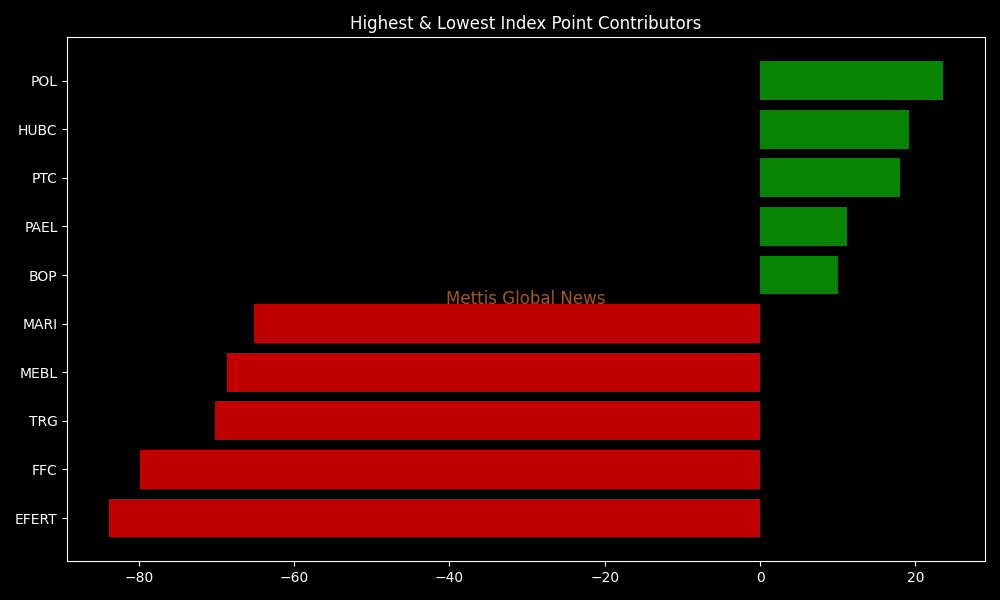

Companies that dragged the index lower were EFERT with 83.84, FFC with 79.8, TRG with 70.17, MEBL with 68.59 and MARI with 65.21 points.

On the other hand, companies that added points to the index were POL with 23.59, HUBC with 19.18, PTC with 17.96, PAEL with 11.16, and BOP with 10.06 points.

In the broader market, the All-Share index closed at 43,279.65 with a net loss of 813.09 points.

Total market volume was 1,358.412 million shares compared to 969.630 from the previous session while traded value was recorded at Rs37.66bn showing an increase of Rs10.73bn.

There were 359,686 trades reported in 411 companies with 92 closing up, 304 closing down and 15 remaining unchanged.

In a related development, Fitch Ratings today affirmed Pakistan's Long-Term Foreign-Currency Issuer Default Rating (IDR) at 'CCC', reflecting high external funding risks amid high medium-term financing requirements.

| Company | Volume |

|---|---|

| WTL | 153,676,751 |

| BOP | 106,283,289 |

| KEL | 90,068,235 |

| HASCOL | 77,879,000 |

| PTC | 62,457,500 |

| KOSM | 59,006,000 |

| TELE | 52,122,897 |

| PIBTL | 50,532,000 |

| PRL | 39,797,617 |

| FCCL | 36,196,500 |

To note, the KSE-100 has gained 23,827 points or 57.48% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 24,860 points, equivalent to 61.5%.

Copyright Mettis Link News

Posted on: 2023-12-13T16:22:24+05:00