Textile sector's profit plunges 64% YoY in Q1 2024

By Abdur Rahman | May 08, 2024 at 06:00 PM GMT+05:00

May 08, 2024 (MLN): Pakistan’s textile industry continued to suffer in the first quarter of 2024 as the sector grappled with challenges in both domestic and export markets.

The KSE-100 listed Textile Composite sector saw a 64.2% YoY plunge in net profit during the quarter, clocking in at Rs5.27 billion as against Rs14.72bn in the same period last year (SPLY).

The sector faced many challenges in both domestic and export markets during the quarter.

The global economic slowdown has subdued demand for textile products in the international market. Accordingly, overall exports of the textile industry have remained stagnant.

Pakistan’s textile exports rise 3% YoY to $1.3bn in March

Domestically, high energy costs, costly financing, and the imposition of government taxation have escalated the cost of doing business.

As per the results compiled by Mettis Global of the income statements of the sector, sales revenue saw an increase of 22.9% YoY, worth Rs133.27bn as compared to Rs108.48bn in SPLY.

To note, the compiled sector result includes GATM, ILP, KTML, and NML.

However, the escalating energy costs and rising raw material prices significantly compressed profit margins.

The cost of sales rose by 35.0% YoY, worsening the gross profit by 16.1% YoY to Rs21.63bn in Q1 2024.

The gross margins fell to 16.23% as compared to 23.76% in SPLY.

Moreover, other income of the sector deflated by 20.8% YoY to stand at Rs2.79bn in Q1 2024 as compared to Rs3.52bn in SPLY.

On the expense side, the selling and distribution expenses fell 27.9% YoY to Rs2.33bn, administrative expenses fell 52.1% YoY to Rs1.55bn, while other operating expenses surged 379.1% YoY to Rs5.76bn.

The finance costs also soared by 37.1% YoY and stood at Rs7.18bn as compared to Rs5.24bn in SPLY, primarily due to high borrowing costs.

On the tax front, the sector paid a higher tax worth Rs2.33bn against the Rs1.68bn paid in the corresponding period of last year, depicting a rise of 38.7% YoY.

| Unconsolidated (un-audited) Financial Results for quarter ended March 31, 2024 (Rupees in '000) | |||

|---|---|---|---|

| Mar-24 | Mar-23 | YoY % Change | |

| Net Sales / Revenue | 133,265,066 | 108,480,383 | 22.8% |

| Cost of sales | (111,639,901) | (82,700,149) | 35.0% |

| Gross Profit | 21,625,165 | 25,780,234 | -16.1% |

| Selling And Distribution Expenses | (2,326,018) | (3,224,098) | -27.9% |

| Administrative Expenses | (1,547,872) | (3,234,410) | -52.1% |

| Other income | 2,785,418 | 3,516,908 | -20.8% |

| Other operating expenses | (5,759,802) | (1,202,324) | 379.1% |

| Profit/ (loss) Before Interest And Tax | 14,776,891 | 21,636,310 | -31.7% |

| Finance cost | (7,183,051) | (5,237,642) | 37.1% |

| Profit/ (loss) before taxation | 7,593,840 | 16,398,668 | -53.7% |

| Taxation | (2,325,650) | (1,677,055) | 38.7% |

| Profit/ (loss) After Tax | 5,268,190 | 14,721,613 | -64.2% |

Outlook

Considering the prevailing global economic dynamics, coupled with the ongoing increase in production costs in Pakistan, the next quarter is expected to remain challenging.

According to Gul Ahmed Textile Mills Limited (PSX: GATM), Pakistan is expected to continue facing foreign exchange liquidity issues due to the persistent trade deficit and limited access to external financing.

Even with the recent successful completion of the International Monetary Fund-SBA and continued rollovers, reserves are projected to remain low, it stressed.

Import management measures are expected to continue disrupting domestic supply chains, while tight macroeconomic policies will mute aggregate consumption and investment.

Economic activity is therefore expected to remain subdued with real GDP projected to grow at 2% in FY24, the company said.

Echoing these concerns, Nishat Mills Limited (PSX: NML) stated it anticipates facing further challenges.

These include the low demand for apparel products in international markets along with already rising energy costs.

Adhering to the terms of the IMF's Stand-by Facility, the government implemented substantial hikes in gas prices

This surge, coupled with inflationary pressures and elevated interest rates, markedly elevates the cost of conducting business compared to previous periods.

Such conditions may precipitate a notable economic deceleration and contraction in export volumes.

Note: Sector includes all share companies

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 125,627.31 258.99M |

1.00% 1248.25 |

| ALLSHR | 78,584.71 1,142.41M |

1.16% 904.89 |

| KSE30 | 38,153.79 69.25M |

0.63% 238.06 |

| KMI30 | 184,886.50 91.38M |

0.01% 13.72 |

| KMIALLSHR | 53,763.81 554.57M |

0.54% 290.61 |

| BKTi | 31,921.68 33.15M |

1.78% 557.94 |

| OGTi | 27,773.98 9.65M |

-0.40% -112.21 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,055.00 | 109,565.00 107,195.00 |

570.00 0.53% |

| BRENT CRUDE | 66.64 | 67.20 65.92 |

-0.16 -0.24% |

| RICHARDS BAY COAL MONTHLY | 97.00 | 97.00 97.00 |

1.05 1.09% |

| ROTTERDAM COAL MONTHLY | 107.65 | 107.65 105.85 |

1.25 1.17% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 64.97 | 65.82 64.50 |

-0.55 -0.84% |

| SUGAR #11 WORLD | 16.19 | 16.74 16.14 |

-0.52 -3.11% |

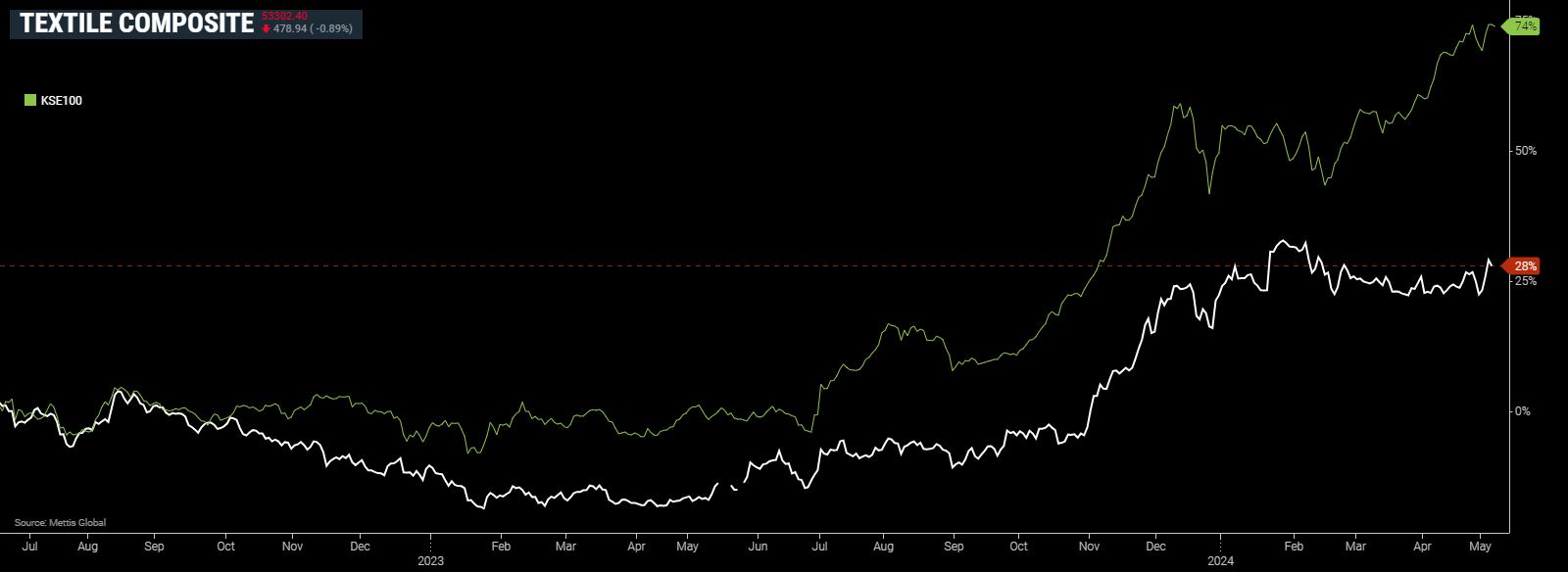

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|