September to Remember

_20251001103857094_5296e0.jpeg?width=950&height=450&format=Webp)

Nilam Bano | October 01, 2025 at 03:44 PM GMT+05:00

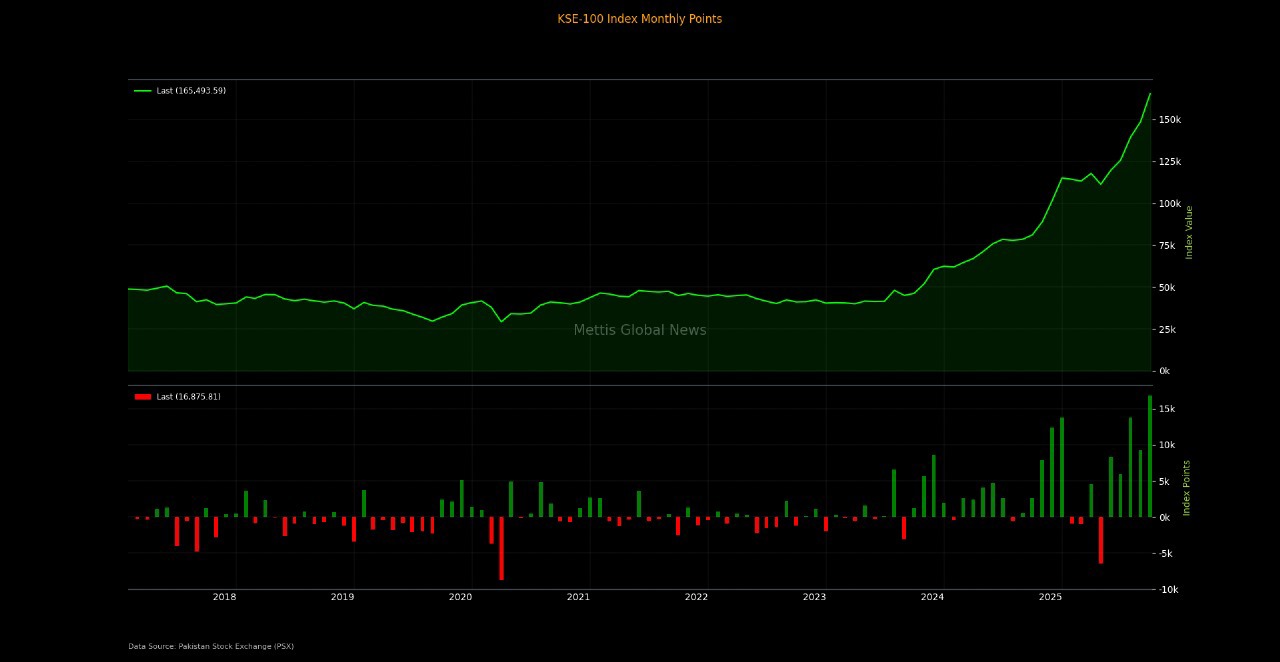

October 01, 2025 (MLN): September was a month

when the Pakistan Stock Exchange refused to look back. The KSE-100 Index

stormed to an all-time high of 165,494 points, adding a staggering 16,876

points or 11.355% in just a month.

On a YoY basis, the index has surged by 84,379 points or 104%

compared to the same period last year.

The bulls had taken the reins, and investors, fueled by a

string of political breakthroughs and economic relief, kept charging forward.

The story of this rally begins in Riyadh, where Prime

Minister Shahbaz Sharif inked the Strategic Mutual Defence Agreement with Saudi Arabia.

It was not just a symbolic handshake; markets read it as a

historic partnership that could draw billions in Saudi and Gulf investment.

Soon after, the Prime Minister’s meeting with the U.S. President at the White

House fanned the flames of optimism, as Washington hinted at exploring

deeper economic engagement with Islamabad.

For investors, it was the kind of diplomatic double win that

bolstered confidence in Pakistan’s global standing.

Back home, the government signed the

country’s largest-ever debt restructuring deal, a Rs1.2 trillion agreement to resolve the power sector’s

circular debt.

At long last, the crippling burden that had haunted energy

producers and rattled investors was given a concrete path toward resolution.

To sweeten the mix, inflation cooled to just 3% in August, while

the current account deficit narrowed to $245 million.

The State Bank of Pakistan, cautious of flood-driven

uncertainties, kept its policy rate unchanged at 11%, a decision that gave

markets the comfort of stability without the shock of surprise.

Overseas Pakistanis continued to keep the wheels turning,

sending home $3.14bn in August 2025, a healthy 7% increase compared to August

2024.

Meanwhile, Pakistan's Roshan Digital Account (RDA) gross

inflows reached $10.91bn as of August.

Market cap

The KSE-100 market capitalization stood at Rs4.9 trillion,

up by 10.85% from the previous month’s Rs4.42tr while compared to september

2024, the market cap has surged by 95.21%.

In USD terms, the market cap was recorded at $17.4bn,

compared to $15.6bn in the prior month, reflecting a surge of 11.07%. When

compared to the previous year, the market capitalization witnessed a notable

jump of 92.8%._20251001103831589_626207.jpeg)

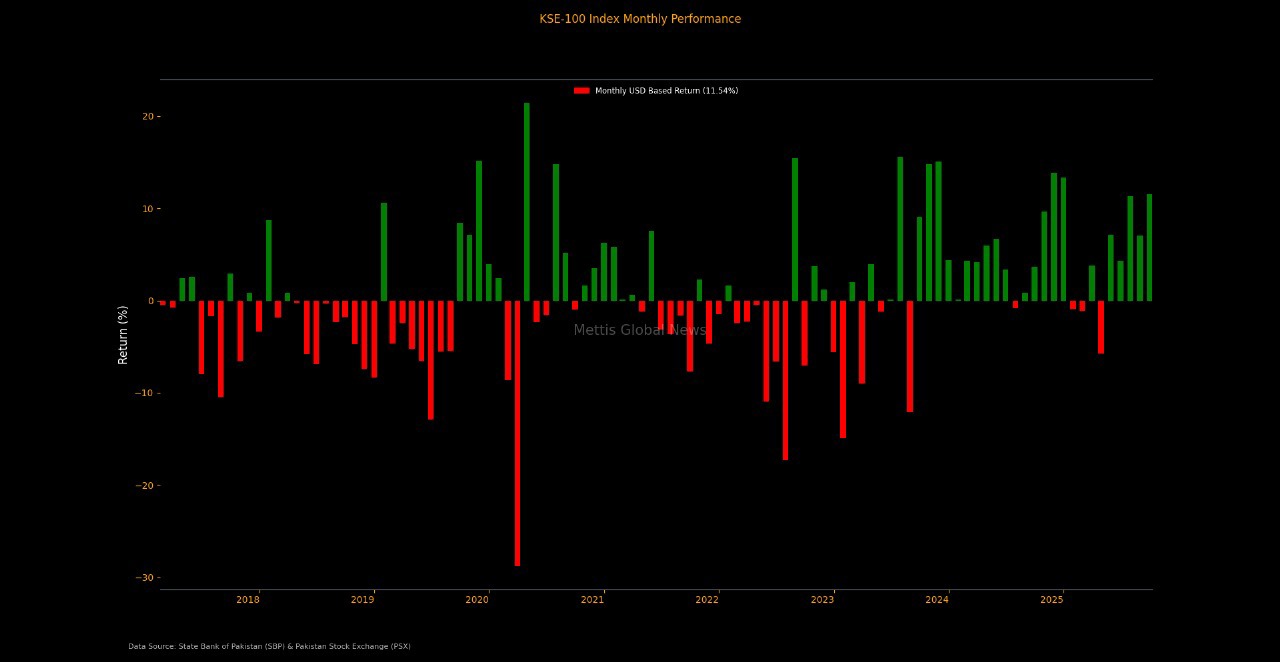

The index return in USD terms stood at 11.53%, compared to

last month’s return of 7.03% and last year’s 3.65%.

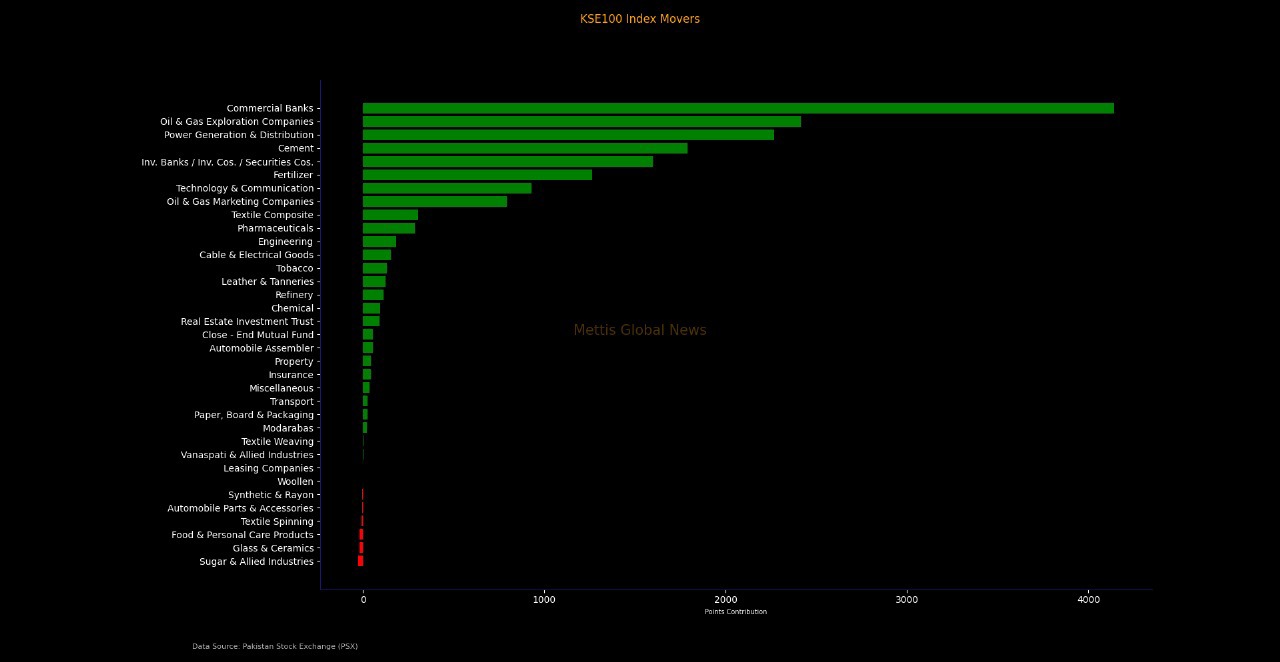

Top Index Movers

During the month, Commercial Banks, Oil & Gas

exploration Companies, Power Generation and Cement added 4,142.94, 2,413.87, 2,265.26,

and 1,790.19, points, respectively.

Among individual stocks, HUBC, ENGROH, MARI, and NBP gained 2,299.36,

1,534.60, 1,106.27, and 960.41 points, respectively._20251001103929773_460a60.jpeg)

FIPI/LIPI

Foreign investors remained as net sellers, offloading the

equities worth $57.32m.

Among them, Foreign Corporations led this activity by

selling securities worth $51.64m while Overseas Pakistanis sold securities

worth $5.83m.

The local investors remained net buyers, purchasing equities

worth $57.32m.

Among them, Mutual Funds and Individuals bought securities

worth $87.26m and $33.96m, respectively.

However, Banks sold securities worth $47.96m._20251001104026213_17d2fa.jpg)

Economy is finding its footing

Momentum was not confined to the trading floor. The real

economy showed some recovery too, as petroleum sales rose by 6% month-on-month (MoM)

in August 2025, reaching a total of 1.3 million tons, while the year-on-year

(YoY) growth increased by 7%.

Fertilizer demand surged as overall nutrient offtake increased by 53.4% YoY, while cement dispatches stood at 3.846 million

tons in August 2025, showing a growth of 12.45% compared to 3.421m tons

recorded in the same month last year.

Moreover, auto sales roared back with a 62% YoY increase in

August.

The manufacturing sector also chipped in, with LSM growth clocking a healthy 9% YoY, led by autos,

furniture, and transport equipment.

For once, multiple sectors seemed to be firing together,

offering investors a sense that the tide was indeed turning.

Yet, amid the jubilation, dark clouds gathered. Devastating

monsoon floods swallowed 2.5 million acres of farmland, laying waste

to crops like rice, sugarcane, and maize, and damaging cotton fields so badly

that Pakistan may be forced to import millions of bales in the coming year.

The human toll was just as grim, with lives lost, homes

washed away, and infrastructure torn apart.

Still, investors have kept faith. With the IMF’s second EFF review underway, Pakistan looks likely

to clear most performance targets, paving the way for another $1 billion

tranche.

The rupee gained 45 paisa or 0.16% during the month, while foreign exchange reserves stood at $19.79bn as of September 19, 2025.

Bottom Line

September 2025 was a month where Pakistan's stock market

wrote a new chapter in its history books, with the KSE-100 Index scaling

unprecedented heights.

The rally was not built on castles in the air; it was

underpinned by genuine positive developments, from diplomatic breakthroughs to

concrete debt resolution agreements.

However, the flood devastation serves as a sobering reminder

that external shocks can quickly change the narrative.

The coming months will test Pakistan's resilience and its

ability to manage flood rehabilitation while staying on track with IMF

commitments, maintaining fiscal discipline, and continuing the reform momentum.

Although, the fundamentals are improving, geo-political

winds are favorable, and structural reforms are moving in the right direction.

But keep one eye on the weather forecast, both literally and

metaphorically. The market has proven it can weather storms, but prudent risk

management remains the name of the game.

Don't fight the trend

Right now, the trend, despite bumps along the way appears to

be pointing upward.

Whether this bull run has legs for the long haul will depend

on execution, delivering on promised reforms, managing flood recovery

effectively, and converting diplomatic wins into concrete economic benefits.

The stage is set, the actors are in place, and

Pakistan's economic drama continues to unfold. Stay tuned.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 146,480.15 378.01M | -6.99% -11015.95 |

| ALLSHR | 88,401.15 613.63M | -6.18% -5825.86 |

| KSE30 | 44,996.51 162.61M | -6.90% -3333.70 |

| KMI30 | 210,039.41 136.40M | -6.52% -14647.92 |

| KMIALLSHR | 57,315.72 369.31M | -5.79% -3523.37 |

| BKTi | 42,364.50 67.24M | -6.87% -3125.46 |

| OGTi | 31,480.49 21.12M | -1.88% -602.98 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,955.00 | 68,215.00 65,685.00 | -340.00 -0.50% |

| BRENT CRUDE | 107.10 | 119.50 99.00 | 14.41 15.55% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -11.85 -10.65% |

| ROTTERDAM COAL MONTHLY | 127.00 | 0.00 0.00 | 0.05 0.04% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 103.47 | 119.48 98.00 | 12.57 13.83% |

| SUGAR #11 WORLD | 14.34 | 14.34 14.25 | 0.24 1.70% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png?width=280&height=140&format=Webp)