Oil slips ahead of Trump Putin talks on Ukraine ceasefire

MG News | August 15, 2025 at 05:13 PM GMT+05:00

Oil slips ahead of Trump Putin talks on Ukraine ceasefire

August 15, 2025 (MLN): Oil prices declined on

Friday as markets looked ahead to a meeting between U.S. President Donald Trump

and Russian President Vladimir Putin, with some anticipating the talks could

pave the way for a relaxation of sanctions on Moscow related to the war in

Ukraine.

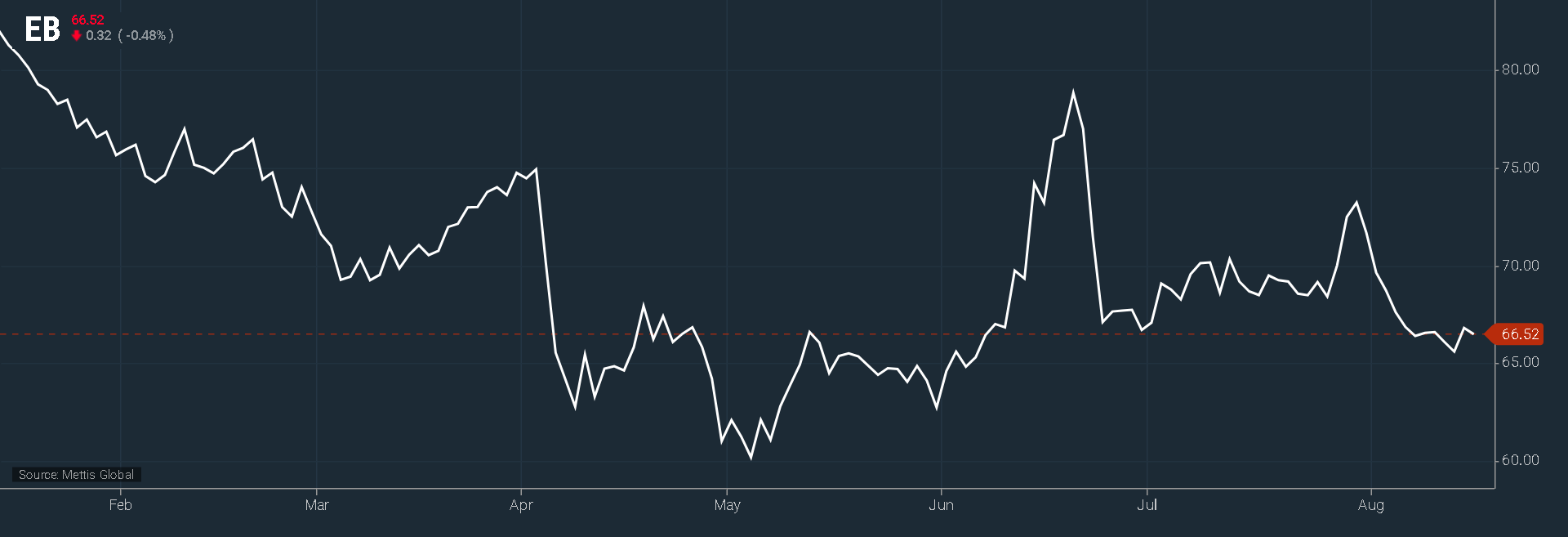

Brent crude futures decreased by $0.32, or 0.48%, to $66.52 per

barrel.

West Texas Intermediate (WTI) crude futures fall by $0.45,

or 0.70%, to $63.51 per barrel by [4:55 pm] PST.

At Friday’s meeting in Alaska between U.S. President Donald

Trump and Russian President Vladimir Putin, a potential ceasefire in Ukraine is

expected to dominate discussions. Trump has expressed confidence that Russia is

ready to end the conflict but has warned that, if peace talks stall, the U.S.

could impose secondary sanctions on nations purchasing Russian oil.

“The market is focused on whether a ceasefire materializes.

A ceasefire would imply higher Russian output,” said Giovanni Staunovo,

commodity analyst at UBS. “The real question is whether we see escalation or

de-escalation.”

Staunovo noted that even if a ceasefire deal is reached,

lifting U.S. sanctions on Russia would be a longer process requiring

congressional approval.

For the week, West Texas Intermediate (WTI) crude is on

track for a 0.7% decline, while Brent crude is set to post a 0.4% gain.

Adding to market pressures, weaker-than-expected economic

data from China stoked concerns over fuel demand. Official figures showed

factory output growth in July fell to its slowest pace in eight months, while

retail sales growth was the weakest since December. This overshadowed data

indicating stronger oil throughput, with Chinese refineries processing 8.9%

more crude year-on-year in July. However, throughput dropped from June’s

nine-month high, and a rise in oil product exports suggested softer domestic consumption.

Forecasts of a widening oil market surplus also weighed on

sentiment, alongside expectations of prolonged higher U.S. interest rates. Bank

of America analysts, in a Thursday note, expanded their surplus outlook, citing

increased supply from OPEC+, which includes the Organization of the Petroleum

Exporting Countries, Russia, and their allies. They now expect an average

surplus of 890,000 barrels per day from July 2025 to June 2026.

The projection came just days after the International Energy

Agency warned that the oil market appears “bloated” following OPEC+ output

hikes.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 184,129.58 798.69M | -1.97% -3702.50 |

| ALLSHR | 110,763.73 1,266.28M | -1.85% -2087.96 |

| KSE30 | 56,278.51 173.32M | -2.19% -1261.46 |

| KMI30 | 259,907.89 102.57M | -2.03% -5380.16 |

| KMIALLSHR | 71,198.64 822.49M | -1.72% -1247.03 |

| BKTi | 53,693.69 102.25M | -2.59% -1425.61 |

| OGTi | 37,589.24 28.20M | -2.72% -1052.27 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 70,580.00 | 71,690.00 60,005.00 | 6785.00 10.64% |

| BRENT CRUDE | 68.10 | 68.83 66.56 | 0.55 0.81% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 96.00 96.00 | 1.50 1.59% |

| ROTTERDAM COAL MONTHLY | 102.75 | 103.25 101.30 | 2.25 2.24% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 63.50 | 64.58 62.20 | 0.21 0.33% |

| SUGAR #11 WORLD | 14.14 | 14.30 14.07 | -0.13 -0.91% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction