Weekly Market Roundup

Abdur Rahman | May 04, 2024 at 07:49 PM GMT+05:00

May 04, 2024 (MLN): Stocks in Pakistan paused after a strong rally as traders reassessed the policy path going forward after the central bank decided to hold rates at a record for seventh consecutive meeting.

The benchmark KSE-100 index snapped its six week long winning streak and concluded at 71,902, a decrease of 841 points or 1.16% WoW.

Meanwhile, the Pakistani Rupee recorded a gain of 0.06% WoW against the US Dollar.

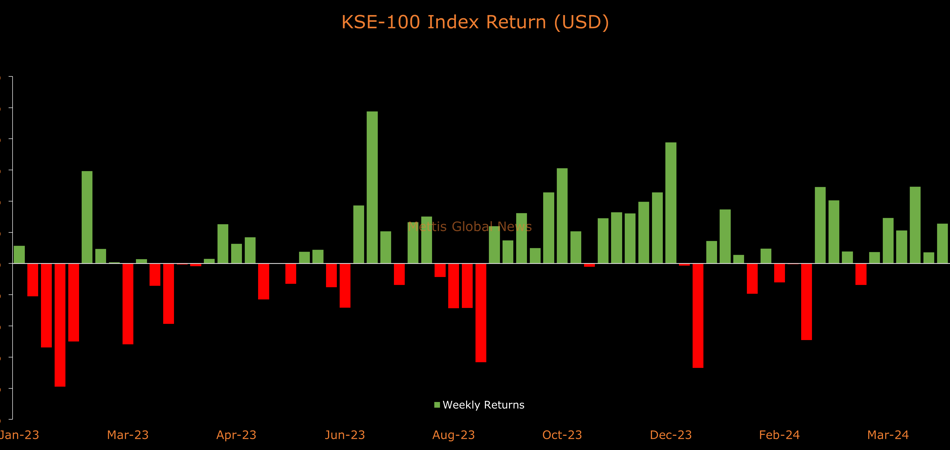

In USD terms, the KSE-100 index lost 1.09% this week.

Throughout the week, KSE-100 traded in a range of 2,739 points, between a high of 73,301 (+558) and a low of 70,562 (-2,181) points.

KSE-100's average traded volume was recorded at 242 million shares worth Rs14.95 billion, marking a decrease of 32.58% WoW in the number of shares and 11.79% WoW in traded value.

Moreover, the overall PSX average traded volume was recorded at 514m shares worth Rs23.88bn, marking a decrease of 20.76% WoW in the number of shares and 8.32% WoW in traded value.

On the economic front, the CPI-based inflation slowed to 17.3% in April, expanding the real interest rates to 4.7%.

Moreover, the State Bank of Pakistan (SBP) received the final installment of SDR 528 million, equivalent to around $1.1bn.

This disbursement will be reflected in SBP reserves for the week ending on May 03, 2024.

The said amount will help bolster the foreign exchange reserves of Pakistan. At present, the total foreign exchange reserves stand at around $8bn.

Meanwhile, corporate results continued to take center stage this week, with lower than market expected earnings hurting investors' confidence.

The government conducted two auctions during the week, picking up Rs253bn through MTBs, and Rs194bn through PIB-PFL auction.

The cut-off yields for the T-Bills remained largely unchanged.

Top Index Movers

From the sector-specific lens, Technology & Communication was the worst performing sector, as it took away 276 points from the index.

This was followed by Fertilizer (265pts), Commercial Banks (201pts), Pharmaceuticals (50pts), and Chemical (43pts).

Contrary to that, the positive contributions came from Oil & Gas Exploration Companies (211pts), Oil & Gas Marketing Companies (22pts), Cable & Electrical Goods (9pts), Leather & Tanneries (8pts), and Inv. Banks / Inv. Cos. / Securities Cos. (7pts).

Scrip-wise, EFERT, SYS, TRG, UBL, and NBP were the worst-performing stocks during the week as they stripped off 228, 120, 118, 96, and 61 points from the index respectively.

Whereas, PPL, BAHL, BAFL, SNGP, and OGDC added 217, 73, 46, 37, and 25 points to the index respectively.

Systems Limited profit plummets 66% YoY to Rs1.24bn

FIPI/LIPI

Foreign investors continued to remain net buyers during the week, acquiring $8.04m worth of equities.

Flow-wise, Foreign Corporates were the dominant buyers, with a net investment of $5.84m.

They allocated the majority of their capital, $2.71m, to Fertilizer, while divesting from the All other Sectors sector, amounting to $0.34m in sales.

On the other hand, the leading sellers were Other Organization, with a net sale of $5.62m.

Their most substantial sales activity was in Fertilizer, amounting to $2.31m, while they acquired $0.14m of equities in the Cement.

Despite a selloff this week, the 100 index is still up 30,449 points or 73.46% during the fiscal year, and 9,451 points or 15.13% during the ongoing calendar year.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 182,340.38 597.72M | -0.97% -1789.20 |

| ALLSHR | 109,847.66 927.99M | -0.83% -916.07 |

| KSE30 | 55,695.28 182.31M | -1.04% -583.23 |

| KMI30 | 256,499.31 111.48M | -1.31% -3408.58 |

| KMIALLSHR | 70,583.87 586.23M | -0.86% -614.78 |

| BKTi | 53,211.20 106.47M | -0.90% -482.48 |

| OGTi | 36,610.68 31.06M | -2.60% -978.56 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 69,190.00 | 72,760.00 68,485.00 | -1070.00 -1.52% |

| BRENT CRUDE | 68.08 | 68.43 67.02 | 0.03 0.04% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | 0.60 0.63% |

| ROTTERDAM COAL MONTHLY | 101.50 | 101.50 101.45 | -1.35 -1.31% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 63.58 | 63.92 62.62 | 0.03 0.05% |

| SUGAR #11 WORLD | 14.26 | 14.29 14.15 | 0.15 1.06% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|