January 20, 2024 (MLN): Despite positive developments on the external front, Pakistan’s stock market suffered a setback this week amid escalating geopolitical tensions.

The benchmark KSE-100 index closed the week at 63,282 showing a decrease of 1,355 points or 2.1% WoW.

Positive developments throughout the week failed to uplift the stock market due to geopolitical tensions offsetting the positive sentiment.

To note, the central bank released key data indicators this week that showed significant improvements on the external front.

Pakistan recorded a significant current account surplus of $387 million in December, ending a streak of five consecutive monthly deficits.

The cash-strapped nation also attracted substantial foreign investments worth $243m in December, a 56% increase from the previous month and the highest level in a year.

Moreover, the central bank received the second installment of SDR 528m, equivalent to $705.6m from the International Monetary Fund (IMF), along with a $2bn loan extension from UAE for another year.

These developments will significantly bolster the foreign reserves position of the country, which currently stands at just $8.03bn.

Meanwhile, the Pakistani Rupee recorded a marginal gain of 0.16% WoW.

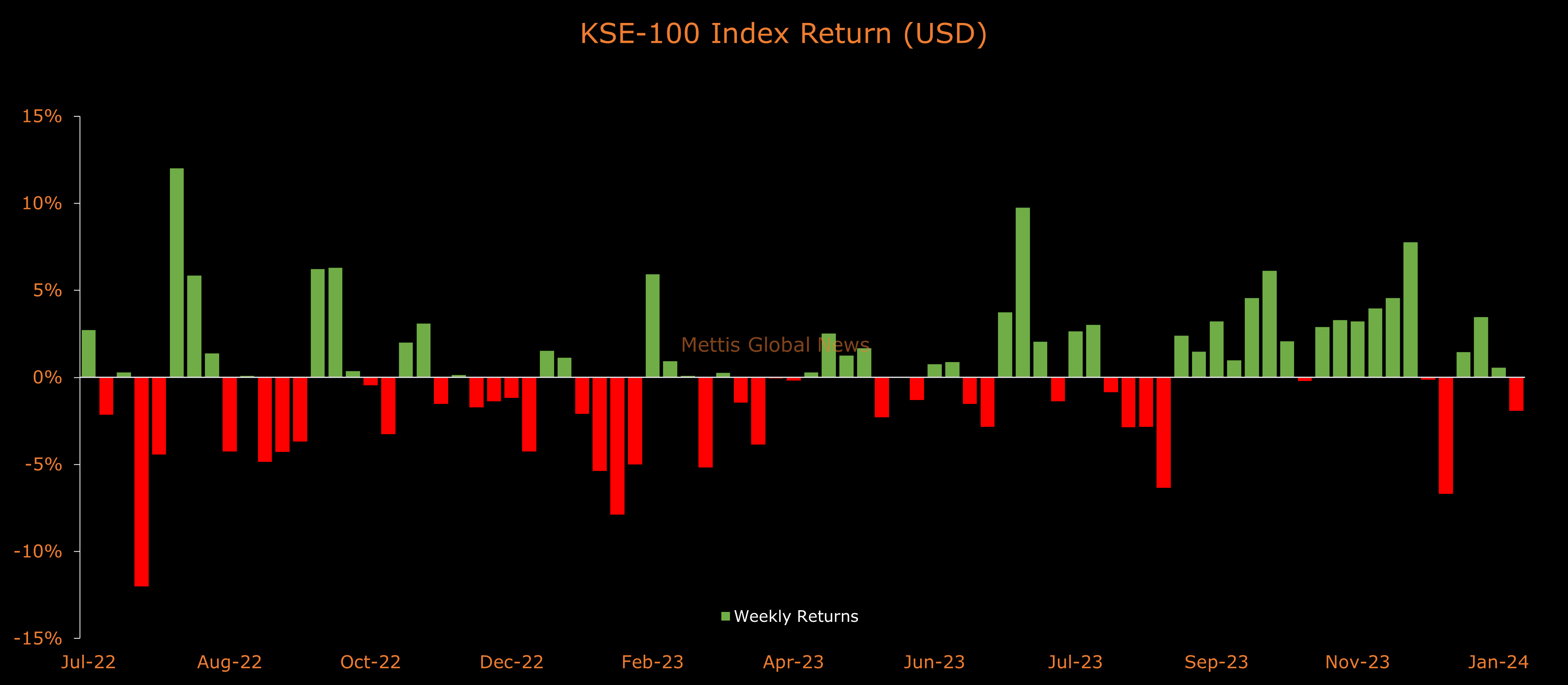

In USD terms, the KSE-100 index lost 1.94% this week.

Throughout the week, KSE-100 oscillated in a range of 2,645 points, between high and low of 65,174 and 62,529 levels, respectively, before settling the week at 63,282.

The market turnover saw a fall during the week, with an average traded volume of 220 million shares worth Rs10.14 billion, marking a decrease of 34.22% WoW in the number of shares and 6.92% WoW in traded value.

Moreover, the overall PSX average traded volume (All-Share) was recorded at 389m shares worth Rs13.76bn, marking a decrease of 30.52% WoW in the number of shares and a decrease of 14% WoW in traded value.

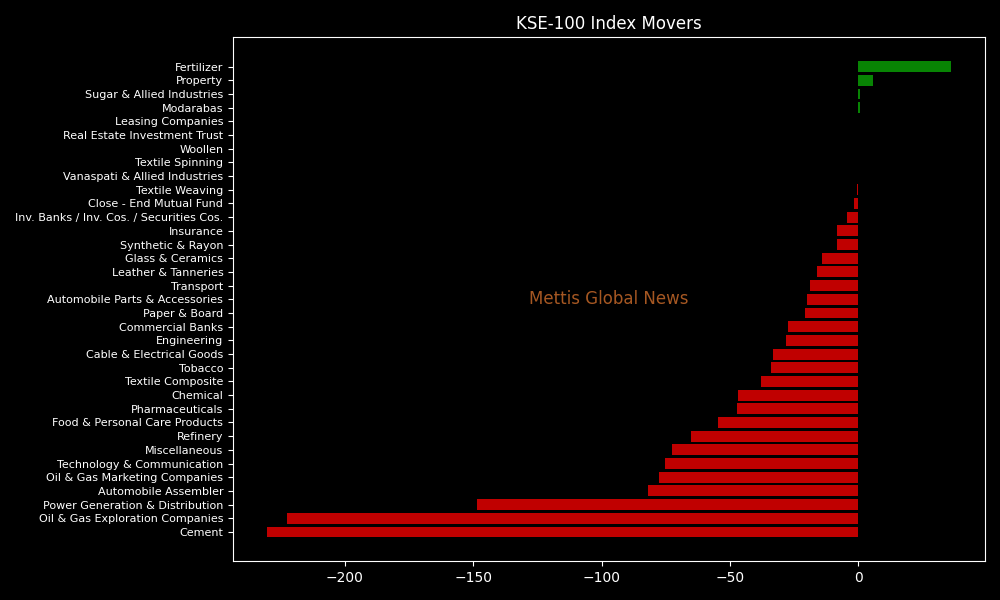

Top Index Movers

From the sector-specific lens, Cement was the worst performing sector, as it took away 230 points from the index.

This was followed by Oil & Gas Exploration Companies, Power Generation & Distribution, Automobile Assembler, and Oil & Gas Marketing Companies as they kept the index in negative territory by taking away 222, 148, 82, and 78 points from the index.

Contrary to that, Fertilizer, Property, Sugar & Allied Industries, and Modarabas were the only sectors that landed in the green zone, cumulatively adding 43 points.

Scrip-wise, PPL, LUCK, HUBC, MTL, and HBL were the worst-performing stocks during the week as they stripped off 234, 103, 100, 91, and 68 points from the index respectively.

Whereas, ENGRO, MEBL, MARI, UBL, and POL were the best-performing stocks during the week as they added 104, 54, 45, 39, and 31 points to the index respectively.

FIPI/LIPI

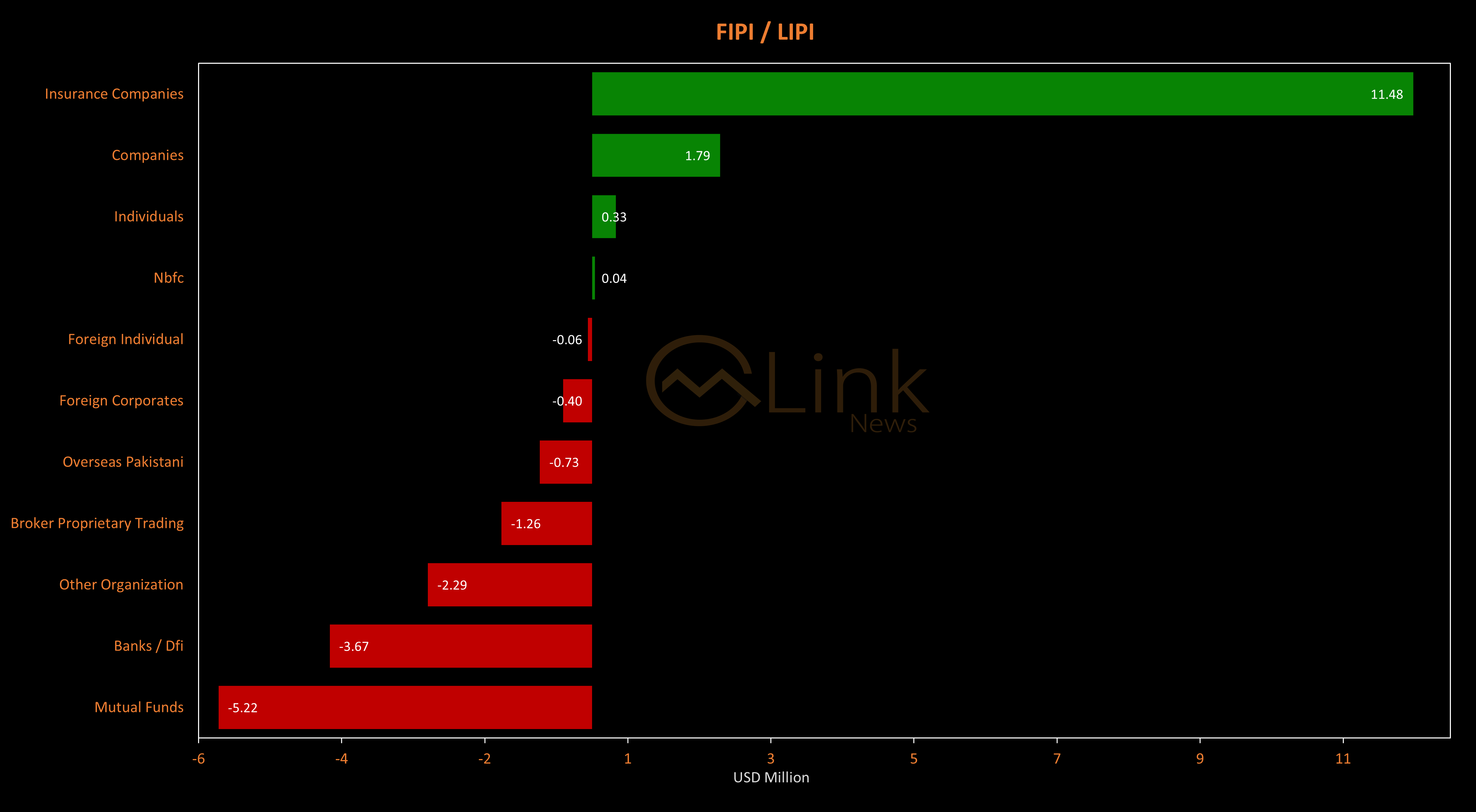

Foreign investors were net sellers during the week as they dumped $1.19m worth of stocks, with overseas Pakistanis doing the bulk of the selling at $0.73m.

On the local front, Insurance Companies picked up $11.48m worth of stocks, the highest amongst its peers.

They allocated the majority of their capital, $4.36m, to Commercial Banks, while divesting from the Oil and Gas Marketing Companies sector, amounting to $1.95m in sales.

Alternatively, significant net selling was observed among Mutual Funds, amounting to $5.22m, as they withdrew securities from sectors all across the board.

The most significant withdrawal was from Oil and Gas Exploration Companies, totaling $2.09m.

The local stock market has been on a bullish streak amid hopes of improved economic conditions following the expected inflows from IMF and friendly countries, relatively stable currency amid government-backed administrative efforts, and a possible slash in the interest rates.

KSE-100 has gained 21,830 points or 52.66% during the fiscal year, whereas it recorded a substantial gain of 22,031 points or 54.5% in the calendar year 2023.

Analysts expect this trend to continue in 2024 owing to robust earnings growth, attractive valuation, and steady economic growth.

Copyright Mettis Link News

Posted on: 2024-01-20T08:00:00+05:00