January 13, 2024 (MLN): The benchmark KSE-100 index closed this week at 64,638 showing an increase of 123 points or 0.19% WoW.

The International Monetary Fund (IMF) successfully completed the first review of the Stand-By Arrangement (SBA) and approved the second tranche worth $700 million.

This will help bolster Pakistan’s foreign exchange reserves, which currently stand at around $8.15 billion.

On the economic front, workers’ remittances in December clocked in at $2.38bn.

Although the number showed an increase of 5.4% MoM and 13.4% YoY, the inflow during the first half of FY24 showed a decline of 6.8% YoY or $983m.

Meanwhile, the Pakistani Rupee (PKR) recorded a marginal gain of 0.37% WoW.

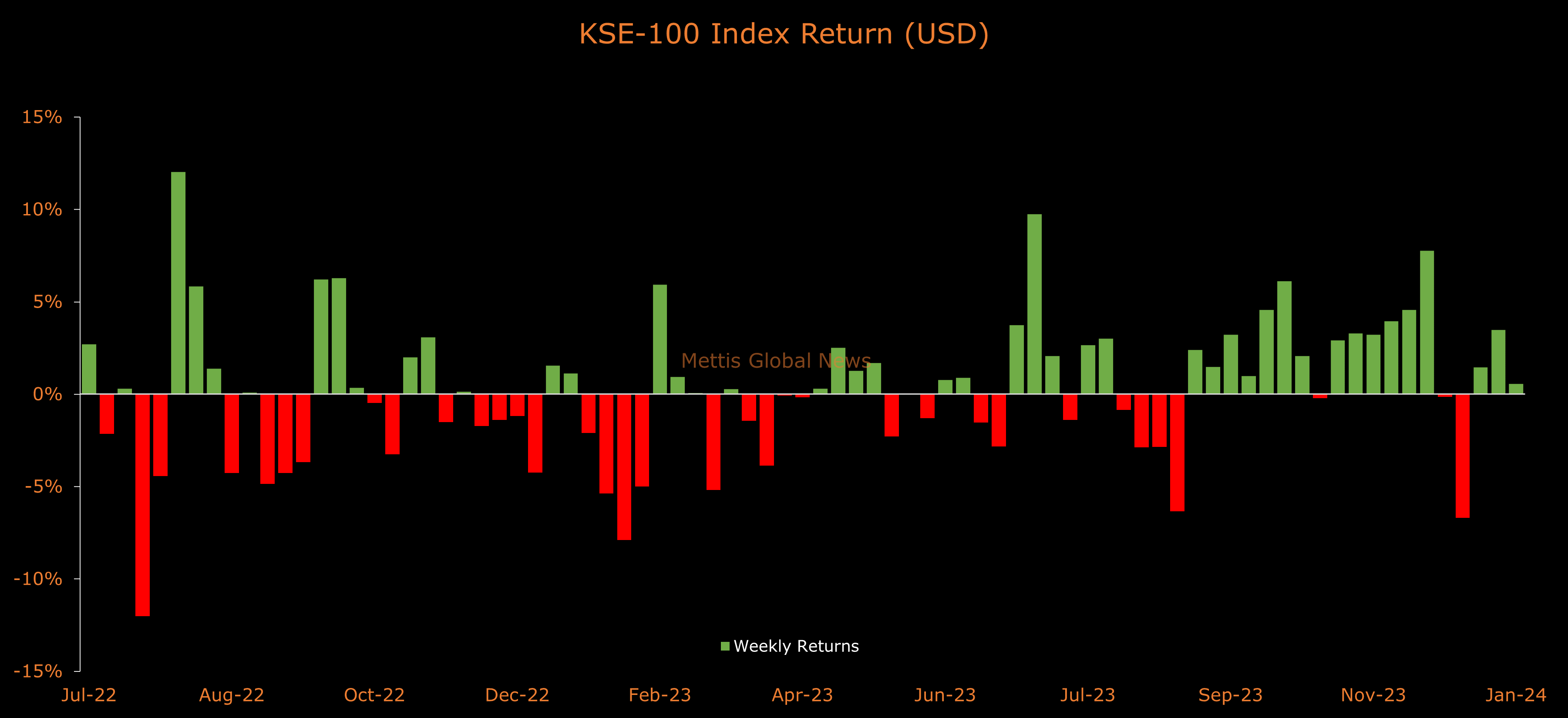

In USD terms, the KSE-100 index gained 0.56% this week.

Throughout the week, KSE-100 oscillated in a range of 1,483 points, between high and low of 65,357 and 63,874 levels, respectively, before settling the week at 64,638.

The market turnover saw a fall during the week, with an average traded volume of 335 million shares worth Rs10.90 billion, marking a decrease of 24.73% WoW in the number of shares and 25.82% WoW in traded value.

Moreover, the overall PSX average traded volume (All-Share) was recorded at 559m shares worth Rs16.00bn, marking a decrease of 18.57% WoW in the number of shares while a decrease of 18.33% WoW in traded value.

Top Index Movers

From the sector-specific lens, Oil & Gas Exploration Companies was the best performing sector, as they added 326 points to the index.

The oil sector remained in the spotlight amid significant achievements in gas discoveries and new exploration blocks.

This was followed by Fertilizer, Automobile Assembler, Inv. Banks / Inv. Cos. / Securities Cos., and Miscellaneous as they kept the index in positive territory by adding 184, 46, 38, and 31 points, respectively.

Contrary to that, Cement, Technology & Communication, Commercial Banks, Oil & Gas Marketing Companies, and Power Generation & Distribution remained red, as they took away 122, 110, 89, 40, and 34 points from the index.

Scrip-wise, MARI, PPL, ENGRO, EFERT, and INDU were the best-performing stocks during the week as they added 156, 129, 120, 108, and 59 points to the index respectively.

Whereas, TRG, UBL, SYS, FFBL, and CHCC collectively took away 208 points from the index.

MARI announced a gas discovery at Shewa-2 well, while PPL gained momentum after securing two new exploration blocks.

OGDC was also awarded four new exploration blocks by the government, as announced by the company during the week.

FIPI/LIPI

Foreign investors were net buyers during the week, acquiring $1.88m worth of equities.

Flow-wise, Companies were the dominant buyers, with a net investment of $6.42m.

They allocated the majority of their capital, $4.91m, to Oil and Gas Exploration Companies, while divesting from the Technology and Communication sector, amounting to $0.26m in sales.

On the other hand, the leading sellers were Banks / Dfi, with a net sale of $4.94m.

Their most substantial sales activity was in Oil and Gas Exploration Companies, amounting to $3.4m, while they acquired $1.02m of equities in the Fertilizer.

To note, the local stock market has been on a bullish streak amid hopes of improved economic conditions following the expected inflows from IMF and friendly countries, relatively stable currency amid government-backed administrative efforts, and a possible slash in the interest rates.

The KSE-100 gained 22,031 points, equivalent to 54.5% in the calendar year 2023.

Analysts expect this trend to continue in 2024 owing to robust earnings growth, attractive valuation, and steady economic growth.

KSE-100 has gained 23,185 points or 55.93% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 2,187 points, equivalent to 3.5%.

Copyright Mettis Link News

Posted on: 2024-01-13T16:19:37+05:00