October 27, 2023 (MLN): Systems Limited (PSX: SYS) reported its profit and loss statement for the nine months of 2023, wherein the profit after tax clocked in at Rs7.15 billion [EPS: Rs24.57] compared to a profit of Rs5.12bn [EPS: Rs18.47] in the same period last year (SPLY).

Going by the results, the company's top line rose by 85.33% YoY to Rs37.33bn as compared to Rs20.14bn in SPLY.

Eliminating the currency impact, revenue was up by 33% in US dollar terms.

The cost of sales also rose by 97.45% YoY but was lesser than proportionate to sales increase, which improved the gross profit by 59.04% YoY to Rs10.11bn in 9MCY23.

Investment in subsidiaries in capability building and resources for aggressive growth and expansion, along with inflationary pressures in the domestic market have impacted margins, however, optimization of revenue and costs has positively impacted margins quarter over quarter.

Moreover, during the review period, other income increased by 73.87% YoY to stand at Rs3.02bn in 9MCY23 as compared to Rs1.74bn in SPLY.

The company’s finance costs skyrocketed by 4.27x YoY and stood at Rs653.88m as compared to Rs153.39m in 9MCY22, mainly due to higher interest rates.

On the tax front, the company paid a higher tax worth Rs399.31m against the Rs279.58m paid in the corresponding period of last year, depicting an increase of 42.82% YoY.

Standalone Results (Quarterly):

During the period under review, standalone revenue grew 56% over the same period last year from Rs14.8bn to Rs23.08bn.

Consequently, gross profit and operating profit are 42% and 39% higher than SPLY (same period last year) respectively.

Margins remain under stress due to significant inflationary pressures in the domestic market, partially eased by the continued devaluation of the Pak Rupee resulting in a revaluation gain of Rs2.39bn compared to the gain in September 2022 of Rs1.17bn increasing net profit by 40%, from Rs4.82bn to Rs6.73bn in this period.

Basic and diluted earnings per share increased by 33% in line with profit for the period.

The growth in revenue, net of the impact of exchange gain, is 12%.

| Consolidated (un-audited) Financial Results for Nine months ended 30 September, 2023 (Rupees in '000) | |||

|---|---|---|---|

| Sep 23 | Sep 22 | % Change | |

| Sales | 37,333,786 | 20,144,849 | 85.33% |

| Cost of sales | (27,220,094) | (13,785,810) | 97.45% |

| Gross Profit | 10,113,692 | 6,359,039 | 59.04% |

| Distribution expenses | (1,288,268) | (451,256) | 185.48% |

| Administrative expenses | (2,975,301) | (1,766,220) | 68.46% |

| Impairment losses on financial assets | (383,057) | (96,697) | 296.14% |

| Share of loss from associate | (284,051) | (231,370) | 22.77% |

| Other Income | 3,016,979 | 1,735,194 | 73.87% |

| Finance cost | (653,875) | (153,393) | 326.27% |

| Profit before taxation | 7,546,119 | 5,395,296 | 39.86% |

| Taxation | (399,307) | (279,583) | 42.82% |

| Net profit for the period | 7,146,811 | 5,115,712 | 39.70% |

| Basic earnings/ (loss) per share | 24.57 | 18.47 | – |

Amount in thousand except for EPS

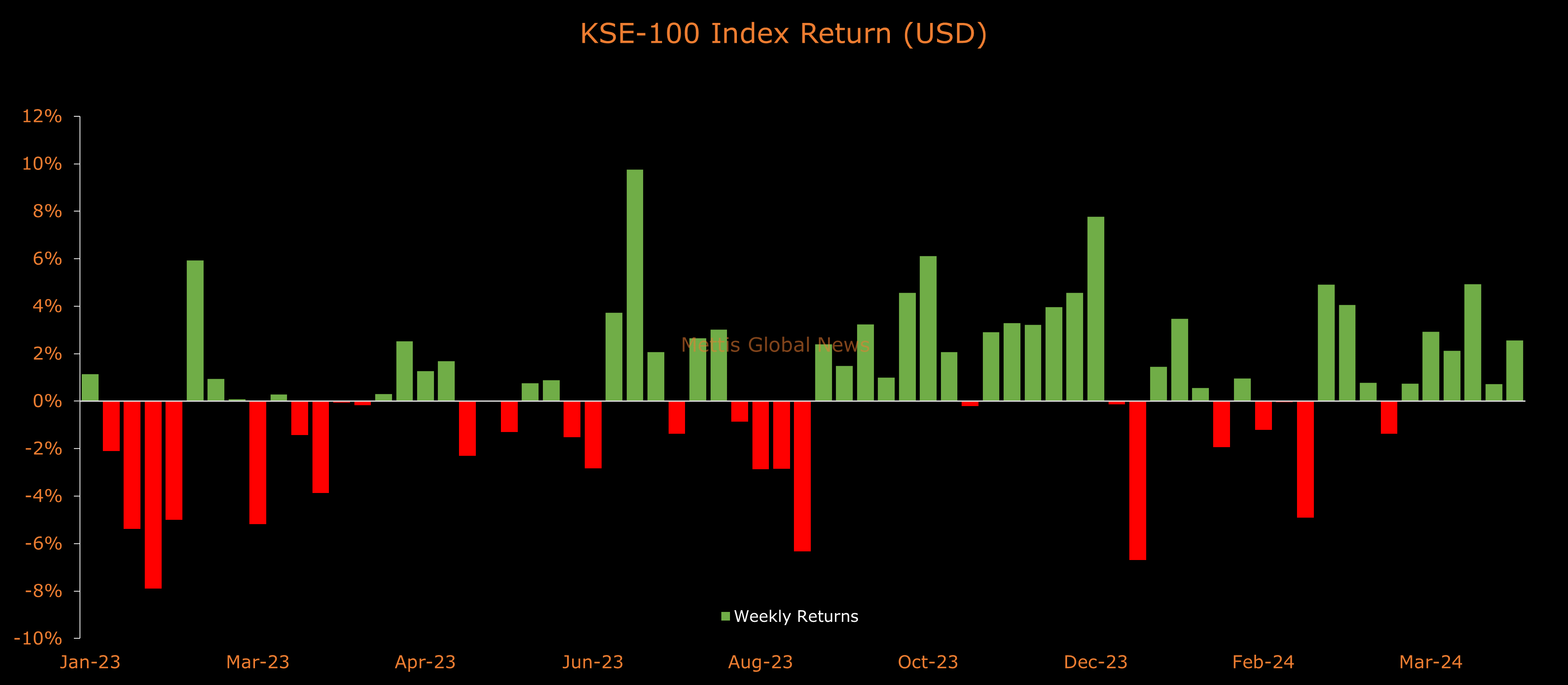

SYS and KSE-100 YTD Performance

Copyright Mettis Link News

Posted on: 2023-10-27T10:17:50+05:00