Samba Bank records 2.87x increase in net profits for 9MCY23

MG News | October 26, 2023 at 03:53 PM GMT+05:00

October 26, 2023 (MLN): Samba Bank Limited (PSX: SBL) announced its results for the nine months of 2023 where the bank’s net profits soared by 2.87x to Rs1.06 billion [EPS: Rs1.05] compared to Rs369.35m [EPS: Rs0.37] in the same period last year (SPLY).

Going by the income statement made available by the company on the PSX, the bank witnessed an increase of 80.25% YoY in its markup interest income to clock in at Rs5.73bn against Rs3.12bn in the same period last year (SPLY).

On the other hand, the bank’s total non-markup interest income declined by 23.64% YoY to Rs847.27m as compared to Rs1.11bn in SPLY.

This was due to a massive loss on securities of Rs465.7m. In addition, the dividend income also declined by 30% YoY in 9MCY23.

Accordingly, the bank’s total income was recorded at Rs6.57bn as against Rs4.29bn in SPLY.

The nine months’ total non-mark-up/interest expenses stood at Rs3.46bn, up by 15.92% YoY.

On the taxation front, the company paid Rs792m, more than three times YoY higher than the Rs256m paid in SPLY.

| Unconsolidated (un-audited) Financial Results for Nine months ended 30 September, 2023 (Rupees in '000) | |||

|---|---|---|---|

| Sep-23 | Sep-22 | % Change | |

| Mark-up/return/interest earned | 21,200,792 | 15,769,769 | 34.44% |

| Mark-up/return/interest expensed | 15,475,308 | 12,593,278 | 22.89% |

| Mark-up/return/interest income | 5,725,484 | 3,176,491 | 80.25% |

| NON MARK-UP/INTEREST INCOME | |||

| Fee and commission income | 298,690 | 300,216 | -0.51% |

| Dividend income | 27,046 | 38,597 | -29.93% |

| Foreign exchange income | 975,044 | 917,788 | 6.24% |

| Income / (loss) from derivatives | |||

| Gain / (loss) on securities | (465,696) | (159,511) | 191.95% |

| Other income | 12,187 | 12,499 | -2.50% |

| Total non mark-up/interest income | 847,271 | 1,109,589 | -23.64% |

| Total Income | 6,572,755 | 4,286,080 | 53.35% |

| NON MARK-UP/INTEREST EXPENSES | |||

| Operating expenses | 3,422,281 | 2,970,091 | 15.22% |

| Workers' Welfare Fund | 37,000 | 12,800 | 189.06% |

| Other charges | 1,303 | -100.00% | |

| Total non mark-up/interest expenses | 3,459,281 | 2,984,194 | 15.92% |

| Profits before provisions | 3,113,474 | 1,301,886 | 139.15% |

| (Provisions) / reversal and write offs - net | (1,261,221) | (676,524) | 86.43% |

| Extraordinary items/unusual items | - | - | |

| Profit before taxation | 1,852,253 | 625,362 | 196.19% |

| Taxation | (791,977) | (256,009) | 209.36% |

| Profit after taxation | 1,060,276 | 369,353 | 187.06% |

| Earning per share - basic (Rupees) | 1.05 | 0.37 | 183.78% |

Amount in thousand except for EPS

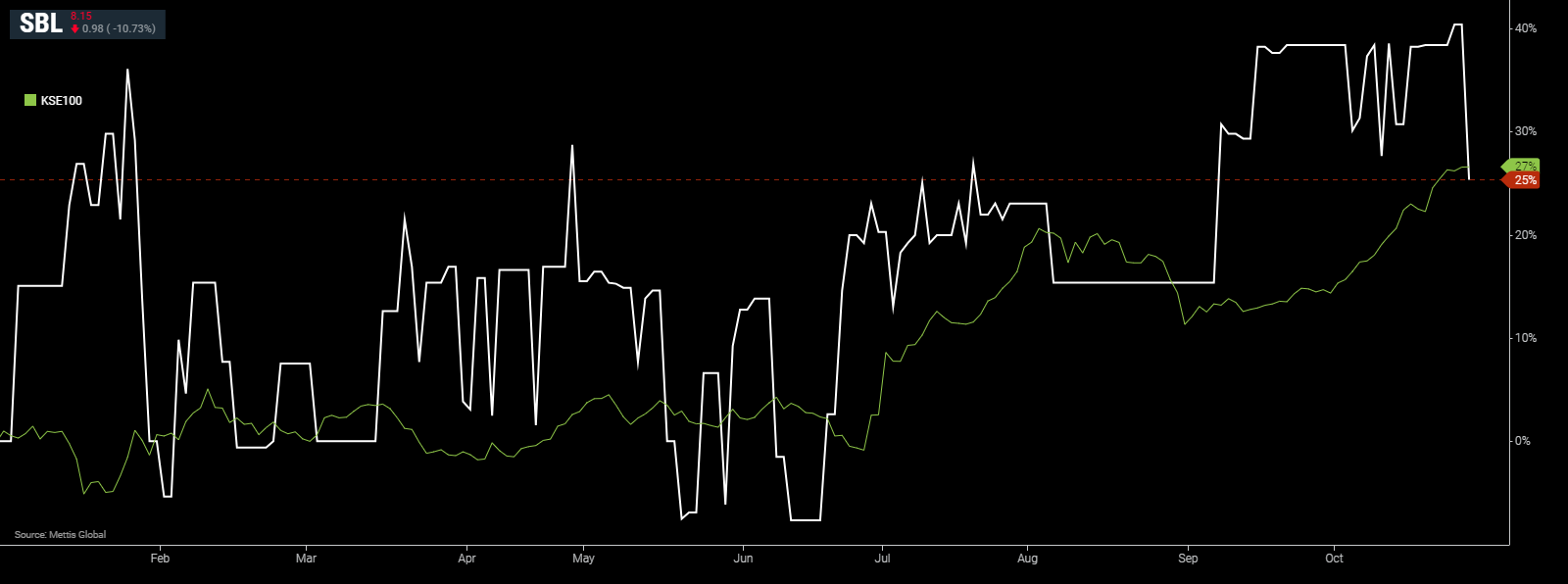

SBL and KSE-100 YTD Performance

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 188,380.39 423.53M | 0.09% 177.53 |

| ALLSHR | 112,632.58 952.35M | 0.19% 209.35 |

| KSE30 | 58,032.20 111.39M | 0.13% 75.72 |

| KMI30 | 267,197.87 107.19M | -0.07% -177.46 |

| KMIALLSHR | 72,476.12 511.85M | 0.16% 112.92 |

| BKTi | 53,757.31 35.30M | 0.51% 271.34 |

| OGTi | 39,295.91 17.16M | 0.97% 379.30 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,335.00 | 90,525.00 88,770.00 | -55.00 -0.06% |

| BRENT CRUDE | 68.73 | 68.73 67.12 | 1.16 1.72% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | -2.35 -2.64% |

| ROTTERDAM COAL MONTHLY | 98.50 | 98.50 98.50 | 0.00 0.00% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 63.50 | 63.57 62.07 | 1.11 1.78% |

| SUGAR #11 WORLD | 14.72 | 14.87 14.67 | -0.11 -0.74% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Total Advances, Deposits & Investments of Scheduled Banks

Total Advances, Deposits & Investments of Scheduled Banks