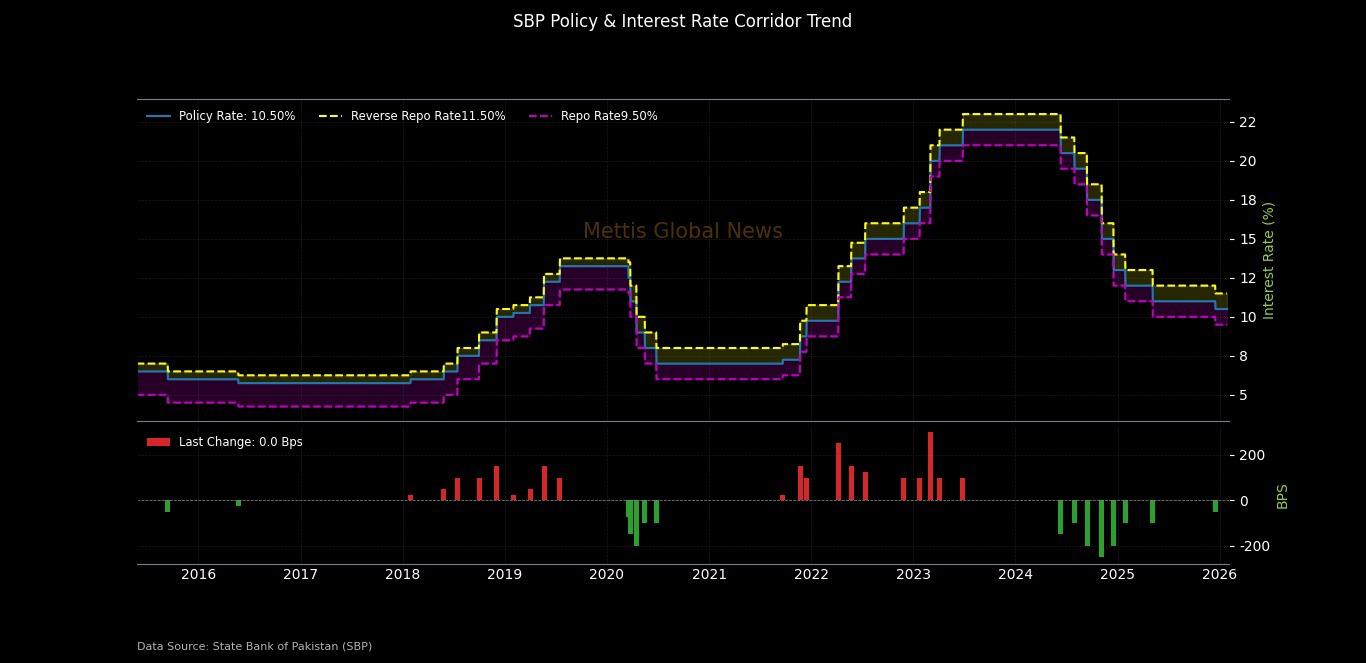

SBP keeps policy rate unchanged at 10.5%

MG News | January 26, 2026 at 04:07 PM GMT+05:00

January 26, 2026 (MLN): The State Bank of

Pakistan (SBP) on Monday kept its key policy rate unchanged at 10.5%

with effect from January 27, 2026.

The decision was taken by the Monetary Policy Committee (MPC) at its scheduled meeting, which is inconsistent with the market sentiments, as analysts predicted that SBP could reduce it by 75-50bps.

Headline inflation stood at 5.6% year-on-year in December

2025, aligning with the central bank’s expectations and remaining within

the target range.

Although core inflation has stabilized at a relatively

higher level of around 7.4%, easing inflation expectations among

consumers and businesses signal improving confidence in macroeconomic

stability.

Recent high-frequency indicators point to a

faster-than-anticipated pickup in economic activity, led largely by domestic-oriented

sectors.

Manufacturing, construction, and consumer demand have all

shown notable strength, reinforcing the MPC’s assessment that growth momentum

is becoming more broad-based and resilient.

While the trade deficit widened due to a surge in

imports and softer export performance, particularly in food items such as rice,

the overall current account deficit has remained manageable.

Strong workers’ remittances, growing ICT services exports, and favorable global commodity prices have played a key role in cushioning external pressures.

As a result, foreign exchange reserves rose to $16.1

billion by mid-January, exceeding earlier targets and supported by

continued interbank market purchases by the SBP.

Against this backdrop, the MPC noted that its outlook for

inflation and the external account remains largely unchanged, while the growth

outlook has improved significantly. The Committee therefore judged it

prudent to keep the policy rate unchanged to consolidate economic gains and

ensure sustainable growth.

Economic Activity Gains Pace

Provisional data shows that real GDP grew by 3.7%

year-on-year in Q1-FY26, a sharp improvement from 1.6% in the same period

last year. Growth was driven mainly by strong performance in the industrial

and agricultural sectors, with momentum continuing into the second quarter.

Large-scale manufacturing recorded robust growth of 8.0%

in October and 10.4% in November 2025, lifting cumulative LSM growth to 6.0%

during July–November FY26.

Rising auto sales, cement dispatches, fertilizer off-take,

POL sales (excluding furnace oil), and increased imports of machinery and

intermediate goods all point to sustained domestic demand. Encouraging

indicators for the wheat crop further support optimism, with positive

spillovers expected for the services sector.

In light of these developments, the MPC has upgraded its

GDP growth projection for FY26 to 3.75–4.75%, with growth expected to

strengthen further in FY27 as the impact of earlier policy easing and improved

macroeconomic stability continues to unfold.

External Sector Outlook Remains Stable

The current account posted a $244 million deficit in

December 2025, bringing the cumulative deficit to $1.2 billion in the

first half of FY26. Despite pressures from higher imports, sustained

remittance inflows and resilient high-value-added textile exports have helped

keep external balances under control.

Looking ahead, the SBP expects the current account deficit

to remain contained within 0–1% of GDP in FY26.

With planned official inflows and continued remittance

growth, foreign exchange reserves are projected to exceed $18 billion by

June 2026 and move closer to the benchmark of three months of import cover

in FY27, although global trade fragmentation and geopolitical uncertainty

remain key risks.

Fiscal and Monetary Conditions Support Stability

On the fiscal side, FBR revenues grew by 9.5% in H1-FY26,

though below target, resulting in a shortfall.

However, lower interest payments and restrained expenditures

have contributed to an improved fiscal balance, supporting overall

macroeconomic stability.

The MPC emphasized the importance of sustaining fiscal

discipline through structural reforms, including tax base expansion and SOE

privatization, to support long-term growth.

Meanwhile, monetary conditions have eased. Broad money

growth rose to 16.3%, supported by increased private sector credit and

government borrowing.

To further encourage lending, the SBP reduced the average

cash reserve requirement from 6.0% to 5.0%, which is expected to provide an

additional boost to private sector activity.

Inflation Outlook Remains Favorable

Headline inflation has moderated due to easing food prices,

while energy inflation edged up following the fading of favorable base effects.

Despite persistent core inflation, the MPC expects overall inflation to remain

within the 5–7% target range in FY26 and FY27, with only temporary upward

pressures in the near term.

Overall, the MPC reaffirmed that a positive real policy rate, combined with coordinated fiscal policy and productivity-enhancing reforms, will be critical to sustaining economic growth, boosting exports, and maintaining macroeconomic stability over the medium term.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 169,842.71 58.01M | -1.35% -2327.58 |

| ALLSHR | 101,959.41 125.89M | -1.47% -1517.23 |

| KSE30 | 51,994.55 20.46M | -1.26% -664.23 |

| KMI30 | 237,197.45 17.70M | -1.38% -3313.84 |

| KMIALLSHR | 65,082.44 62.39M | -1.37% -905.59 |

| BKTi | 50,290.72 8.39M | -1.42% -722.19 |

| OGTi | 33,357.70 3.30M | -0.62% -207.77 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,270.00 | 67,665.00 66,880.00 | 65.00 0.10% |

| BRENT CRUDE | 71.91 | 72.16 71.59 | 0.25 0.35% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.10 -3.13% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.75 -1.63% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.65 | 66.86 66.31 | 0.25 0.38% |

| SUGAR #11 WORLD | 13.72 | 13.85 13.62 | -0.04 -0.29% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png?width=280&height=140&format=Webp)

Roshan Digital Account

Roshan Digital Account