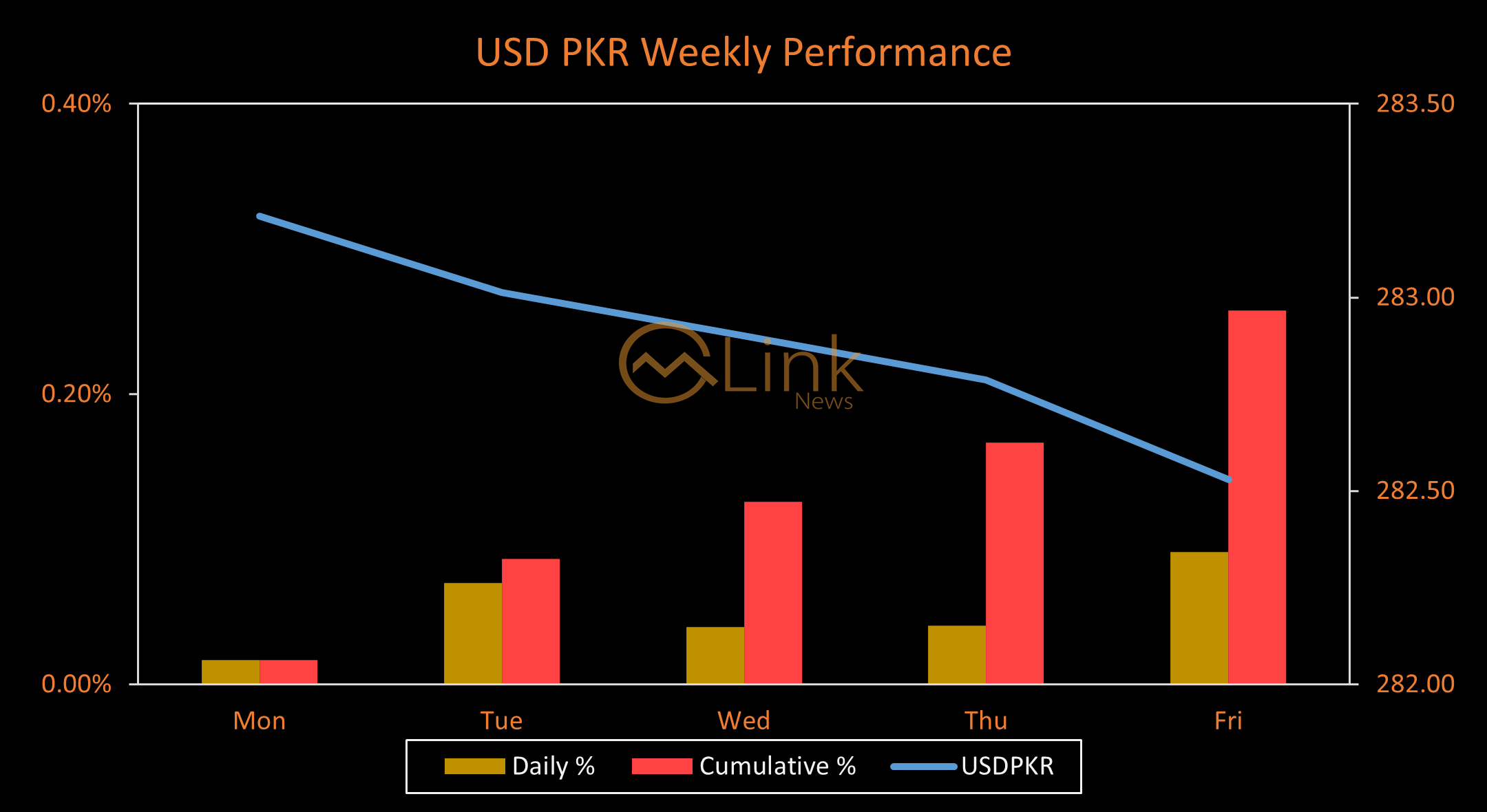

December 22, 2023 (MLN): The Pakistani rupee (PKR) appreciated by around 73 paisa against the US dollar this week and settled at PKR 282.53 per USD, compared to the previous session's closing of PKR 283.26 per USD.

The local unit saw an intraday high (bid) of 282.75 and a low (ask) of 282.65.

In the open market, the PKR gained 25 paisa as Exchange Companies quoted the dollar at 281 for buying and 284 for selling, compared to the previous session's closing of 281.25 for buying and 284.25 for selling.

Note, that this marks the sixth consecutive weekly gain witnessed by the local unit against the greenback.

Whereas on a daily basis this is the nineth consecutive victory for the local unit against the mighty Dollar.

According to Asad Rizwi, the former Treasury Head at Chase Manhattan Bank, the PKR has remained steady since the last quarter following the inflows from the International Monetary Fund (IMF) and other bilateral and multilateral sources.

"Indeed, there has been a slowdown in general trading activity, but this is good for the economy," he further added.

This upswing is further attributed to the successful staff-level agreement (SLA) between the IMF and Pakistani authorities during the first review under the Stand-By Arrangement (SBA).

Pending approval by the IMF's Executive Board, the agreement will grant Pakistan access to SDR 528 million, around $700m.

The upward momentum this week is associated with the latest trade numbers for the month of November which showed a surplus of $9 million compared to deficits of $184m in October and $157m in November 2022.

In addition, the market is experiencing further positive sentiment attributed to a substantial surge in foreign investment, with a 7.28% month-on-month rise and a 12.25% year-on-year expansion, ultimately settling at $131.37 million in November.

To recall, the pressure resulting from the gap between the demand and supply of dollars prevailed over the market for days and the PKR suffered losses for four consecutive weeks.

According to Bloomberg's latest report, the local unit is set to end the year as Asia’s worst-performing currency and the losses are expected to persist in 2024.

In comparison to major currencies, PKR lost 1.24 rupees against the Euro, closing at 310.81 compared to the previous value of 309.57.

The British Pound became expensive by 1.24 rupees, closing at 358.66 compared to 357.41 from a day ago.

Swiss franc saw gains of 1.88 rupees, closing at 329.84 compared to 327.96 from the previous session.

Against the Japanese Yen, PKR lost 1.23 paisa, closing at 1.986 versus 1.974 a day ago.

The Chinese Yuan lost 2.66 paisa, closing at 39.5496 against 39.5762 from the previous session.

The Saudi Riyal closed at 75.31 with a loss of 6.86 paisa from its value of 75.38 a day ago.

The U.A.E Dirham decreased in value by 6.59 paisa from 76.999 a day ago to 76.933.

During the current financial year, PKR has appreciated against the Dollar by 3.46 rupees or 1.23%. While the current calendar year has seen PKR depreciated by 56.1 rupees or 19.86%.

In the Money Market, the benchmark 6-month Karachi Interbank Bid and Offer rates inched up by 3 bps to 21.21% and 21.46%.

The State Bank of Pakistan (SBP) conducted a reverse repo and Shariah Compliant Modarabah Open Market Operation (OMO) today, in which it cumulatively injected a total of Rs2.72 trillion into the market.

Of which Rs2.66tr were injected through reverse repo OMO.

Meanwhile, the remaining Rs68 billion was injected through Shariah-compliant Modarabah-based OMO.

Performance Summary

| Currency | Dec 22, 2023 | Dec 21, 2023 | Change | 1 Month | FYTD | CYTD | 1 Day | 7 Day | 1 Month | MTD | FYTD | CYTD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD | 282.5286 | 282.7862 | 0.2576 | 2.7365 | 3.4619 | -56.0977 | 0.09% | 0.26% | 0.97% | 0.93% | 1.23% | -19.86% |

| EUR | 310.8097 | 309.566 | -1.2437 | 0.4145 | 2.1211 | -69.5022 | -0.40% | 0.19% | 0.13% | 0.50% | 0.68% | -22.36% |

| GBP | 358.656 | 357.4134 | -1.2426 | -1.8892 | 5.4813 | -85.5803 | -0.35% | 0.81% | -0.53% | 0.98% | 1.53% | -23.86% |

| CHF | 329.8449 | 327.9632 | -1.8817 | -7.0372 | -10.0881 | -84.8163 | -0.57% | -0.97% | -2.13% | -0.93% | -3.06% | -25.71% |

| JPY | 1.9864 | 1.9741 | -0.0123 | -0.0749 | 0.0059 | -0.2728 | -0.62% | 0.40% | -3.77% | -2.33% | 0.30% | -13.73% |

| SAR | 75.3139 | 75.3825 | 0.0686 | 0.7426 | 0.9401 | -15.1089 | 0.09% | 0.25% | 0.99% | 0.93% | 1.25% | -20.06% |

| AED | 76.933 | 76.9989 | 0.0659 | 0.7409 | 0.9288 | -15.2806 | 0.09% | 0.25% | 0.96% | 0.94% | 1.21% | -19.86% |

| CNY | 39.5496 | 39.5762 | 0.0266 | 0.4085 | 0.1201 | -6.9839 | 0.07% | 0.79% | 1.03% | 1.10% | 0.30% | -17.66% |

52 Week Performance

| Currency | High | Low | Trading Band | % Since High | % Since Low | High Date | Low Date | Days Since High | Days Since Low |

|---|---|---|---|---|---|---|---|---|---|

| USD | 225.642 | 307.1 | 81.4581 | -20.13% | 8.70% | 23-Dec-22 | 05-Sep-23 | 364 | 108 |

| EUR | 239.154 | 332.701 | 93.5470 | -23.05% | 7.04% | 06-Jan-23 | 31-Aug-23 | 350 | 113 |

| GBP | 270.362 | 387.972 | 117.6101 | -24.62% | 8.17% | 06-Jan-23 | 31-Aug-23 | 350 | 113 |

| CHF | 242.141 | 347.163 | 105.0222 | -26.59% | 5.25% | 26-Dec-22 | 31-Aug-23 | 361 | 113 |

| JPY | 1.688 | 2.2178 | 0.5298 | -15.02% | 11.65% | 28-Dec-22 | 11-May-23 | 359 | 225 |

| SAR | 60.0031 | 81.8703 | 21.8672 | -20.33% | 8.71% | 23-Dec-22 | 05-Sep-23 | 364 | 108 |

| AED | 61.4408 | 83.6089 | 22.1681 | -20.14% | 8.68% | 23-Dec-22 | 05-Sep-23 | 364 | 108 |

| CNY | 32.2968 | 43.0908 | 10.7940 | -18.34% | 8.95% | 23-Dec-22 | 11-May-23 | 364 | 225 |

Copyright Mettis Link News

Posted on: 2023-12-22T16:54:58+05:00