February 07, 2022 (MLN): After enjoying higher gains on the back of IMF’s tranche in previous sessions, the Pakistani rupee (PKR) took a breather on Monday as the local unit settled trading session relatively unchanged at 174.47 per USD in the interbank market.

Throughout the day, the rupee traded in a range of 67 paisa per USD showing an intraday high bid of 174.92 and an intraday low offer of 174.55.

Though PKR is stable, the real challenge is elevated oil prices, Asad Rizvi, the former Treasury Head at Chase Manhattan said in a morning Tweet.

With thin fiscal space, high inflation and effort to keep the interest rate unchanged, it is a tough ask to execute and perform to get the remaining $3bn IMF loan due to commitment, he added.

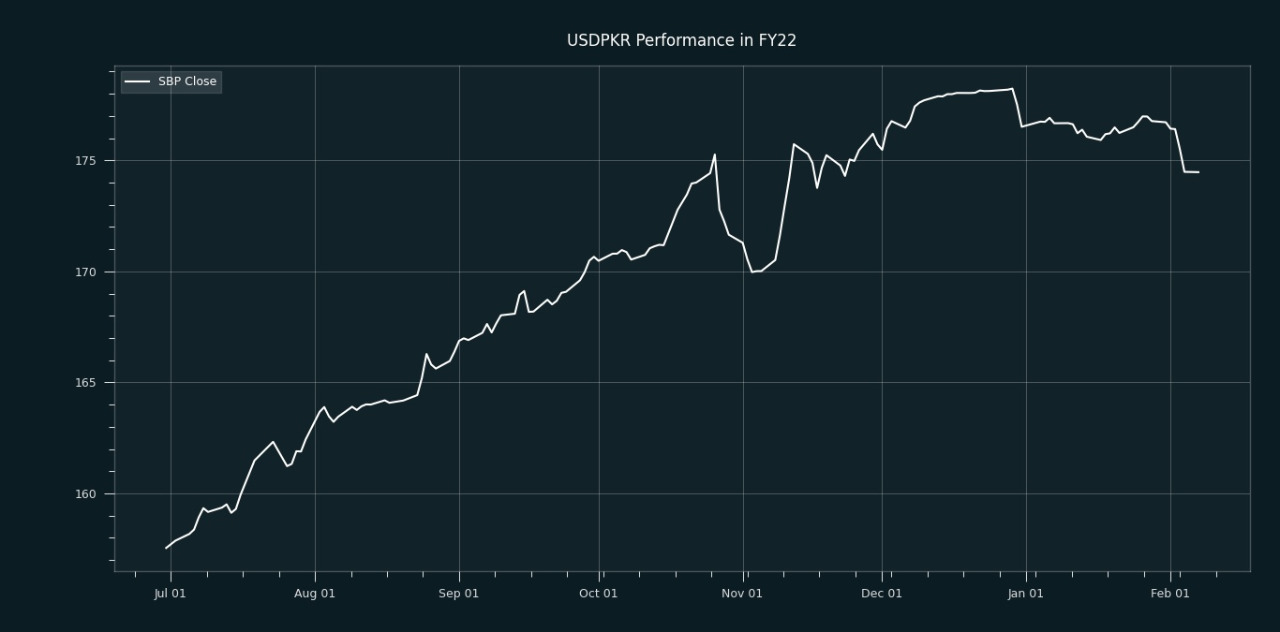

Meanwhile, the local unit has lost Rs16.92 against the USD from July’21 to date, Whereas, the rupee appreciated by PKR 2.04 in CY22, with the month-to-date (MTD) position showing a gain of 1.29%, as per data compiled by Mettis Global.

While hitting an upward rally, the performance of PKR remained comparatively better against other currencies as well as the local unit appreciated by 1.29% against USD and, AED, while the currency has also moved up by 1.28%, 1.06%, 0.55%, 0.52% against SAR, JPY, CHF and GBP, respectively. On the other hand, it had to lose some ground against EUR by 1.04% from month to date.

According to the ECAP, PKR gained 20 paisa in the open market as the currency closed at PKR 175.80 and PKR 176.80 for buying and selling, respectively.

Meanwhile, the currency gained 81 paisa against the Pound Sterling as the day's closing quote stood at PKR 236.24 per GBP, while the previous session closed at PKR 237.05 per GBP.

Similarly, PKR's value strengthened by 51 paisa against EUR which closed at PKR 199.48 at the interbank today.

On another note, within the money market, the overnight repo rate towards the close of the session was 9.85/10.00 percent, whereas the 1-week rate was 9.80/9.90 percent.

Copyright Mettis Link News

30661