Oil drops as China fails to deliver fresh stimulus measures

By MG News | October 14, 2024 at 11:12 AM GMT+05:00

October 14, 2024 (MLN): Oil fell at the start of the week after China’s highly anticipated Finance Ministry briefing on Saturday lacked new measures to stimulate consumption in the world's biggest crude importer, while the country's deflationary pressures worsened in September.

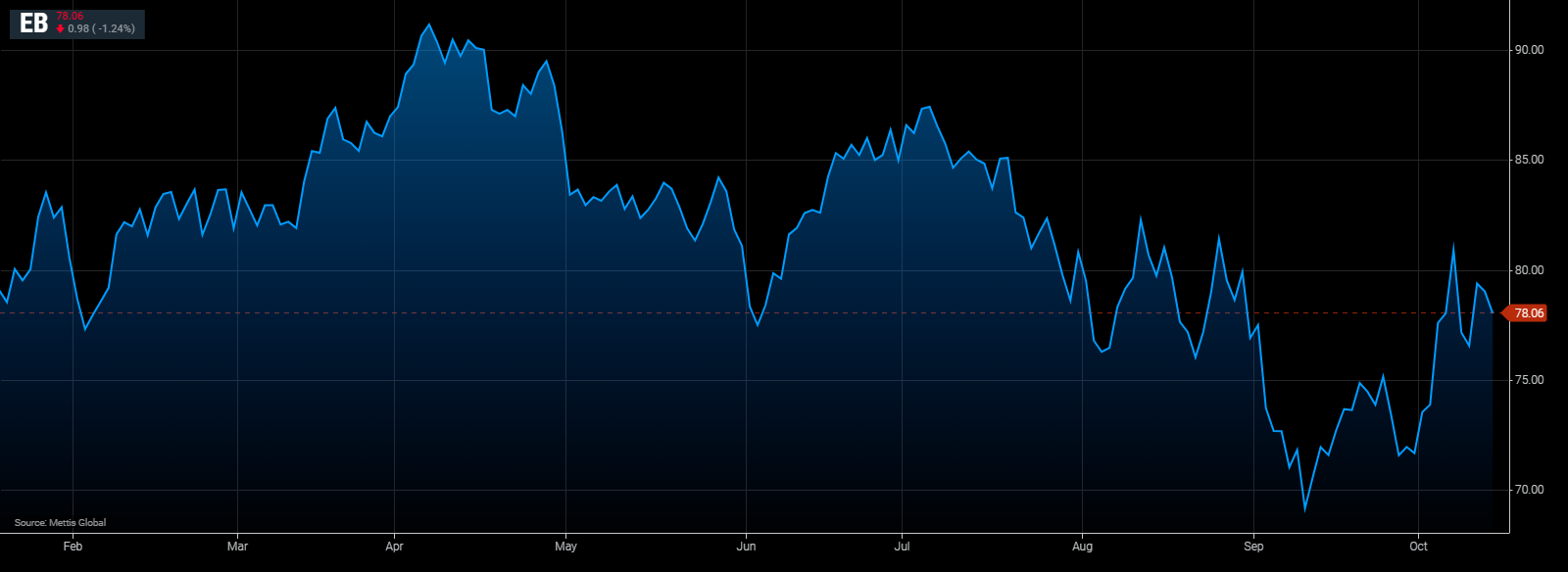

Brent crude slipped over 1% to $78.08 a barrel after notching its second weekly gain in a row.

While West Texas Intermediate crude (WTI) traded near $74.63 per barrel, down 1.23% on the day.

Despite Beijing’s promises of more support for the struggling property sector and hinting at greater government borrowing, the briefing didn’t produce the headline dollar figure for fresh fiscal stimulus that the markets had sought, Bloomberg reported.

Moreover, China's deflationary pressures worsened in September. The consumer price index inched up 0.4% from last year, and the core CPI rose 0.1%, the lowest since February 2021.

Producer inflation fell by 2.8% year-on-year, marking the 24th consecutive month of decline.

Meanwhile, oil traders are continuing to monitor Israel’s response to Iran’s October 01 ballistic missile attack, with one report suggesting it has narrowed down potential targets to military and energy infrastructure.

Over the weekend, a Hezbollah drone attack killed four Israeli soldiers, while the Pentagon said it would send an advanced missile defense system and associated troops to help shield its ally.

“A bumpy recovery in Chinese demand overshadowed the concerns of further escalation in the Middle East, which could dampen the flow of oil barrels from the key producing nations,” Priyanka Sachdeva, a senior market analyst at brokerage Phillip Nova Pte in Singapore, said in a note. “Oil prices are largely expected to be rangebound.”

Brent has risen about 9% this month as the prospect of an escalation in the Middle East conflict threatens output from a region that supplies about a third of the world’s oil.

The tensions have seen hedge funds flee bearish bets against the crude benchmark at the fastest pace in nearly eight years.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 130,344.03 345.79M |

1.67% 2144.61 |

| ALLSHR | 81,023.99 1,021.87M |

1.55% 1236.37 |

| KSE30 | 39,908.26 141.62M |

2.05% 803.27 |

| KMI30 | 189,535.00 150.29M |

1.40% 2619.39 |

| KMIALLSHR | 54,783.66 508.76M |

1.07% 581.78 |

| BKTi | 34,940.73 55.86M |

4.37% 1464.05 |

| OGTi | 28,296.06 16.02M |

1.19% 333.47 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,005.00 | 108,430.00 105,440.00 |

2255.00 2.13% |

| BRENT CRUDE | 67.78 | 68.10 66.94 |

0.67 1.00% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 109.20 | 110.00 108.25 |

1.70 1.58% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.14 | 66.43 65.23 |

0.69 1.05% |

| SUGAR #11 WORLD | 15.69 | 15.97 15.58 |

-0.01 -0.06% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Trade Balance

Trade Balance

CPI

CPI