Oil gains slightly as market eyes Iran, OPEC+ moves

MG News | July 02, 2025 at 04:35 PM GMT+05:00

July 02, 2025 (MLN): Oil futures inched higher on Wednesday as Iran halted its cooperation with the U.N. nuclear watchdog, while markets assessed the likelihood of increased supply from major producers next month amid a further weakening of the U.S. dollar.

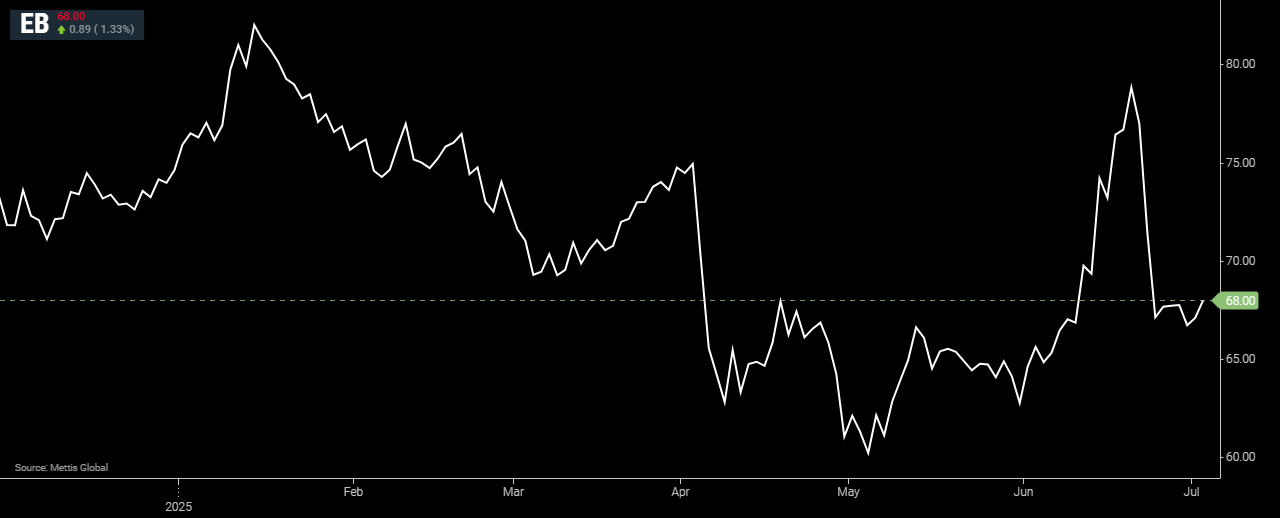

Brent crude futures increased by $0.86, or 1.33%, to $68 per barrel.

West Texas Intermediate (WTI) crude futures rose by $0.9, or 1.38%, to $66.35 per barrel by [4:35 pm] PST.

Brent crude has traded within a narrow range between $66.34 and $69.05 per barrel since June 25, as supply disruption concerns from the Middle East have eased following a ceasefire agreement between Iran and Israel.

In a fresh development, Iran enacted a law on Wednesday requiring that any future inspections of its nuclear facilities by the International Atomic Energy Agency (IAEA) receive prior approval.

The inspections must now be cleared by Tehran’s Supreme National Security Council.

The move follows accusations by Iran that the IAEA is biased toward Western nations and has indirectly justified Israeli airstrikes.

UBS commodity analyst Giovanni Staunovo noted that while the market is factoring in some geopolitical risk premium from Iran’s latest stance, "this is about sentiment there are no disruptions to oil."

On the supply front, the market seems to have already factored in the planned production increases by OPEC+, the coalition of oil-producing nations led by Saudi Arabia and Russia.

The group is expected to raise output by 411,000 barrels per day next month, in line with the hikes scheduled for May, June, and July.

Despite these planned increases, actual supply impact remains limited.

“We are all talking about additional supply coming to the market, but the supply has not really hit the market,” Staunovo added, suggesting that most of the output is being consumed domestically.

Data from Kpler shows Saudi Arabia boosted its oil shipments by 450,000 barrels per day in June compared to May its highest in over a year though total OPEC+ exports remain relatively flat since March.

This trend is expected to persist through the summer as regional energy demand surges due to high temperatures.

Meanwhile, a weakening U.S. dollar hitting a 3.5-year low against major currencies is providing mild support to oil prices by making crude cheaper for holders of other currencies.

Market participants now await key U.S. economic indicators, as CNBC reported.

The U.S. non-farm payrolls data, due Thursday, will help shape expectations around potential interest rate cuts by the Federal Reserve in the second half of 2025.

Lower rates could stimulate economic activity and, in turn, support oil demand.

On the inventory side, the American Petroleum Institute (API) reported a 680,000-barrel rise in U.S. crude stockpiles last week unusual for a season typically marked by stock draws.

Official data from the U.S. Energy Information Administration (EIA) is expected later today at 10:30 a.m. ET.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 184,174.49 344.20M | 1.01% 1836.37 |

| ALLSHR | 110,725.47 802.30M | 1.02% 1116.66 |

| KSE30 | 56,462.88 128.04M | 0.96% 535.72 |

| KMI30 | 261,050.23 116.63M | 1.37% 3522.37 |

| KMIALLSHR | 71,230.99 382.91M | 1.23% 862.76 |

| BKTi | 53,229.04 40.62M | 1.01% 532.20 |

| OGTi | 38,590.42 18.06M | 1.28% 488.37 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 84,560.00 | 84,945.00 81,210.00 | 160.00 0.19% |

| BRENT CRUDE | 69.83 | 70.21 67.79 | 0.24 0.34% |

| RICHARDS BAY COAL MONTHLY | 90.00 | 0.00 0.00 | -0.90 -0.99% |

| ROTTERDAM COAL MONTHLY | 103.70 | 103.70 99.40 | 4.90 4.96% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 65.74 | 66.11 63.64 | 0.32 0.49% |

| SUGAR #11 WORLD | 14.26 | 14.71 14.15 | -0.44 -2.99% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Total Advances, Deposits & Investments of Scheduled Banks

Total Advances, Deposits & Investments of Scheduled Banks