Volatile week for oil wraps up with gains

Rafay Malik | October 12, 2024 at 10:28 PM GMT+05:00

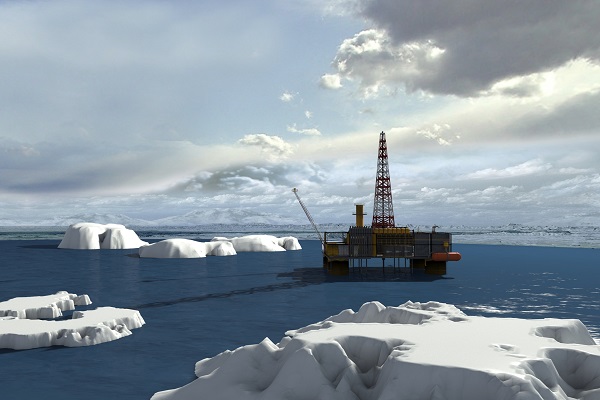

October 11, 2024 (MLN): Global oil prices faced immense volatility this week, yet managed to settle with a modest gain driven by rising Israel-Iran fears and signs that demand for energy could grow in the U.S. and China.

Global benchmark Brent rose 1.27% to close at $79.04 per barrel, crossing the $80 mark during intraday trading this week for the first time since August 27, 2024.

While West Texas Intermediate crude (WTI) settled at $75.56 per barrel, up by 1.59% WoW.

The rally extends from the past week, in which oil prices surged 9.06%, the highest weekly gain since February 2022.

Middle East tensions have been the primary factor benefiting commodity prices both this week and last week.

Iran's launch of a missile barrage against Israel on October 01 triggered a red alert among traders who were filled with concerns that a response from Israel could threaten Iran’s oil production.

These concerns drove most of last week’s gains and have continued to exert a positive influence on the market this week.

However, what turned this week into a seesaw for the commodity was the news of a potential ceasefire between Hezbollah and Israel along with concerns about dampening fuel demand in China, the world's largest crude importer.

Additionally, the higher-than-expected rise in crude inventories by 5.8 million barrels, compared to analysts’ estimates of 2m, also created a bearish impact.

This almost resulted in oil prices plunging as much as 5.68% in two trading sessions.

Nonetheless, these restrictions to the pump in oil prices soon vanished as war tensions once again took the center stage. On the demand side, China unveiled a law to help the private sector flourish, signaling a sort of confidence to traders.

Moreover, U.S. inflation fell to a 43-month low- despite exceeding expectations - strengthened hopes for a quarter rate cut by the U.S. Federal Reserve, which is beneficial for oil prices.

Further support came as Hurricane Milton swept out across Florida, leading to a sudden spark in demand for gasoline and the closure of various product stations.

As a consequence, oil managed to extend its rally for another week.

Pakistan’s market

Fuel prices in Pakistan are determined on a fortnight basis based on international prices. Based on the data of the past eleven days, it appears that the government is likely to end its price-cutting streak in the upcoming fortnight.

This possible hike in prices, on the back of surging crude oil, would come after five consecutive drops in fuel prices.

The statement supporting a hike in fuel prices can further be reinforced as the Oil & Gas Regulatory Authority (OGRA), after thorough analysis and deliberation on the data, has submitted a proposal to the federal government to increase the OMC margin by Rs1.35 per liter and the dealer margin by Rs1.40 per liter.

Both OMC and dealer margin play a significant role in the computation of fuel prices in the country.

As of now, the margin for OMCs and dealers, stands at Rs7.87 per liter and Rs8.64, respectively for both petrol and diesel.

It is proposed that these margins be raised to Rs10.04 per liter.

Hence, if approved, another factor would be added to the already rising petrol prices in the country.

Moreover, since the petroleum import bill constitutes the dominant portion of Pakistan's total imports (28.5% in FY24), a reduction in the import bill from lower international prices could ease the negative trade balance and reduce pressure on the country's limited dollar reserves.

However, it is crucial to mention that two trading sessions are still left for the next petrol price determination, so this rise is subject to further volatility in oil prices and exchange rates.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 135,939.87 307.74M |

-0.41% -562.67 |

| ALLSHR | 84,600.38 877.08M |

-0.56% -479.52 |

| KSE30 | 41,373.68 101.15M |

-0.43% -178.94 |

| KMI30 | 191,069.98 82.45M |

-1.17% -2260.79 |

| KMIALLSHR | 55,738.07 422.01M |

-1.03% -577.24 |

| BKTi | 38,489.75 45.79M |

-0.02% -8.33 |

| OGTi | 27,788.15 6.87M |

-1.24% -350.24 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 116,770.00 | 120,695.00 116,090.00 |

-3465.00 -2.88% |

| BRENT CRUDE | 68.78 | 69.41 68.60 |

-0.43 -0.62% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 96.50 96.50 |

0.50 0.52% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.25 |

-2.05 -1.92% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.65 | 67.13 66.22 |

-0.33 -0.49% |

| SUGAR #11 WORLD | 16.56 | 16.61 16.25 |

0.26 1.60% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|