PSX Closing Bell: The Wanderer

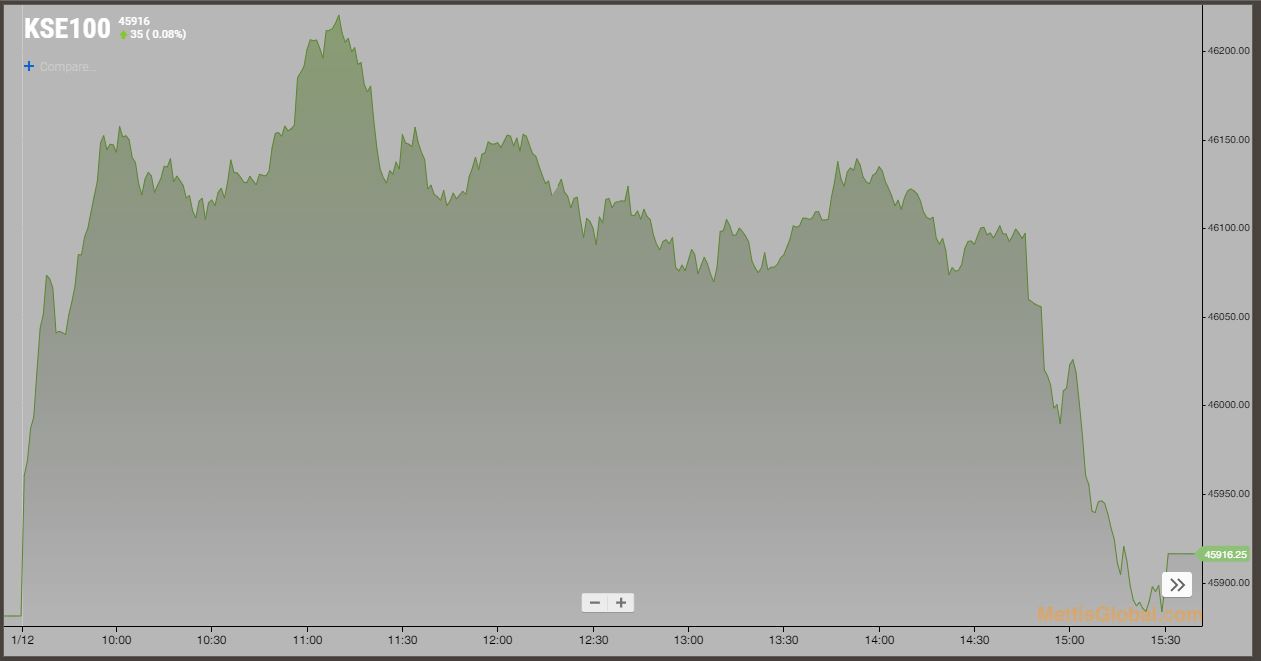

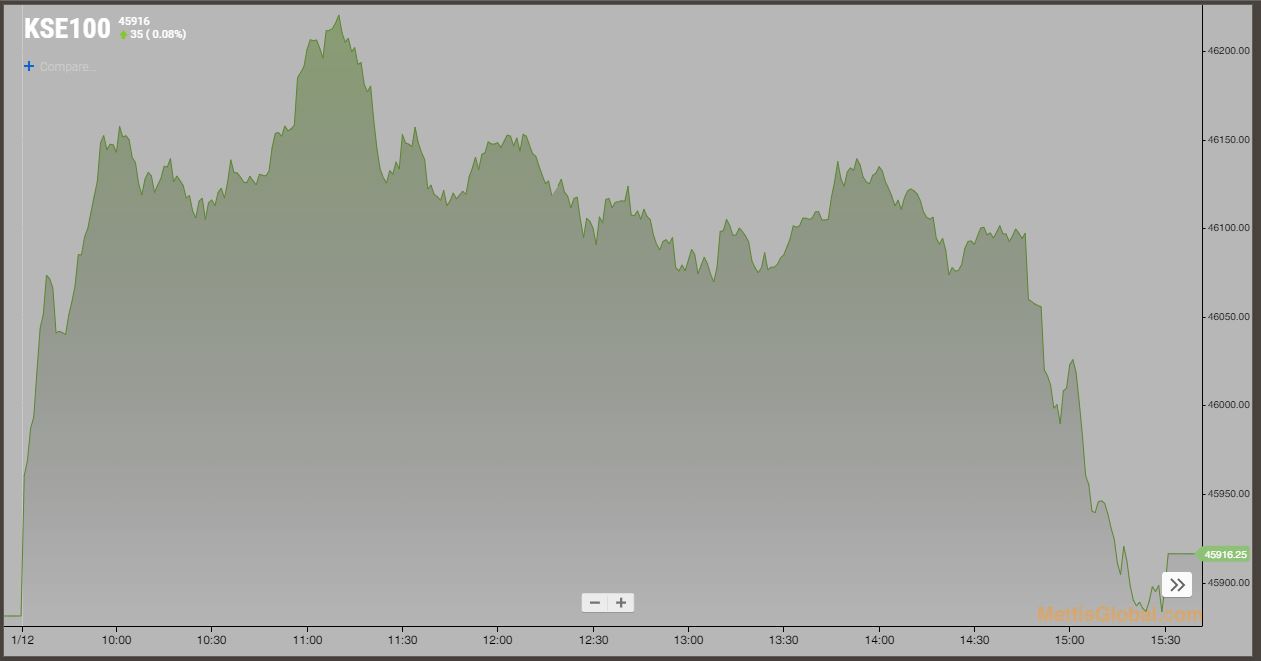

January 13, 2022 (MLN): Domestic equities remained under pressure throughout the day today as the country reported the highest ever Covid-19 infections in the last 4 months. The market opened on a bleak note as

January 13, 2022 (MLN): Domestic equities remained under pressure throughout the day today as the country reported the highest ever Covid-19 infections in the last 4 months. The market opened on a bleak note as

January 13, 2022 (MLN): Last year, Pakistan’s banking sector did not perform well despite stellar balance sheet growth, as foreigners sold around $167mn worth of shares in CY21 against $168mn in CY20 on account of

January 13, 2022 (MLN): The adverse impact of rising commodity prices has badly hit the cargo handling companies across the globe and now making its way to plague the local companies. Pakistan International Bulk Terminal

January 13, 2022 (MLN): The board of directors (BoD) of Nimir Industrial Chemicals Limited (PSX: NICL) has re-appointed Mr Zafar Mahmood as Chief Executive Officer (CEO) of the company, the company filing on PSX showed

January 13, 2022 (MLN): The Board of Directors of Cnergyico Pk Limited (PSX: CNERGY) (formerly Byco Petroleum Pakistan Limited) has approved the acquisition of a 57.37% stake in Puma Energy Pakistan Private Limited (Puma), the

January 13, 2022 (MLN): Pakistan Stock Exchange (PSX) on Thursday, revealed the criteria for selecting the top 25 companies for the year 2021. As per the notification issued by bourse, the prerequisites for the selection of

January 13, 2022 (MLN): National Clearing Company of Pakistan Limited (NCCPL) on Thursday announced that it will collect capital gain tax (CGT) from clearing members and Pakistan Mercantile Exchange (PMX) for the month of November’21

January 13, 2022 (MLN): Nishat Chunain Limited (NCL) has requested Nepra to delete 2 Bulk Power Consumers (BPC) and add 11 new BPCs in its generation licence, a notice issued by the authority showed today.

January 13, 2022 (MLN): The board of directors of ZIL Limited (ZIL), in a meeting, held on January 12, 2022, approved the closure of a factory located at Hyderabad as it faced operational difficulties due

January 12, 2022 (MLN): Cnergyico Pk Limited (CNERGY), formerly known as Byco Petroleum, is in final talks to acquire a controlling stake of nearly 57% in Puma Energy Pakistan Pvt limited, which will double its

January 12, 2022 (MLN): The management of the D. M. Textile Mills Limited (PSX: DMTX), in a notification to exchange, stated that the placement of the company “on defaulter segment” at this stage of difficult environment

January 12, 2022 (MLN): Fateh Sports Wear Limited (FSWL) has informed that production activities will be started in the shortest possible time on the availability of working capital and the receipt of stuck-up funds of

January 12, 2022 (MLN): The capital market on Wednesday opened on a positive note but remained dull throughout amid lack of fresh triggers. The rising Covid-19 cases in the country kept the investors’ interests subdue which

January 12, 2022 (MLN): Image’s sales are projected to grow to Rs1.6 billion for the year ending June 30, 2022, from the actual level of over Rs1bn for the year ended June 30, 2021, on

January 12, 2022 (MLN): Sazgar Engineering Works Limited (SAZEW) sold 579 units of Auto Rickshaw during the month of December 2021, which was around 33% lower than the sales of 865 units made in the

January 13, 2022 (MLN): Domestic equities remained under pressure throughout the day today as the country reported the highest ever Covid-19 infections in the last 4 months. The market opened on a bleak note as

January 13, 2022 (MLN): Last year, Pakistan’s banking sector did not perform well despite stellar balance sheet growth, as foreigners sold around $167mn worth of shares in CY21 against $168mn in CY20 on account of

January 13, 2022 (MLN): The adverse impact of rising commodity prices has badly hit the cargo handling companies across the globe and now making its way to plague the local companies. Pakistan International Bulk Terminal

January 13, 2022 (MLN): The board of directors (BoD) of Nimir Industrial Chemicals Limited (PSX: NICL) has re-appointed Mr Zafar Mahmood as Chief Executive Officer (CEO) of the company, the company filing on PSX showed

January 13, 2022 (MLN): The Board of Directors of Cnergyico Pk Limited (PSX: CNERGY) (formerly Byco Petroleum Pakistan Limited) has approved the acquisition of a 57.37% stake in Puma Energy Pakistan Private Limited (Puma), the

January 13, 2022 (MLN): Pakistan Stock Exchange (PSX) on Thursday, revealed the criteria for selecting the top 25 companies for the year 2021. As per the notification issued by bourse, the prerequisites for the selection of

January 13, 2022 (MLN): National Clearing Company of Pakistan Limited (NCCPL) on Thursday announced that it will collect capital gain tax (CGT) from clearing members and Pakistan Mercantile Exchange (PMX) for the month of November’21

January 13, 2022 (MLN): Nishat Chunain Limited (NCL) has requested Nepra to delete 2 Bulk Power Consumers (BPC) and add 11 new BPCs in its generation licence, a notice issued by the authority showed today.

January 13, 2022 (MLN): The board of directors of ZIL Limited (ZIL), in a meeting, held on January 12, 2022, approved the closure of a factory located at Hyderabad as it faced operational difficulties due

January 12, 2022 (MLN): Cnergyico Pk Limited (CNERGY), formerly known as Byco Petroleum, is in final talks to acquire a controlling stake of nearly 57% in Puma Energy Pakistan Pvt limited, which will double its

January 12, 2022 (MLN): The management of the D. M. Textile Mills Limited (PSX: DMTX), in a notification to exchange, stated that the placement of the company “on defaulter segment” at this stage of difficult environment

January 12, 2022 (MLN): Fateh Sports Wear Limited (FSWL) has informed that production activities will be started in the shortest possible time on the availability of working capital and the receipt of stuck-up funds of

January 12, 2022 (MLN): The capital market on Wednesday opened on a positive note but remained dull throughout amid lack of fresh triggers. The rising Covid-19 cases in the country kept the investors’ interests subdue which

January 12, 2022 (MLN): Image’s sales are projected to grow to Rs1.6 billion for the year ending June 30, 2022, from the actual level of over Rs1bn for the year ended June 30, 2021, on

January 12, 2022 (MLN): Sazgar Engineering Works Limited (SAZEW) sold 579 units of Auto Rickshaw during the month of December 2021, which was around 33% lower than the sales of 865 units made in the

| ID | Symbol | CompanyName | Title | Category | ImageFileNumber | PDFFileNumber | ImageFile | PDF File | Link | FileName | DateTime | isupdateStatus | formula_1 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 169,875 | BOP | The Bank of Punjab | Application for further issue of shares by way of other than right offer under Section 83(1)(b) of the Companies Act, 2017 read with regulation 5 of the Companies (Further Issue of Shares) Regulations, 2020 – SECP Letter | 0 | 169,875 | javascript:void(0); | 20/05/2024 03:25 PM | 1 | 0.000 | |||||

| 169,874 | PAKOXY | Pakistan Oxygen Limited | Board Meeting in Progress | 169,874 | 169,874 | https://research.mettisglobal.net/AnnouncementImage/ANN_GIF_169874_231954.gif | javascript:void(0); | 20/05/2024 03:20 PM | 1 | 0.000 | ||||

| 169,873 | SYS | Systems Limited | Disclosure of Interest by a Director CEO, or Executive of a listed company and their Spouses and the Substantial Shareholders u/c 5.6.1.(d) of PSX Regulations | 169,873 | 0 | https://research.mettisglobal.net/AnnouncementImage/ANN_GIF_169873_231955.gif | javascript:void(0); | 20/05/2024 03:20 PM | 1 | 0.000 | ||||

| 169,872 | KEL | K-Electric Limited | Disclosure of Material Information. | 169,872 | 169,872 | https://research.mettisglobal.net/AnnouncementImage/ANN_GIF_169872_231953.gif | javascript:void(0); | 20/05/2024 03:19 PM | 1 | 0.000 | ||||

| 169,871 | ATLAS-FUNDS | ATLAS-FUNDS | Atlas Liquid Fund (ALF) – Atlas Asset Management Ltd | 169,871 | 169,871 | https://research.mettisglobal.net/AnnouncementImage/ANN_GIF_169871_231952.gif | javascript:void(0); | 20/05/2024 03:17 PM | 1 | 0.000 | ||||

| 169,869 | SYS | Systems Limited | Disclosure of Interest by a Director CEO, or Executive of a listed company and their Spouses and the Substantial Shareholders u/c 5.6.1.(d) of PSX Regulations | 169,869 | 0 | https://research.mettisglobal.net/AnnouncementImage/ANN_GIF_169869_231951.gif | javascript:void(0); | 20/05/2024 03:14 PM | 1 | 0.000 | ||||

| 169,870 | DSL | Dost Steels Limited | Miscellaneous Information | 169,870 | 169,870 | https://research.mettisglobal.net/AnnouncementImage/ANN_GIF_169870_231950.gif | javascript:void(0); | 20/05/2024 03:10 PM | 1 | 0.000 | ||||

| 169,868 | CNERGY | Cnergyico PK Limited | Corporate Briefing Session | 169,868 | 169,868 | https://research.mettisglobal.net/AnnouncementImage/ANN_GIF_169868_231949.gif | javascript:void(0); | 20/05/2024 03:09 PM | 1 | 0.000 | ||||

| 169,867 | BIFO | Biafo Industries Limited | Credit of Interim Cash Dividend | 169,867 | 0 | https://research.mettisglobal.net/AnnouncementImage/ANN_GIF_169867_231948.gif | javascript:void(0); | 20/05/2024 03:09 PM | 1 | 0.000 | ||||

| 169,866 | SYS | Systems Limited | Disclosure of Interest by a Director CEO, or Executive of a listed company and their Spouses and the Substantial Shareholders u/c 5.6.1.(d) of PSX Regulations | 169,866 | 0 | https://research.mettisglobal.net/AnnouncementImage/ANN_GIF_169866_231947.gif | javascript:void(0); | 20/05/2024 03:07 PM | 1 | 0.000 | ||||

| 169,865 | SYS | Systems Limited | Disclosure of Interest by a Director CEO, or Executive of a listed company and their Spouses and the Substantial Shareholders u/c 5.6.1.(d) of PSX Regulations | 169,865 | 0 | https://research.mettisglobal.net/AnnouncementImage/ANN_GIF_169865_231946.gif | javascript:void(0); | 20/05/2024 02:58 PM | 1 | 0.000 | ||||

| 169,864 | PKGP | Pakgen Power Limited | CREDIT OF 20% INTERIM CASH DIVIDEND | 169,864 | 169,864 | https://research.mettisglobal.net/AnnouncementImage/ANN_GIF_169864_231945.gif | javascript:void(0); | 20/05/2024 02:57 PM | 1 | 0.000 | ||||

| 169,862 | PMRS | The Premier Sugar Mills | Board Meeting | 169,862 | 0 | https://research.mettisglobal.net/AnnouncementImage/ANN_GIF_169862_231944.gif | javascript:void(0); | 20/05/2024 02:42 PM | 1 | 0.000 | ||||

| 169,861 | CHAS | Chashma Sugar Mills Limited | Board Meeting | 169,861 | 0 | https://research.mettisglobal.net/AnnouncementImage/ANN_GIF_169861_231943.gif | javascript:void(0); | 20/05/2024 02:42 PM | 1 | 0.000 | ||||

| 169,863 | AHL | Arif Habib Limited | Initial Public Offering of International Packaging Films Limited | 169,863 | 169,863 | https://research.mettisglobal.net/AnnouncementImage/ANN_GIF_169863_231942.gif | javascript:void(0); | 20/05/2024 02:39 PM | 1 | 0.000 | ||||

| 169,859 | MRNS | Mehran Sugar Mills Limited | Financial Results for the Half Year ended March 31, 2024 | 0 | 169,859 | javascript:void(0); | 20/05/2024 02:28 PM | 1 | 0.000 | |||||

| 169,860 | RUPL | Rupali Polyester Limited | CORPORATE BRIEFING SESSION | 169,860 | 169,860 | https://research.mettisglobal.net/AnnouncementImage/ANN_GIF_169860_231940.gif | javascript:void(0); | 20/05/2024 02:26 PM | 1 | 0.000 | ||||

| 169,858 | RMPL | Rafhan Maize Products Company Limited | Notice to Shareholders in Pursuance of Section 72 and Section 244 of the Companies Act 2017 | 169,858 | 169,858 | https://research.mettisglobal.net/AnnouncementImage/ANN_GIF_169858_231937.gif | javascript:void(0); | 20/05/2024 02:04 PM | 1 | 0.000 | ||||

| 169,857 | SYM | Symmetry Group Limited | Material Information | 169,857 | 169,857 | https://research.mettisglobal.net/AnnouncementImage/ANN_GIF_169857_231938.gif | javascript:void(0); | 20/05/2024 02:04 PM | 1 | 0.000 | ||||

| 169,856 | ICL | Ittehad Chemicals Limted | Credit of Interim Cash Dividend | 169,856 | 169,856 | https://research.mettisglobal.net/AnnouncementImage/ANN_GIF_169856_231936.gif | javascript:void(0); | 20/05/2024 02:04 PM | 1 | 0.000 |

Data is delayed by 20 minutes

| Symbol | CompanyName | Time | City | Agenda | Meeting Date |

|---|---|---|---|---|---|

| PKGI | Atlas Honda Limited | 04:00 PM | Lahore | To consider the half yearly accounts for the period ended March 31, 2024 | 20/05/2024 |

| ANSM | Ansari Sugar Mills Limited | 04:30 PM | Karachi | To consider the accounts for the period ended June 30, 2022. | 20/05/2024 |

| AABS | Al-Abbas Sugar Mills Limited | 11:00 AM | Karachi | To consider the financial accounts for the period ended March 31, 2024 | 21/05/2024 |

| KEL | K-Electric Limited | 03:00 PM | Karachi | Board Meeting Other than Financial Results | 21/05/2024 |

| DLL | Dawood Lawrencepur Limited | 11:00 AM | Karachi | To consider the financial accounts for the period ended March 31, 2024 | 22/05/2024 |

| ASC | Al Shaheer Corporation Limited | 03:00 PM | Karachi | Board Meeting Other than Financial Results | 22/05/2024 |

| GTYR | Ghandhara Tyre & Rubber Company Limited | 11:00 AM | Karachi | Board Meeting Other than Financial Results | 23/05/2024 |

| AWTX | Allawasaya Tex. & Finishing Mills Ltd | 02:30 PM | Multan | Extra-Ordinary General Meeting | 23/05/2024 |

| ADAMS | Adam Sugar Mills Limited | 11:00 AM | Lahore | To consider the financial accounts for the period ended March 31, 2024 | 24/05/2024 |

| TICL | The Thal Industries Corporation Limited | 11:30 AM | Lahore | To consider the financial accounts for the period ended March 31, 2024 | 24/05/2024 |

| GADT | Gadoon Textile Mills Limited | 11:00 AM | Karachi | To consider the financial accounts for the period ended March 31, 2024 | 25/05/2024 |

| HCAR | Honda Atlas Cars (Pakistan) Limited | 11:00 AM | Karachi | To consider the financial accounts for the year ended March 31, 2024 | 27/05/2024 |

| SHSML | Shahmurad Sugar Mills Limited | 11:00 AM | Karachi | To Consider The Financial Accounts for the Period ended March 31, 2024 | 27/05/2024 |

| CHAS | Chashma Sugar Mills Limited | 11:00 AM | Islamabad | To Consider The Financial Accounts for the Period ended March 31, 2024 | 27/05/2024 |

| JSML | Jauharabad Sugar Mills Limited | 11:30 AM | Lahore | To Consider The Financial Accounts for the Period ended March 31, 2024 | 27/05/2024 |

| PMRS | The Premier Sugar Mills | 11:30 AM | Islamabad | To Consider The Financial Accounts for the Period ended March 31, 2024 | 27/05/2024 |

| KPUS | Khairpur Sugar Mills Limited | 02:30 PM | Karachi | To Consider The Financial Accounts for the Period ended March 31, 2024 | 27/05/2024 |

| DWSM | Dewan Sugar Mills Limited | 04:30 PM | Karachi | To Consider The Financial Accounts for the Period ended March 31, 2024 | 27/05/2024 |

| PKGI | The Pakistan General Insurance Co. Ltd. | 04:00 PM | Lahore | Annual General Meeting | 28/05/2024 |

| PICT | Pakistan International Container | 09:00 AM | Karachi | Annual General Meeting | 29/05/2024 |

| TCORP | Tariq Corporation Limited | 11:30 AM | Lahore | To consider the financial accounts for the period ended March 31, 2024 | 29/05/2024 |

| BAPL | Bawany Air Products Limited | 04:00 PM | Karachi | Extra-Ordinary General Meeting | 29/05/2024 |

| HBL | Habib Bank Limited | 03:00 PM | Islamabad | Extra-Ordinary General Meeting | 30/05/2024 |

| SLGL | Secure Logistics Group Limited | 10:00 AM | Islamabad | Annual General Meeting | 31/05/2024 |

| BOK | The Bank of Khyber | 11:00 AM | Peshawar | Extra-Ordinary General Meeting | 31/05/2024 |

| AHCL | Arif Habib Corporation Limited | 10:30 AM | Karachi | Extra-Ordinary General Meeting | 01/06/2024 |

| CCM | Crescent Cotton Mills Limited | 10:30 AM | Faisalabad | Extra-Ordinary General Meeting | 03/06/2024 |

| OCTOPUS | Octopus Digital Limited | 10:00 AM | Lahore | Extra-Ordinary General Meeting | 08/06/2024 |

| FSWL | Fateh Sports Wear Limited | 10:00 AM | Hyderabad | Extra-Ordinary General Meeting | 10/06/2024 |

| NML | Nishat Mills Limited | 12:30 PM | Lahore | Extra-Ordinary General Meeting | 11/06/2024 |

| ATLH | Atlas Honda Limited | 10:00 AM | Karachi | Annual General Meeting | 27/06/2024 |

Data is delayed by 20 minutes

| IndexValue | IndexID | CompanyID | Symbol | CompanyName | SumFFMarketCap | MSCIType | Last | Change | % Change | Volume | High | Low | FreeFloat | Close | LDCP | LDCPLast | MarketCap | IndexLDCP | OutstandingShares | SumPayouts | FaceValue | IndexWGT | IndexPoints | IndexPct | DateTime | Volume1 | SectorID | SectorName | Earnings | MarketCapOS | EarningsOS | PE | DividendYield | PctFreeFloat | Direction |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 131,160 | THALL | Thal Limited | 496.3 | 16.42 | 0.034 | 164,826 | 515.9 | 480.0 | 479.890 | 479.890 | ||||||||||||||||||||||||

| 1 | 211,100 | INIL | International Industries Limited | 194.1 | 11.64 | 0.064 | 2,768,463 | 195.8 | 182.4 | 182.440 | 182.440 | ||||||||||||||||||||||||

| 1 | 261,020 | SYS | Systems Limited | 407.6 | 9.18 | 0.023 | 1,249,130 | 416.3 | 401.2 | 398.410 | 398.410 | ||||||||||||||||||||||||

| 1 | 321,085 | SRVI | Service Industries Limited | 785.0 | 6.97 | 0.009 | 520 | 799.5 | 775.0 | 778.030 | 778.030 | ||||||||||||||||||||||||

| 1 | 181,095 | PKGP | Pakgen Power Limited | 66.0 | 4.60 | 0.075 | 27,500 | 66.0 | 66.0 | 61.370 | 61.370 | ||||||||||||||||||||||||

| 1 | 291,300 | LCI | Lucky Core Industries Limited | 903.3 | 4.28 | 0.005 | 4,070 | 910.0 | 890.0 | 899.020 | 899.020 | ||||||||||||||||||||||||

| 1 | 211,110 | ISL | International Steels Limited | 87.4 | 3.29 | 0.039 | 2,468,450 | 89.0 | 82.7 | 84.140 | 84.140 | ||||||||||||||||||||||||

| 1 | 201,075 | MARI | Mari Petroleum Company Limited | 2,811.2 | 3.17 | 0.001 | 29,733 | 2,826.0 | 2,785.0 | 2,808.040 | 2,808.040 | ||||||||||||||||||||||||

| 1 | 331,300 | RMPL | Rafhan Maize Products Company Limited | 8,001.4 | 2.79 | 0.000 | 174 | 8,100.0 | 8,000.0 | 7,998.640 | 7,998.640 | ||||||||||||||||||||||||

| 1 | 301,160 | PKGS | Packages Limited | 492.6 | 2.28 | 0.005 | 5,896 | 510.0 | 483.0 | 490.300 | 490.300 |

Data is delayed by 20 minutes

| IndexValue | IndexID | CompanyID | Symbol | CompanyName | SumFFMarketCap | MSCIType | Last | Change | % Change | Volume | High | Low | FreeFloat | Close | LDCP | LDCPLast | MarketCap | IndexLDCP | OutstandingShares | SumPayouts | FaceValue | IndexWGT | IndexPoints | IndexPct | DateTime | Volume1 | SectorID | SectorName | Earnings | MarketCapOS | EarningsOS | PE | DividendYield | PctFreeFloat | Direction |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 331,295 | UPFL | Unilever Pakistan Foods Limited | 18,983.7 | -31.26 | -0.002 | 87 | 19,100.0 | 18,961.0 | 19,015.000 | 19,015.000 | ||||||||||||||||||||||||

| 1 | 331,160 | NESTLE | Nestle Pakistan Limited | 7,417.8 | -12.00 | -0.002 | 130 | 7,498.0 | 7,200.0 | 7,429.820 | 7,429.820 | ||||||||||||||||||||||||

| 1 | 221,210 | INDU | Indus Motor Company Limited | 1,579.6 | -8.03 | -0.005 | 216 | 1,598.0 | 1,575.0 | 1,587.580 | 1,587.580 | ||||||||||||||||||||||||

| 1 | 281,250 | HINOON | Highnoon Laboratories Limited | 671.2 | -7.75 | -0.011 | 4,702 | 684.8 | 665.0 | 678.990 | 678.990 | ||||||||||||||||||||||||

| 1 | 331,200 | MUREB | Murree Brewery Company Limited | 408.1 | -6.86 | -0.017 | 20,924 | 415.0 | 402.1 | 414.910 | 414.910 | ||||||||||||||||||||||||

| 1 | 271,200 | ENGRO | Engro Corporation Limited | 344.4 | -6.77 | -0.019 | 241,655 | 353.9 | 340.7 | 351.170 | 351.170 | ||||||||||||||||||||||||

| 1 | 171,080 | NRL | National Refinery Limited | 295.0 | -4.78 | -0.016 | 564,553 | 299.9 | 293.0 | 299.800 | 299.800 | ||||||||||||||||||||||||

| 1 | 61,098 | MCB | MCB Bank Limited | 212.0 | -4.40 | -0.020 | 500,372 | 216.4 | 208.6 | 216.380 | 216.380 | ||||||||||||||||||||||||

| 1 | 271,160 | DAWH | Dawood Hercules Corporation Limited | 164.5 | -3.71 | -0.022 | 213,355 | 170.0 | 164.0 | 168.250 | 168.250 | ||||||||||||||||||||||||

| 1 | 281,000 | ABOT | Abbott Laboratories (Pakistan) Limited | 666.0 | -3.26 | -0.005 | 35,890 | 677.0 | 662.0 | 669.260 | 669.260 |

Data is delayed by 20 minutes

| IndexID | CompanyID | Symbol | Volume | CompanyName | Last | LDCP | Change | % Change | Open | High | Low | Close | CreateDateTime |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 181,060 | KEL | 18,317,678 | K-Electric Limited | 4.7 | 4.570 | 0.10 | 0.022 | 4.590 | 4.7 | 4.6 | 4.570 | 20/05/2024 10:06 PM |

| 1 | 271,205 | FFBL | 9,853,209 | Fauji Fertilizer Bin Qasim Limited | 34.6 | 33.060 | 1.53 | 0.046 | 33.100 | 34.8 | 33.1 | 33.060 | 20/05/2024 10:06 PM |

| 1 | 281,530 | SEARL | 9,391,539 | The Searle Company Limited | 59.9 | 61.360 | -1.49 | -0.024 | 62.010 | 62.1 | 59.6 | 61.360 | 20/05/2024 10:06 PM |

| 1 | 241,120 | PAEL | 8,867,407 | Pak Elektron Limited | 26.6 | 27.120 | -0.51 | -0.019 | 27.400 | 27.6 | 26.3 | 27.120 | 20/05/2024 10:06 PM |

| 1 | 171,010 | CNERGY | 6,390,582 | Cnergyico PK Limited | 4.5 | 4.560 | -0.10 | -0.022 | 4.540 | 4.6 | 4.4 | 4.560 | 20/05/2024 10:06 PM |

| 1 | 241,170 | AVN | 6,155,316 | Avanceon Limited | 58.3 | 57.300 | 1.00 | 0.017 | 57.500 | 60.0 | 57.5 | 57.300 | 20/05/2024 10:06 PM |

| 1 | 151,065 | FCCL | 6,139,061 | Fauji Cement Company Limited | 21.9 | 22.500 | -0.57 | -0.025 | 22.700 | 22.7 | 21.7 | 22.500 | 20/05/2024 10:06 PM |

| 1 | 151,050 | DGKC | 5,844,764 | D.G. Khan Cement Company Limited | 87.6 | 90.300 | -2.75 | -0.030 | 90.390 | 90.4 | 85.2 | 90.300 | 20/05/2024 10:06 PM |

| 1 | 201,130 | PPL | 5,249,792 | Pakistan Petroleum Limited | 122.3 | 123.500 | -1.21 | -0.010 | 122.800 | 123.5 | 121.4 | 123.500 | 20/05/2024 10:06 PM |

| 1 | 151,110 | MLCF | 5,108,683 | Maple Leaf Cement Factory Limited | 38.5 | 39.890 | -1.43 | -0.036 | 39.890 | 39.9 | 38.1 | 39.890 | 20/05/2024 10:06 PM |

Data is delayed by 20 minutes

© 2024 Mettis Link News All rights reserved