Weekly Market Roundup

MG News | November 22, 2025 at 02:10 AM GMT+05:00

November 22, 2025 (MLN): The KSE-100 Index edged higher this week, closing at

162,103, up 168 points from last week’s 161,935, as investors navigated a mix

of optimism and caution.

Market sentiment was lifted by sector-specific developments

that captured attention across the board.

FFC

led the charge following its inclusion in the KMI-30 index, drawing fresh

interest from domestic and offshore investors.

The market was also supported by a combination of recovering activity in the large-scale manufacturing sector and positive sector-specific catalysts.

_20251121200754049_eae2c7.jpeg)

The broader market capitalization increased to Rs4.76 trillion from Rs4.756tr last week, translating into a modest USD market capitalization rise to $16.96 billion from $16.94bn.

_20251121200759633_2f3db7.jpeg)

In USD terms, the weekly return of 0.13% was notably subdued compared to the rupee-denominated gains, compared to last week’s 1.5% USD return.

_20251121200724268_2d6c9d.jpeg)

On the macroeconomic front, Pakistan’s current

account deficit widened to $733 million in the first four months of FY26,

over 3.5 times higher than the $206 million deficit recorded in the same period

last year.

Pakistan’s real

effective exchange rate (REER) increased to 103.95 in October 2025, up from

101.70 in September 2025, reflecting a 2.2% MoM gain and a 3.2% rise

YoY from 100.78 in October 2024.

The country has recorded a value of $178.93m foreign

direct investment in October, compared to $145.92m in the Same Period Last

Year (SPLY).

Automobile

financing in Pakistan has increased to Rs315.4bn in October 2025,

witnessing a rise of 3.49% MoM compared to Rs304.77bn recorded in September

2025.

In the banking sector, the return

on bank deposits has decreased by 18 basis points to 5.10% in October 2025

compared to the deposit rate of 5.28% last month, according to the latest

official data.

Moreover, scheduled

banks’ total deposits eased marginally by 0.2% to Rs35.15tr in October,

down from Rs35.21tr recorded at the end of September.

Foreign investors' repatriation

of profit and dividends rose 38.97% YoY in 4MFY26 to $1.14 billion compared

to $818.36 million worth of repatriation in the same period last yea

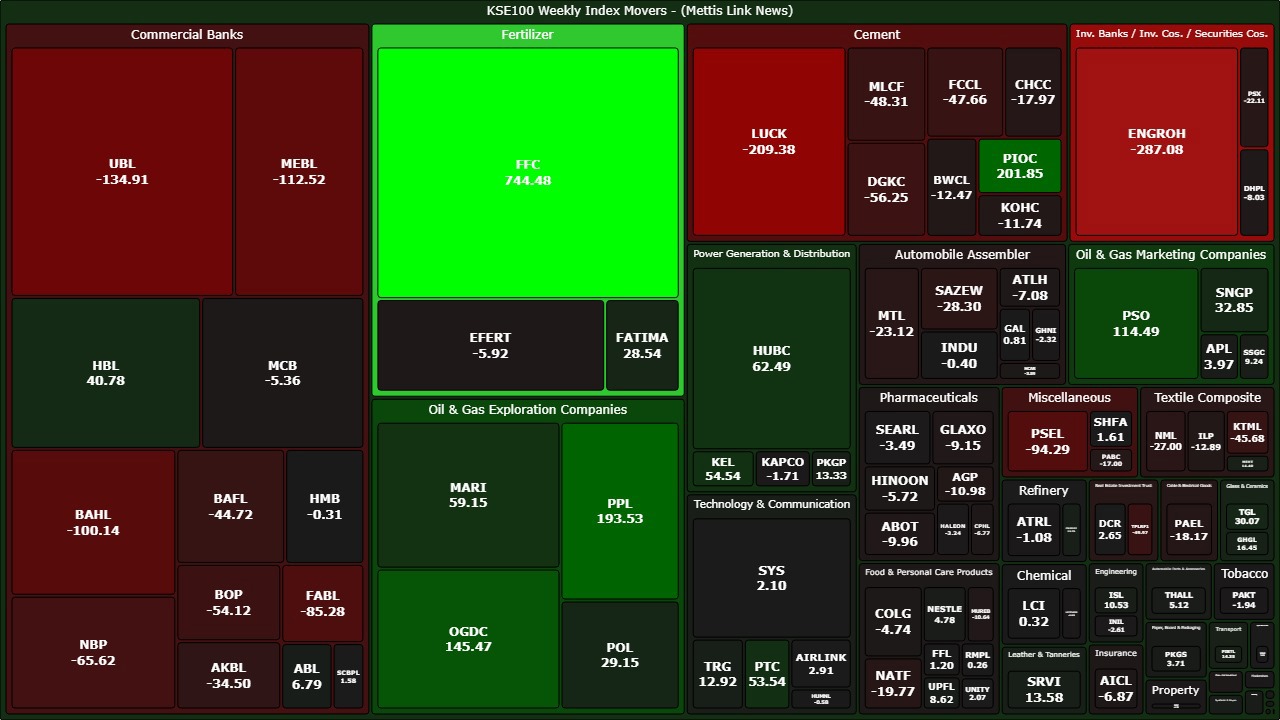

Index Movers:

Market activity was dominated by the oil and gas, fertilizer, and technology sectors, which posted the largest gains in the week. Oil and gas exploration companies led the charge, with significant contributions from FFC, PIOC, PPL, and OGDC.

_20251121200718393_5f12dd.jpeg)

The fertilizer sector

also showed robust performance, with FFC at the forefront. Technology and

communication stocks surged, reflecting investor optimism about export growth

and sector-specific developments.

On the other hand, commercial banks, investment banks, and

cement companies were the primary laggards, collectively dragging the index

down.

Stocks such as ENGROH, LUCK, UBL, and BAHL saw notable declines as profit-taking and sector rotation impacted investor sentiment.

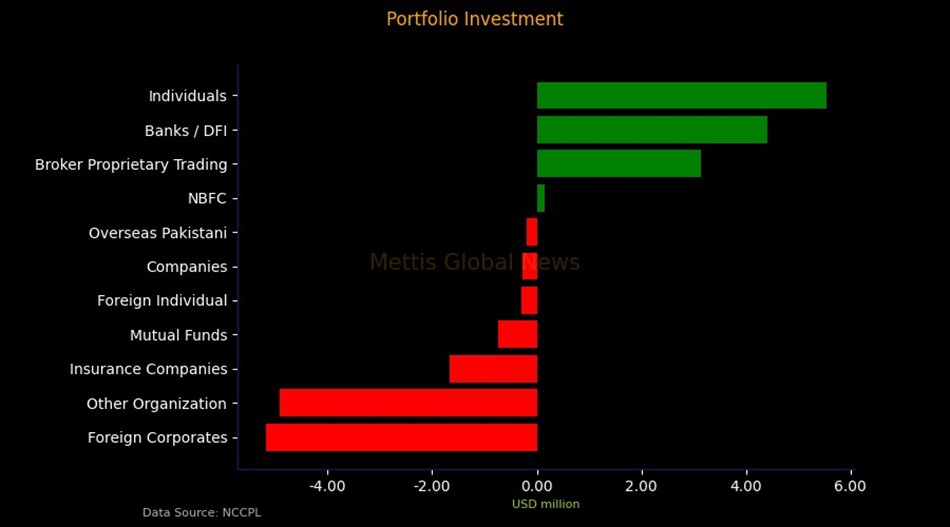

FIPI/LIPI:

Foreign portfolio investors (FIPI) remained net sellers,

offloading $5.67 million during the week, primarily across commercial and

banking sectors.

In contrast, local investors provided strong support, with

banks, DFIs, broker proprietary accounts, and individuals contributing to net

inflows of $5.67 m, effectively offsetting foreign selling and stabilizing

market performance.

Insurance companies, mutual funds, and other organizations

recorded net outflows, but the broad support from domestic participants kept

the market buoyant.

Overall, the week reflected a cautious but steady recovery,

with the market gaining modestly amid improving macroeconomic signals,

sector-specific catalysts, and continued domestic support.

While foreign selling persisted, the strong buying by local

institutions and individuals provided resilience, suggesting that investor

confidence is gradually returning to key growth sectors, particularly oil and

gas, technology, and fertilizer.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 188,202.86 341.59M | -0.20% -384.80 |

| ALLSHR | 112,423.22 745.46M | -0.07% -79.96 |

| KSE30 | 57,956.48 141.89M | -0.12% -70.41 |

| KMI30 | 267,375.33 135.18M | -0.39% -1043.48 |

| KMIALLSHR | 72,363.20 391.84M | -0.20% -146.78 |

| BKTi | 53,485.97 53.11M | 0.26% 139.85 |

| OGTi | 38,916.61 17.01M | 0.72% 278.13 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 87,690.00 | 88,985.00 87,550.00 | 105.00 0.12% |

| BRENT CRUDE | 66.17 | 66.78 65.00 | 0.58 0.88% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | -2.65 -2.96% |

| ROTTERDAM COAL MONTHLY | 99.00 | 0.00 0.00 | 0.30 0.30% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 61.22 | 61.86 60.14 | 0.59 0.97% |

| SUGAR #11 WORLD | 14.93 | 14.98 14.74 | 0.14 0.95% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png?width=280&height=140&format=Webp)

SBP Interventions in Interbank FX Market

SBP Interventions in Interbank FX Market