Weekly Market Roundup

Sarah Shafique | June 29, 2025 at 04:16 PM GMT+05:00

June 29, 2025 (MLN): The market closed the week on a strong note, buoyed

by improved investor sentiment following a ceasefire between Israel and Iran

that helped ease geopolitical tensions.

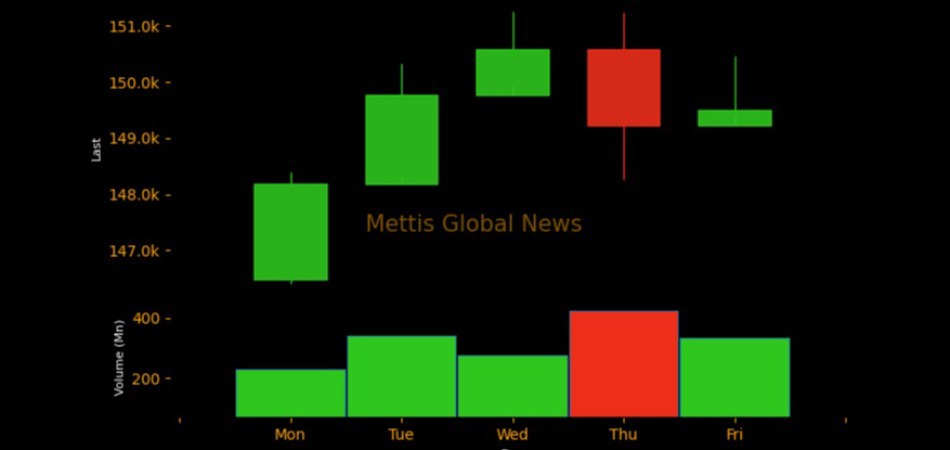

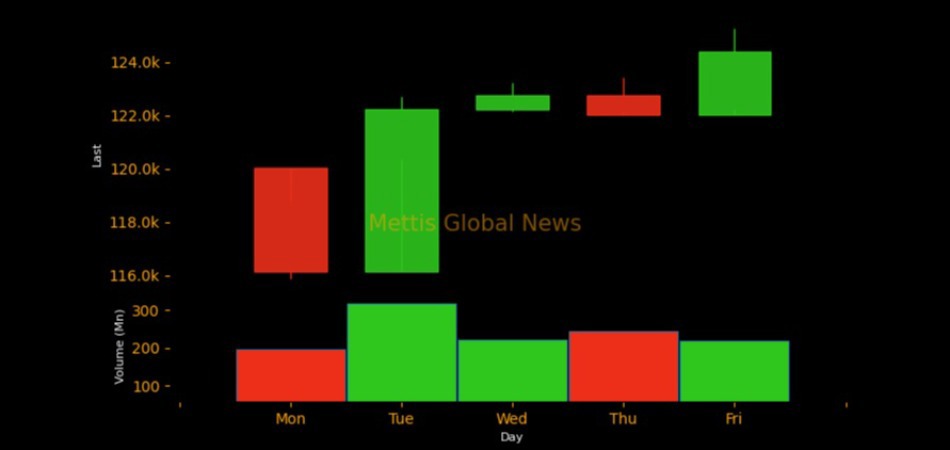

Consecutively, the bench mark KSE 100 index gained 4,355.83 points

or 3.63%, closing the session at 124,379.06 compared to the previous

week’s close of 120,023.23.

Intraday swings were significant, with the index reaching a high of 125,285.05 (+905.99 points) and a low of 115,887.48 (-8,491.58 points).

Market cap

The KSE-100 market capitalization stood at Rs3.72 trillion, up 3.6% from the previous week’s Rs3.58tr. In USD terms, the market cap was recorded at $13.1 billion, compared to $12.65bn in the prior week.

This week, the index return in USD terms was 3.6%, compared to -1.99% the previous week, with the market also marking its all-time high during the week.

On the economic front, Broad money (M2) rose to Rs38.44tr as of June 13, up Rs347.57bn WoW and Rs2.55tr since June 2024.

Government borrowing rose by Rs381.92bn in the week ended June 13, taking FY25 net borrowing to Rs2.92tr.

SBP reserves fell by $2.66bn WoW to $9.06bn, while total reserves dropped by $2.61bn to $14.4bn as of June 20, 2025.

RDA inflows reached $201mn in May 2025, up $24mn from April, taking cumulative inflows to $10.38bn.

Furthermore, Money supply rose to Rs42.8tr in May 2025, up 1.75% MoM and 12.78% YoY.

Short-term inflation fell by 0.18% WoW and declined 1.52% YoY during the week.

The positive economic cues helped stabilize investor sentiment, pushing the KSE-100 index’s fiscal year-to-date returns to 58.55%, while CYTD return stood at 8.03%.

Top Index Movers

During the week, Commercial Bank, Leasing Cement and Fertilizer

contributed 1120.44, 690.78, and 628.7 points to the index.

On the flip side, Miscellaneous, Leasing Companies and Textile Weaving dented the index by -83.56, -0.17 and -0.13 points, respectively.

Among individual stocks, LUCK added 381.55 points

to the index while FFC, ENGROH, and UBL contributed to the index by 356.64,

350.52, and 319.19, respectively.

Conversely, PSEL, PKGP, and ISL eroded -132.62, -95.8,

and -7.38 points, respectively.

FIPI/LIPI

This week, foreign investors remained net sellers,

offloading equities worth $11.78m.

Foreign Corporates led the selling spree worth $13.66m while

Overseas Pakistanis bought equities worth $1.97m.

On the other hand, local investors were net buyers this

week, purchasing equities worth $11.78m.

Mutual Funds and Insurance Companies bought securities worth $9.93m and $6.15m, respectively, while Individuals sold securities worth $4m.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 149,035.49 162.92M | -0.31% -457.56 |

| ALLSHR | 91,811.29 557.97M | -0.19% -176.80 |

| KSE30 | 45,272.90 51.43M | -0.54% -245.51 |

| KMI30 | 210,523.28 55.24M | -0.54% -1143.78 |

| KMIALLSHR | 60,775.57 275.63M | -0.39% -238.73 |

| BKTi | 42,084.05 29.17M | -0.63% -268.50 |

| OGTi | 30,088.48 4.31M | -0.28% -83.30 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 111,530.00 | 113,800.00 111,100.00 | -5320.00 -4.55% |

| BRENT CRUDE | 67.92 | 68.03 67.57 | 0.19 0.28% |

| RICHARDS BAY COAL MONTHLY | 92.00 | 0.00 0.00 | 1.45 1.60% |

| ROTTERDAM COAL MONTHLY | 99.85 | 0.00 0.00 | 0.00 0.00% |

| USD RBD PALM OLEIN | 1,039.00 | 1,039.00 1,039.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 63.91 | 64.02 63.53 | 0.25 0.39% |

| SUGAR #11 WORLD | 16.44 | 16.51 16.27 | 0.09 0.55% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|