Weekly Market Roundup

Abdur Rahman | April 19, 2024 at 11:20 PM GMT+05:00

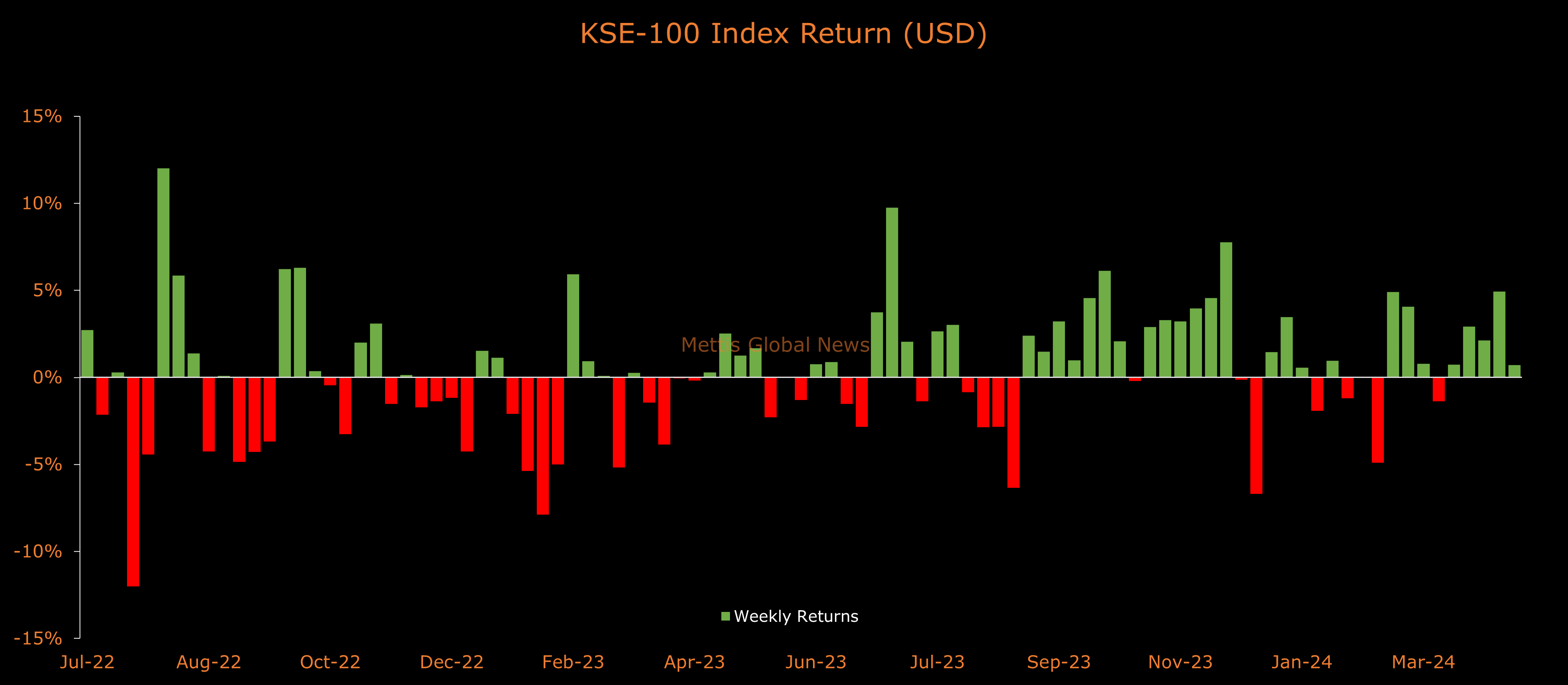

April 19, 2024 (MLN): The benchmark KSE-100 index closed fifth consecutive week in green, gaining 595 points or 0.85% to a record high of 70,910.

Meanwhile, the Pakistani Rupee recorded a decline of 0.13% WoW. In USD terms, the KSE-100 index gained 0.71%.

Throughout the week, KSE-100 traded in a range of 1,309 points, between a high of 71,093 (+778) and a low of 69,783 (-531) points.

KSE-100's average traded volume was recorded at 230 million shares worth Rs12.9 billion, marking a rise of 12.7% WoW in the number of shares and 16.3% WoW in traded value.

Similarly, the overall PSX average traded volume rose to 492m shares worth Rs21.3bn, an increase of 35.8% WoW in the number of shares and 30.9% WoW in traded value.

Main highlights of the week included the IMF and World Bank 2024 Spring Meetings, taking place in Washington DC, where the Finance Minister Muhammad Aurangzeb is representing Pakistan as head of a delegation.

Pakistan has initiated discussions with the International Monetary Fund (IMF) over a new multi-billion dollar loan agreement to support its economic reform program.

The country hopes to agree the contours of a new IMF loan in May, he told Reuters, and has kicked off talks with ratings agencies to lay the groundwork for a return to international debt markets.

Moreover, during the meetings, Aurangzeb pitched bankable projects to attract investments from Saudi Arabia and UK.

In a separate 'Saudi Arabia-Pakistan Investment Conference' held in Islamabad on Tuesday, Foreign Minister of Saudi Arabia expressed great significance and interest in the improving investment ecosystem in Pakistan, a statement by the Prime Minister’s office said.

The Saudi side expressed appreciated Special Investment Facilitation Council’s (SIFC) role in amicable resolution of KSA's legacy investment/business related issues, and showed keen interest to invest in key sectors of Pakistan.

On a separate note, government borrowed Rs898bn during the week through three auctions; MTBs, PIB Fixed Rate, and PIB Floating Rate.

The yields remained largely stable, as investors await the upcoming SBP decision on the policy rate.

Meanwhile, strong corporate results also played its due role in boosting investors' sentiment this week.

Top Index Movers

From the sector-specific lens, Commercial Banks was the best performing sector, as it added 436 points to the index.

This was followed by Oil & Gas Exploration Companies (167pts), Power Generation & Distribution (156pts), Refinery (43pts), and Fertilizer (41pts).

Contrary to that, negative contributions came from Technology & Communication (118pts), Pharmaceuticals (31points), Engineering, (30pts), Miscellaneous (30pts), and Automobile Assembler (26pts).

Scrip-wise, HUBC, UBL, OGDC, HBL, and BAFL were the best-performing stocks during the week as they added 147, 135, 113, 100, and 94 points to the index respectively.

Whereas, MEBL, SYS, ENGRO, PTC, and FFC collectively took away 267 points from the index.

FIPI/LIPI

Foreign investors were net buyers during the week, acquiring a significant $33.9m worth of equities.

Flow-wise, Foreign Corporates were the dominant buyers, with a net investment of $34.4m.

They allocated the majority of their capital, $32.4m, to All other Sectors, which largely included the purchase of Pak Suzuki Motor Company Limited (PSMC) shares.

To recall, the majority shareholder of PSMC is required to purchase at least around 13.9m shares at Rs609 per share to qualify for delisting.

PSMC saw a trading volume of 17.1m shares this week, according to PSX website.

On the other hand, the leading sellers were Individuals, with a net sale of $14.4m.

Their most substantial sales activity was in All other Sectors, amounting to $20.0m, while they acquired $2.3m of equities in the Fertilizer.

To note, the KSE-100 has gained 29,457 points or 71.1% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 8,459 points, equivalent to 13.5%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 136,502.54 259.91M |

1.64% 2202.77 |

| ALLSHR | 85,079.90 838.35M |

1.26% 1061.74 |

| KSE30 | 41,552.62 97.27M |

1.81% 738.33 |

| KMI30 | 193,330.76 84.69M |

0.39% 741.60 |

| KMIALLSHR | 56,315.31 366.02M |

0.43% 243.06 |

| BKTi | 38,498.08 37.91M |

4.13% 1526.33 |

| OGTi | 28,138.38 5.66M |

-0.36% -101.89 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 120,095.00 | 123,615.00 118,675.00 |

1565.00 1.32% |

| BRENT CRUDE | 69.14 | 71.53 69.08 |

-1.22 -1.73% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.25 0.26% |

| ROTTERDAM COAL MONTHLY | 106.50 | 106.60 106.50 |

-2.20 -2.02% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.89 | 69.65 66.84 |

-1.56 -2.28% |

| SUGAR #11 WORLD | 16.31 | 16.67 16.27 |

-0.26 -1.57% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|