Weekly Market Roundup

MG News | March 08, 2024 at 09:10 PM GMT+05:00

March 08, 2024 (MLN): After a rangebound week, the benchmark KSE-100 index closed at 65,794 showing a marginal increase of 468 points or 0.72%.

Investors adopted a wait-and-see approach ahead of the anticipated monetary policy meeting, which is expected to provide clearer guidance on the market's next major move.

Throughout the week, KSE-100 traded in a narrow range of 963 points, between high and low of 66,151 and 65,188 levels, respectively.

Despite the week's restrained activity, the KSE-100 index hovered near record levels throughout the week, and closed just 633 points or 0.95% short of its all-time high.

To note, the index yielded a 2.6% return to investors one month following the general elections, which, however, was far less than the historical post-election average return of 7.5%.

The average traded volume clocked in at 197 million shares worth Rs10.87 billion, marking a decrease of 8.39% MoM in the number of shares while an increase of 1.42% MoM in traded value.

The overall PSX average traded volume (All-Share) was recorded at 425m shares worth Rs16.51bn, 1.54% MoM higher in the number of shares and 6.45% MoM higher in traded value.

Meanwhile, the Pakistani Rupee recorded a marginal gain of 0.06% WoW.

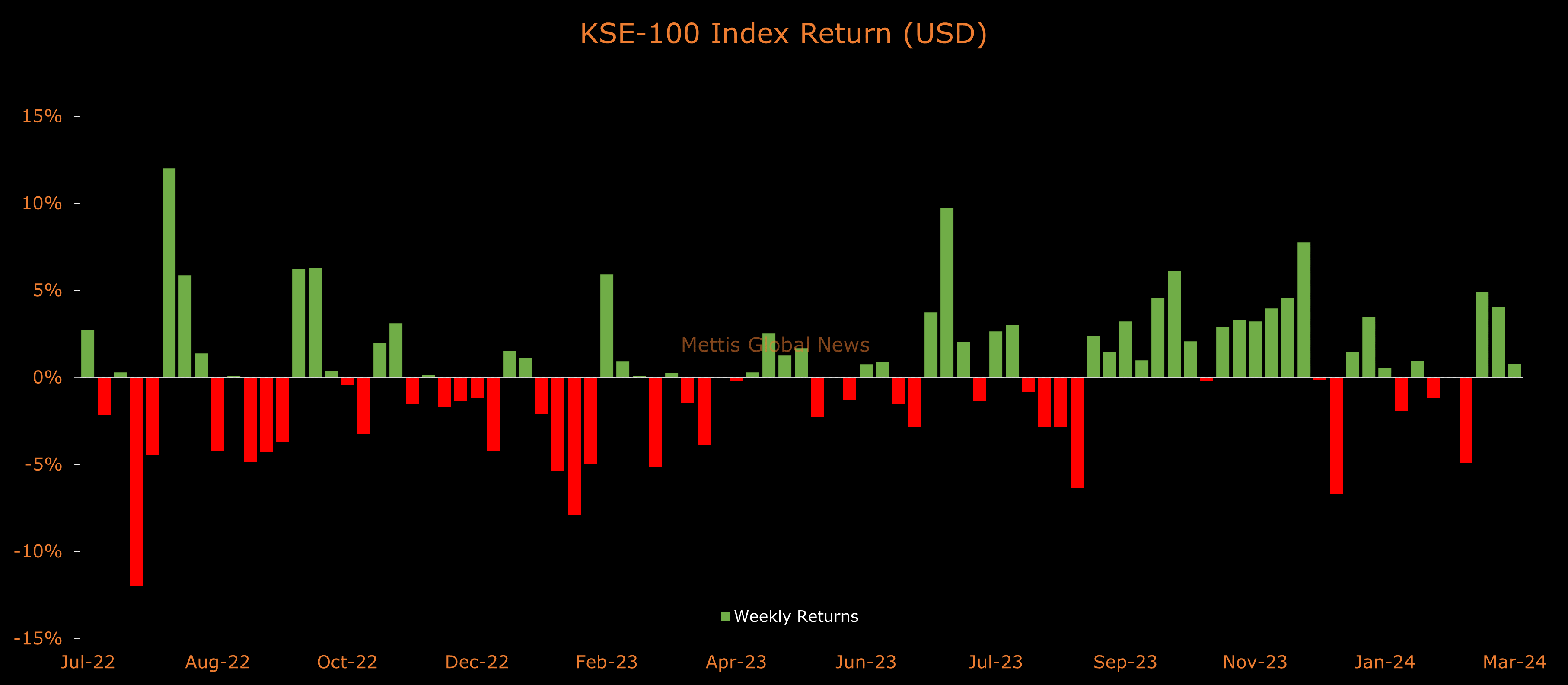

In USD terms, the KSE-100 index gained 0.77% this week.

Right after taking oath as the 24th Prime Minister of Pakistan, Shehbaz Sharif directed immediate talks with the International Monetary Fund (IMF) regarding its Extended Fund Facility.

The IMF has also expressed its readiness to work with the new government for the second review of the Stand-by.

Other major news flows during the week included a report from Goldman Sachs anticipating a favorable shift in Pakistan’s credit rating, alongside Moody’s upgrade of the outlook for Pakistan’s banking sector.

The government conducted two auctions during the week, picking up Rs527bn through MTBs, and Rs65.25bn through PIB-PFL auction.

The cutoff yields in the MTBs auction witnessed a fall of up to 30bps, as the market has renewed bets for a rate cut in the near term amid a significant slowdown in inflation.

Top Index Movers

From the sector-specific lens, Oil & Gas Exploration Companies was the best-performing sector, as it added 217 points to the index.

This was followed by Inv. Banks / Inv. Cos. / Securities Cos. with 189, Refinery with 104, Power Generation & Distribution with 61, and Cement with 61 points, respectively.

Contrary to that, Commercial Banks, Fertilizer, Chemical, Tobacco, and Leather & Tanneries remained red, as they took away 210, 98, 23, 18, and 9 points from the index.

Scrip-wise, DAWH, OGDC, PPL, HUBC, and NRL were the best-performing stocks during the week as they added 175, 164, 89, 62, and 46 points to the index respectively.

Whereas, MEBL, FFC, HBL, BAHL, and ENGRO collectively took away 290 points from the index.

FIPI/LIPI

Foreign investors remained net buyers during the week, acquiring $6.27m worth of equities. Last week, foreign buying was clocked in at $10.44m.

Flow-wise, Foreign Corporates were the dominant buyers, with a net investment of $7.32m.

They allocated the majority of their capital, $7.32m, to Commercial Banks, while divesting from the Oil and Gas Marketing Companies sector, amounting to $0.52m in sales.

On the other hand, the leading sellers were Companies, with a net sale of $6.77m.

Their most substantial sales activity was in Commercial Banks, amounting to $5.93m, while they acquired $0.70m of equities in the Oil and Gas Marketing Companies.

To note, the KSE-100 has gained 24,341 points or 58.72% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 3,343 points, equivalent to 5.35%.

Last week, the index had surged 2,510 points or 4%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction