Weekly Market Roundup

By MG News | March 01, 2024 at 09:35 PM GMT+05:00

March 01, 2024 (MLN): Pakistan stock market extended its rally for the second consecutive week, with the benchmark KSE-100 index gaining 2,510 points or 4% WoW to close at 65,326.

The positivity comes amid further political clarity over the initiation of formation of the new government, coupled with positive economic data.

The latest inflation data showed consumer prices rose 23.1% in February from a year earlier, the slowest pace in over 20 months.

Other major news flows during the week included the country recording a trade deficit of $1.7 billion, Moody’s affirming Pakistan’s credit rating at ‘Caa3’ with a stable outlook, and strong corporate results.

Last week, the index had surged 2,943 points or 4.92%.

The index has completely erased all post-election losses and gained around 1,181 points or 1.84% since February 08, 2024.

Meanwhile, the Pakistani Rupee recorded a marginal gain of 0.06% WoW.

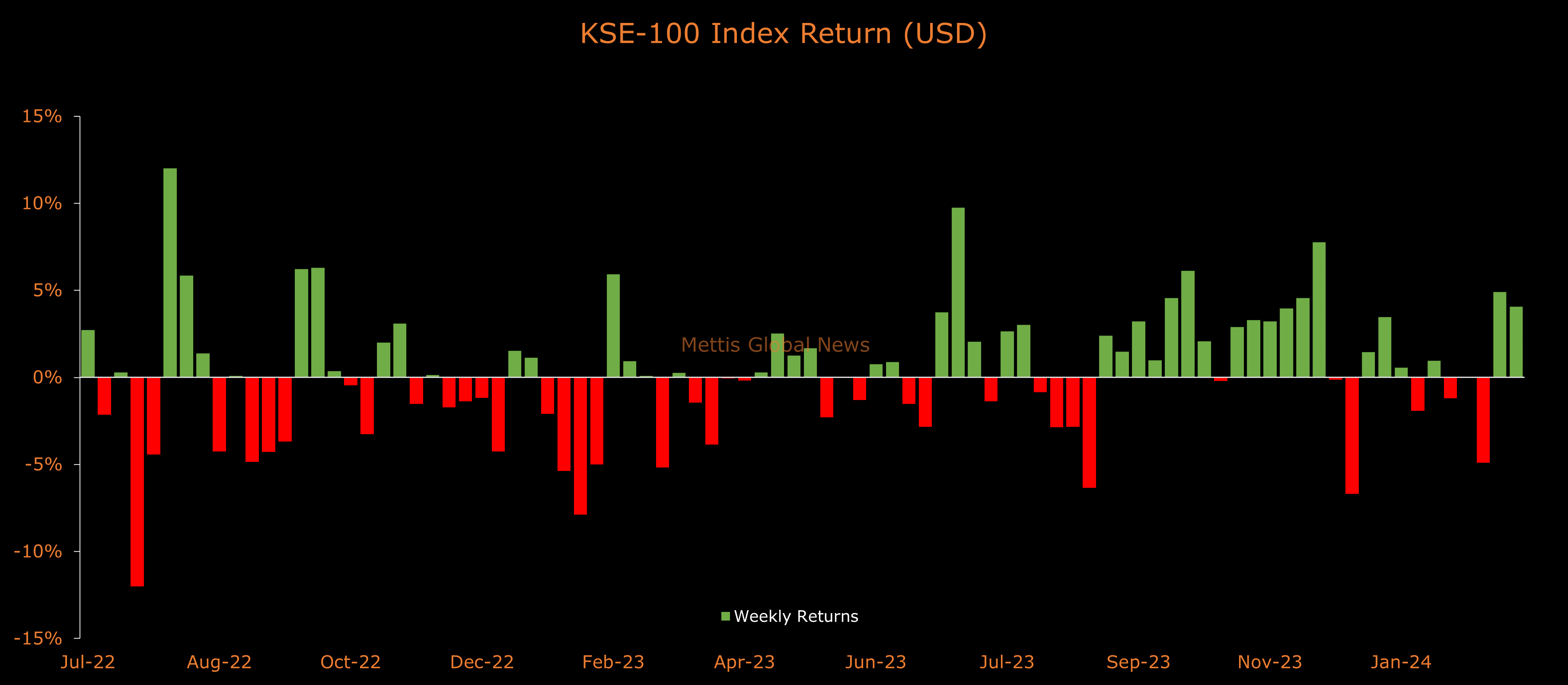

In USD terms, the KSE-100 index gained 4.06% this week.

Throughout the week, KSE-100 oscillated in a range of 2,571 points, between high and low of 65,486 and 62,915 levels, respectively, before settling the week near the weekly highs at 65,326.

The market turnover saw a rise during the week, with an average traded volume of 216 million shares worth Rs10.72 billion, marking an increase of 14.65% MoM in the number of shares and 25.35% MoM in traded value.

Moreover, the overall PSX average traded volume (All-Share) was recorded at 418m shares worth Rs15.51bn, marking an increase of 23.69% MoM in the number of shares while an increase of 22.57% MoM in traded value.

Top Index Movers

From the sector-specific lens, Commercial Banks was the best performing sector, as it added 806 points to the index.

This was followed by Fertilizer, Oil & Gas Exploration Companies, Automobile Assembler, and Cement as they kept the index in positive territory by adding 669, 280, 184, and 159 points, respectively.

Contrary to that, Technology & Communication, Pharmaceuticals, Leather & Tanneries, Cable & Electrical Goods, and Synthetic & Rayon remained red, as they took away 37, 28, 24, 11, and 6 points from the index.

Scrip-wise, ENGRO, EFERT, MEBL, MTL, and MARI were the best-performing stocks during the week as they added 279, 211, 182, 160, and 160 points to the index respectively.

Whereas, TRG, OGDC, SRVI, PAEL, and ABOT collectively took away 134 points from the index.

FIPI/LIPI

This week's rally was largely driven by foreign buying, which clocked in at $10.44m.

Flow-wise, Foreign Corporates were the dominant buyers, with a net investment of $11.95m.

They allocated the majority of their capital, $4.10m, to Commercial Banks, while divesting from the Technology and Communication sector, amounting to $0.35m in sales.

On the other hand, flow wise, the leading sellers were Banks / Dfi, with a net sale of $6.38m.

Their most substantial sales activity was in Commercial Banks, amounting to $3.26m, while they acquired $0.19m of equities in the Food and Personal Care Products.

To note, the KSE-100 has gained 23,873 points or 57.59% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 2,875 points, equivalent to 4.6%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 125,627.31 258.99M |

1.00% 1248.25 |

| ALLSHR | 78,584.71 1,142.41M |

1.16% 904.89 |

| KSE30 | 38,153.79 69.25M |

0.63% 238.06 |

| KMI30 | 184,886.50 91.38M |

0.01% 13.72 |

| KMIALLSHR | 53,763.81 554.57M |

0.54% 290.61 |

| BKTi | 31,921.68 33.15M |

1.78% 557.94 |

| OGTi | 27,773.98 9.65M |

-0.40% -112.21 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,165.00 | 109,565.00 107,195.00 |

680.00 0.63% |

| BRENT CRUDE | 66.65 | 67.20 65.92 |

-0.15 -0.22% |

| RICHARDS BAY COAL MONTHLY | 97.00 | 97.00 97.00 |

1.05 1.09% |

| ROTTERDAM COAL MONTHLY | 107.65 | 107.65 105.85 |

1.25 1.17% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 64.99 | 65.82 64.50 |

-0.53 -0.81% |

| SUGAR #11 WORLD | 16.19 | 16.74 16.14 |

-0.52 -3.11% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|