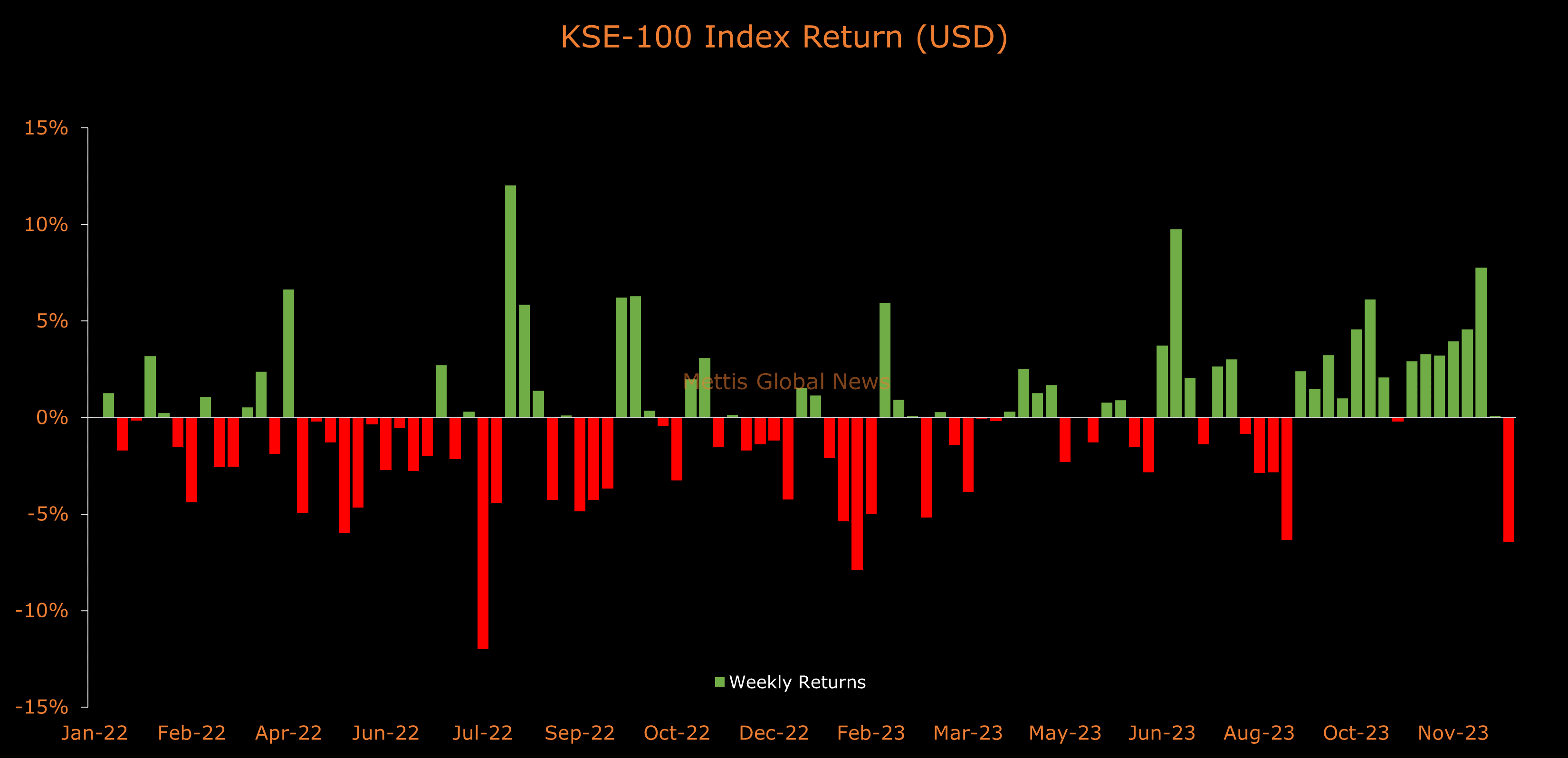

December 23, 2023 (MLN): The benchmark KSE-100 index recorded a sharp decline of 4,425 points or 6.69% this week to close at 61,705 — the largest weekly drop since the Covid-19 crash.

This decline comes after the index experienced a historical bullish run since September that lifted the index to record highs.

KSE-100 is now entering the ‘correction territory’, having fallen more than 8% from its peak.

The market sell-off was triggered by big players cashing in on the long rally, which led to cascading liquidations, as the market had been experiencing one-sided price action since September, with no consequences for overleveraged longs.

However, it is pertinent to note that the leverage remains relatively stable when measured as a percentage of market capitalization or free float.

Therefore, the decline can also be attributed to a diminishing influx of fresh capital amid a lack of new catalysts for the trend continuation.

Meanwhile, the Pakistani Rupee (PKR) extended its winning streak for the sixth consecutive week by recording a marginal gain of 0.26% WoW.

In USD terms, the index lost 6.45% this week, the largest decline since January.

Throughout the week, KSE-100 oscillated in a wide range of 5,504 points, between high and low of 66,587 and 61,083 levels, respectively, before settling the week near weekly lows at 61,705.

The market turnover remained heightened during the week, with an average traded volume of 687.36 million shares. However the traded value fell significantly to Rs15.96 billion as compared to Rs22.48bn in the previous week, marking an increase of 9.1% WoW in the number of shares while a decrease of 29% WoW in traded value.

Moreover, the overall PSX average traded volume (All-Share) was recorded at 1.21 billion shares worth Rs22bn, marking decrease of 3% WoW in the number of shares while a decrease of 27.46% WoW in traded value.

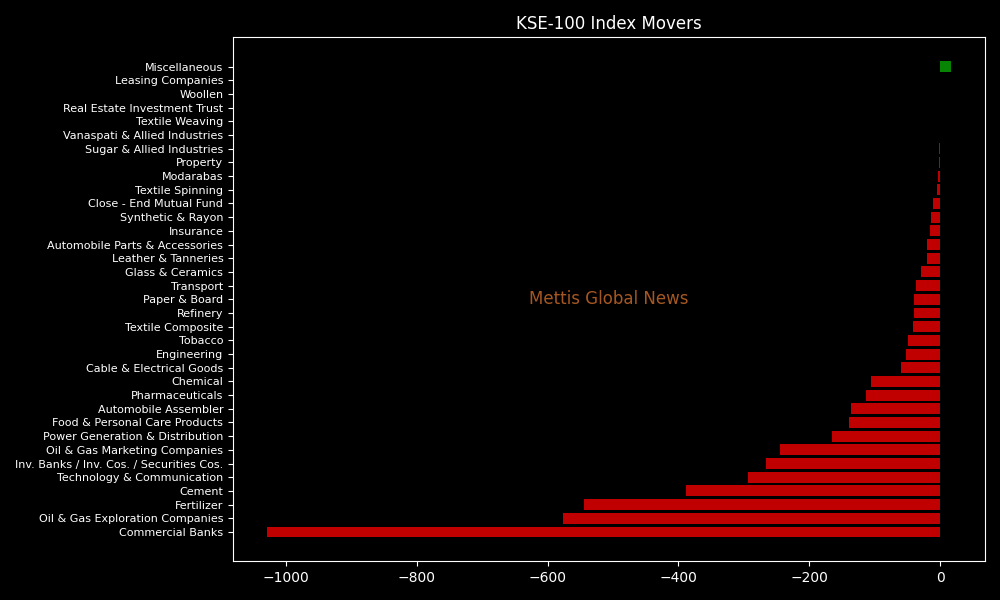

Top Index Movers

Almost all the stocks remained in red throughout the week.

Sector-wise, commercial banks remained top losers this week, as they took away a substantial 1,029 points from the index.

This was followed by Oil & Gas Exploration Companies, Fertilizer, Cement, and Technology & Communication as they kept the index in negative territory by taking away 576, 545, 388, and 294 points, respectively.

Contrary to that, only the miscellaneous sector remained green during the week, adding 16.45 points to the index.

Scrip-wise, MCB, OGDC, ENGRO, DAWH, and, FFC were the worst-performing stocks during the week as they took away 265, 257, 251, 240, and 174 points from the index respectively.

Whereas, the only four companies; PSEL, ILP, PKGP, and PABC were green during the week, collectively adding 24.76 points to the index.

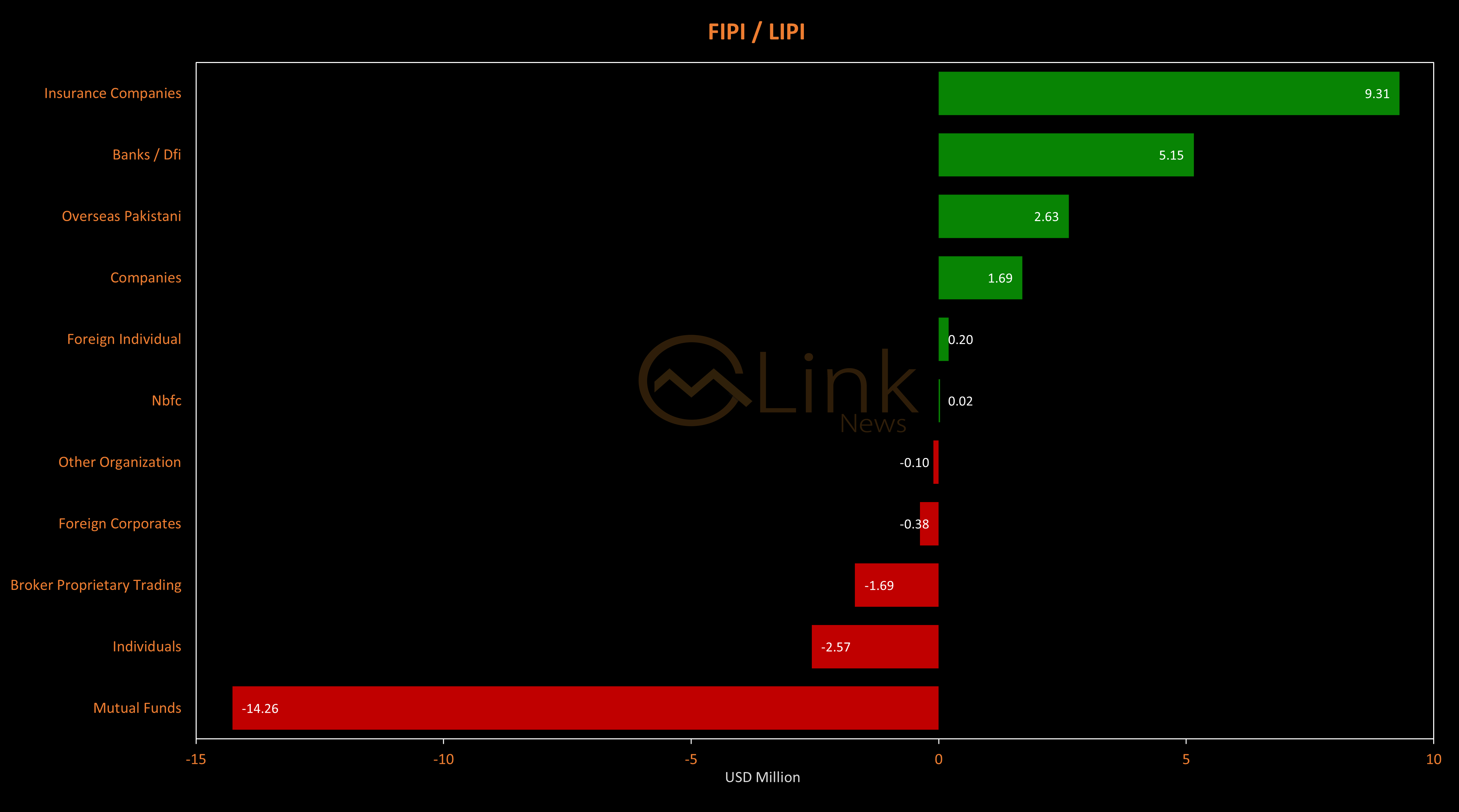

FIPI/LIPI

Flow-wise, the dominant buyers during the week were Insurance Companies, with a net investment of $9.31m.

To note, Insurance Companies were the top sellers during the previous week.

They allocated the majority of their capital, $3.16m, to Oil and Gas Exploration Companies, while divesting from the Technology and Communication sector, amounting to $79,361 in sales.

Moreover, foreign investors remained net buyers for the seventh consecutive week, reflecting restored confidence in the market.

However, this week Foreign Corporates were net sellers, while overseas Pakistanis acquired $2.63m worth of stocks.

On the other hand, the leading sellers were Mutual Funds, with a net sale of $14.26m.

Their most substantial sales activity was in the Oil and Gas Exploration Companies, amounting to $4.26m.

To note, the local stock market has been on a bullish streak amid hopes of improved economic conditions following the expected inflows from IMF and friendly countries, relatively stable currency amid government-backed administrative efforts, and a possible slash in the interest rates.

Analysts expect this trend to continue in 2024 owing to robust earnings growth, attractive valuation, and steady economic growth.

The KSE-100 has gained 20,252 points or 48.86% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 21,285 points, equivalent to 52.66%.

Copyright Mettis Link News

Posted on: 2023-12-23T09:30:00+05:00