Six giant companies are driving the KSE-100 rally

Abdur Rahman | October 24, 2024 at 05:42 PM GMT+05:00

October 24, 2024 (MLN): The six megacap Pakistan stocks have accounted for half of the total KSE-100 Index rally this year.

Pakistan equity benchmark KSE-100 Index is up a significant 26,495 points or 42.4% so far in 2024, buoyed by improving macroeconomic indicators thanks in no small part to the International Monetary Fund's support.

Fauji Fertilizer, United Bank, Engro Fertilizers, Mari Petroleum, Oil & Gas Development Company, and Meezan Bank have gained 13,179 points—49.7% of the total KSE-100 return, according to data compiled by MG Research.

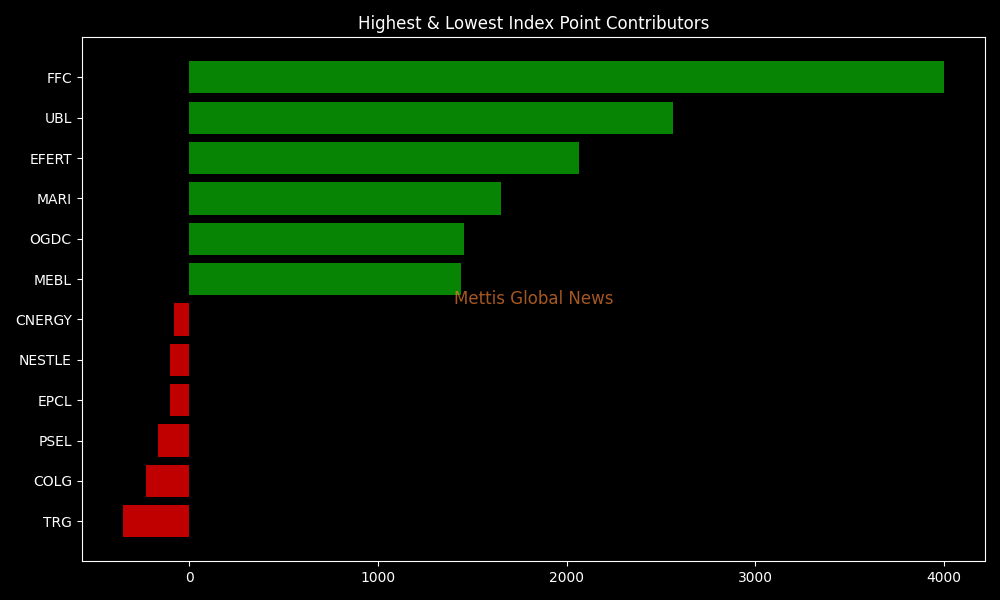

The best-performing stocks so far this year have been FFC (+4,001pts), UBL (+2,565pts), EFERT (+2,066pts), MARI (+1,654pts), and OGDC (+1,455pts).

Whereas, the worst-performing are TRG (-353pts), COLG (-230pts), PSEL (-166pts), EPCL (-103pts), and NESTLE (-103pts).

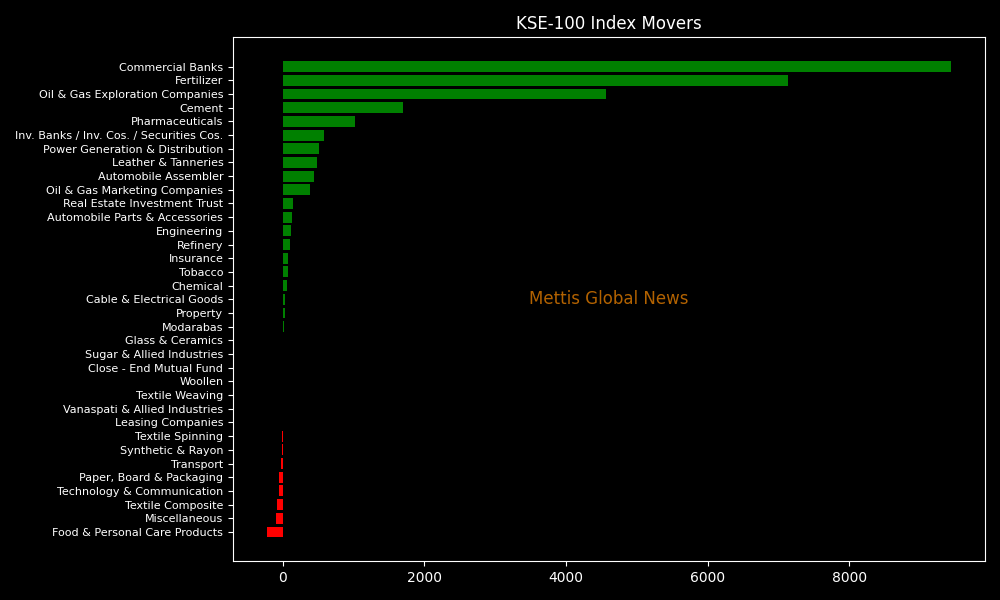

Sector-wise, top positive contributors are Commercial Banks (+9,435pts), Fertilizer (+7,138pts), Oil & Gas Exploration Companies (+4,570pts), Cement (+1,700pts), and Pharmaceuticals (+1,025pts).

Contrary to that, negative contributions have come from Food & Personal Care Products (-221pts), Miscellaneous (-99pts), Textile Composite (-79pts), Technology & Communication (-57pts), and Paper, Board & Packaging (-53pts).

FIPI/LIPI

Foreign investors have dumped $11 million of stocks in 2024 due to FTSE rebalancing, which demoted Pakistan from Secondary Emerging to Frontier Market in July.

Flow-wise, Mutual funds have been the dominant buyers, with a significant investment of $79.4m.

They have allocated the majority of their capital to Fertilizer ($26.2m), followed by Cement ($19.2m).

On the other hand, the leading sellers are Banks / Dfi with $63.7m. Their most substantial sales activity is in Fertilizer ($35.2m), followed by Commercial Banks ($33m).

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 178,853.10 424.99M | 3.29% 5702.68 |

| ALLSHR | 107,335.86 693.28M | 2.85% 2972.30 |

| KSE30 | 54,676.69 210.97M | 3.52% 1860.41 |

| KMI30 | 250,620.93 139.36M | 2.14% 5257.28 |

| KMIALLSHR | 68,647.30 398.45M | 1.89% 1273.91 |

| BKTi | 52,773.10 107.33M | 7.09% 3494.44 |

| OGTi | 35,032.42 34.95M | 0.79% 274.54 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,355.00 | 68,570.00 65,895.00 | -1510.00 -2.23% |

| BRENT CRUDE | 70.55 | 70.70 67.36 | 3.13 4.64% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.00 -3.03% |

| ROTTERDAM COAL MONTHLY | 105.50 | 105.50 105.50 | -0.10 -0.09% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 65.30 | 65.43 62.04 | 3.04 4.88% |

| SUGAR #11 WORLD | 13.77 | 13.78 13.47 | 0.29 2.15% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Roshan Digital Account

Roshan Digital Account