SBP’s shift to monetary easing may spark Pakistan stocks surge

Abdur Rahman | February 28, 2024 at 05:27 PM GMT+05:00

February 28, 2024 (MLN): Pakistan’s already explosive stock rally may get another leg up as the central bank shifts its gears to monetary easing.

Investors widely expect the State Bank of Pakistan (SBP) to start unwinding this year after what has been the most aggressive fight against soaring inflation, as pressure now moderates.

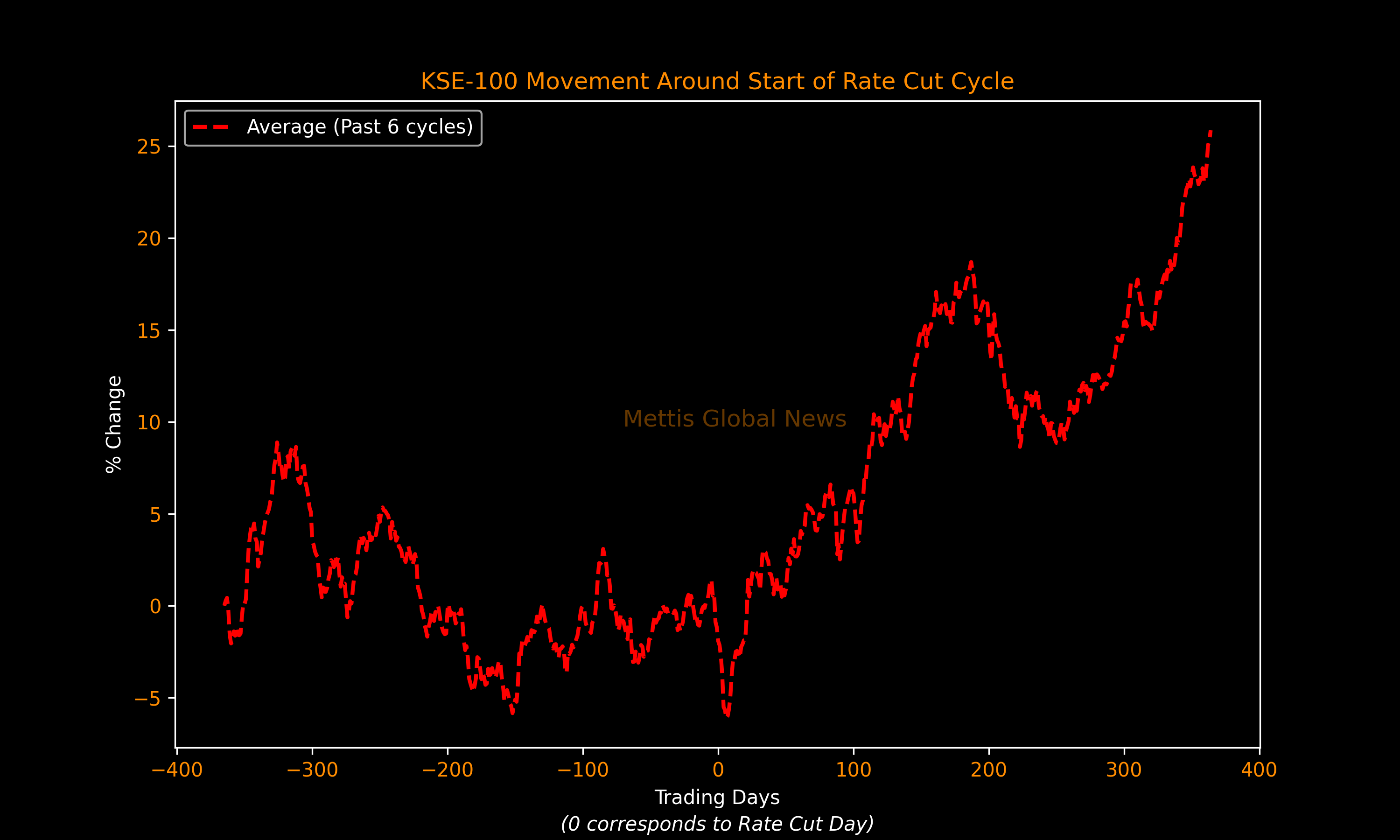

Historical data shows start of a rate-cut cycle bodes really well for the local stock market.

Three months following the first rate cut, the benchmark KSE-100 index has averaged a 4.4% gain.

While over a six-month period, the index has increased 14.9% on average, data from the past six easing cycles compiled by Mettis Global shows.

Moreover, the gauge has advanced 19.1% on average a year after the initial cut, and a whopping 62.8% two years later.

Inflationary pressures have started to ease. February's CPI is expected to drop to a 17-month nadir.

The central bank's monetary easing is now a question of 'when', rather than 'if'.

The base case is a cut in the second half of 2024, although a few analysts expect the SBP to act as soon as March.

| KSE-100 Performance After Start of Rate Cut Cycle | |||||||

|---|---|---|---|---|---|---|---|

| Date | 1 Week | 1 Month | 2 Months | 3 Months | 6 Months | 1 Year | 2 Years |

| Jun-1997 | 0.77% | 17.73% | 22.13% | 17.39% | 11.02% | -34.16% | -32.87% |

| Jul-2001 | -2.46% | 0.50% | -11.23% | -2.99% | 11.09% | 40.10% | 192.23% |

| Apr-2009 | -5.16% | -11.03% | -10.14% | -1.58% | 25.58% | 35.18% | 52.20% |

| Aug-2011 | -6.93% | -9.65% | -4.01% | -5.65% | -2.39% | 18.96% | 90.26% |

| Nov-2014 | -0.66% | -3.27% | 6.57% | 7.07% | 4.22% | 7.45% | 33.76% |

| Mar-2020 | -10.48% | 7.94% | 11.81% | 11.85% | 39.83% | 47.04% | 41.47% |

| Average | -4.15% | 0.37% | 2.52% | 4.35% | 14.89% | 19.10% | 62.84% |

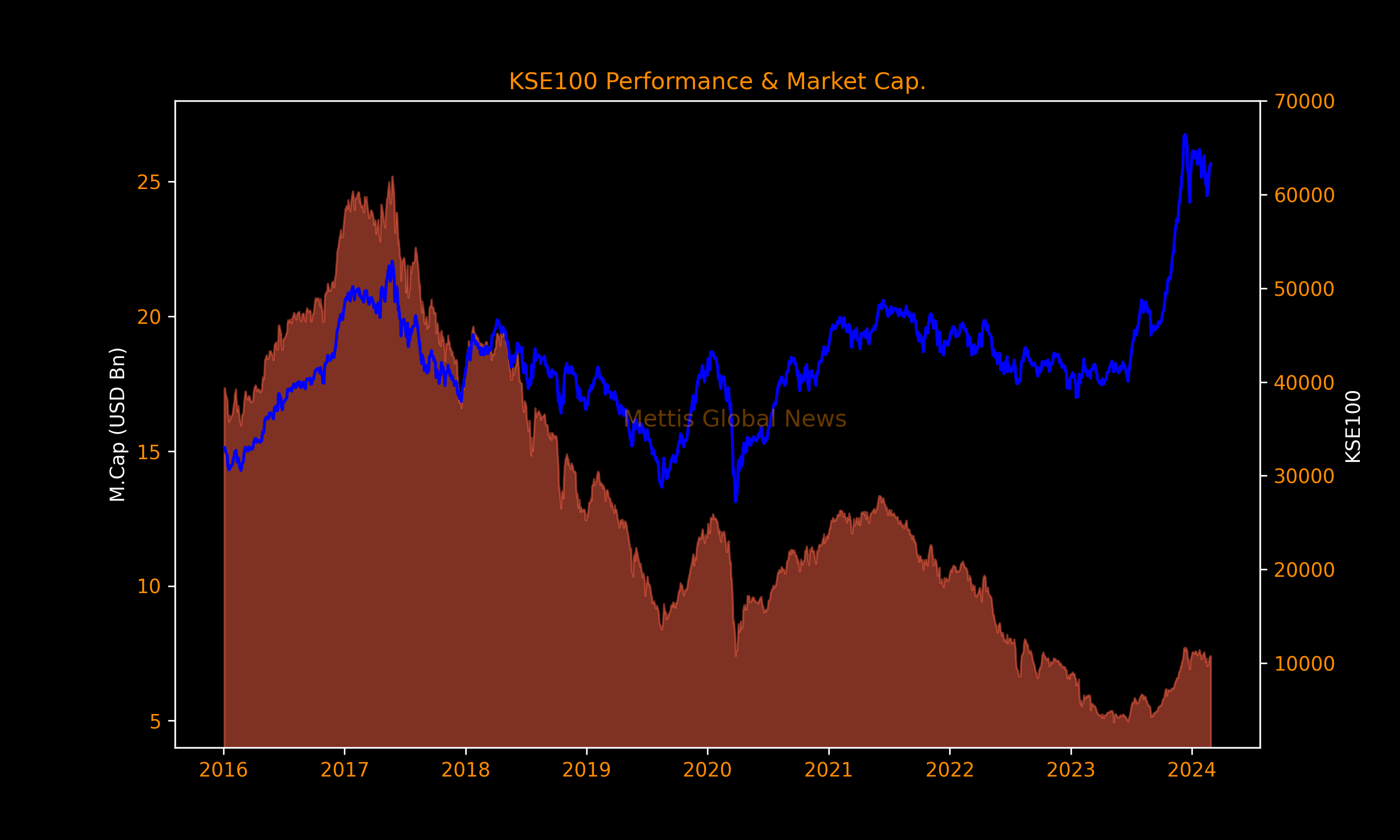

This gain would be on top of a 22,251 points or 53.68% surge in the current fiscal year, since the International Monetary Fund (IMF)'s bailout program.

Disclaimer: The views and analysis in this article are the opinions of the author and are for informational purposes only. It is not intended to be financial or investment advice and should not be the basis for making financial decisions.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 173,169.71 245.48M | 0.58% 999.42 |

| ALLSHR | 103,952.96 533.68M | 0.46% 476.31 |

| KSE30 | 53,042.90 95.92M | 0.73% 384.11 |

| KMI30 | 242,931.39 83.21M | 1.01% 2420.10 |

| KMIALLSHR | 66,507.09 270.16M | 0.79% 519.06 |

| BKTi | 51,058.55 42.50M | 0.09% 45.65 |

| OGTi | 34,159.98 10.77M | 1.77% 594.51 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,925.00 | 68,450.00 66,565.00 | 720.00 1.07% |

| BRENT CRUDE | 71.68 | 72.34 71.06 | 0.02 0.03% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.45 -1.36% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.31 | 67.03 65.81 | -0.09 -0.14% |

| SUGAR #11 WORLD | 13.86 | 14.02 13.61 | 0.16 1.17% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Roshan Digital Account

Roshan Digital Account