August 21, 2023 (MLN): Having the promising progression on the horizon of refineries landscape, Pakistan Refinery Policy 2023 demands contributions from refineries as the utilization of funds to be collected from tariff protection for the import of used and new refining equipment to upgrade infrastructure have been capped.

Accordingly, refineries are asked to bear 78% and 75% of the project cost while importing used and new equipment, respectively, in order to upgrade infrastructure as the government has imposed a cap of 22% and 25% fiscal incentives.

The document further revealed that shall be a minimum customs duty of 10%, for a period of 6 years from the date of notification of this Policy, on Motor Gasoline and Diesel imported in the country. Any customs duty imposed over 10% and reflected in the ex-refinery price, will be deposited in the Inland Freight Equalization Margin (IFEM) pool.

In case any refinery is not eligible to avail of the incentives provided in this policy, it will be bound to deposit the same in IFEM. Any customs duty on crude oil shall be reimbursed to refineries through IFEM.

"The refineries shall be allowed 10% tariff protection/ deemed duty applicable on Motor Gasoline and Diesel’s ex-refinery price for 6 years from the date of notification of this policy and opening of the joint Escrow Account with OGRA,” the policy statement reads.

However, 2.5% of the deemed duty on Diesel and 10% on Motor Gasoline, incremental incentive, shall be deposited by refineries in the Escrow Account maintained by OGRA and the respective refinery jointly in National Bank of Pakistan for utilization of Upgrade Projects only.

The respective refinery and OGRA will open the requisite joint Escrow Account within three months after the notification of this Policy. Until the opening of the said account, the incremental incentive shall be deposited in the IFEM.

How can a refinery become eligible for the aforementioned incentives?

For an existing refinery to be eligible for the fiscal incentives provided in this Policy, it shall within 3 months after the notification of this Policy, execute a legally binding Upgrade Agreement with OGRA. The said Upgrade Agreement shall include:

- Output and outcome of the committed upgrade.

- The proposed milestones/ deliverables with tentative timelines (including Feasibility study, / Front-End Engineering Design (FEED), Financial Close, EPC & Commissioning)

- The potential configuration/units/size

- The tentative product slate after upgradation; and

- a project management methodology/ firm for on-time delivery, as per approved cost and specification. The milestones/ deliverables and timelines will be firmed up in FEED of the Upgrade Project.

Refinery eligibility tied to government dues settlement:

Refinery defaulting on any government dues/ petroleum levy on Petroleum Products would not be eligible to avail of this Policy until a legally binding and enforceable (with a recourse) settlement is reached with the government. Till such time, the defaulting refinery will deposit the incremental incentives into IFEM pool.

Once a settlement is reached with the government, the refinery will become eligible to open a joint Escrow Account with OGRA and start depositing the incremental incentives on a prospective basis. The funds available in the joint Escrow Account can only be drawn and used by the respective refinery on the Upgrade Project after payment of all outstanding government dues/ petroleum levy on Petroleum Products.

What will happen if the refinery defaults?

As soon as a refinery defaults in payment of the government’s revenue/ petroleum levy on petroleum products in a timely manner after the execution of the Upgrade Agreement, the refinery’s right to claim expenditure out of the joint Escrow Account will be suspended by OGRA till the time the refinery deposits the outstanding amount.

If the default continues beyond 60 days, the joint Escrow Account will be ceased by OGRA and the balance will be confiscated by OGRA in favour of IFEM and the waiver to produce and market their products shall also stand withdrawn/cancelled.

OGRA shall also encash bank guarantees against the outstanding dues of incremental incentives.

Refinery to deposit Rs1 billion in terms of Bank Guarantee:

With the execution of the said Upgrade Agreement, each refinery shall submit an unconditional and irrevocable bank guarantee of Rs1 billion, issued by at least a “AA” rated bank to OGRA valid till the committed successful commissioning date of the Upgrade Project plus six (6) months.

The refinery will ensure an extension of the bank guarantee in case the committed commissioning date of the Upgrade Project is extended by OGRA to cure any default. The bank guarantee, net of any outstanding obligations due under this Policy, shall be released upon OGRA’s satisfaction with the successful commissioning of the respective Upgrade Project.

OGRA to monitor the Upgrade Projects:

Failure to meet the timelines committed in the Upgrade Agreement/ FEED will initially result in a default notice by OGRA to the respective refinery, with an allowed cure period.

OGRA may allow a maximum of one-year cumulative cure period along with an automatic extension of the waiver for the entire Upgrade Project. The refinery’s right to claim expenditure out of a joint Escrow Account will be suspended after the lapse of the cure period.

Capacity of refineries to be increased:

Under the brownfield policy, all existing refineries are encouraged to upgrade their refineries to produce environmentally friendly fuels as per Euro-V specifications and to maximize the production of Motor Gasoline and Diesel by minimizing furnace oil (FO)/ other fuels.

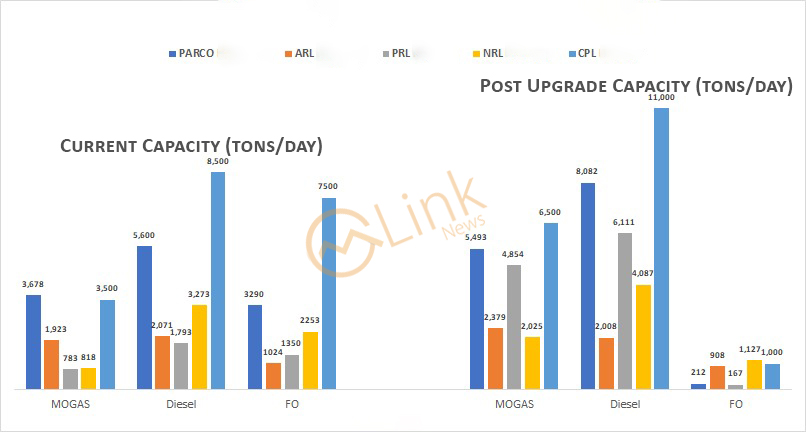

The current production capacity of PARCO for MOGAS is 3,678 tons/day, for Diesel is 5,600 tons/day, and for Fuel Oil (FO) is 3,290 tons/day where after the upgrade, the production capacity for MOGAS is projected to increase to 5,493 tons/day, for Diesel to 8,082 tons/day, and for Fuel Oil (FO) to 212 tons/day.

Similarly, the current production capacity of all the other refineries and after upgradation is mentioned below:

At present, Pakistan’s oil refining capacity is about 450,000 barrels per day (bpd), equivalent to 20 million tons per annum. However, the actual capacity utilization is at around 10 million tons.

This is mainly due to the decreasing FO demand in the country as a result of a change in the energy mix in the power sector.

It is important to note that in essence the production slate for refineries is fixed. i.e., they cannot produce just MS or HSD, all products are produced simultaneously. Thus, as FO demand 9 declines, refineries have to lower their overall production and struggle to maintain their throughput at optimal levels.

Historically, local refineries have supplied about 45% of the country’s requirements of HSD, 30% of MS and more than 100% of Jet fuel for defence. The rest of the demand is supplied through imported refined products.

As per the forecast by an international consultant, Pakistan’s demand for MS and HSD is expected to reach 33 million tons per annum (mpta) by 2035.

Copyright Mettis Link News

Posted on: 2023-08-21T16:22:04+05:00