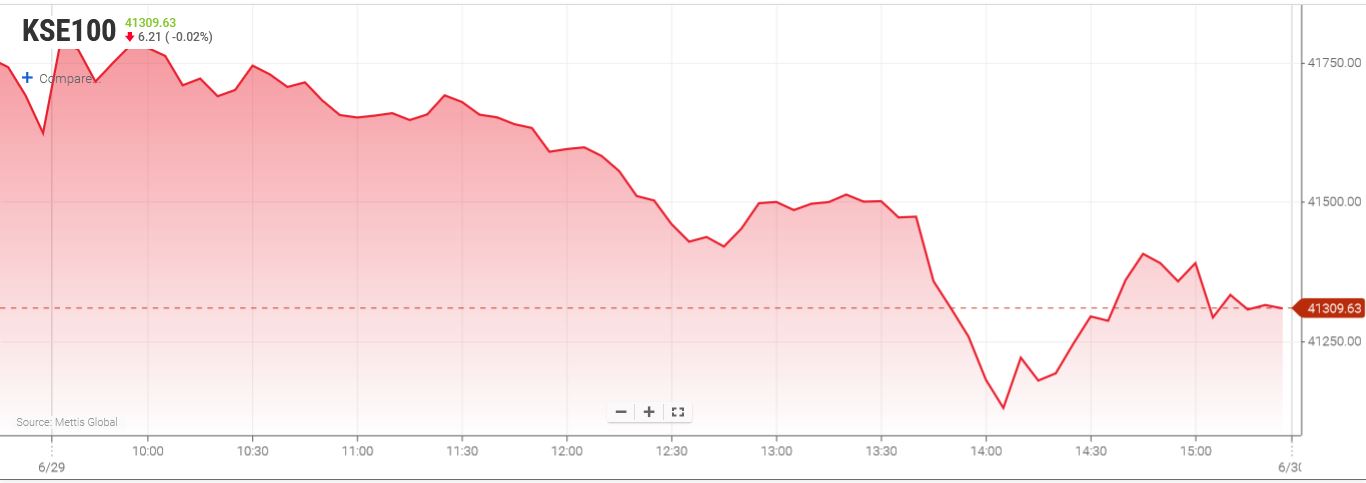

June 29, 2022 (MLN): Pakistan’s stock market remained in bearish spell today as investors preferred to remain sidelined amid lack of fresh triggers.

Initially, market opened on a positive note where the KSE100 index made an Intraday high at 41,814 but rumors regarding possible restriction on dividend payment of those banks which want to reclassify their PIB profile triggered selling spree in the banking sector stocks, resulted in intraday low at 41,119, a closing note by Topline Securities said.

However, some value hunting at the aforesaid low rescued the KSE100 Index and assisted it to eventually settled at 41,298 level, i.e., down by 468 points; or 1.12% DoD.

Of the 91 traded companies in the KSE100 Index 28 closed up 59 closed down, while 4 remained unchanged. Total volume traded for the index was 78.95 million shares.

Sector wise, the index was let down by Commercial Banks with 272 points, Oil & Gas Exploration Companies with 59 points, Technology & Communication with 57 points, Cement with 23 points and Power Generation & Distribution with 18 points.

The most points taken off the index was by HBL which stripped the index of 90 points followed by MCB with 69 points, SYS with 45 points, BAHL with 42 points and MARI with 23 points.

Sectors propping up the index were Oil & Gas Marketing Companies with 10 points, Tobacco with 5 points, Real Estate Investment Trust with 1 points, Engineering with 1 points and Textile Composite with 1 points.

The most points added to the index was by COLG which contributed 9 points followed by EFERT with 7 points, SNGP with 6 points, JVDC with 6 points and PAKT with 5 points.

All Share Volume decreased by 114.97 Million to 142.19 Million Shares. Market Cap decreased by Rs.53.48 Billion.

Total companies traded were 316 compared to 331 from the previous session. Of the scrips traded 124 closed up, 168 closed down while 24 remained unchanged.

Total trades decreased by 16,474 to 82,123.

Value Traded decreased by 2.36 Billion to Rs.5.35 Billion

| Company | Volume |

|---|---|

| K-Electric | 14,377,500 |

| Worldcall Telecom | 11,615,500 |

| Hascol Petroleum | 7,563,500 |

| Cnergyico PK | 5,719,107 |

| TPL Properties | 4,359,799 |

| Pakistan Refinery | 4,212,157 |

| Sui Northern Gas Pipelines | 4,074,392 |

| Habib Bank | 3,443,169 |

| Kot Addu Power Company | 3,435,333 |

| MCB Bank | 2,949,393 |

| Sector | Volume |

|---|---|

| Technology & Communication | 24,728,542 |

| Power Generation & Distribution | 19,686,747 |

| Commercial Banks | 17,209,866 |

| Oil & Gas Marketing Companies | 14,185,516 |

| Cement | 12,136,674 |

| Refinery | 10,913,568 |

| Chemical | 7,926,039 |

| Food & Personal Care Products | 5,860,080 |

| Miscellaneous | 5,083,599 |

| Oil & Gas Exploration Companies | 3,878,181 |

Copyright Mettis Link News

33808