PSX Closing Bell: The Bubble Bursts

By MG News | August 05, 2024 at 04:24 PM GMT+05:00

August 05, 2024 (MLN): Pakistan's stocks also succumbed to the global selloff on Monday, with the benchmark KSE-100 Index plummeting 1,141.5 points or 1.46% to close at 77,084.48.

The index traded in a range of 1,386.85 points showing an intraday high of 78,330.09 (+104.11) and a low of 76,943.24 (-1,282.74) points.

The total volume of the KSE-100 Index was 169.49 million shares.

Globally, most financial markets tumbled at the start of a new week as fears of a deeper US economic slowdown and rising tensions in the Middle East prompted investors to shun risk assets.

US stock futures were trading lower, with the Nasdaq 100 down over 4.5%, set for its biggest opening drop in more than four years.

Japan's benchmark stock index closed 12.40% lower, its largest one-day fall since October 1987. Taiwan’s benchmark stock index plunged 8.4%, marking its worst selloff since 1967.

Cryptocurrencies also tumbled, with Bitcoin down more than 12% and saddling second-ranked Ether experiencing its steepest fall since 2021.

Oil also extended losses from the lowest close in seven months, with Brent falling 2.2% towards $75 a barrel.

The VIX index which measures market volatility jumped 115% to 50.3, the highest since 2020.

Gold, which had been one of the few bright spots amidst a sea of red earlier, also succumbed to the selloff and fell 1.5%.

In Pakistan, of the 100 index companies 15 closed up, 82 closed down, while 3 were unchanged.

Top losers during the day were AKBL (-6.29%), AICL (-5.05%), CNERGY (-4.50%), NPL (-4.47%), and PIOC (-4.38%).

On the other hand, top gainers were YOUW (+31.85%), PKGP (+7.79%), FCEPL (+2.53%), LCI (+2.40%), and EFERT (+1.87%).

In terms of index-point contributions, companies that dragged the index lower were HUBC (-193.72pts), HBL (-79.87pts), POL (-73.57pts), SYS (-69.77pts), and BAHL (-66.99pts).

Meanwhile, companies that added points to the index were EFERT (+59.73pts), PKGP (+31.57pts), FFC (+25.92pts), LCI (+9.65pts), and NATF (+4.78pts).

Sector-wise, KSE-100 Index was let down by Commercial Banks (-423.50pts), Power Generation & Distribution (-179.34pts), Oil & Gas Exploration Companies (-143.93pts), Cement (-119.45pts), and Technology & Communication (-95.22pts).

While the index was supported by Fertilizer (+48.61pts), Leather & Tanneries (+3.14pts), Chemical (+2.94pts), Textile Weaving (+2.37pts), and Sugar & Allied Industries (+0.32pts).

In the broader market, the All-Share Index closed at 49,204.70 with a net loss of 546.58 points or 1.10%.

Total market volume was 501.19 million shares compared to 443.48m from the previous session while traded value was recorded at Rs21.06 billion showing an increase of Rs0.56bn.

There were 248,068 trades reported in 440 companies with 129 closing up, 259 closing down, and 52 remaining unchanged.

| Symbol | Price | Change % | Volume |

|---|---|---|---|

| KOSM | 5.41 | 22.68% | 86,045,086 |

| YOUW | 4.14 | 31.85% | 32,793,243 |

| WTL | 1.21 | -3.97% | 19,643,915 |

| PACE | 3.64 | 19.74% | 19,453,743 |

| TPLP | 8.85 | 4.98% | 16,769,167 |

| CNERGY | 3.82 | -4.50% | 14,102,903 |

| TOMCL | 44.22 | -1.01% | 13,892,929 |

| PRL | 23.48 | -1.92% | 11,638,893 |

| FFL | 8.76 | 2.70% | 9,854,065 |

| EFERT | 171.15 | 1.87% | 9,511,945 |

To note, the KSE-100 has lost 1,360 points or 1.73% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 14,633 points, equivalent to 23.43%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 122,143.57 238.19M |

-1.57% -1949.56 |

| ALLSHR | 76,055.22 966.52M |

-1.36% -1051.07 |

| KSE30 | 36,883.30 115.66M |

-1.74% -653.39 |

| KMI30 | 180,397.18 129.11M |

-2.16% -3973.50 |

| KMIALLSHR | 52,092.45 393.86M |

-1.73% -918.69 |

| BKTi | 29,957.41 15.86M |

-1.36% -411.82 |

| OGTi | 27,188.26 11.39M |

-1.70% -471.10 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 105,715.00 | 106,630.00 103,010.00 |

-1380.00 -1.29% |

| BRENT CRUDE | 75.18 | 78.50 70.41 |

5.82 8.39% |

| RICHARDS BAY COAL MONTHLY | 88.00 | 0.00 0.00 |

-2.00 -2.22% |

| ROTTERDAM COAL MONTHLY | 103.60 | 103.60 103.50 |

1.00 0.97% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 73.18 | 77.62 68.49 |

5.14 7.55% |

| SUGAR #11 WORLD | 16.54 | 16.94 16.52 |

-0.16 -0.96% |

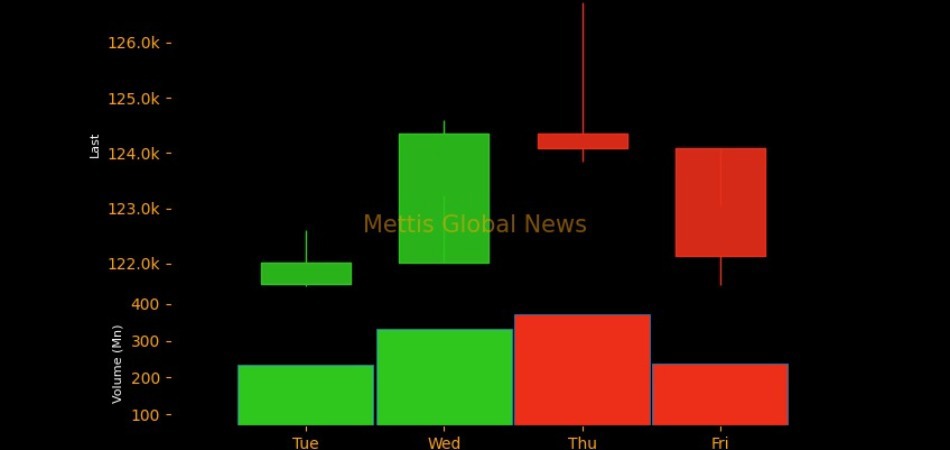

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Auto Numbers

Auto Numbers