PSX Closing Bell: A Hard Day’s Fall

MG News | June 13, 2025 at 05:03 PM GMT+05:00

June 13, 2025 (MLN): The benchmark KSE-100 Index concluded Friday's trading session at 122,143.56, showing a decrease of 1,949.56 points or 1.57%.

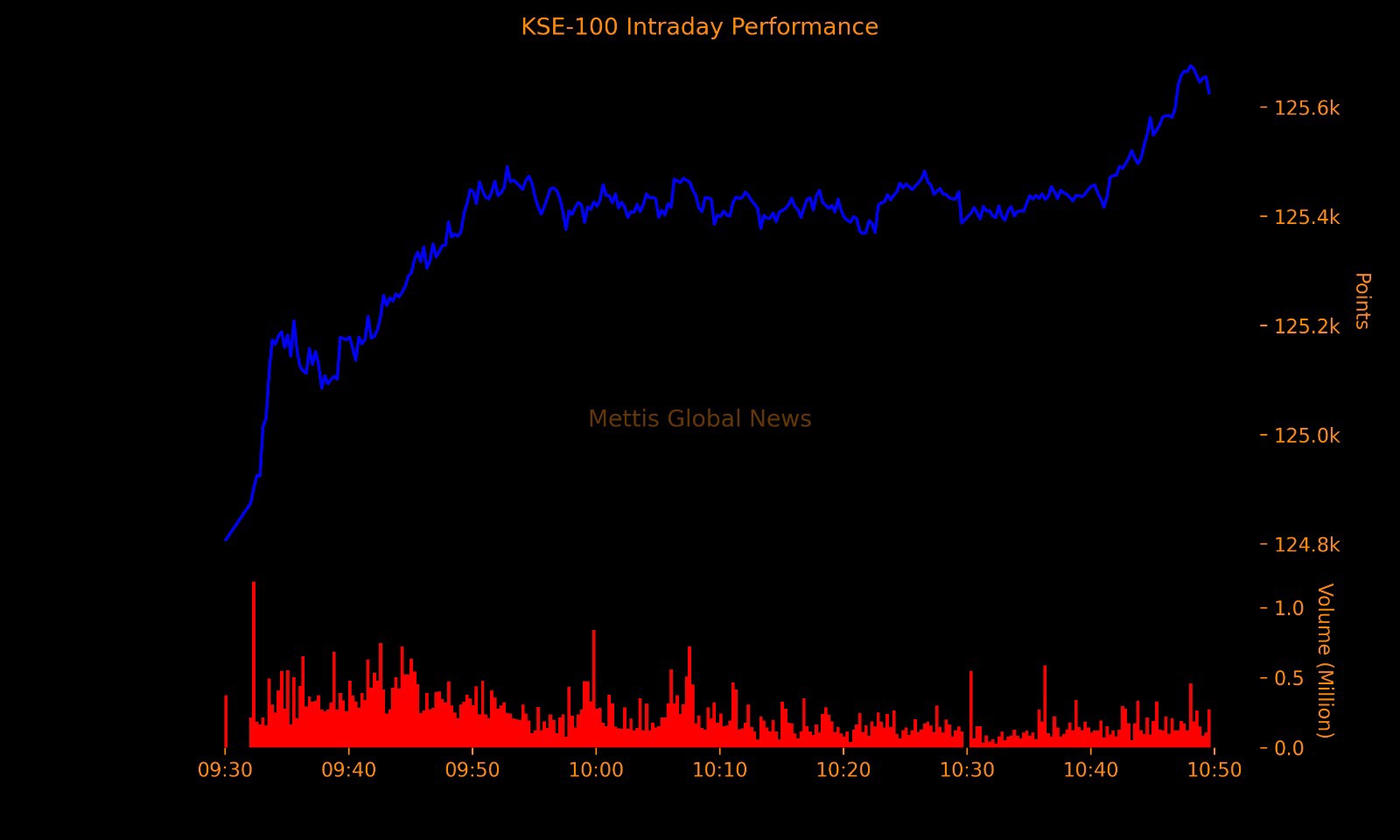

The index traded in a range of 1,453.47 points showing an intraday high of 123,058.06 (-1,035.06) and a low of 121,604.59 (-2,488.53) points.

The total volume of the KSE-100 Index was 238.19 million shares.

The sharp decline in the KSE-100 Index was driven by escalating geopolitical tensions after Israel launched a military strike on Iran.

The shockwaves from the conflict triggered a global market selloff, with Asian indices sliding, U.S. futures tumbling, and investors flocking to safe-haven assets such as gold and the Swiss franc, while oil prices surged amid rising uncertainty.

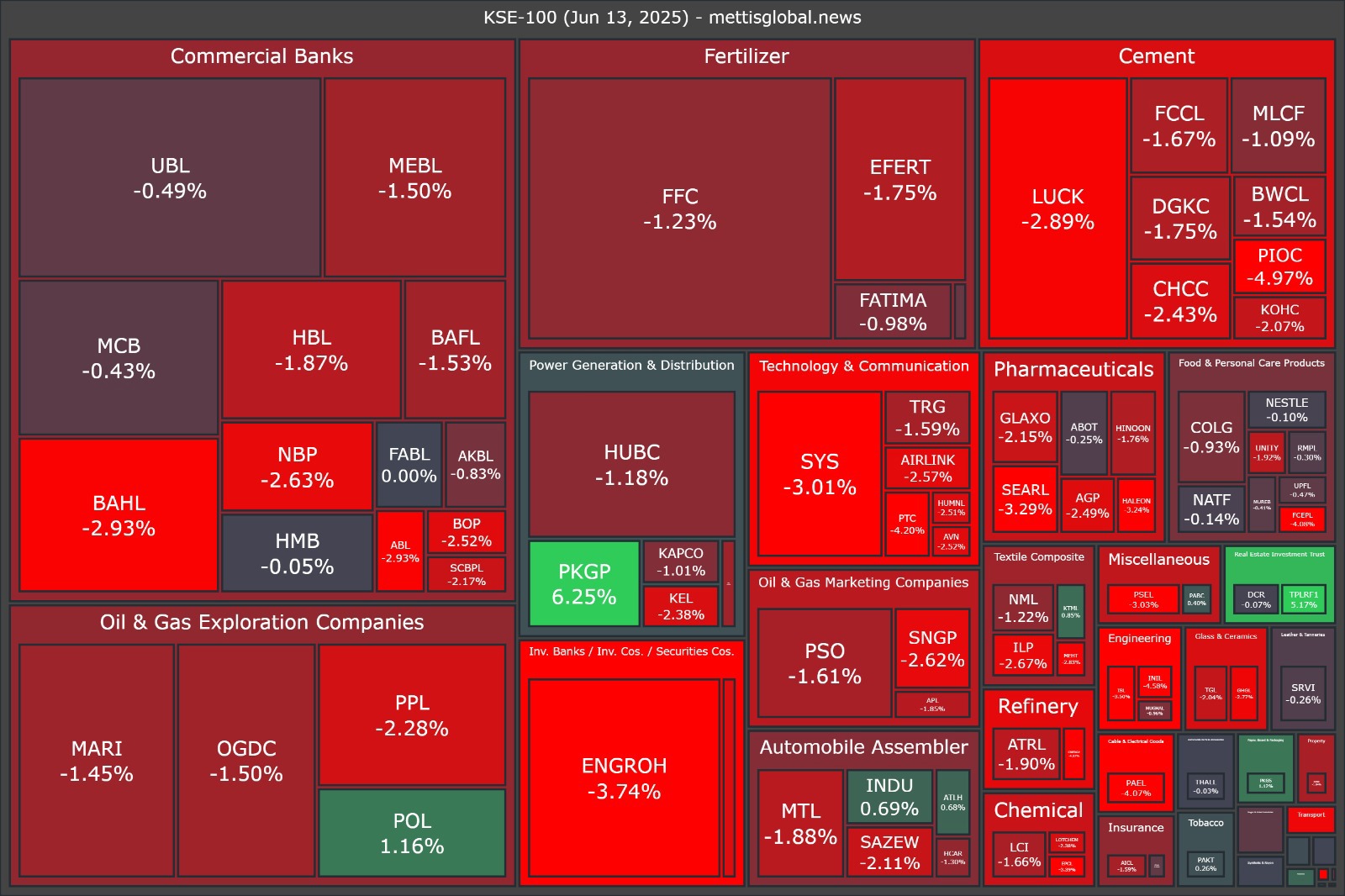

Of the 100 index companies 12 closed up, 85 closed down, while 3 were unchanged.

Top losers during the day were POML (-7.63%), PIOC (-4.97%), INIL (-4.58%), CNERGY (-4.57%), and PTC (-4.20%).

On the other hand, top gainers were BNWM (+7.39%), PKGP (+6.25%), TPLRF1 (+5.17%), POL (+1.16%), and PKGS (+1.12%).

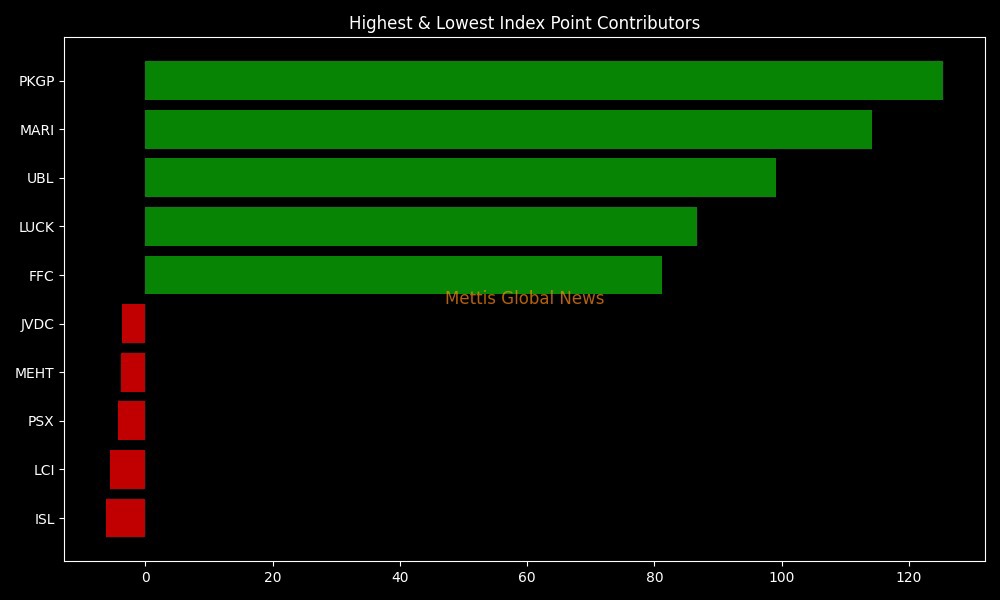

In terms of index-point contributions, companies that dragged the index lower were ENGROH (-222.94pts), LUCK (-151.09pts), FFC (-134.78pts), BAHL (-117.60pts), and SYS (-101.11pts).

Meanwhile, companies that added points to the index were PKGP (+85.86pts), POL (+27.03pts), TPLRF1 (+24.73pts), INDU (+5.92pts), and PKGS (+5.22pts).

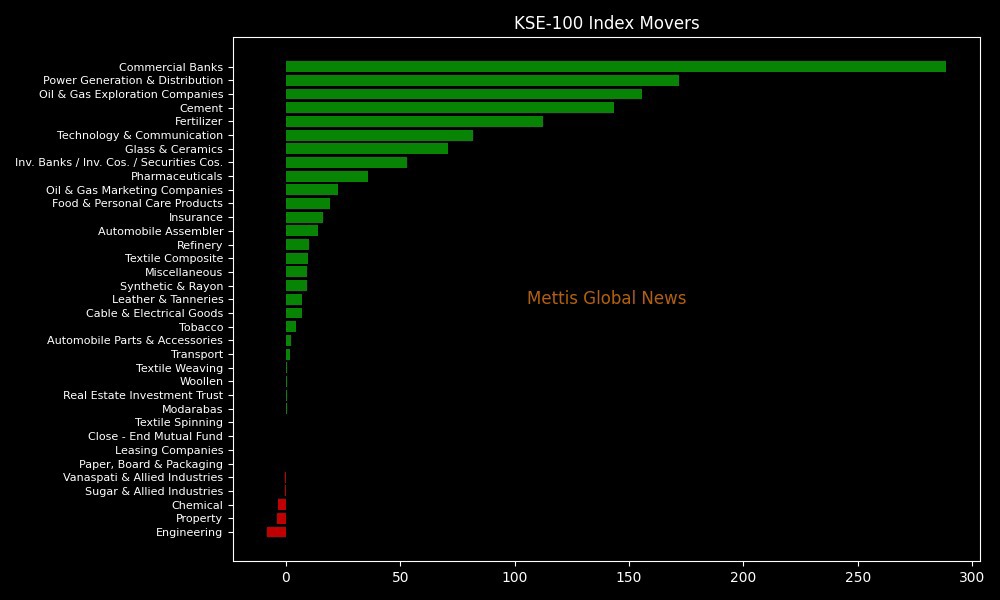

Sector-wise, KSE-100 Index was let down by Commercial Banks (-421.61pts), Cement (-300.98pts), Inv. Banks / Inv. Cos. / Securities Cos. (-234.20pts), Fertilizer (-210.66pts), and Oil & Gas Exploration Companies (-203.64pts).

While the index was supported by Real Estate Investment Trust (+24.36pts), Power Generation & Distribution (+12.50pts), Paper, Board & Packaging (+5.22pts), Tobacco (+1.31pts), and Woollen (+0.52pts).

In the broader market, the All-Share Index closed at 76,055.21 with a net loss of 1,051.08 points or 1.36%.

Total market volume was 968.22 million shares compared to 1,024.56m from the previous session while traded value was recorded at Rs29.55 billion showing a decrease of Rs20.99bn.

There were 380,962 trades reported in 469 companies with 130 closing up, 304 closing down, and 35 remaining unchanged.

| Symbol | Price | Change % | Volume |

|---|---|---|---|

| PASLNC | 2.93 | 51.81% | 116,655,242 |

| WTL | 1.45 | 5.84% | 100,891,108 |

| FCSC | 3.06 | 44.34% | 85,324,384 |

| PIAHCLA | 22.38 | 2.85% | 30,960,243 |

| BOP | 10.05 | -2.52% | 27,555,139 |

| KOSM | 5.63 | 3.11% | 27,294,482 |

| MDTL | 2.71 | 27.23% | 27,189,737 |

| CNERGY | 7.3 | -4.57% | 26,834,469 |

| PMI | 3.39 | 41.84% | 23,063,464 |

| SSGC | 41.52 | -0.95% | 21,700,047 |

To note, the KSE-100 has gained 43,699 points or 55.71% during the fiscal year, whereas it has increased 7,017 points or 6.09% so far this calendar year.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,550.00 | 119,740.00 117,455.00 | -745.00 -0.63% |

| BRENT CRUDE | 73.34 | 73.63 71.75 | 0.83 1.14% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.12 | 70.51 68.45 | 0.91 1.31% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png)