PSX Closing Bell: Strong Resistance

MG News | June 03, 2024 at 04:22 PM GMT+05:00

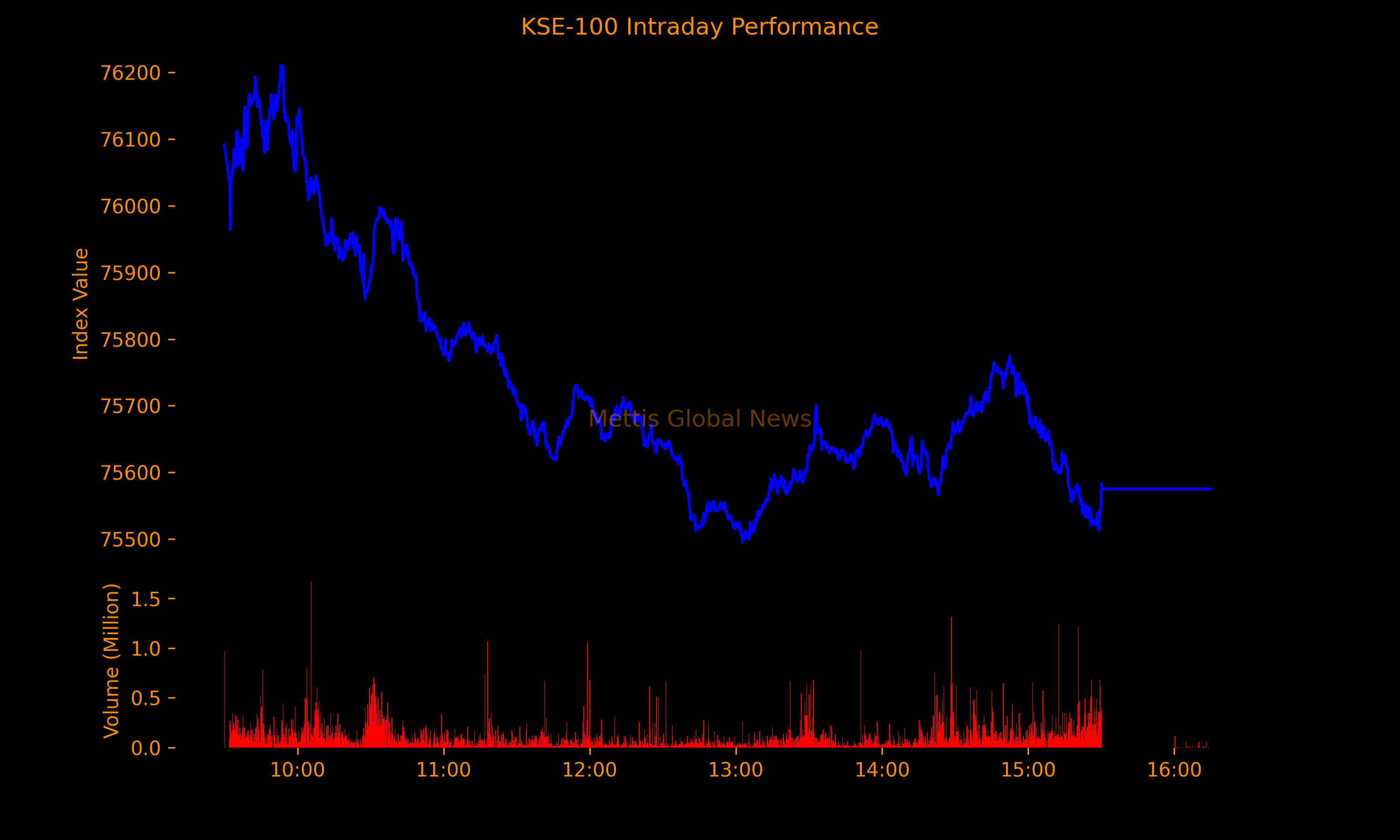

June 03, 2024 (MLN): Despite a significant slowdown in inflation, the 76,000 level proved to be a strong selling point, as the benchmark KSE-100 index experienced heavy selling pressure after briefly crossing above it during the day.

By the end of Monday's trading session, the KSE-100 index concluded at 75,575.26 showing a decrease of 303.22 points or 0.4%.

The index traded in a range of 714.59 points showing an intraday high of 76,209.97 (+331.49) and a low of 75,495.38 (-383.09) points.

The total volume of the KSE-100 index was 190.98 million shares.

Official data today showed consumer price gains eased to 11.8% YoY in May compared to last year, far slower than what economists forecasted, strengthening bets for SBP to shift away from its “higher-for-longer” stance on interest rates.

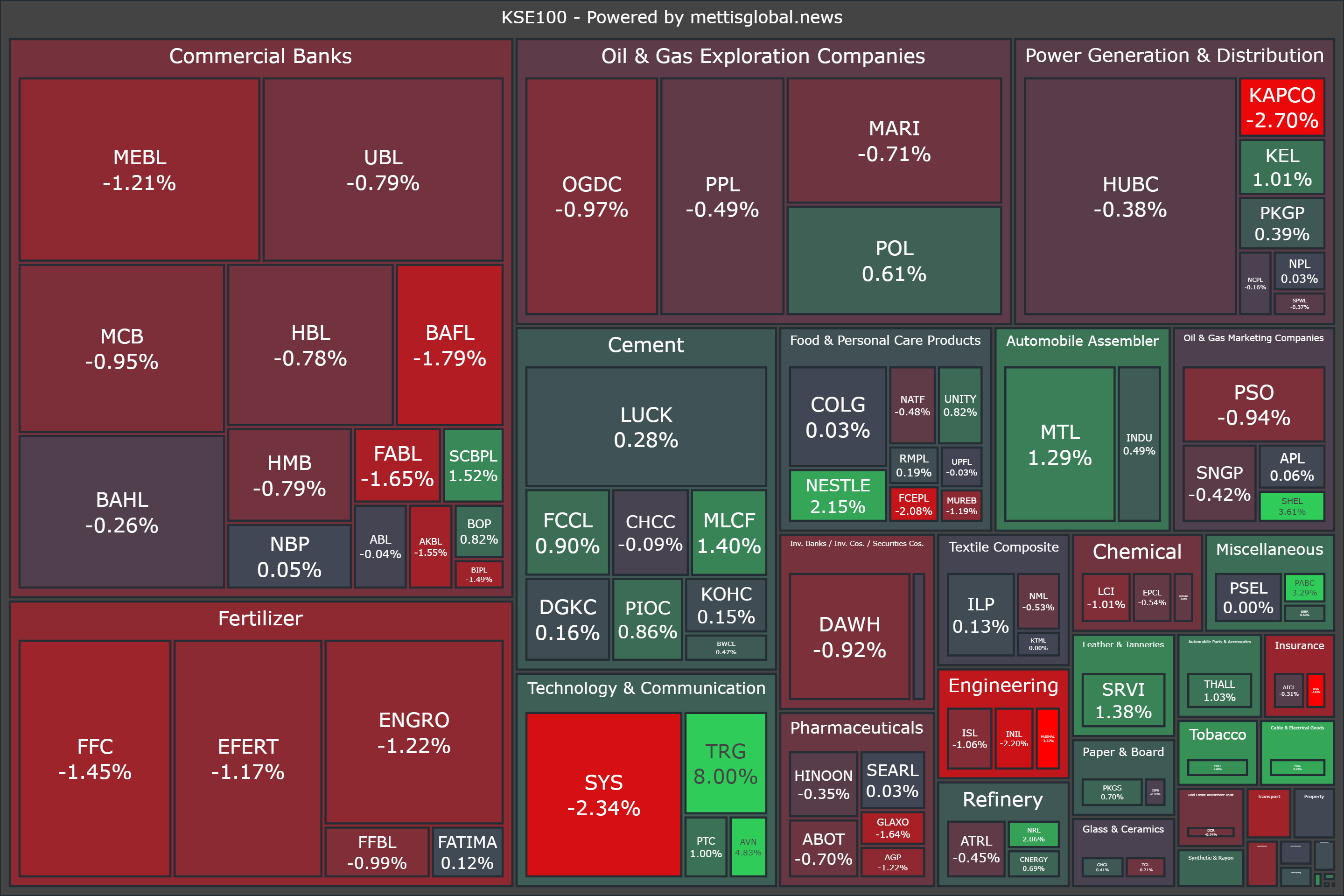

Of the 100 index companies 45 closed up, 51 closed down, 2 were unchanged, while 2 remained untraded.

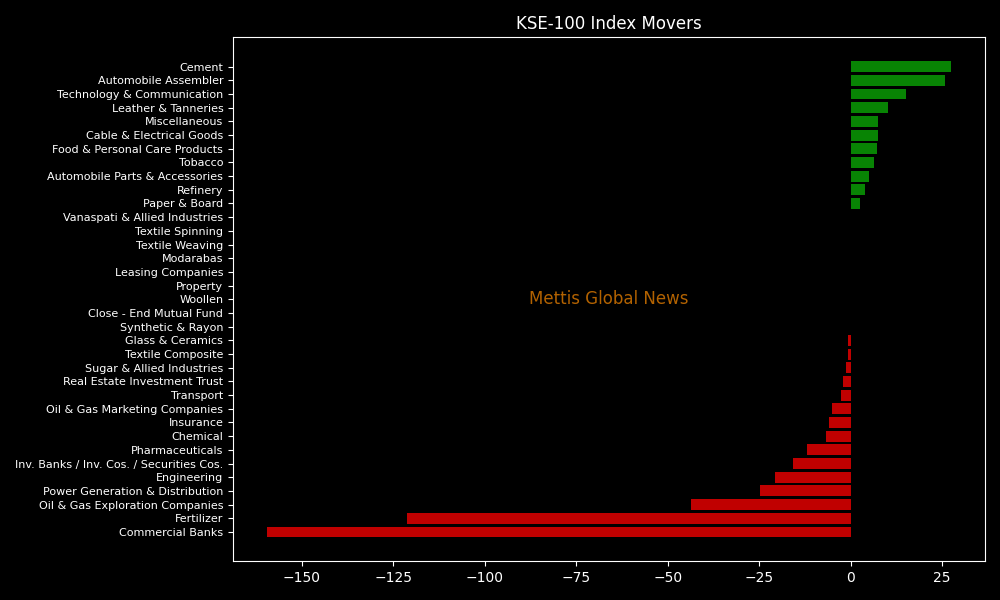

KSE-100 index was let down by Commercial Banks (159.46pts), Fertilizer (121.19pts), Oil & Gas Exploration Companies (43.61pts), Power Generation & Distribution (24.66pts), and Engineering (20.68pts).

On the flip-side, the index was supported by Cement (27.37pts), Automobile Assembler (25.86pts), Technology & Communication (15.21pts), Leather & Tanneries (10.13pts), and Miscellaneous (7.6pts).

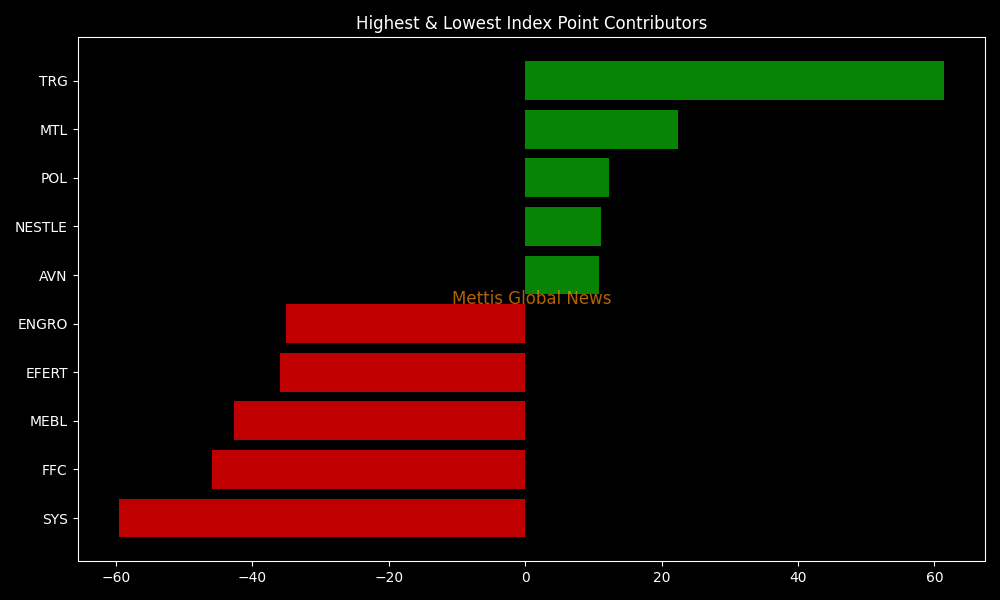

Companies that dragged the index lower were SYS (59.57pts), FFC (45.88pts), MEBL (42.62pts), EFERT (35.95pts), and ENGRO (35.01pts).

On the other hand, companies that added points to the index were TRG (61.36pts), MTL (22.42pts), POL (12.32pts), NESTLE (11.16pts), and AVN (10.78pts).

In the broader market, the All-Share index closed at 48,804.39 with a net loss of 23.93 points.

Total market volume was 441.26 million shares compared to 523.30m from the previous session while traded value was recorded at Rs18.63 billion showing a decrease of Rs1.94bn.

There were 231,745 trades reported in 426 companies with 199 closing up, 178 closing down and 49 remaining unchanged.

| Company | Volume |

|---|---|

| FCCL | 32,835,391 |

| KEL | 31,651,913 |

| PIAHCLA | 25,572,549 |

| DFML | 18,872,126 |

| AIRLINK | 16,065,198 |

| WTL | 14,530,438 |

| PAEL | 14,056,348 |

| AVN | 10,274,922 |

| KOSM | 10,244,388 |

| HUMNL | 10,198,333 |

To note, the KSE-100 has gained 34,123 points or 82.32% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 13,124 points, equivalent to 21.02%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 184,129.58 798.69M | -1.97% -3702.50 |

| ALLSHR | 110,763.73 1,266.28M | -1.85% -2087.96 |

| KSE30 | 56,278.51 173.32M | -2.19% -1261.46 |

| KMI30 | 259,907.89 102.57M | -2.03% -5380.16 |

| KMIALLSHR | 71,198.64 822.49M | -1.72% -1247.03 |

| BKTi | 53,693.69 102.25M | -2.59% -1425.61 |

| OGTi | 37,589.24 28.20M | -2.72% -1052.27 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 70,580.00 | 71,690.00 60,005.00 | 6785.00 10.64% |

| BRENT CRUDE | 68.10 | 68.83 66.56 | 0.55 0.81% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 96.00 96.00 | 1.50 1.59% |

| ROTTERDAM COAL MONTHLY | 102.75 | 103.25 101.30 | 2.25 2.24% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 63.50 | 64.58 62.20 | 0.21 0.33% |

| SUGAR #11 WORLD | 14.14 | 14.30 14.07 | -0.13 -0.91% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20260206191044099_c99cfd.jpeg?width=280&height=140&format=Webp)

MTB Auction

MTB Auction