August 23, 2023 (MLN): The benchmark KSE-100 index stayed in the red zone throughout most of today's trading session, before getting uplifted by Bank AL Habib Limited (BAHL)’s impressive earning results to close the day flat at 47,418.63 with 0.73 point gain.

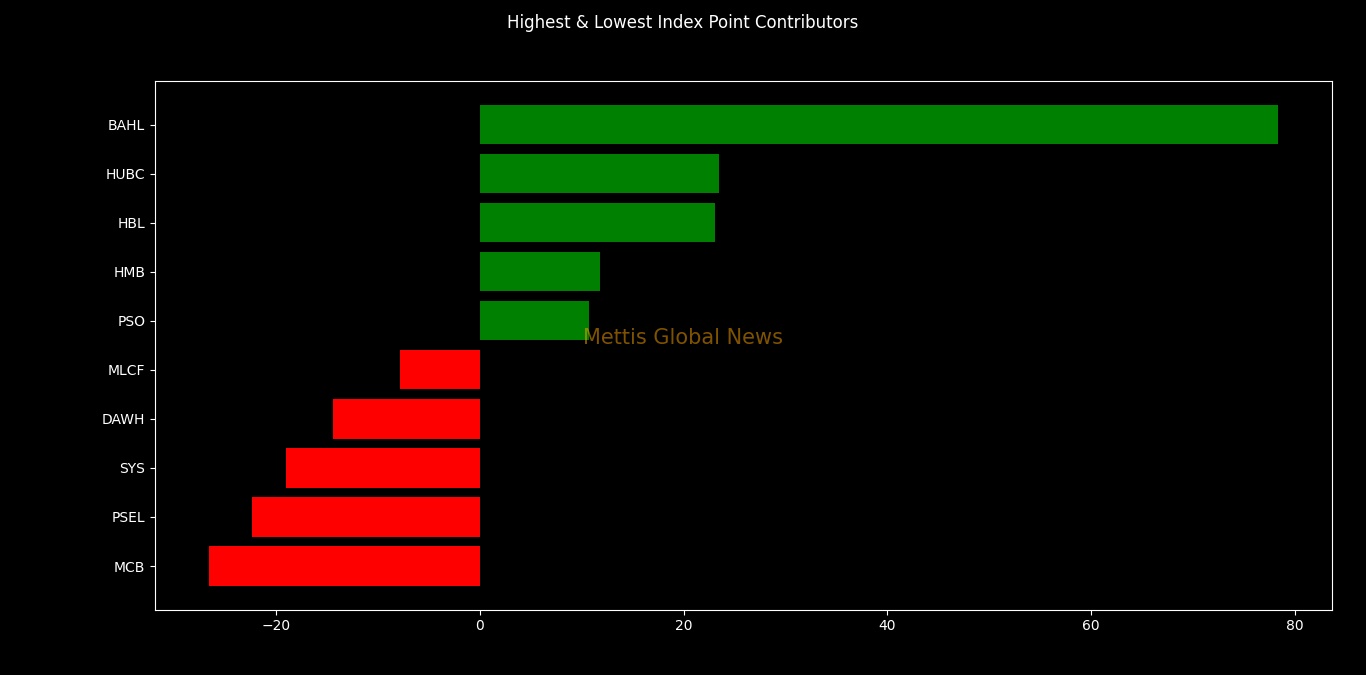

Notably, BAHL's stock price increased by 7.31% DoD, contributing 78.63 points to the index.

The KSE-100 index traded in a range of 580.58 points showing an intraday high of 47,588.23 (+170.33) and a low of 47,007.65 (-410.25) points.

Total Volume of the KSE100 Index was 96.281 million shares.

Of the 100 index companies 34 closed up, 55 closed down, 4 were unchanged while 7 remained untraded.

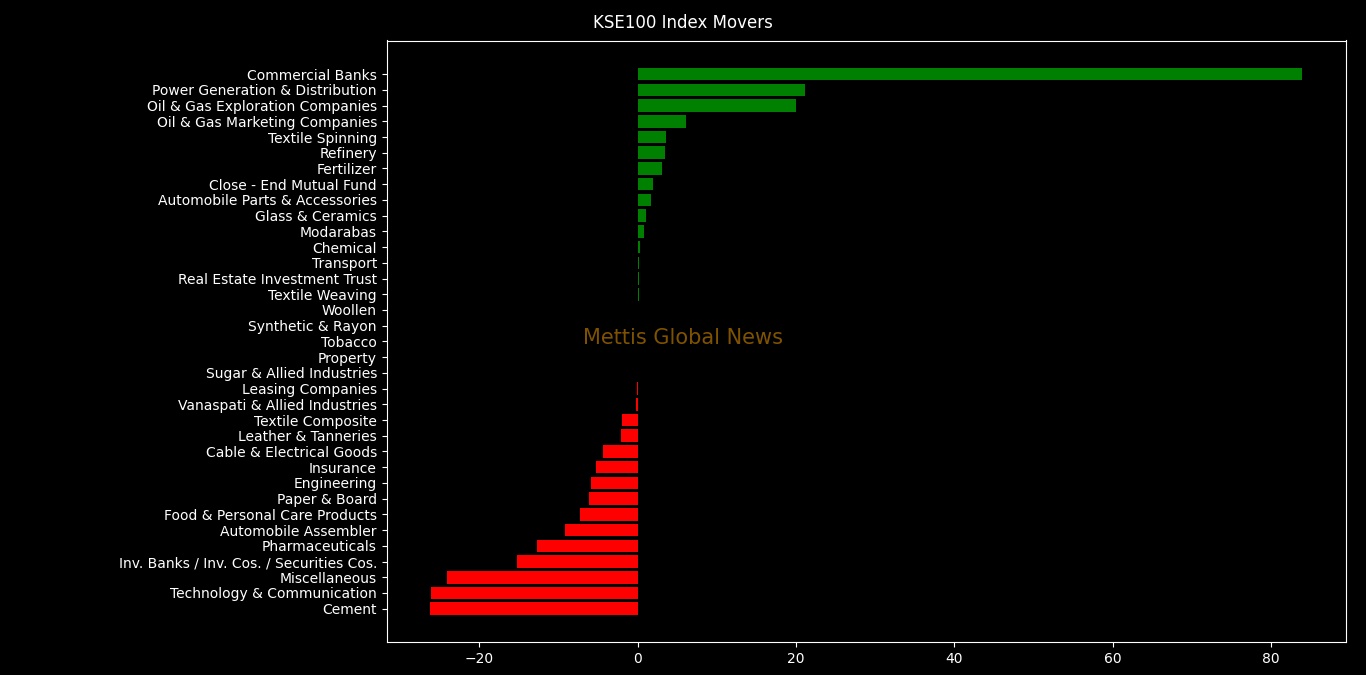

KSE100 index was supported by Commercial Banks with 83.88, Power Generation & Distribution with 21.14, Oil & Gas Exploration Companies with 20.05, Oil & Gas Marketing Companies with 6.06 and Textile Spinning with 3.58 points.

Companies adding points to the index were BAHL with 78.38, HUBC with 23.49, HBL with 23.06, HMB with 11.79 and PSO with 10.74 points.

KSE100 Index was let down by Cement with 26.16, Technology & Communication with 26.13, Miscellaneous with 24.1, Inv. Banks / Inv. Cos. / Securities Cos. with 15.27 and Pharmaceuticals with 12.71 points.

Companies dragging the index lower were MCB with 26.62, PSEL with 22.33, SYS with 18.99, DAWH with 14.45 and MLCF with 7.82 points.

In the broader market, the All-Share index closed at 31,494.11 with a net loss of 36.93 points.

Total market volume was 188.68 million shares compared to 185.754 from the previous session while traded value being recorded at 8.79 billion showing an increase of Rs.2.57 billion.

There was 102,141 trades reported in 321 companies with 106 closing up, 186 closing down and 29 remaining unchanged.

| Company | Volume |

|---|---|

| WTL | 20,986,139 |

| OGDC | 16,050,104 |

| JSBL | 12,258,500 |

| DFML | 9,906,895 |

| PPL | 8,827,889 |

| KEL | 7,962,856 |

| LPL | 6,836,000 |

| PSO | 6,788,187 |

| PRL | 5,808,434 |

| BAHL | 4,938,589 |

On the economic front, Pakistani Rupee (PKR) continues to remain under pressure and settled at an all-time low of 299.64 per US Dollar.

High demand for the dollar, a 30% MoM increase in imports in July, and many individuals being heavily invested in dollars are putting pressure on the rupee’s value.

On the earnings front, in contrast to BAHL’s strong earnings, PSO reported a 90% YoY decline in its profits in FY23. Nevertheless, the company rewarded its shareholders with a dividend payout of Rs7.5 per share (75%).

KSE-100 Weekly time-frame chart

Copyright Mettis Link News

Posted on: 2023-08-23T16:23:11+05:00