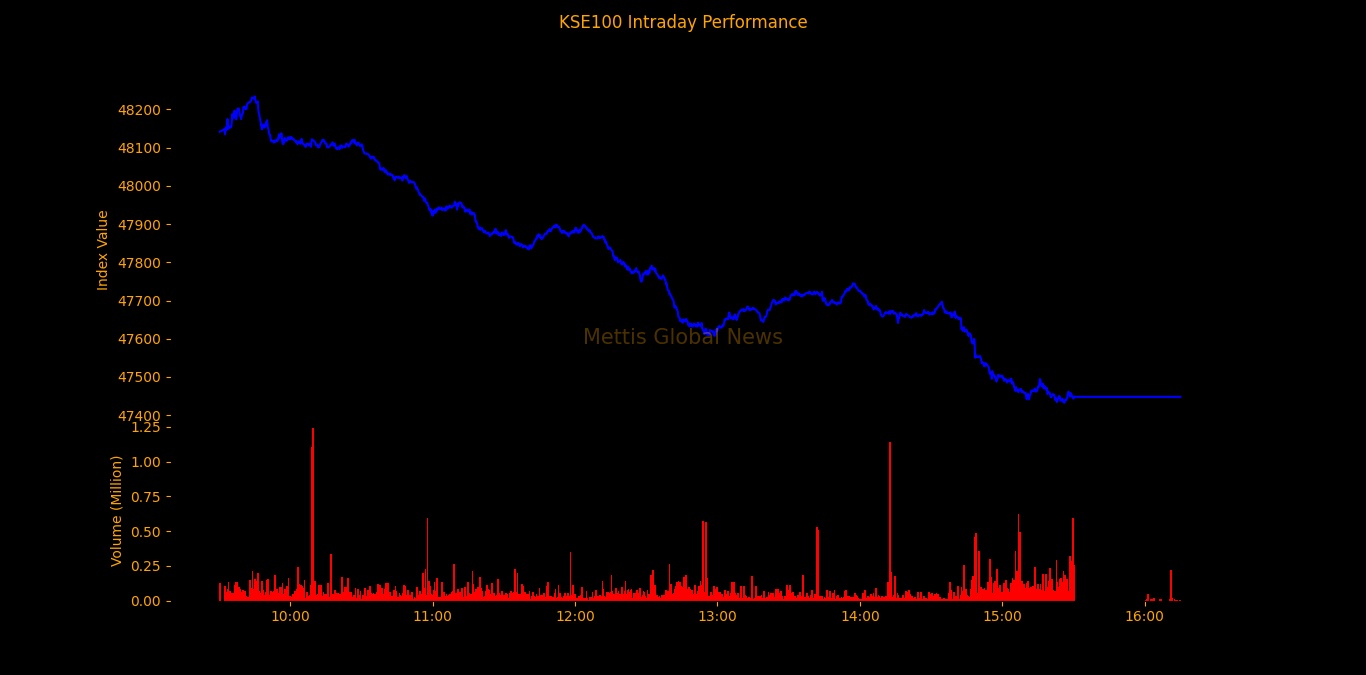

August 21, 2023 (MLN): The market sentiment remained skewed towards bearishness and caution in today’s trading session, with the benchmark KSE-100 index closing the day at 47,447.96, losing 770.54 points or 1.6% from the previous day.

The index traded in a range of 801.54 points showing an intraday high of 48,234.25 and a low of 47,432.71.

Total Volume of the KSE100 Index was 84.335 million shares.

The decline in the stock market today can be attributed to political uncertainty in the country.

Of the 100 index companies 5 closed up, 87 closed down, 2 were unchanged while 6 remained untraded.

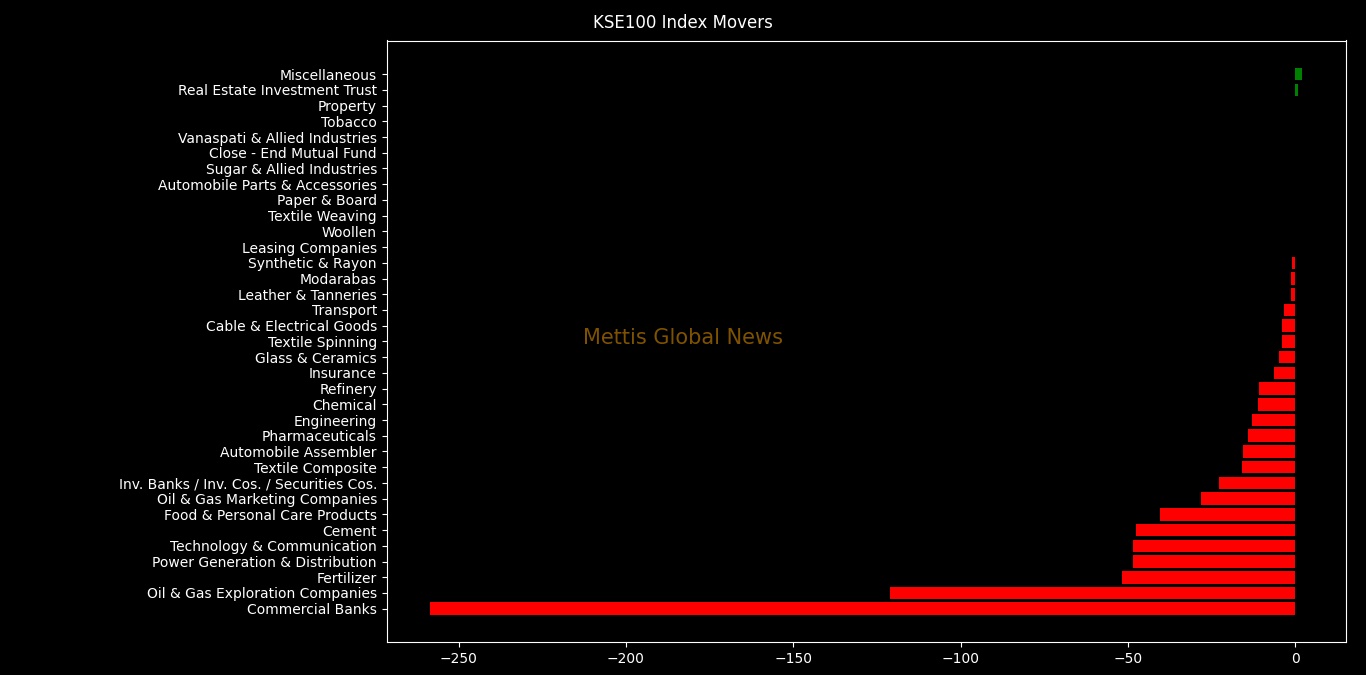

KSE100 Index was let down by Commercial Banks with 258.47, Oil & Gas Exploration Companies with 121.06, Fertilizer with 51.69, Power Generation & Distribution with 48.48 and Technology & Communication with 48.46 points.

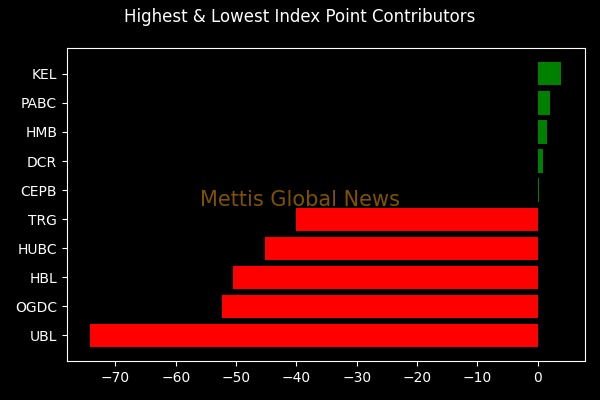

Companies dragging the index lower were UBL with 74.15, OGDC with 52.33, HBL with 50.54, HUBC with 45.14 and TRG with 39.99 points.

KSE100 index was supported by Miscellaneous with 2.0 and Real Estate Investment Trust with 0.95 points.

Companies adding points to the index were KEL with 3.93, PABC with 2.0, HMB with 1.61, DCR with 0.95 and CEPB with 0.24 points.

In the broader market, the All-Share index closed at 31,499.58 with a net loss of 459.17 points.

Total market volume was 211.231 million shares compared to 254.814 from the previous session while traded value being recorded at 7.08 billion showing a decrease of Rs.3.34 billion.

There was 103,319 trades reported in 318 companies with 49 closing up, 248 closing down and 21 remaining unchanged.

| Company | Volume |

|---|---|

| WTL | 51,424,053 |

| KEL | 8,423,086 |

| OGDC | 7,312,226 |

| PRL | 6,214,957 |

| PPL | 6,101,632 |

| PABC | 5,752,943 |

| NPL | 5,714,509 |

| NCPL | 5,292,500 |

| LPL | 4,640,000 |

| DFML | 3,915,190 |

Furthermore, market sentiments were also hurt by the latest FTSE September 2023 Semi-annual Index Review, which revealed some major changes in the composition and weighting of Pakistani stocks.

According to the review, MCB Bank will be removed from the FTSE All Cap index, resulting in an estimated outflow of $9 million, while PPL will be downgraded to the small-cap segment.

Moreover, some market players will face a transition as L&M Capital will move out from the FTSE All World index to the Small Cap segment.

On a country level, Pakistan’s overall weight will remain broadly unchanged at 0.04%.

In addition, the Pakistani Rupee continues to remain under strain, depreciating by 1.35 rupees against the greenback in today’s interbank session.

Adding to these developments, following four consecutive periods of current account surpluses, the country witnessed a significant shift, recording a substantial current account deficit of $809 million in July 2023.

KSE-100 Weekly time-frame chart

On the global front, the People’s Bank of China (PBoC) surprised markets by lowering its 1-year loan prime rate (LPR) by only 10 bps 3.45% to support its economy which is facing new threats from a deteriorating housing market and low consumer spending.

While it kept the 5-year rate steady at 4.2%.

China's Hang Seng Index closed down by 1.82%, the lowest closing since November 2022.

Copyright Mettis Link News

Posted on: 2023-08-21T16:24:38+05:00