July 19, 2022 (MLN): A blood bath was witnessed on the trading floors today due to uncertain political and economic conditions and a freefall of a PKR.

The political uncertainty and slump in rupee after govt lost in Punjab province by polls has dented investors’ sentiments. Moreover, IMF delay over the release of tranche to next two to three weeks and uncertainty over funding of friendly countries to support plunging rupee played a catalyst role in the bearish activity, Ahsan Mehanti, Director Arif Habib Group told MG News.

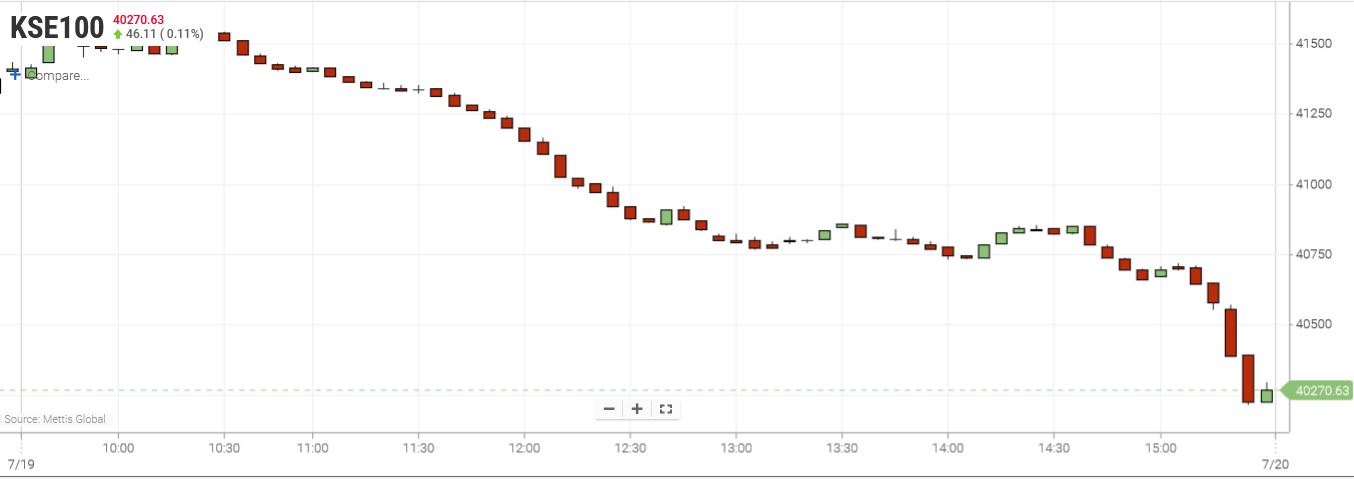

As a result, the benchmark KSE100 index ended the trading session on Tuesday with a loss of 978 points or 2.36% decline to close at 40,389 points level.

The index traded in a range of 1336.76 points or 3.23% of previous close, showing an intraday high of 41,551and a low of 40,215 points

Of the 93 traded companies in the KSE100 Index 9 closed up 84 closed down, while 0 remained unchanged. Total volume traded for the index was 103.50mn shares.

Sector wise, the index was let down by Commercial Banks with 236 points, Oil & Gas Exploration Companies with 140 points, Fertilizer with 131 points, Cement with 100 points and Power Generation & Distribution with 57 points.

The most points taken off the index was by MEBL which stripped the index of 61 points followed by ENGRO with 58 points, HUBC with 56 points, PPL with 48 points and HBL with 43 points.

Sectors propping up the index were Paper & Board with 1 points, Modarabas with 1 points and Miscellaneous with 1 points.

The most points added to the index was by PKGS which contributed 4 points followed by NESTLE with 2 points, ABOT with 2 points, KAPCO with 1 point and FHAM with 1 point.

All Share Volume increased by 43.51mn to 194.87mn shares. Market Cap decreased by Rs137.21bn.

Total companies traded were 339 compared to 326 from the previous session. Of the scrips traded 46 closed up, 285 closed down while 8 remained unchanged.

Total trades increased by 19,833 to 109,470.

Value Traded increased by Rs1.43bn to Rs5.78bn.

| Company | Volume |

|---|---|

| K-Electric | 19,619,000 |

| Worldcall Telecom | 17,677,000 |

| Cnergyico PK | 9,967,464 |

| Cordoba Logist(R) | 7,939,500 |

| Unity Foods | 7,474,484 |

| Ghani Global Holdings | 7,359,815 |

| Pakistan Refinery | 5,762,948 |

| TPL Properties | 5,700,980 |

| Sui Northern Gas Pipelines | 5,060,864 |

| Pak Elektron | 4,643,500 |

| Sector | Volume |

|---|---|

| Technology & Communication | 30,381,095 |

| Power Generation & Distribution | 24,291,870 |

| Refinery | 20,778,402 |

| Chemical | 16,750,927 |

| Oil & Gas Marketing Companies | 12,694,877 |

| Cement | 12,440,547 |

| Transport | 12,174,400 |

| Food & Personal Care Products | 11,975,916 |

| Commercial Banks | 9,680,973 |

| Miscellaneous | 7,440,280 |

34131