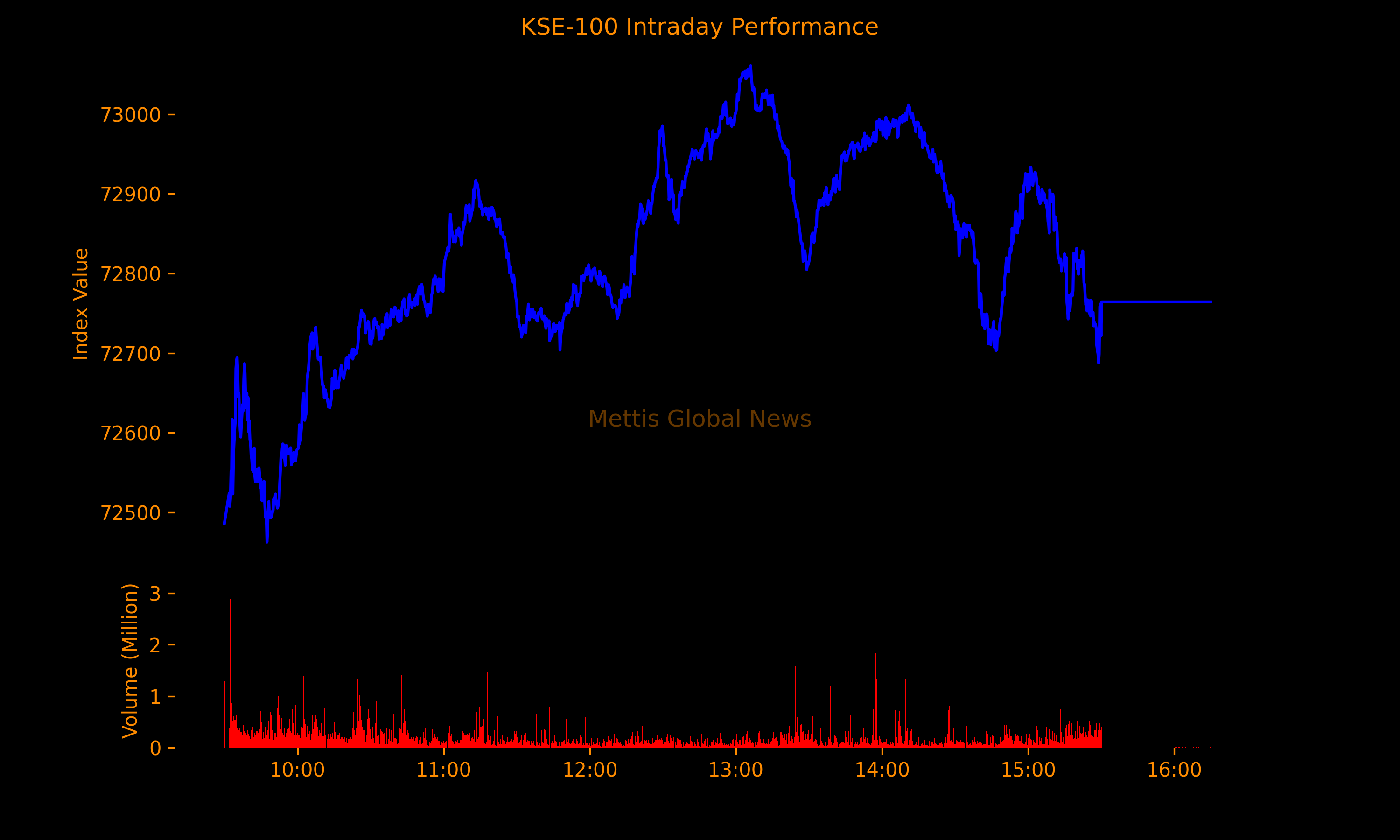

May 06, 2024 (MLN): The benchmark KSE-100 index jumped 862.15 points or 1.2% to close Monday's trading session at a new all-time high of 72,764.24.

The index remained positive throughout the day, showing an intraday high of 73,060.74 (+1158.65) and a low of 72,462.49 (+560.4) points.

The total volume of the KSE-100 index was 313.38 million shares.

The positivity comes amid positive developments on the economic front.

An International Monetary Fund mission is expected to visit Pakistan this month to discuss a new program, the lender said on Sunday ahead of Islamabad beginning its annual budget-making process for the next financial year.

Pakistan is expected to seek at least $6bn and request additional financing from the Fund under the Resilience and Sustainability Trust.

The developments on the privatization front have also played a due role in boosting the investors’ sentiments.

The privatization process of Pakistan International Airlines Corporation Limited (PIACL) crossed another milestone, as the Competition Commission of Pakistan (CCP) has given the green light to the Scheme of Arrangement (SOA).

This approval signals a pivotal step towards PIACL’s restructuring process and approval from SECP.

Meanwhile, Pakistan and China have expressed the determination to complete all CPEC projects and further upgrade this cooperation to achieve shared objectives.

Furthermore, a business and official delegation from the Kingdom of Saudi Arabia (KSA) has arrived in Pakistan to hold business-to-business (B2B) meetings.

Key sectors like IT, energy, and agriculture are set for ground-breaking B2B discussions.

In Monday's trading session, of the 100 index companies 70 closed up, 28 closed down, 1 was unchanged, while 1 remained untraded.

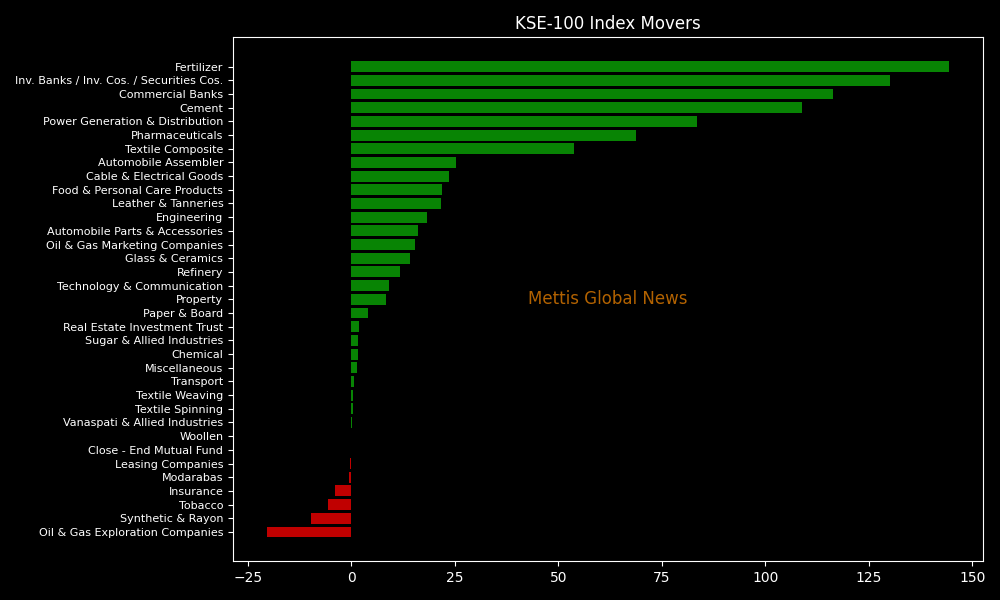

KSE-100 index was supported by Fertilizer (144.31pts), Inv. Banks / Inv. Cos. / Securities Cos. (130.2pts), Commercial Banks (116.25pts), Cement (108.79pts), and Power Generation & Distribution (83.5pts).

On the flip-side, the index was let down by Oil & Gas Exploration Companies (20.39pts), Synthetic & Rayon (9.71pts), Tobacco (5.63pts), Insurance (4.09pts), and Modarabas (0.5pts).

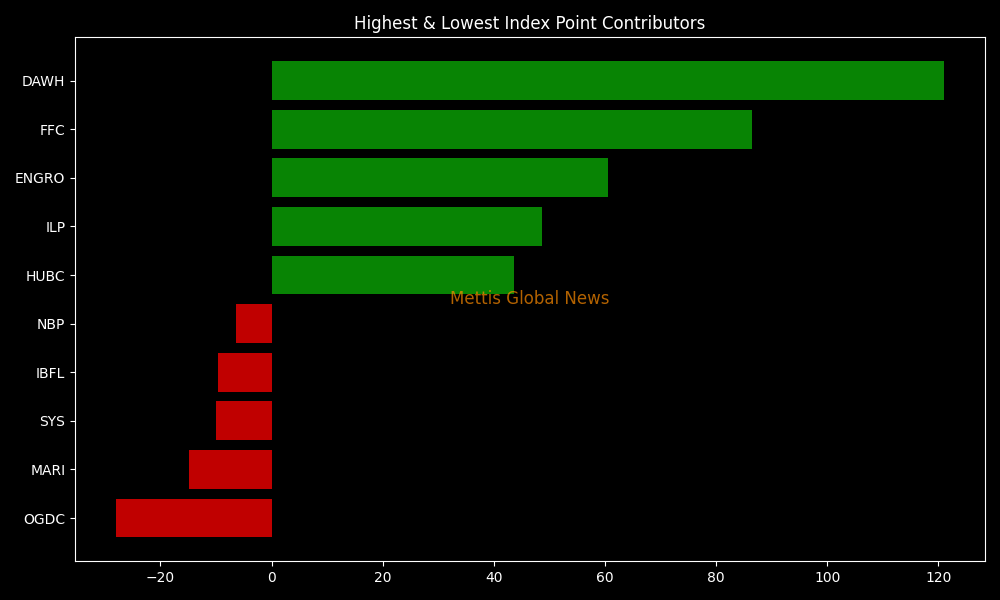

Companies adding points to the index were DAWH (120.94pts), FFC (86.38pts), ENGRO (60.49pts), ILP (48.59pts), and HUBC (43.62pts).

Meanwhile, companies that dragged the index lower were OGDC (27.91pts), MARI (14.83pts), SYS (10.04pts), IBFL (9.71pts), and NBP (6.43pts).

In the broader market, the All-Share index closed at 47,351.15 with a net gain of 431.17 points.

Total market volume was 578.39 million shares compared to 452.16m from the previous session while traded value was recorded at Rs24.52 billion showing a decrease of Rs38.45m.

There were 262,028 trades reported in 387 companies with 257 closing up, 107 closing down and 23 remaining unchanged.

| Company | Volume |

|---|---|

| PAEL | 48,443,791 |

| FCCL | 40,362,811 |

| KEL | 26,775,432 |

| WTL | 24,879,085 |

| HASCOL | 23,880,290 |

| PRL | 19,244,175 |

| FFL | 16,544,181 |

| PPL | 14,348,667 |

| PTC | 14,068,830 |

| DGKC | 11,946,009 |

To note, the KSE-100 has gained 31,312 points or 75.54% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 10,313 points, equivalent to 16.51%.

Copyright Mettis Link News

Posted on: 2024-05-06T16:20:58+05:00